Did Dr. Bydon slip and replace Noem’s heart as well? Was it something Reynold said? Or is Team Noem in trouble at the polls?

Last winter, Governor Kristi Noem refused to consider cutting South Dakota’s food tax, arguing that while she could justify subsidizing the packing of pistols in civilians’ pants, the economy looked too grim to risk giving up the revenue that South Dakota gets from applying its sales tax to food.

Seven months later (but only six weeks before the election), Noem has completely changed her mind. She wants to cut the food tax:

…Noem said the proposed policy would be worth more than $100 million in tax cuts, the largest in state history.

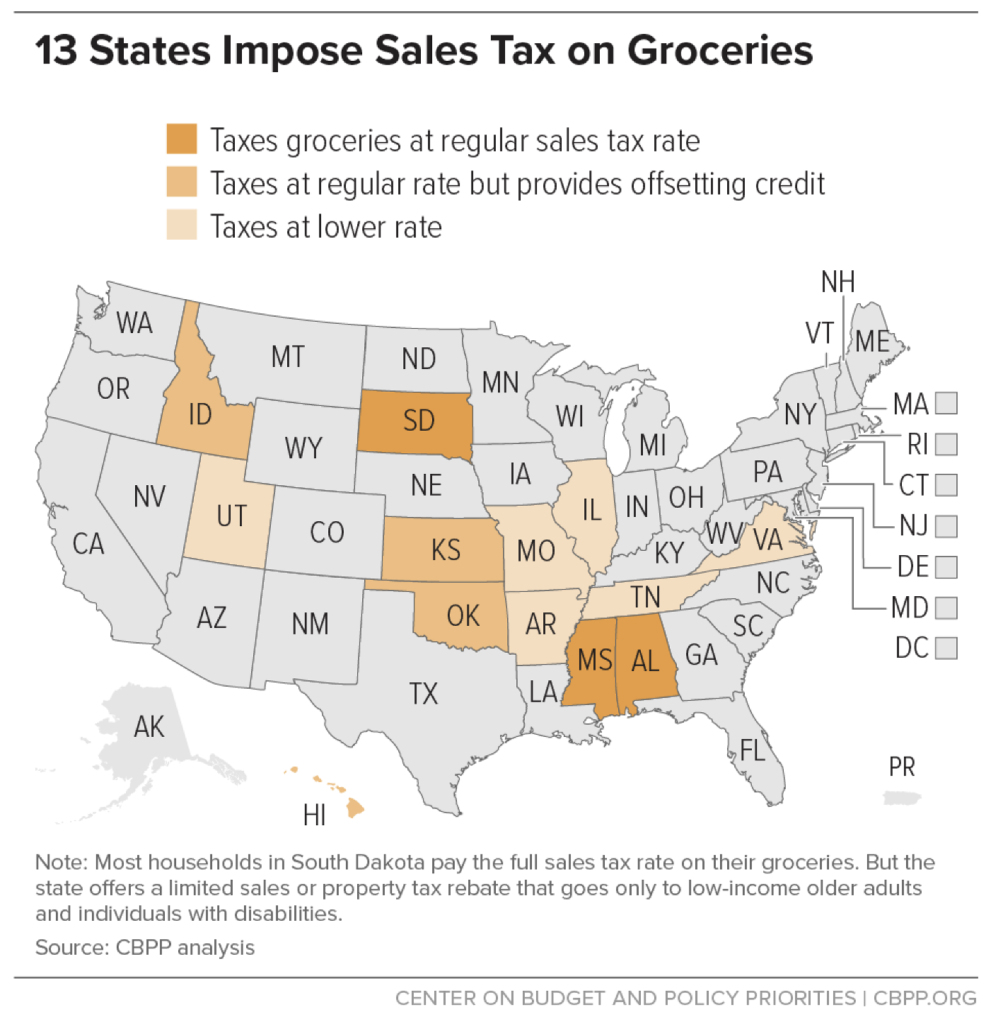

Currently, South Dakota is one of three states that impose a full sales tax rate on food. The tax rate is 4.5%, according to the Department of Revenue [Annie Todd, “Gov. Kristi Noem Proposes Permanent Tax Cut on Groceries,” Sioux Falls Argus Leader via Yahoo, 2022.09.28].

