State Income Tax Could Raise $918 Million!

Eager reader Nick Krebs contributed to yesterday’s post on the LRC’s comparison of neighboring state tax systems this comment on the newest analysis from the Institute on Taxation and Economic Policy of how states distribute their tax burdens across income groups. As noted in past discussions at the Legislature and here on this blog, South Dakota continues to reward the rich and punish the poor worse than almost every other state in the nation.

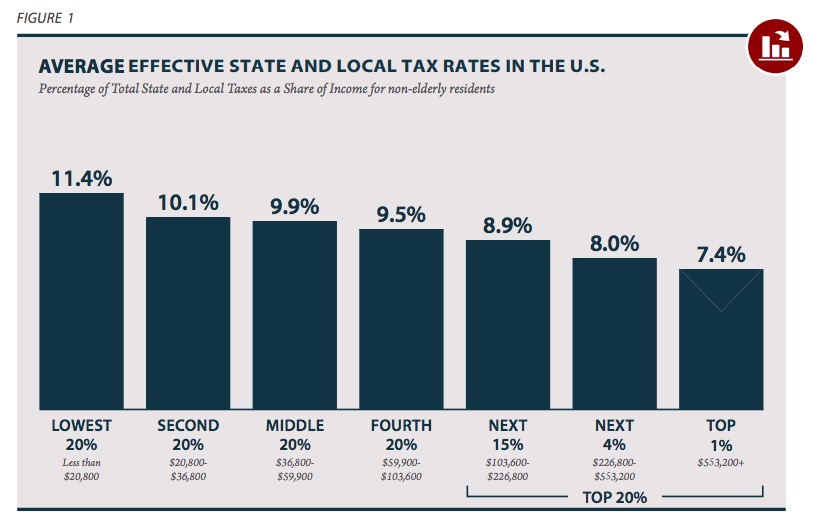

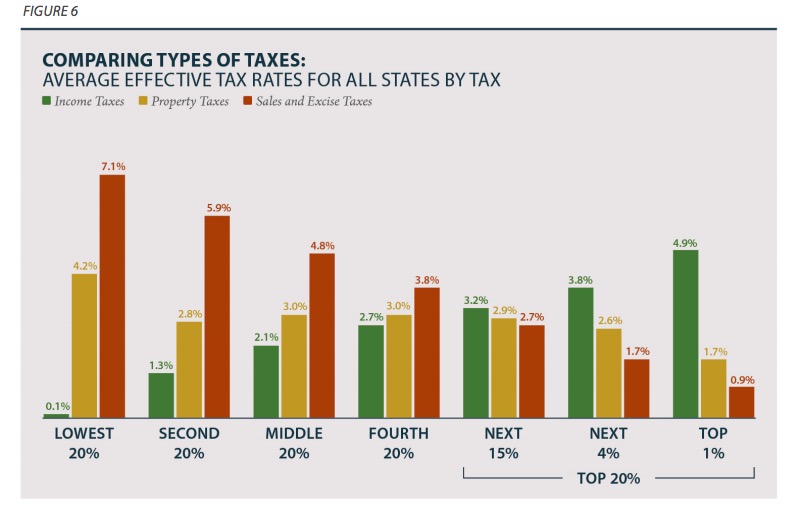

State and local taxes nationwide are generally regressive, due to reliance on sales tax and property tax damping the positive effects of progressive income tax:

