The Legislative Research Council issued last week the first monthly report on general fund receipts under the first Kristi Noem fiscal year.

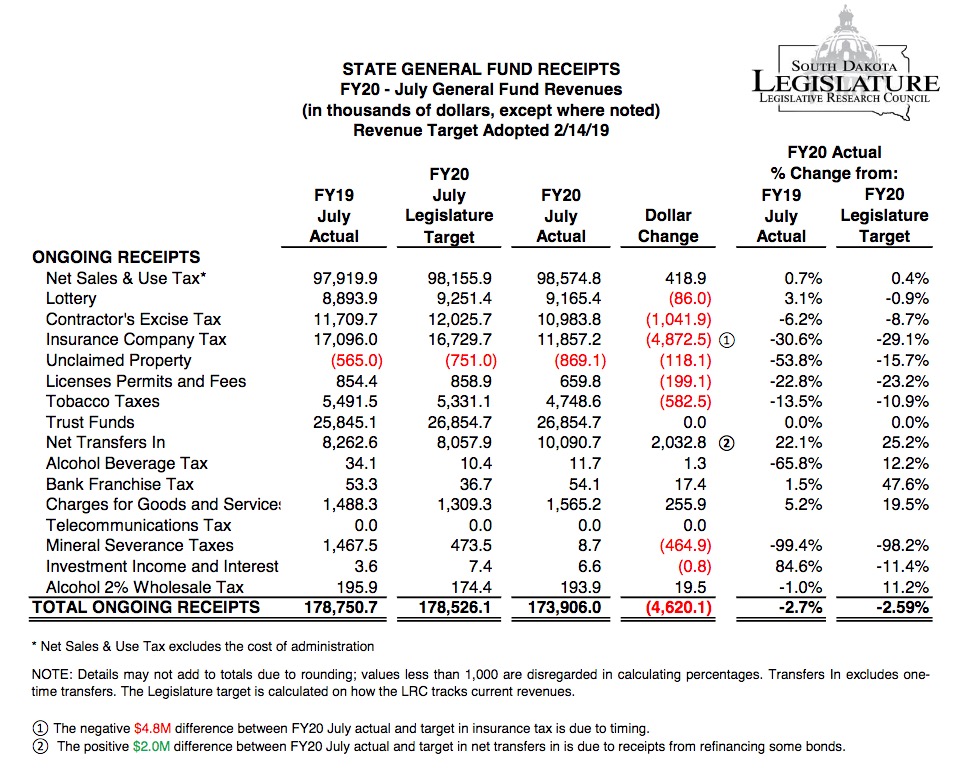

In good news—if you think government collecting more taxes and people buying more stuff is good—we collected $419K more in sales tax than the Legislature expected. That’s 0.4% above the target established in February.

In bad news, we collected $1.04M less than hoped in contractor’s excise tax. That’s 8.7% below target.

In debatable news—bad if you are balancing a state budget, good if you oppose sin and budgets based thereupon—tobacco tax collections keep dropping hard, bringing in $583K/10.9% less than expected, lottery chipped in $86K/0.9% under target, and alcohol taxes (beverage and wholesale) poured $23K under target into the state pot.

Add those figures and everything else, and we would have come out 0.14% above target revenues for July. But then mistiming of the income tax that we charge insurance companies blew a $4.8M hole in revenues. Thus, for July, we ended up short $4.62M what we were hoping we’d bring in, down 2.59% from projections and down 2.7% from the mad money Governor Daugaard had to play with last July.

But we’re not $4.8M in the hole. According to the current BFM dashboard on expenditures, Governor Noem is still squirreling away money, spending $478K less than budgeted for general fund personal services and $1.16M less than budgeted for general fund operating expenditures. So as of July 31, the state general fund was only short $2.98 million, easily covered by the mistimed insurance company income tax that should retime in August… right?

.7% keeps up with neither inflation (up more than 3 times that much in cy ’18) nor SD’s population growth (up more than 2 times that much in ’18).

Maybe SD should try sending citizens to work in other countries, take advantage of the remittances economy.

(You anti-immigrant/anti-humanity types should not read this because it treats immigrants like human beings.)