The simple headline/takeaway/response to this dramatic change of political heart is, “Yay! The governor of South Dakota finally agrees that taxing food is bad for families!” If Noem follows through with her promise (and remember: she can’t executively order the food tax away; the Legislature has to do it), South Dakota will join 37 other states in completely removing this regressive plank from its revenue framework. Democrats can celebrate because the Governor is finally coming around to good sense; Republicans can celebrate because the Governor is finally acting like a Republican again and cutting taxes; everybody who eats can celebrate because each peanut butter sandwich will cost 1.4 cents less.

Wow! Maybe next we can convince Noem to adopt the logic of the 38 other states that have expanded Medicaid! We could have a real family-values revolution on our hands!

Of course, on those rare and blessed occasions when South Dakota Republicans surrender to the logic and wisdom of proposals Democrats have been advocating for years, they have to surround themselves with Republicans so people think it was a Republican idea:

The announcement came Wednesday during a press conference about policy proposal hosted by Noem in Rapid City, at Dakota Butcher. Special guests included Lt Gov. Larry Rhoden, the commissioner of economic development Steve Westra and two legislators, Helene Duhamel (R-Rapid City) and Mary Fitzgerald (R-Spearfish) [Todd, 2022.09.28].

Senator Duhamel’s presence is important. She’s part of Senate boss Lee Schoenbeck’s club, and Schoenbeck killed the rebellious House Republicans’ last-minute effort to grate Noem’s cheese with a food tax repeal last March. Schoenbeck warned in February that any sales tax relief would drive us off a fiscal cliff. Noem might say, “Look at that $115M surplus we just ran! We can totally cover the food tax repeal!” but Schoenbeck would surely respond, “Yeah, but that surplus was all Biden bucks; we’re not going to get another round of federal covid/stimulus dollars to save the next few budgets.” Noem may have asked Duhamel to stand beside her today to signal to Schoenbeck that his friends like the idea, so he should, too.

But getting Schoenbeck on board might kind of tough when Noem appears to be throwing him under the revisionist-history bus:

A spokesman for Noem’s campaign, Ian Fury, said that Noem had privately voiced support for the grocery tax cut bill to Senate leadership during budget negotiations. At the time, Republican Sen. Lee Schoenbeck, one of the most powerful lawmakers in the chamber, had said the House proposal was dead on arrival in the Senate. He said in a text message that he remains opposed to the tax cut.

Schoenbeck also told The Dakota Scout that Noem, even in a private conversation in March, was “adamantly opposed” to the House proposal [Stephen Groves, “Noem Speaks Out on Grocery Tax, Promises to Repeal It,” AP, 2022.09.28].

What?! Noem now dares claim that she actually supported cutting the food tax in February? Was she lying then when she publicly said she opposed that cut? Or is she lying now…just when she needs your vote?

