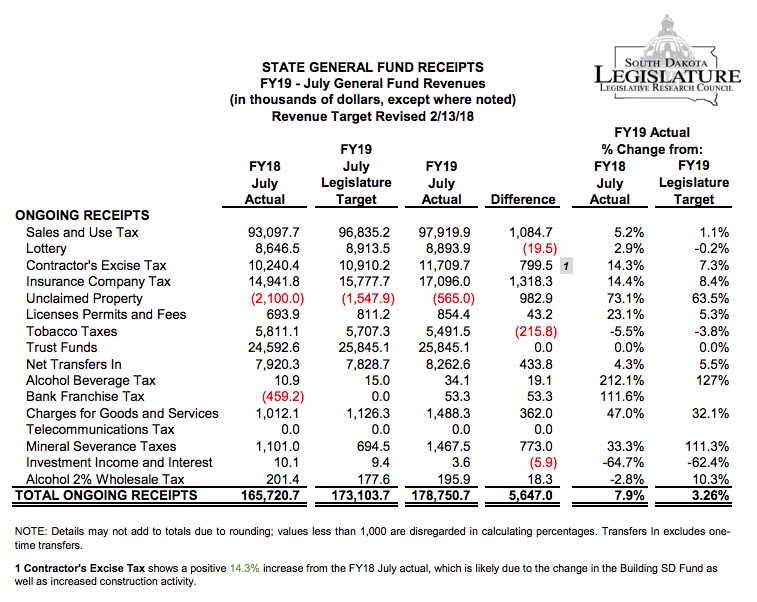

The first monthly revenue report of Fiscal Year 2019 suggests our tax revenues are again outperforming our Legislature’s conservative estimates. We bought more stuff in July than expected… and we also appear to have bought a lot more insurance on that stuff:

This July, we collected 5.2% more sales tax than we did in July last year and 1.1% more than the Legislature guessed we would. Insurers paid 14.4% more state income tax (really, that’s what it is!) than they did last July and 8.4% more than the state expected.

We spent a teeny bit less (0.2%) than expected on lottery tickets and a bigger bit less (3.8%) than the Legislature projected on tobacco. Those are both trends we could stand to extend.

$1.3 million in unexpected insurance tax and $1.1 million in unexpected sales tax far exceeded the $216K tobacco shortfall and $19.5K lottery shortfall. Sales tax and insurer income tax also made up the two biggest chunks of a total $5.6-million revenue surplus for July.

And we haven’t even implemented the post-Wayfair tax hike yet.

Might be an uptick from the extra take-home pay this year.

The insurance tax is the gouge Comrade trump gave to South Dakota health insurance policy holders. Another hidden tax that is like pennies from heaven for the state coffers. Good news though, the higher the gouge, the more tax collected from your misery.

“Insurers paid 14.4% more state income tax (really, that’s what it is!)”

Hi Cory,

Nope, it’s not really an income tax. Insurers pay the state a premium tax on all collected premiums (gross). If the insurer had a loss during their fiscal year, they still have to pay premium tax… where they wouldn’t have had to pay income tax, since there is no income.

Also, insurers can make income on investments. A billion dollars in a 1% CD, for example, is $10 million of income that has no obligation to the state… but does have obligations for federal corporate income tax.

Kind regards,

David

What date did Amazon start collecting SD sales tax?

Dang it, David, you and your accurate specificities. Premiums are income, just not all of insurers’ income. Can’t I call it some sort of non-loopholed, direct-service-related income tax?

I suppose it would be easier just to say premium tax.

Jason, Amazon began collecting SD sales tax in Feb 2017 and remitting in March 2017.

Hi Cory,

True, premium tax is non-loopholed but it’s also non-progressive, which is your favorite aspect of income tax.

Altogether I consider it closer in kind to sales tax.

Kind regards,

David

i.e. the poor pay the same rate of premium tax on their health insurance as the rich… just like sales tax on food

That is not so true Mr. Bergan. The poor are subsidized so the higher premium is just another back door tax on the taxpayer, a hidden tax. A double tax if you will. The more the premiums are raised for the folks on subsidized ACA/Obamacare plans, the more subsidy they receive. So the perceived pain and cruelty that Comrade NOem and Comrade trump have sought to beat up on the recipients of the ACA, the more it doubles down on all the taxpayers. Karma? Damn straight. Daugaard giggles like a little middle schooler with the extra cash that no one has a clue about.

Hi jerry,

The same argument could be used on food sales tax… those who use food stamps ignore the tax on food purchased with said stamps.

Kind regards,

David

Mr. Bergan, can that argument be made, by all states and in all circumstances, perhaps not.

“Sales Tax

SNAP licensed retailers may not charge state or local sales tax on SNAP purchases. This does NOT mean that food items that are subject to sales tax (e.g. soft drinks, snack foods, etc) are ineligible. Eligible items that are subject to sales tax may still be purchased with SNAP benefits. Sales tax, however, cannot be charged when SNAP is used to make the purchase. Sales tax can, however, be charged on the portion of

eligible items paid for with manufacturers or other discount coupons. Such tax cannot be paid with SNAP benefits.” https://fns-prod.azureedge.net/sites/default/files/Retailer_Notice_111412.pdf

Hi jerry,

I think we agree, no?

Kind regards,

David