When she adopted as her own campaign promise the longstanding Democratic proposal to repeal South Dakota’s unusual tax on food, Governor Kristi Noem said exempting food from sales tax would reduce South Dakotans’ tax burden by $100 million.

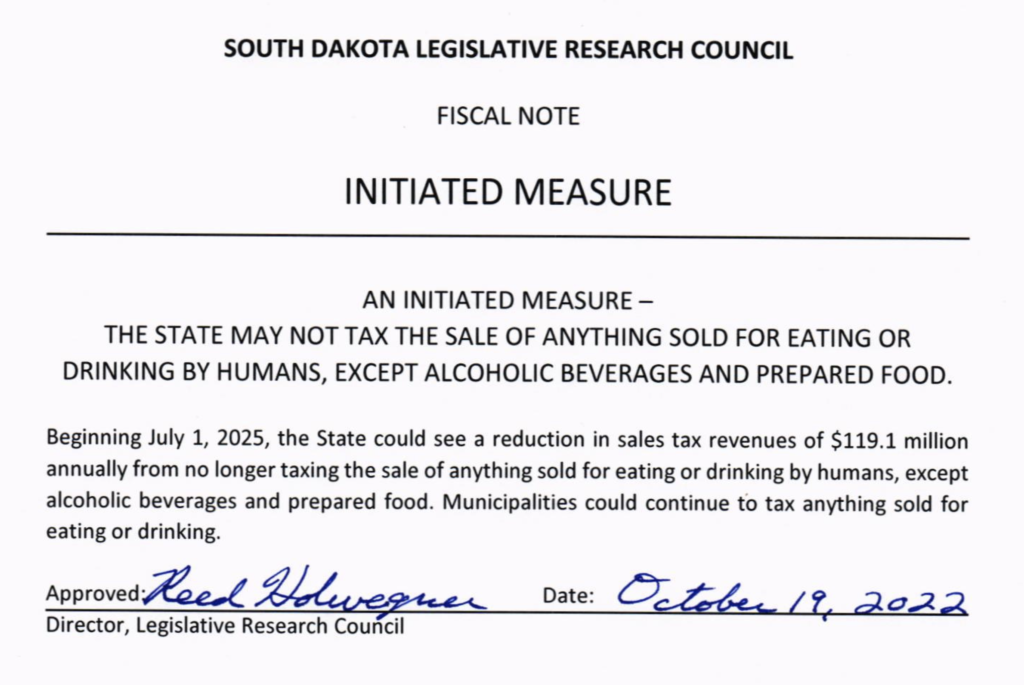

Noem underestimates the value of the Democratic proposal. According to fiscal notes prepared by the Legislative Research Council for a constitutional amendment and an initiated measure proposed by Rick Weiland and Dakotans for Health for the 2024 ballot, exempting anything sold for eating or drinking by humans, except alcoholic beverages and prepared food, would reduce the state’s sales tax revenues by $119.1 million annually.

$119.1 million—that’s 8.8% of the sales tax South Dakota collected in Fiscal Year 2022 and 5.3% of all general fund revenues that year. That’s more than the $115-million surplus, made possible only by the last windfall of federal coronavirus relief, that Noem mentioned when she promised last month to repeal the food tax. It is less than the $147.5 million increase in sales tax revenue that South Dakota enjoyed in FY2022 compared to FY2021. So conceivably, if South Dakota could replicate that 12.2% growth in sales tax revenue in the coming year, the state could repeal the food tax, forgo that $119.1 million in revenue, and still have more sales tax revenue to spend than it did the previous year.

Perhaps worth considering: so far this calendar year, the state has collected $80.5 million in sales tax from remote sellers. With steady remote sales, the state will end this year with over $100 million in sales tax collected from remote sellers. Just five years ago, South Dakota wasn’t receiving any of that money. So between that new revenue stream and strong sales tax growth, we could repeal the food tax and still be in a stronger fiscla position than we were five years ago.