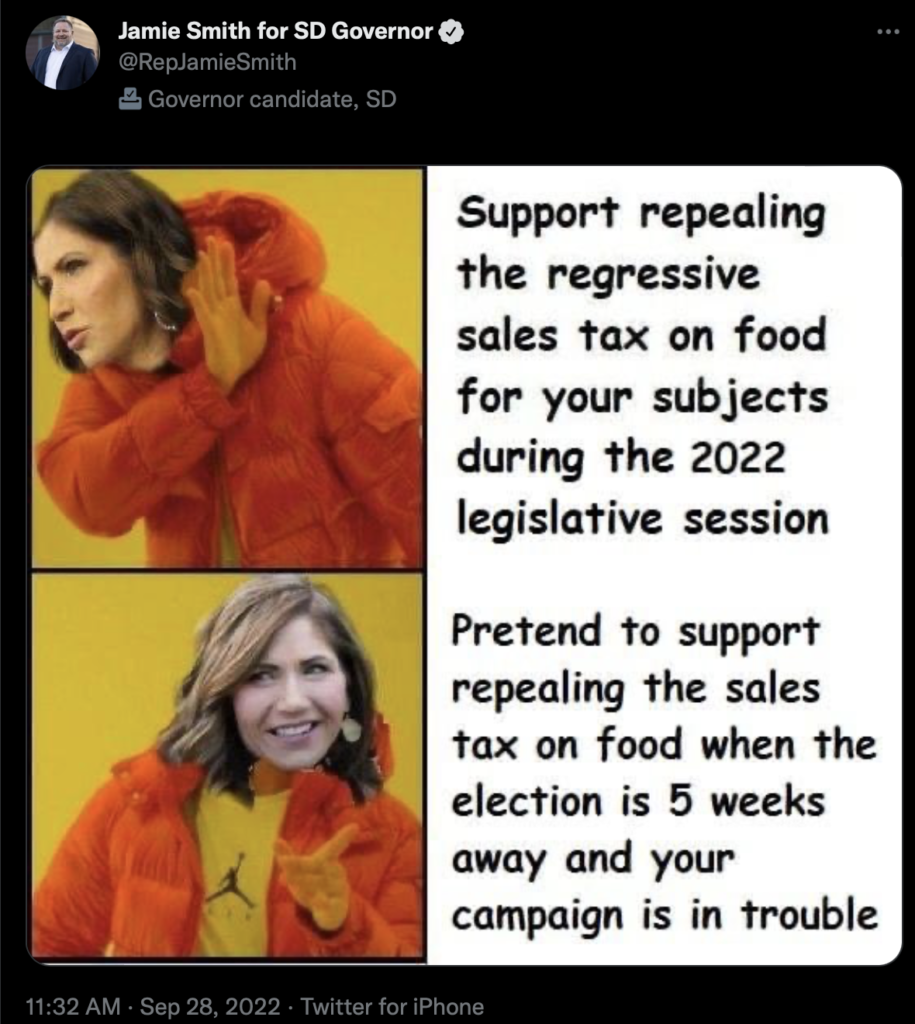

Noem’s challenger in the gubernatorial election, Representative Jamie Smith (D-15/Sioux Falls), suspects it’s the latter. Smith says Noem is pretending to come to food-tax-Jesus now because she’s afraid she could lose in November:

So does Senator Reynold Nesiba (D-15/Sioux Falls), who has worked on repealing the food tax since his first term in the Senate and says Noem is coming awfully late to this party:

“Governor Noem has been governor for four years. She could’ve addressed this,” said Nesiba. “The only thing she’s eliminated is a sales tax on bingo. To see this 41 days before the election just suggests to me that her political campaign is desperate.”

Nesiba clarified that regardless of the reason for Noem’s interest in repealing the tax, he is glad people are talking about it. He went on to talk about the bipartisan nature of the issue. “This started out as a Republican issue and then it was one that Democrats really took up — but I think there’s bipartisan support for it” [Jacob Newton, “Attempts to Repeal the Food Sales Tax Go Back Decades,” KELO-TV, 2022.09.28].

In an interesting parallel, Oklahoma’s Republican Governor Kevin Stitt went before the cameras yesterday to promise to repeal Oklahoma’s food tax. Governor Stitt still can’t get his Senate Republicans on board with the proposal. The Oklahoman reports that the latest polls show Stitt’s Democratic challenger, state schools superintendent Joy Hofmeister, within single digits of Stitt.

Noem explicitly rejected repealing the food tax seven months ago. Now she’s promising voters that she will repeal the food tax. Voters, I’d suggest that any time a Republican promises to cut your taxes and you aren’t a millionaire, you should take that promise with a grain of that salt that Noem until today insisted must be taxed. Jamie Smith co-sponsored Nesiba’s and Rep. Ray Ring’s food tax repeal six years ago. Smith voted with Democrats and House Republicans to repeal the food tax this year. Smith has votes to prove he’ll repeal this regressive tax.

Ending South Dakota’s regressive tax on food is good policy. Whoever wins in November should go to Pierre and tell Lee Schoenbeck to make food-tax repeal Senate Bill 101.

But whom do you trust to do that job: the gal who tosses a surprise promise to voters that contradicts pretty much every public statement she’s made about repealing the food tax, or the guy who has supporting repealing the food tax all along, on the record, with real votes?

p.s.: Whoever wins the November election may still have a very narrow window in which to fulfill her promise and claim credit for the Democrats’ great idea. Dakotans for Health has an initiative to exempt groceries from sales tax in the hopper right now, awaiting Attorney General Mark Vargo’s review. If neither Governor Noem nor Governor Smith can convince Senator Schoenbeck to unstick himself from the regressive mud, voters may have to take the matter into their own hands and vote to repeal the food tax in 2024.

It’s really suspicious. Why do this right before the election unless you have to? To me, the only explanation is that her polling is showing vulnerability.

Dear Jesus… I promise not to drink too much if she is defeated, like I did when Trump lost.

Jamie’s got her on the run. She knows she’s in trouble. It’s time for Jamie to come out with repealing the tax on clothing as Governor and see if she wants to steal this idea as well.