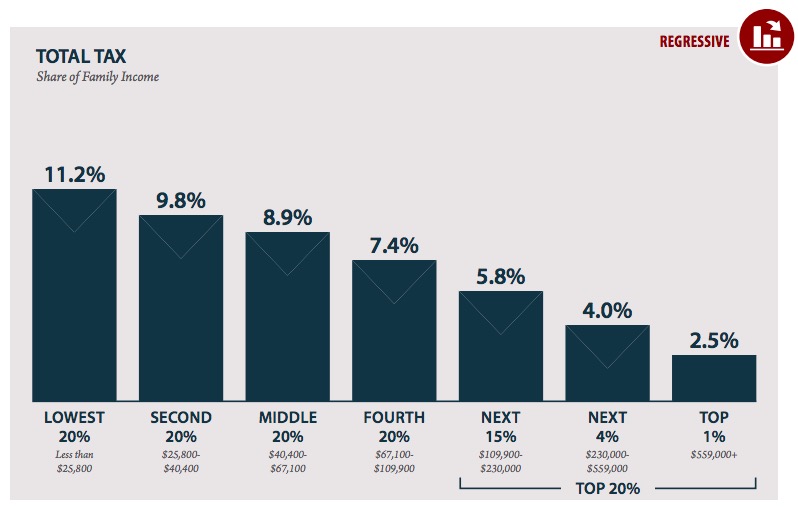

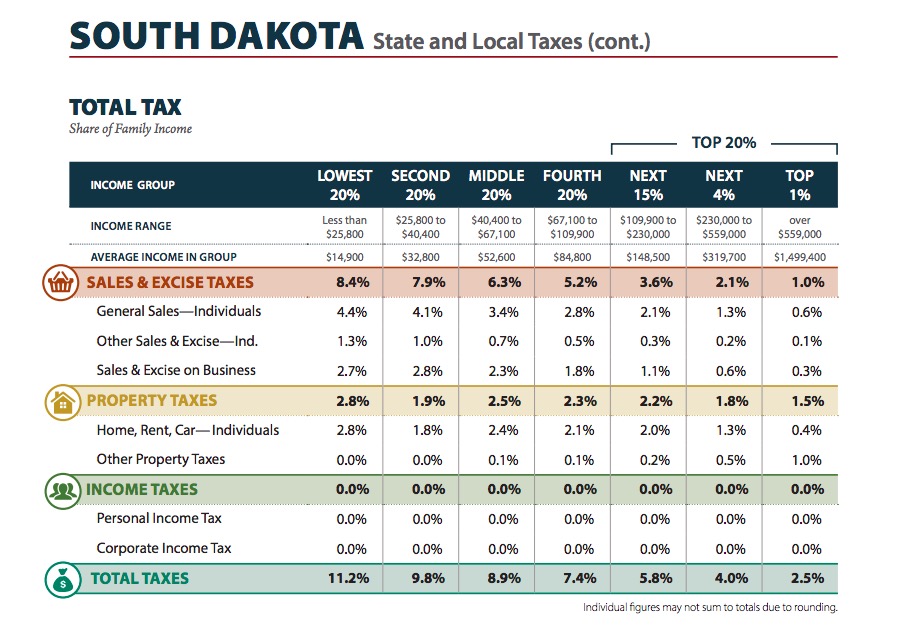

South Dakotans do generally pay a lower percentage of their income in state and local taxes than the national average. But the break South Dakota’s rich get is far greater than the break low-income South Dakotans get:

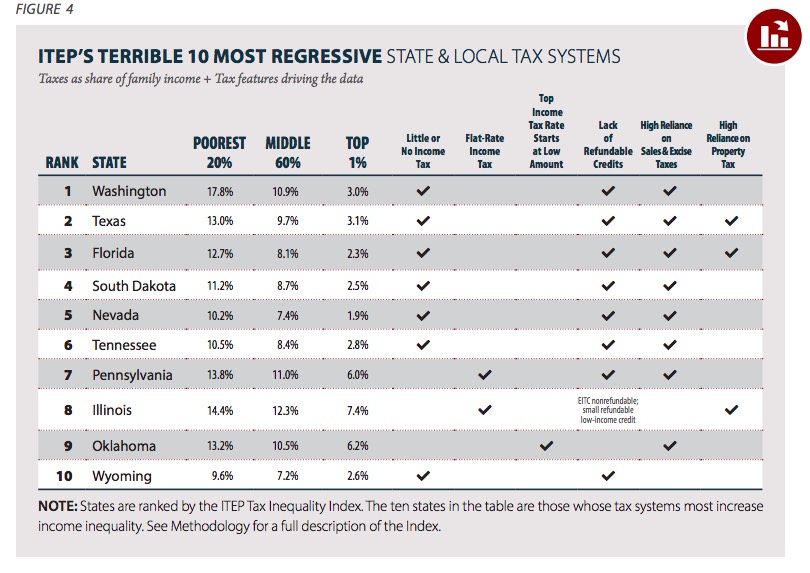

South Dakota ranks #4 in ITEP’s “Terrible 10” most regressive states:

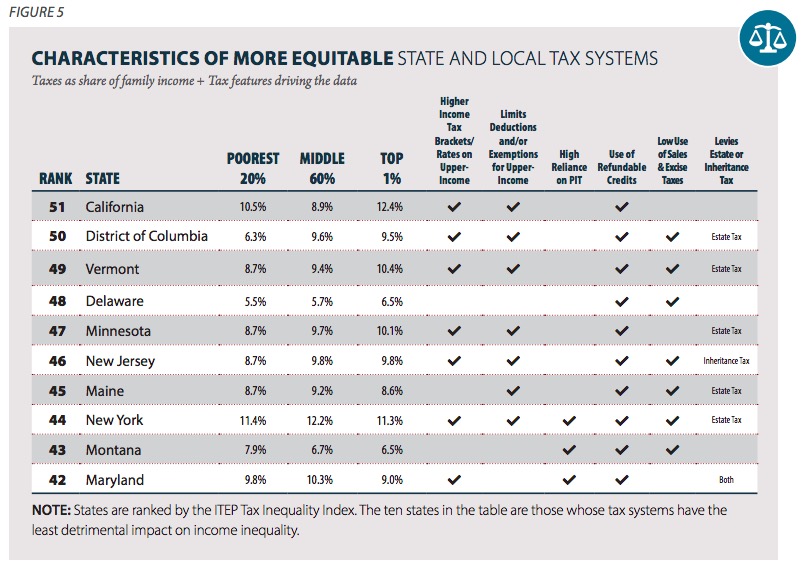

No state is perfect: even ITEP’s “most equitable” state, California, still hits the poor harder than it hits the middle class, but at least the rich pay a higher percentage:

Minnesota, as we would expect, is far more progressive than South Dakota, taxing its poor less than South Dakota does and taxing its rich more, while taking just one percentage point more of its middle class’s higher incomes.

Under ITEP’s lens, it’s probably a good thing we rejected Initiated Measure 25; G. Mark Mickelson’s proposed cigarette tax would have hit the poor harder and lost value over time:

Overall, state excise taxes on items such as gasoline, cigarettes and beer take about 1.7 percent of the income of the poorest families, 0.8 percent of the income of middle-income families, and just 0.1 percent of the income of the very best-off. In other words, these excise taxes are 17 times harder on the poor than the rich, and 8 times harder on middle-income families than the rich.

In addition to being the most regressive tax, excise taxes can be relatively poor revenue raising tools because they decline in real value over time. Since excise taxes are levied on a per-unit basis rather than ad valorem (percentage of value), the revenue generated is eroded by inflation. That means excise tax rates must continually be increased merely to keep pace with inflation, not to mention real economic growth. Policymakers using excise tax hikes to close fiscal gaps should recognize that relying on excise tax revenues means balancing state budgets on the back of the very poorest taxpayers—and that these revenues represent a short-term fix rather than a long-term solution [ITEP, Oct 2018, p. 20].

Remember: our Governor-Elect Kristi Noem agrees that regressive taxes are bad. Since regressive taxes strangle public services and drive young people elsewhere, Noem will surely want to turn to tax reform as the first major project of her governorship.

But remember: the only way you make South Dakota’s tax system less regressive is by adopting an income tax.