But while fiscal pragmatists may say we need to identify replacement revenue before we can justify repealing the food tax, we can still appeal to the moral point: whether the food tax collects $119.1 million a year or just a $1.19, it’s an immoral tax on the stuff of life, on bare essentials for every South Dakotan. 37 other states manage to fund their state government services without taxing food; surely South Dakota can replicate those other states’ moral sense and find ways to do without taxing baby food and bologna sandwiches.

p.s.: My own February estimate of $80.4 million was way off because I looked strictly at revenue from sales at retail food stores, which are in Standard Industrial Classification Major Group 54. My February estimate did not include revenue from sales at SIC Major Group 53: General Merchandise Stores, which include the Walmarts, Targets, and dollar stores where South Dakotans buy truckloads of groceries.

Noem’s proposal to eliminate the food tax is a pre-election expedient meant only to garner a few headlines in the final month before a general election that is closer than she thought it might be. It will be forgotten the day after the election.

Ah, if the food tax collects $1.19 , it’s still immoral. Yes!

That’s gives me a great idea!

Since the Republican dominated Legislature is still moaning and groaning about “losing” sales tax revenue, as in, is it really “yours” to lose? Here’s another great way of looking at it—

Any organization or nonprofit or group of 2 or 3 people, or even 1 person is a “legislature “ (small L) and do completely understand the wrongness of collecting sales tax on food, therefore we accept our “legislatures” collecting dues of $1.19 or $5 or $10 a year and acting forward every day as moral legislatures, spending and investing the money therein far more responsibility for everyone’s benefit, we the people can do this!

We will ignore the groanings and harrumphings of the old legislature and watch as in our year of freedom, 2022, we set up and place thousands of little legislatures, running on as little as $1.19 a year (Thank you, Cory!) and these thousands of our little legislatures will have such overpowering positive moral rightness, positive consciousness that many thousands of great things every year will sprout, grow and prosper from our great little legislatures!

This does not require anything but a smile, a little cash and a nod from the First Amendment.

Can you imagine and feel how lucky we are?

This happens now!

Start your own! Even with 98 cents, you can!

In addition, we need to consider the remote sales tax collected for grocery items like the coffee and chocolates I ordered via Amazon and Equal Exchange last week. I can also reference that 2 years ago when I was doing weekend Fedex deliveries – a decent percentage of them were grocery boxes. Just sayin’.

Nick is correct. Under the Republicans an elimination of the sales tax on food is going exactly nowhere. Even a .05% reduction is only a remote possibility. The wealthy enjoy not paying much in taxes and still having at least marginal public services, like highways, universities, (at least first class athletic facilities so they can socialize in the boxes on fall weekends), and a robust police force. It’s why they are here, at least six months and one day of the year.

Everyone knows the Research Councils of the legislatures are wildly low guessers, especially under young Mr. Holwegner’s reign of incompetence. You could probably do a plus or minus 50% guess yourself and be just as close. No matter, I agree with Mr. H that when the food tax is repealed there will be no raises for teachers. Doobie tax won’t even scratch this hole…just look at the tax rate in the former Mr. Lansing’s home state, and they only bring in like 3 times how much we do in food tax, but at 6 times the tax rate. Doobie tax won’t scratch this hole. So get ready for big cuts, boys and girls.

When does the rhetoric go from being the “largest” tax cut in SD history to the “most irresponsible” tax cut in SD history? I would even ask to dig deeper into the data to ask of the $147.5 million increase in sales tax revenue that South Dakota enjoyed in FY2022 compared to FY2021, how much of that was in the area of food? Given how Governor Noem has demonized Jamie Smith’s looking at broadening SD’s tax base, replacement of this revenue will be political death. I also know that the needs of education, medicaid, and elderly care are not going down in this state. How does the state come out the other side of this cut with anything but Peter robbed to pay Paul?

Nothing in your state will ever change for the better as long as negative doom purveyors like grudznick are listened to. Positivity is contagious.