The repeal must also forbid municipal sales tax on food.

Almost no one pays 4.5% sales tax; some pay 7.5%.

Watch out! Livestock from Meade county may have anthrax.

https://kbhbradio.com/news/anthrax-reported-in-meade-county-cattle-herd

Back on topic, Gov. Noem was in Rapid City today looking like recent surgery is all healed up. Uh huh. Uh huh. Yep. She said something about Joe Biden causing groceries and gas to cost more-from what she hears people tell her. Uh huh. Sounds about right. She definitely wouldn’t have a clue. I doubt she does the chore of grocery store shopping. That task is probably 4x removed down the line from Ian F. to his assistant’s assistant. Pure speculation on my part mind you. I bet Rep. Smith pushed for the tax cut way back when because he actually helps with the supermarket trips and sees the price of butter and takes out his billfold and pays with HIS OWN $cratch.

There is no bill just Mrs. Noem talking about a bill that MIGHT be introduced. Talk is cheap with the Governor and she likes to be all over the block with various proposals most of which never see the light of day. Even at the mention of a repeal of the sales tax on groceries by a Republican Governor, Walter Dale Miller is spinning in his grave.

For Noem, I dunno.. Maybe people have finally noticed she’s out of state a lot. Maybe they care she hangs out with Lewendowski, again. Maybe people think SD abortion laws are uncomfortably heavy handed.

Are those things and the general lack of leadershio enough to put her campaign in trouble? I dunno. Voters are weird. To many voters, she can do no wrong. Right or wrong.

P.S. Schoenbeck apparently forgot to print Drain the Swamp postcards with his name on them.

HB 1327 would have notched down the State Sales tax 1/4 of 1 percent. This reduction would have been painless to the State yet given some relief to tax paying Citizens. The bill would roll back the sales tax rate another one quarter percent in 2023, another painless belt tightening measure. Inflation was on the rise and a simple math equation would reveal if goods and services would double, what would tthat do to sales tax revenue to the State? Take a listen on how HB 1327 was promoted, and got canned https://sdlegislature.gov/Session/Bill/23463 And, ask yourself which party is the tax and spend party? Thank you Rep. Carr, Hoffman, Dennert, Weis, Greenfield, and May for your foresight and your efforts you gave promoting this bill.

Grocery shoppers in Fall River County need to scrutinize their receipts before leaving the store; I tried to buy a food item that is regularly $.99 and it rang up at $1.18. Municipal sales tax is 6.5%, making the item HONESTLY $1.05435. A buck five. The store manager was restocking cigarettes near the checkout, so I asked him why. He just shrugged and did the “I dunno nuffin’ ’bout nuffin” shuffle.

Left the item at the checkstand. Made me wonder about the true total bill of the customer in front of me who spent > $320.00.

Gov. Noem’s “change of heart” campaign promise to eliminate South Dakota’s sales tax on food

will barely budge South Dakota’s high ranking as a “family unfriendly” regressive tax state.

“According to ITEP’s Tax Inequality Index, South Dakota has the fourth most unfair state and local tax system in the country.”

https://itep.org/whopays-map

In South Dakota, households in the bottom 20% tier of family household income pay 11.2% in state and local taxes,

while those in the top 1% tier pay only 2.5%.

For the record, I bought a gallon of milk, Great Value, at Wal Mart for $2.96, yesterday. Last month it was three something.

Nobody seems to be answering Sen. Schoenbeck’s original question, how will we here in Northern Mississippi, the anti-tax kingdom, fill the $100 million budget hole when President Biden stops shoveling money into our state? Which Paul will the legislature rob to pay this Peter? As much as comments like Marie’s are well taken that the 1% should be called on to pay their fair share, and Cory as detailed in the past the list of those who pay no sales taxes in SD, I don’t see them or their well payed lobbyists paving the way to increase their taxes.

Noem said that she’s for getting rid of the tax on food now because of Biden’s inflation.

This is BS. Prices have gone up but it wasn’t Biden’s fault and what Noem has done is nothing more than a political stunt.

Some smart people need to survey the candidates for the legislature to determine if there will be enough votes in January to pass a repeal of the state sales tax on food. I suspect Noem will either forget about this promise the day after the election, or she will introduce a token proposal to reduce a tiny fraction of the sales tax on food. None of this means anything if a Republican legislature is in charge.