Suppose South Dakota adopted an individual income tax with rates reflecting those national averages. What would taxes look like for South Dakotans? Well, first, let’s look at the income brackets ITEP defines for its quintiles and the smaller divisions at the top in South Dakota:

Now if we multiply the average state income tax rates by the average South Dakota incomes within each bracket, and then multiply each of those figures by the number of families in each bracket (I operate from this figure, 340,000, given by Statista.com), we can calculate just how much South Dakota could raise with a conservative yet progressive state income tax built on the average rates imposed by all other states:

| Income Bracket | average income in bracket | income tax rate (nat’l average for bracket) | average income tax | # of households | Total Tax paid by bracket |

| 0-25,799 | $14,900 | 0.10% | $15 | 68,000 | $1,013,200 |

| 25,800–40,399 | $32,800 | 1.30% | $426 | 68,000 | $28,995,200 |

| 40,400–67,099 | $52,600 | 2.10% | $1,105 | 68,000 | $75,112,800 |

| 67,100–109,899 | $84,800 | 2.70% | $2,290 | 68,000 | $155,692,800 |

| 109,900–229,999 | $148,500 | 3.20% | $4,752 | 51,000 | $242,352,000 |

| 230,000–558,999 | $319,700 | 3.80% | $12,149 | 13,600 | $165,220,960 |

| 559,000+ | $1,499,400 | 4.90% | $73,471 | 3,400 | $249,800,040 |

| Totals: | $2,700.55 | 340000 | $918,187,000 |

$918,187,000, from a state income tax under which 80% of South Dakotans would pay less than 3% of their income. That revenue would replace 92% of our sales tax revenue and would impose far less burden on low-income families. That revenue could pay all $809 million the state spends on education (K-12, universities, and vo-techs) and leave $109 million to pay for corrections and public safety.

Divide that money up as you see fit, but imposing a state individual income tax with the brackets and rates listed above would make South Dakota’s tax system far fairer than the regressive mess it is now.

If only Billie could have illustrated this point as succinctly. Even my just-left-of-center sister fell for the Noem ads that showed him “favoring an income tax” (when taken in context, his argument was far more simple: all options should be on the table) and voted against her own self-interest.

I’ve said this many times before….but alas, it’s time.

And before the FOX-watchers blast me with the “rich pay more” argument, let me again show the simple math:

If you’re a millionare, and I earn $10k, and we both pay 10% in taxes….the total revenue earned is $100,001k. Yes, you paid more. But your 100,000 still leaves you with $900k to do a lot with. My $9k leaves me far more precarious for food, rent, gas…

I understand arguments about equity and fairness, but what about the social contract?

A Nicer Person, you point ought to be the center of all taxation discussion: focus more on what taxes LEAVE than what they TAKE.

This issues clearly shows the tail wagging the dog; far more citizens would pay less in taxation (assuming any fairness/progressive income tax), yet the messaging by those wealthy few who would pay more effectively defines the public perception — another frustrating example of people willing to vote against their own best interests.

Maybe it is time for re-branding (taking a page from the GOP playbook) instead maybe we could discuss an “obscene abundance tax?”

The republican social contract: “I’m alright Jack, pull up the ladder.”

The rich should totally pay more. With greater power comes greater responsibility. We tac the rich more to mitigate the advantages they get that can lead to political inequality.

What they leave instead of what they take—excellent point, O.

We have two years to frame this argument properly for the 2020 Legislative candidates and four years to frame it for the Democrat (or Green? or independent?) who will rise up to challenge Noem.

Didn’t SD try to do an income tax through initiated measure about two decades ago?

The last time it was seriously discussed was during the Mickelson administration in the late 1980s. He put together a task force to consider comprehensive tax reform. I have a copy of the report, and it is comprehensive indeed, which basically concluded that an income tax was the most efficient and fairest means of taxation. As one of the task force members told me, the political opposition just wouldn’t allow Mickelson to back an income tax, so the idea died.

John, did that make it to a ballot? I remember signing a petition, but am blank to any more details. I do remember there was some SERIOUS math behind the findings.