“… it’s an immoral tax on the stuff of life, on bare essentials for every South Dakotan.” Food is a common thing to everyone. It is also a common thing for everyone to benefit from services provided by the government. Everyone, regardless of income level, should support those services by paying taxes. There is nothing more inherently unfair in taxing food than me paying a water bill every month. You benefit, you pay. If you want to pay fewer taxes as a percentage of your income, then either increase your income, consume less (things other than food are taxed), or both.

Richard, I have wondered what percentage of online sales might be groceries. LRC does not explain its methodology, so we don’t know if its $119.1M includes such sales online. But could we safely say that food purchases make up only a small percentage of online sales?

Ron Jon, it makes sense that we all should support government, but it does not make sense to tie that support to the food we eat. Sure, everyone should support the government, but practically, not everyone has the cash to do so and still support themselves. We recognize that in the federal income tax, exempting the first chunk of every taxpayer’s income to acknowledge the fact that people need to take care of basic personal expenses first before we start taking a chunk of their meager wealth to pay for government.

Your water bill largely pays for the public infrastructure that brings water to your tap, not the water itself. If the food tax is somehow a fee for services, how is the government providing food? If you are suggesting that we need to pay taxes to build infrastructure to get food to our stores and our homes, well, we already pay gasoline tax to build the roads. Why tax the food itself? Conversely, why not tax advertising, which relies on public airwaves to reach us? Why not tax all the agricultural inputs that depend on public infrastructure to reach their factories and farm customers?

Your suggestion that we shold be able to pay a smaller percentage of our income in taxes if we are rich appears to contradict your thinking. The more income you make, the more you rely on government services to protect that income and the wealth you accumulate, so shouldn’t you have to continue to pay at least the same percentage in taxes, if not a greater percentage?

Cory – My rough estimate of on-line sales that are groceries, based on number of parcels per route 5-6%.

Realistically speaking, that $119 million in revenue is not going to get replaced. The super-majority requirement to raise taxes makes that a Herculean undertaking. The extra half-penny barely got over the finish line when championed by a governor that got reelected with over 70% of the vote. Ultimately, most of that money is going to come from education (where we are again near last in teacher pay) and from Medicaid reimbursement rates (which are the lowest in the region and causing nursing homes to close left and right).

If we were creating a system of taxation from scratch, most of us would probably want to exclude food. But given the realities of the situation we are in, is eliminating that tax without any viable replacement really a good idea?

Cory, I would be inclined to agree with you about the tax on groceries if I believed it was excessive, I don’t, and I don’t think my water bill is excessive either. The reality is many low income people don’t pay federal income tax while higher incomes do. A sales tax allows people avoiding an income tax to contribute in some manner for governmental services rendered. There is nothing immoral about being reasonably taxed.

Ron, only in MAGA world could being poor be seen as “avoiding income tax.” The rich avoid income tax by lobbying their bought-and-paid congress to sing the lies of trickle-down economics and bring a nation’s economy to ruin for personal greed. Th rich should be taxed at a rate of 80% — that is REASONABLE taxation. This nation flourished when that truth was lived.

O, everyone avoids paying taxes when they can, whether poor or rich. There may be a few souls not claiming deductions when they could but I suspect it is a rarity. Render unto Caesar what is Caesar’s, but not one cent more. True for rich and poor alike.

Ron Jon – in case you hadn’t noticed – all money – ALL of it – is Ceasar’s. Likewise, all the real estate is Ceasar’s. Pay attention.

When that the poor have cried, Caesar hath wept.

Much like Governor Noem.

Richard S, perhaps so, but only in the sense it is printed by Caesar. Pleased to live in a country where Caesar ultimately answers to the people and not the reverse. If you prefer, I have some of Caesar’s money but he is only getting back what he is due. Regarding real estate, I must have missed when the takings clause in the 5th amendment was repealed – “Nor shall private property be taken for public use, without just compensation.” I will try and pay more attention.

