One jar of peanut butter. A Sioux Falls woman brought one jar of peanut butter to Senate Taxation this morning. Her furnace broke down this winter, wiping out her emergency fund and forcing her to turn to The Banquet for food assistance. The sales tax she would pay on one load of groceries would pay for that one jar of peanut butter. When you’re hungry, when you’re feeding kids, one jar of peanut butter can go a long way.

Senator Reynold Nesiba (D-15/Sioux Falls) brought Senate Bill 159 to help that woman buy some peanut butter and to help make other South Dakotans’ straits a little less dire. His plan would refocus sales tax relief already written into statute in 2016 from a general reduction of the state sales tax rate to a deeper cut of the sales tax rate on food.

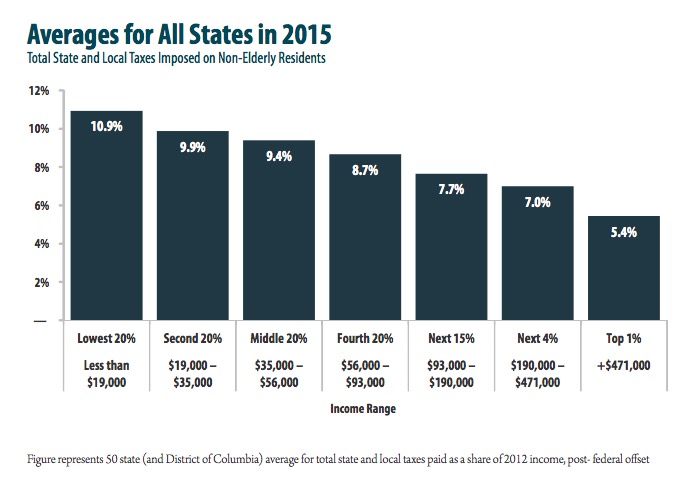

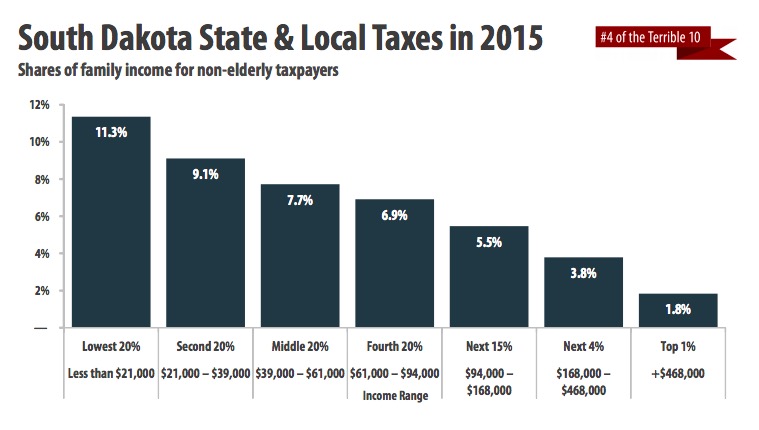

The arguments Senator Nesiba and his allies offered were familiar: South Dakota has a uniquely regressive tax structure (we tax the poor at a rate higher than the national average while taxing the rich less than the national average), sales tax eats up three weeks worth of grocery money, and dang it, people gotta eat! We also received the reminder that as the only state in the region taxing food, we lose all sorts of business and tax revenue on non-food item from residents who hop the border to buy cheaper groceries in Iowa, Minnesota, and other eater-friendlier states.

And then Senator Nesiba gave these important numbers. According to the Legislative Research Council, about 7% of our sales tax revenue comes from food sales. Out of $950 million total revenue, that’s about $66.5 million from taxing food. Per a conservative amendment Senator Nesiba offered this morning, SB 159 would knock one percentage point off the food tax for every $20 million brought in by online sales tax. Thus, to completely zero out the $66.5 million we make taxing food, SB 159 would require $90 million in online sales tax to jingle-jangle into the state’s collection plate. SB 159 thus broadens the tax base and leaves a net increase in revenue.