I’m pretty sure but not positive that it did not, o. The report is titled Governor’s Advisory Commission On Taxation and it’s dated November 29, 1988. It identified several problems: 1) Property Taxes Are High, 2) Property Tax Assessments Are Unequal And Unfair, and 3) Current Tax Sources Are Inequitable. Individually, each problem was addressed and potential solutions on a problem by problem basis are suggested. But the omnibus solution after the respective fixes took hold and created a drop in state revenues was that “the only remaining major new tax sources to South Dakota are corporate and personal income taxes. Adopting these taxes would provide the revenue diversification that many state and local government experts consider desireable.” Seems like 30 years ago that state officials came to the same conclusion that Cory and I (in various columns and blog posts over the past few years) and others have reached. South Dakota needs an income tax. But as we contemporaries have found, along with Mickelson and his commission 30 years ago, the political will to make it happen just isn’t there. The report btw, numbers 440 pages, 3/4ths of which are dedicated to supporting tables, graphics and explanatory data.

O said, “focus more on what taxes LEAVE than what they TAKE.”

Brilliant.

What would the income tax replace? That’s also a critical element to address. Will it leave lower and middle income South Dakotans with More or approximately the Same?

Debbo, bookmark this page. ITEP’s income bracket data and averages provide me the basis for contending that a simple individual income tax could raise $918M in revenue, which number we can use to talk about what the income tax would replace. This post is central to future fiscal debates.

I am willing to propose this income tax to replace sales tax dollar-for-dollar. Do it just like the Partridge Amendment: for every $20M in new revenue generated by the state income tax, we scale back the state sales tax by 0.1 percentage points. Every $100M in income tax drops the sales tax by half a percentage point. $900M in income tax reduces the state sales tax to zero. (Locals are welcome to keep collecting, although if they want to enact fairer municipal income taxes instead, I invite them to do so.)

One note: adopting a form of my sixer surtax—setting the rate on the top quintile, most of the folks making six figures at 6%—would raise another $350M.

I love your plan Cory.

When Gov. Dayton ran his first gubernatorial campaign in 2010 his main theme was raising the income tax rate on the richest Minnesotans to make them “Pay their fair share.” It resonated with voters and he followed through with a Democratic legislature.

(Previous GOP Gov Pawlenty had trashed the budget cutting and slashing. Usual GOP fiscal incompetence. Democrat fixed it. Usual D fiscal competence.)

The rich should only pay more if they get more say and get bettwr use of paying more. It is absurd for then to pay more simply because they make more. A simple flat tax is what is needed.

Nope. A flat tax is regressive.

Should they pay less because they’re a trust fund baby, sitting on their butt, spending their dead daddy’s hard earned $?

Or should they pay less because they bribed the Congress to give them a sweetheart deal so they can charge us 50% more for our meds than the rest of the world pays?

Should they pay less because they’re swindling the military by installing cheap ass showers instead of what they agreed on, and so our soldiers get electrical shocks?

Everyone should pay their fair share.

What Debbo said. Fairness is about what each taxpayer has left, not what each taxpayer pays.

Progressive taxes also take a bite out of inequality, redistributing not just money but power in democracy.

Besides, the rich do get more: more assets protected, more contracts enforced, more educated laborers building their wealth at their factories….

Again, what Debbo said: a flat tax is regressive, says this National Review writer.

Cory wrote:

“redistributing not just money but power in democracy.”

What Cory just said is one of the main reasons why the founding fathers did not want an income tax.

Since SD does not have an income tax, Government can not exert power over the Citizens of South Dakota.

The Democrat party is all about power over you. You can see it in Cory’s statement above and his statement about coal miners.

The Republicans control the Government in SD because of ideas, policy, and values, not money.

Jason’s assertion that “the founding fathers did not want an income tax” carries some interesting ramifications. Presumably, Jason must mean that since the Constitution did not provide for an income tax without a subsequent amendment, that shows the founding fathers’ objection to such a provision.

Jason’s idea would hold true for the 2nd Amendment – the founding fathers did not place this langauage in the original Constitution, hence showing the founding fathers’ objection to establishing or protecting any rights of gun owners. In both cases, it was later miscreants that caused amendments to the original Constitution for gun rights and an income tax, all to defeat the will of the founding fathers.