“remittances — the sums migrants send home — are three times the world’s foreign aid budgets combined. Migration is the world’s largest antipoverty program, a homegrown version of foreign aid.”

That comes from a book. “Author Jason DeParle, a New York Times reporter, writes in the prologue to ‘A Good Provider Is One Who Leaves.'”

“This ambitious and successful book profiles an extended Filipino family inching toward prosperity by laboring out of country for years, migrating to do arduous work in harsh places. — revealing family and work scenes set in the Philippines, Oman and Saudi Arabia, aboard wandering cruise ships and deep in the heart of Texas.”

The review is paywalled by the Strib.

http://strib.mn/2KXFXj8

This is the Amazon link, including reviews.

https://amzn.to/2MpoPpY

I see that Unclaimed Property revenue was down. Does that mean more was claimed, thus less for the state to keep?

If SD welcomed more immigrants, they’d be working more jobs, spending more $ and sales tax revenue would be up. State income as a whole would be up since immigrants create much more economic activity than they consume state support.

Immigration = improved economy.

Here’s another way to help the budget from Occupy Democrats:

(This is based on national, but state %s are probably in the ballpark.)

In one year, the average American making $50,000 pays ……

$36 for food stamps

$6 for other safety net programs

$870 for corporate subsidies

$1600 to offset corporate tax loopholes

$1231 to offset tax losses to corporate overseas tax havens

John T, I was surprised to see that the Legislature only projected a 0.24% increase in sales tax revenues over last July. They didn’t expect anything like the growth you say we’d need to reflect either inflation or our population growth. What’s going on here? More buying online can’t explain that laggardly growth, because we’re supposed to be getting our 4.5% of Amazon and Wayfair sales now, too, right? What’s missing here?

Debbo, I’m not clear on how that unclaimed property line works, but I am clear on the economics of welcoming immigrants. More South Dakotans would mean more people buying groceries and household goods and paying more sales tax. Evidently South Dakota prefers white poverty to rainbow riches.

Nothing’s missing, Cory. South Dakota’s economy just isn’t keeping up.

We’ve got more people… are we just losing our big spenders to other states, leaving behind a consumer population made up of a larger population of low-wage workers?

Led by a faltering, tariff damaged agriculture sector the South Dakota economy is slowing down. I know this farmer is watching the bottom line closely and buying less “stuff”.

Thousands of penny-pinching farmers can’t be wrong… but they can lead the state into recession.

Yeah! Every farmer who plans to vote for Trump again should buy a new combine–in South Dakota. That’ll produce some loot for the state to squander. C’mon! Where’s your patriotism, you chumps.

20 % down on RV’s. Instead of a combine, how about an RV? Boys and girls, this thing is now in the crapper. It will be interesting to see when the new tax cuts will be upcoming.

“Total wholesale shipments of recreation vehicles are down 20.3 percent, year to date, across the industry, signaling to some Indiana economists that a recession is on the way. Companies such as Elkhart-based Thor Industries Inc. have slashed production and cut back the work week to slow the pace of production.

Economists reading the tea leaves for signs of a recession have typically held declining RV shipments as a strong warning of a contracting U.S. economy.”

What did anyone expect with a coke sniffing Larry, a leggo movie Munchkin and some dude that could not balance a checkbook appointed by the bankruptcy king?

The trump recession marches onward

“In a Worker Adjustment and Retraining Notification filed on Aug. 5, the Pittsburgh-based company said it expects to let go fewer than 200 workers following its decision to halt production at the Michigan facility.

In mid-June, the company said it would idle two blast furnaces at its Great lakes and Gary Works plants, citing lower steel prices and softening demand.

U.S. Steel said the lay-offs at the Michigan plant could last beyond six months. They will impact nearly every area of the facility, from blast furnace to finishing operations, a company spokeswoman told Reuters.” https://www.reuters.com/article/us-u-s-steel-layoffs-idUSKCN1V91XQ

Brother can you spare a dime?

RVs… RVs… maybe sales tax is stagnant because RVers aren’t coming and spending as many nights in our corrupt, bigoted state.