Whether you’re counting beans or jars of peanut butter, SB 159 works out.

But Republicans and the business lobby aren’t going have it work out in South Dakota. State economist Jim Terwilliger said South Dakota follows a safe, stable philosophy of taxing everyone a little to avoid taxing anyone a lot. That statement is fallacious, of course, because taxing the price of a jar of peanut butter taxes a poor woman with a broken furnace a lot.

The Chamber of Commerce and the Retailers Association both testified against easing the food tax, competitive disadvantage with Iowa and Minnesota be darned.

Senator Ernie Otten and Senate Taxation Chairman Jeff Monroe both signaled that the poor already get enough help from food stamps and other welfare programs and thus don’t need a break from the food tax. Senator Monroe said that chart of South Dakota’s regressivity rates probably doesn’t take into account low-income folks’ lavish public benefits…. but he made no mention of the fact that we can apply the impact of public benefits in all states and still see that South Dakota is taxing the poor more and taxing the rich less than other states do.

Senator Jack Kolbeck said South Dakota may be an island of food tax, but we are also an island of no income tax. Kolbeck’s logical conclusion, of course, is that if we exempt food from sales tax, we’ll end up with an income tax, and then everything will go to heck.

David Owen of the Chamber credited Senator Nesiba with coming up with a better plan than past attempts to cut the food tax. Senator Gary Cammack said SB 159 is well-intended and well-crafted. Senator Otten called SB 159 “one of the best proposals I’ve ever seen” in six Sessions and said the bill really got him thinking.

But Senate Taxation still voted 4–1, on party lines, to kill this umpteenth effort to repeal South Dakota’s tax on food. The online sales tax offset thus remains general relief, promising to cut the state sales tax by one tenth of a percentage point for every $20 million in online sales tax. So that woman in Sioux Falls may still benefit… but instead of a jar of peanut butter, our Internet shopping will spot her a handful of peanuts.

Instead of rewarding state pols at the expense of the poors, why not give $123 per diem on top of those lavish public benefits to the poor?

Jif? Aren’t there store brand peanut butters and honeys that cost less? Let us hope it is at least the more healthy crunch peanut Jif. Would this knock the sales tax off restaurant meals to patrons who breakfast there?

This issue is such a no-brainer that it is now perfectly clear, to the whole wide world, how the leadership in South Dakota has very little brain, and what’s worse – this indicates how poor of heart as well.

Trumptards outnumber everyone else in SD. So, can we really expect thoughtful policy? They can’t stop being crappy people and our state government is saturated with them.

If $1.50/week is a big win for the masses like Paul Ryan claims, and it’ll stimulate the hell out of the economy enough to pay for tax cuts for the wealthy and for corporations like the GOP Party claims, then a food tax cut will be a win/win/win for everybody. That pie will come down from the sky and feed Grudznick and everybody else.

I thought GOPs like tax cuts, but who could forget the part about them only liking tax cuts if the wealthy get most of the benefit?

The out of touch elites used to say to the struggling commoners “Let them eat cake,” but that has now evolved into “Let them eat peanuts.”

The hypocrisy of the GOP on this issue is palpable. The supposed party of lower taxes remains firmly committed to the idea that food should be taxed while the income of the wealthy should go undiminished by taxation in our state. We tax our elderly neighbors who live on a fixed income when they go buy a loaf of bread at the store, but we don’t tax the out of state doctor who comes here to do temporary work and takes back to their state hundreds of thousands of dollars. It is a strange and unfair system that favors the wealthy over the poor and out of state residents over our own citizens.

Rorschach has a solid point, why don’t these people just use their yuge $1.50 weekly bonuses from Paul Ryan and the Koch Bros to buy more of their precious food if they’re so darn hungry? Too bad they probably already spent it on shelter, drugs, and smart phones. Some folks you just can’t help.

Here is another scenario to watch out for- https://crooksandliars.com/2018/02/republican-state-legislatures-weaken-state

Wingnuts are desperately trying to rein in state courts that vote against them.

grudznick,

That jar of PB was the one on sale last week – for less than store brand.