I really don’t like having to say that Don Haggar and Jeff Monroe were right. But these two extremist anarcho-capitalists were right to warn us that the Legislature would try to renege its 2016 promise to ease back on the state sales tax it raised to fund teacher pay if the Supreme Court let us collect sales tax from out-of-state online vendors.

The author of that compromise amendment, Senator Jeff Partridge (R-34/Rapid City) tells Bob Mercer that’s he’s working on a bill to erase the 2016 plan, which would have scaled back the state sales tax by 0.1 percentage point for every $20 million in new sales tax revenue from remote online vendors, and leave it up to the Legislature to decide whether or not to live up to its 2016 promise:

[Partridge] said the trigger is confusing.

What Partridge now proposes is a different requirement.

He wants the state Department of Revenue to provide sales-tax statistics to the Legislature’s Joint Committee on Appropriations. That deadline would be day 21 of the annual legislative session.

He also wants to clarify how online revenue is calculated.

Those changes would let appropriators — nine from the Senate and nine from the House — set the annual revenue estimate and provide approval for any tax cut [Bob Mercer, “South Dakota Lawmaker Would Change State Sales-Tax Rollback,” KELO-TV, 2019.01.21].

First, let me rebut Partridge’s characterization of his own amendment as “confusing.” Sure, some questions have been raised about the wording of the Partridge Amendment, but the intent is pretty clear: to cobble together the two-thirds majority necessary to pass Governor Dennis Daugaard’s signature education funding plan, Partridge and other backers had to promise fence-sitters who were read-my-lips squeamish about passing a new tax that that dread tax might go away in few years.

The means of calculating that promised tax rollback is also quite clear:

- Give me two spreadsheets, one showing all sales tax payments for twelve months before our win in South Dakota v. Wayfair, one showing all sales tax payments in twelve months after we started collecting that SCOTUS-approved sales tax from out-of-state vendors.

- Mark all of the out-of-state vendors who appear on the latter sheet but don’t appear on the former.

- Add up those vendors’ payments, divide by 20,000,000, drop the remainder, multiply by 0.1—the result is the percentage points by which we decrease the state sales tax.

Partridge’s bill isn’t in the hopper yet, but Mercer provides a snap of a circulating draft that indicates Partridge would stick with that basic math and work with calendar years.

Partridge doesn’t swap variables, but he changes one key word: where the 2016 legislation said that the sales tax rate “shall be reduced,” Partridge’s new draft says the Joint Appropriations Committee “may introduce legislation to reduce” the sales tax rate.

And even if Joint Appropriations suggested giving any money back, Partridge’s draft actually sets a minimum sales tax rate of 4%. If we all go gangbusters and buy $4.4 billion of stuff from Wayfair, thus generating $200 million in additional sales tax revenue, the new Partridge rule would not let us drop the sales tax rate by a full percentage point.

Now if I were still a Rush Limbaugh Republican (I was farther right than G. Mark Mickelson once, and more philosophically consistent about it!), I’d say what Jeff Monroe said last month: “You’re never gonna see government lower a tax.” The big-government fix is in! Government is inherently greedy and evil!

I won’t go that far, but Governor Kristi Noem, who isn’t inherently selfless and good, seems willing to help bring in the fix. Governor Noem insists that she’s not seeing any extra sales tax revenue coming in.

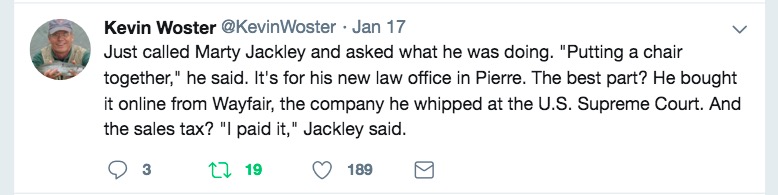

None other than one of the men Noem beat to become governor, Marty Jackley, refutes that claim, via Kevin Woster:

No new revenue? Marty just bought a chair from Wayfair! That’s new revenue!

And I’ll bet there’s millions more where that came from, or soon on the way.

Watch the revenue estimates closely, and watch the Partridge Amendment… or now, the Partridge Repeal. Republicans promised to walk back the regressive tax that we Democrats had to swallow to get the first substantive teacher pay raise in two generations; now they want to take back that promise and tell us there isn’t really any money coming in to fund that refund. You don’t have to be an anarcho-capitalist like Haggar or Monroe to say that plan kinda stinks.

Why those lying walk-back bossturds! We should cut the sales tax rate all the way down to 3% and pull back the raises to teachers too!

Got a red shirt, Mr. Heidelberger? LA Teacher’s strike results in a win for teachers.

The tentative deal includes what amounts to a 6% raise for teachers — with a 3% raise for the last school year and a 3% raise for this school year.

The agreement, which runs through June 2022, also includes a reduction of class sizes over four years to levels in the previous contract, but removes a contract provision that has allowed the school district to increase class sizes in times of economic hardship.

https://www.latimes.com/local/education/la-me-edu-lausd-teachers-strike-negotiations-20190122-story.html

Good work, Los Angeles and organized labor!

Meanwhile, back at the ranch, when it comes down to it, Democrats are probably going to have to get behind whatever scam Partridge and Noem are cooking up. Regressivity be damned, online sales tax is still the only funding the Noem party will be willing to commit to preserving that 2016 Blue Ribbon funding formula. Let the Partridge Amendment take effect as originally planned, or let Don Haggar and Americans for Prosperity push their tax cut, and Noem will not raise taxes (and sure as shootin’ not any progressive taxes) to make up the difference and prevent the Blue Ribbon funding formula from collapsing. We’ll be stuck waiting for God to bring down the “Next Big Thing” for Noem to take credit for in the absence of any policy vision.

Red Shirted Teachers on a roll . Now it’s Denver. https://www.denverpost.com/2019/01/22/denver-teachers-strike-union-authorizes-walkout/

I’d suggest a different way for Sen.Partridge or some other senator to amend the Partridge amendment now: It turns out that for the same funds, whole percents of state tax could come off food, rather than tenths of percent off the general rate. I think many South Dakotans would prefer that food tax relief, and one percent at a time would improve our food buying power by a half-week worth of food at a time.

Now there you go again, Cathy B, trying to be progressive and democratic—small-d democratic, thinking what the people of South Dakota would prefer matters one whit to Partridge, the GOP leaders, or the Koch Brothers.

The proper policy solution:

1. Be 100% transparent in reporting the revenues and their sources.

2. Allocate the $55 million directly to a reduction of the sales tax rate on food.

3. Expand Medicaid to boost tax revenues by $55 million and then some to keep South Dakota teacher pay out of the gutter.

4. Pass a progressive state income tax with margins set to national averages to raise $912 million, which will allow eliminating all remaining sales tax.

I won’t demand that we achieve all four planks. I’m willing to compromise.