And we know that is true with slavery, hence the adoption of the 13th Amendment certainly must have made the founding fathers’ ghosts livid, just like gun rights in the 2nd Amendment and income tax in the 16th Amendment.

BCB wins “Best Brain on DFP” again!

Jason is silly.

How did you get to the conclusion that only income tax gives a government power over the tax payer? Why is that not true for sales, property, or any other tax? In my experience, the lack of income tax has not stopped the SD legislature from passing regulations that affect citizens.

The Democrat Party is all about power FOR you. The point here is how we define you. Democrats take the large view that “you” are “We the people . . .” — the people of the United States, the common defense, general welfare . . . The Republican Party has become about the few; the GOP “you” has become the wealthy 1%.

The GOP controls SD government because of tribalism (mostly, not exclusively) and marketing. Look to how often initiated measures or referred laws have been passed by the citizens of SD in direct opposition to the laws and positions taken by our governing officials. To me that says that it is not policy agreement or adhesion that put politicians in office. Over and over, many on this blog have marveled at the cognitive dissonance between voters and their votes.

It makes me sad that BCB doesn’t know the bill of rights was written by a founding father. The education system is not very good.

0 wrote;

The Democrat Party is all about power FOR you.

That’s hilarious.

Do you really want to get into the needless regulations just during Obama’s presidency to keep the discussion to under 1000 posts?

Jason, define “needless.”

Not only did founding fathers support payroll taxes, they thought those funds should pay for national health care:

https://www.forbes.com/sites/rickungar/2011/01/21/thomas-jefferson-also-supported-government-run-health-care/#64adbda85324

Don’t feel bad Jason. You just need to recall that the founding fathers who generally supported the Constitution were the Federalists, and they opposed the Bill of Rights. Even James Madison, the author of the Bill of Rights opposed a Bill of Rights until he realized that the Anti-federalists’ opposition to ratification of the Constitution without an explicit Bill of Rights jeopardized the whole project.

Nevertheless, None of the founding fathers were even alive when the 13th Amendment (slavery) and the 16th Amendment (income tax) were introduced and ratified, hence my analysis of your odd theory that the founders opposed an income tax stills stands despite Madison’s change of heart.

O- this gives some history of SD’s income tax history-

https://www.csgmidwest.org/policyresearch/nov2011sdtaxes.aspx

I don’t know how accurate it is but I’m guessing it must be close.

bearcreekbat, you’re spot on again. You may find this an interesting read about the founding fathers and the need for a “national tax” and how they managed to put it together. http://www.taxhistory.org/www/website.nsf/Web/THM1777?OpenDocument

BCB,

Both the Federalists and Anti-federalists passed the bill of rights.

Please link me to a quote by a Founding Father that supported a tax on “income”.

Jason, if you have a genuine interest in understanding the founders’ views on taxation, including direct quotes, you might want to start with the article Jerry linked at 14:50. It seems quite thorough and accurate.

Your attempt to move the goalposts of our discussion is noted, as I never asserted that the founders either favored or opposed taxation. That was your claim. I simply pointed out that if your claim was accurate (which is doubtful given other false claims you have made on DFP, such as there is “no evidence” supporting most scientists’ conclusions about human activity affecting global warming), the founders contemplation of and the later adoption of amendments to the Constitution modified whatever original intentions some or all of the founders may have had when promoting (Federalists) or merely acceding to (the Anti-federalists) our founding document – the Constitution. In other words, such intentions became wholly irrelevant once each particular subsequent amendment changed the Constitution contrary to whatever evidence of original intent exists.

Where there hasn’t been an amendment, original intent is critical in interpreting the meaning of any constitutional provision. But the game changes whenever we amend it, just as the founders intended by specifically providing for amendments.

BCB,

My claim is the Founding Fathers did not want an income tax.

If you have evidence that they wanted one feel free to present it.

I never claimed they opposed taxation. You clearly misread my first post in this thread.