Why Senate Bill 101? How about Senate Bill 1?

Note to Bonnie: Please send that receipt to the Dept. of Revenue and ask them to straighten out the grocery store there in Fall River Co. As you note, the correct tax is 6.5%(state+city).

Note to “gtr”: Think about possible higher priorities than getting tax off clothing, such as getting tax off home heating bills, internet and phone bills (Cell phone service has an extra 4% tax), the labor on car repairs, …. Meanwhile, let’s keep up momentum for ending the food tax.

Clearly Ms. Noem and her election minions got a lot of goats with this one. Mr. Smith should have been more on the front end, instead he got run over with this. Less government is good. It is good Ms. Noem like to cut taxes and nobody likes to pay them. Tomorrow night Mr. Smith will have to explain how it was his party that put us all in a position where cutting this tax was necessary to help people live better. I hear all this whining about people not being able to pay to feed their kids lunch, now they will have money to pay the lunch bills.

Since it is what it is Cook Political Report still has my home state rated “Solid R” in the gubernatorial race but in some hope for deplorables here in New Mexico the race has slipped from”Solid D” to “Likely D.”

Thank you, Cathy B. Since I did not buy that $.99 item, I did not get a receipt. I restrained myself from doing the “WTF?” thing with the innocent cashier and confronted the store manager, whom I mentioned did the “I dunno shuffle.”

The Fall River County grocery store has found a way to outsmart the residents of Hot Springs City. They will charge the tax and keep it for theirownselfs.

Grocery stores here are so greedy that they’ll raise their prices immediately to grab that tax savings away. We are 100 miles from a Walmart Mike from Iowa and you are paying less for a gallon of milk than I am for 1/2 gallon. The nursing home here closed 4 years ago and we are the largest town for a 100 mile radius. The school has 50 less students this year…….and the county is going broke. Noem’s tax savings is a joke here.

Inflation started while Trump was in office. For the past 8 years I have shopped for disabled and elderly, most of whom are on fixed incomes, have worked hard all their lives, and find themselves in a downward spiral financially. If they get EBT, they are already exempt from taxes. Anyway, they may have $40 for the week so we budget to the penny. Right when the pandemic hit and things closed down, prices rose sharply and have not stopped since March 2019. The fact is no one was prepared for supply issues etc but the grocery store owners made a fortune from being an essential business. Millions went to grocery stores and then we got took with higher prices which has now become gouging.

Grudz-I doubt that any goats have been exchanged in this hub-bub about the sales tax on food. Repeal has been on top of the Democrats Legislative agenda since the 50’s and people know that. People also know that the Republicans have ALWAYS vehemently opposed any talk of reducing much less repealing the sales tax.From Walter Dale Miller in the 70’s to the Senator Schoenbeck,, flag bearer of the GOP last year. Republicans and their talk about “everyone must pay their fair share and how else can low income people pay their fair share if not through a tax on groceries” is well remembered by South Dakota voters. Mrs Noem talks a lot, releases a lot of hot air balloons, and flip-flops with abandon. Talking about introducing a bill next January is a long way from having the political will to fight for it through the session, twisting arms for votes, and winning enactment in March.

Trump and Biden shoveled $11 billion of federal COVID money to South Dakota…and that was just through June of 2021. But sure, $100 million annually is going to change the world for SD families. If she wins re-election, and gets rid of the state sales tax on food, (she won’t get rid of the municipal 2%), she’ll be cutting education and health care Daugaard style again before her second term is over. She probably could care less about that right now.

Bonnie, Are you in Fall River County? If so, can you go to that store and buy something priced at 99cents and see what happens? It’s important to catch mistakes such as the one you described.

Cathy B: I am, indeed, in FRC; your suggestion is excellent, and I’ll do that. I avoid Hot Springs as much as I can because of the rabid Trump cult; only reason I was in town that day was to get my Omicron bivalent jab and thought I’d buy that unbought item. It might be a few days before I descend into H*ck again and risk assault (my Biden/Harris 2020 bumperstickers enrage the Trump humpers.)

I think I’ll have read all my library books by Tuesday; then it will be an emergency trip :) into Hot Springs.

So you shop at Maverick Junction then, Ms. Fairbank? Where the libbies rule the roost, and nary a redneck be seen. Or do you cotton to Edgemont? where the locals glow from Mr. Pay’s uranium dumpings used to backfill against their basements.