Young Ms. Quint agrees with Mr. Ron Jon about the taking of private property. She is busy kicking Extreme Mr. Smith’s arse farther to the left during the debates, whilst Ms. Noem is out feeding the poor veterans.

Mr. G- my brother has a chloroform napkin he takes on his dates. I’m sure he will lend it to her if the governor starts weeping and needs a hanky.

Ron Jon – “private property” is a much more general term to real estate, or land. While you may hold a “title in fee simple” regarding a particularly described chunk of the surface of the Earth that is precisely what you “own” – I/E., the piece of paper. What that “title” is – essentially, is a transferable lease that “entitles” you to occupy and use the described surface area of the Earth – IF you pay the “rent fee” (property taxes) AND you make no use of that surface area to engage in activities that are in violation of the landlord’s rules (laws, ordinances, and so on). Fail to pay thee rent – you forfeit the title. Fail to follow the rules – you forfeit the title.

The state *the landlord) holds “Sovereign Title” which is NON-TRANSFERABLE.

Yes – pay attention. That 5th amendment “Private property” =/= real estate, and only applies to those who follow the landlord’s other rules and obligations, for which one may be compensated for the loss of the USE, not the loss of ownership, which one never has.

Ron, you and I may well disagree on what “avoids paying taxes when they can” means. In true MAGA fashion, even Thune is touting the party line of fear mongering about the new IRS agents being sent by President Biden to squeeze money from the middle class. No money can be squeezed by new agents (because there are NOT new tax regulations) from people honoring their CURRENT obligations. That again is a boon of the wealthy: the ability to cheat the tax system with impunity because they have better resources than the IRS has to enforce and investigate. Now that they may have to live up to their social obligations, the wealthy send out their misinformation specialists.

When the IRS agents descend on Mr. President Biden’s orders to squeeze the middle class tighter, the crowds will rise up against taxes even more. They will be mostly ignorant in the way of numbers, and half will be libbies on welfare, but make no mistake there will be whining. Nobody likes the tax man. Except grudznick and Mr. Stan…we pay our fair shares.

Ah, grudznick, even you know the old adage that one cannot squeeze blood from a stone, so if looking to squeeze, I suggest those IRS agents remember the words of Willie Sutton and look to the banks (or the rich, bloated righties who own them), because that’s where the money is. And just like that Trump fellow, they make a delightful squeal when their assets are squeezed.

They should go after Mr. Trump, indeed. grudznick would like to see him imprisoned, with all his money given to babies in NYC who are 1% lactose intolerant and 3 cat shelters in each borough, but no money allowed for skunks/weasels/guinea pigs that find themselves in those shelters.

I think Mr. Biden should stop spending and stop shoving new taxes on people. Or perhaps, like Extreme Jamie Smith would say, “we don’t need new taxes, we need more tax police to gather up the taxes on stuff we already have.”

My observation of who pays and who doesn’t pay federal taxes in S.D.. Look at independent contractors and self-owned businessmen. In this town, over 1/2 the male residents are not claiming all their income; guiding for fishing, hunting, and whatever men pay for (a local brags about the $100 a day per man for killing prairie dogs and doesn’t claim because he’s a veteran, he’s entitled)

-the 25 year old angry man who mows lawns and shovels sidewalks under the name of a family business (town of 3200 and we have about 20 lawn businesses, with young men who can’t work for anyone)

-the kid down the street who lives at home, cuts down trees for $150 an hour and will someday regret not paying in

-many of the plumbers, electricians, and heating/cooling men who go to coffee twice a day, do a job or two when convenient and depend on the wife’s income from the school for insurance.

– construction workers and other seasonal personnel

I could go on and on, but I think you get the jest of it.

I really resented handing over MY tips to a local cafe owner when my minimum wage was met. I’d spend 2 hours serving those men coffee for a 25-cent tip if any. Some shifts, I never met my minimum.

BRING IN THE IRS

How fair is our system of claiming income? I”m not claiming mine in this state unless all the independent contractors do to