I said they opposed an “income” tax.

The goalpost was “income tax”.

BCB moves it to include all taxes.

He seems to move the goalposts a lot when he debates me.

Jason, I think I clarified my point. I looked back, however, and find it odd that you make a claim with no links, argument nor proof offered, yet insist others prove their points, do research for you, and provide you with links to answer your questions or objections. Is there a sauce that is good for both the goose and gander that I am missing here?

Oh,Brother.

I never claimed they opposed taxation. You clearly misread my first post in this thread.

I said they opposed an “income” tax.

So income tax isn’t a tax?

https://tenthamendmentcenter.com/2016/04/14/the-founders-vs-the-progressive-income-tax/

I can’t provide a link to a Founding Father saying they wanted an income tax because not one of them said that.

It’s common sense.

Jason, your link only deals with a “progressive” income tax, not any other taxes on income. Got anything to actually prove your original claim?

Your turn.

Please provide a link to a Founding Father saying they wanted an “income tax”.

Jason, although not relevant to anything I have asserted on this issue, due to the 16th Amendment, here is such a quote for you:

The tax expert providing this quote, who appears to know a great deal more than I know about taxes and their history, explains:

https://www.huffingtonpost.com/mark-steber/a-founding-father-on-taxe_b_10559178.html

Your post would be relevant if I asserted the Founding Fathers were against taxes.

I did not assert that.

It’s still your turn.

So while Jason is playing his little Russian games, SD still needs to implement a progressive income tax. The figures provided in this post don’t lie. A progressive income tax with everyone paying their fair share, could result in removing sales tax from food and reducing property taxes, thereby making SD’s taxing system even more fair.

Debbo,

People of SD are already paying their fair share by paying sales tax to fund the Government.

Everyone in SD pays the same tax. How can that be made more fair?

I love how you bring up Russia. Russia hates me because I’m not a socialist communist like you.

Russia pays you troll, you’re their house boy.

Right Jason, we all believe Pootie hates you. Riiiiiiight.

Progressive taxes make everyone pay their fair share. Look it up.

“The Legislature is empowered to impose taxes upon incomes and occupations, and taxes upon incomes may be graduated and progressive and reasonable exemptions may be provided.”

South Dakota Constitution, Article 11, Section 2, as amended in 1918.

I should get a petition going to amend that.

How many signatures do I need to get that on the ballot?

Here is the only thing you need to understand out of Cory’s post “South Dakotans do generally pay a lower percentage of their income in state and local taxes than the national average.”

Understand what he has said here: Cory told each of you (you citizens of South Dakota), you get to provide more for your families than you would in other states. This means you can buy food, cloth the kids, afford health insurance and generally live a better life for the same dollar than you would in other states.

Troll, are income taxes not taxes? Game, set and match to bcb, as usual. Jason fouled out.

OldSarg,

Here’s the overlooked part of your analysis: that family makes less than other states, that family is more likely to be on assistance paid from from federal (not state) funds, South Dakota requires federal funds to keep its government solvent and to make vast parts of its economy running, and, therefore, South Dakota citizens, in general, are dependent on the federal teat. They are, let’s be honest, on the federal dole.

You get to provide more for your family because citizens in other states who actually pay for their own state services subsidize yours. Understand that, OldSarg.

When did DFP hire an interpreter for us dummies?

Jason, to place a constitutional amendment on the ballot, you will need 33,916 signatures. My proposed initiative needs 16,958 signatures to be placed on the 2020 ballot.

That’s a lot of unpaid volunteers I would need.

I think I will look in the legislative option first.

Donald Pay,

South Dakota has 13% of its population in medicaid and chip.

Wisconsin has 17% of its population in medicaid and chip.

Good response, Donald. South Dakota families don’t have more money to provide for themselves. We recruit businesses angling to exploit low-wage labor. We provide fewer public services, thus shifting more costs to individuals, who will inevitably find it less efficient to provide certain goods for themselves than if the state provided them (see health insurance, drive exam translations, snow removal…).