Last month the Legislature’s Executive Board received a basket of new Issue Memoranda from the Legislative Research Council. One of the tastiest is the “Comparison of the Neighboring State Tax Systems,” which charts the total tax revenue and per-capita tax burdens in each state:

| State | Total 2015 Tax Revenue (millions) | Revenue per capita | Rank in US |

| Iowa | $9,189 | $2,942 | 20 |

| Minnesota | $24,439 | $4,452 | 6 |

| Montana | $2,843 | $2,753 | 24 |

| Nebraska | $5,087 | $2,683 | 27 |

| North Dakota | $5,740 | $7,583 | 2 |

| South Dakota | $1,674 | $1,950 | 46 |

| Wyoming | $2,356 | $4,020 | 7 |

Now if you squint your eyes at that chart, you might think, “Gadzooks! If I moved from Aberdeen to Jamestown, I’d end up paying $5,633 more in taxes! That’s almost quadruple my South Dakota tax bill!” That would likely only be true if you were going into the oil business, since North Dakota gets a huge chunk of its revenues from severance taxes on oil and gas:

| State and Local Tax Collections 2015, percentage from each source | |||||||

| Tax | IA | MN | MT | NE | ND | SD | WY |

| Property | 33.0% | 25.8% | 37.3% | 37.5% | 13.3% | 36.0% | 36.7% |

| Sales | 22.6% | 17.3% | 0.0% | 22.6% | 23.2% | 40.5% | 28.0% |

| Individual Income | 24.1% | 31.8% | 28.3% | 23.4% | 7.7% | 0.0% | 0.0% |

| Corporate Income | 3.1% | 4.5% | 4.0% | 3.6% | 2.7% | 0.1% | 0.0% |

| Other | 17.2% | 20.6% | 30.4% | 12.9% | 53.1% | 23.4% | 35.3% |

Severance tax makes up 53.1% of that $7,583 of per-capita tax burden in North Dakota, so if you aren’t drilling for oil, that’s over $4,000 of that additional $5,600 per-capita burden that you will never pay, leaving the North Dakota per-capita tax burden for the normal non-oily capita at $3,556, just $1,606 more than that person would bear in South Dakota.

Then we have to consider how much of that additional burden comes from income taxes:

| Individual Income Tax 2015 | |||||||

| Iowa | IA | MN | MT | NE | ND | SD | WY |

| Total Revenue (millions) | $3,576 | $10,370 | $1,180 | $2,240 | $537 | N/A | N/A |

| Rev per cap | $1,145 | $1,900 | $1,143 | $1,181 | $709 | N/A | N/A |

| Rev per cap rank | 21 | 6 | 22 | 17 | 37 | N/A | N/A |

| Min tax rate | 0.36% | 5.35% | 1% | 2.46% | 1.10% | N/A | N/A |

| Max tax rate | 8.98% | 9.85% | 6.90% | 6.84% | 2.90% | N/A | N/A |

| State and Local Corporate Income Tax Collections 2015 | |||||||

| State | IA | MN | MT | NE | ND | SD | WY |

| Total Revenue (millions) | $463 | $1,477 | $168 | $344 | $186 | N/A | N/A |

| rev per capita | $148 | $269 | $163 | $182 | $246 | N/A | N/A |

| Min tax rate | 6% | 9.80% | 6.75% | 5.58% | 1.48% | N/A | N/A |

| Max tax rate | 12.0% | 9.80% | 6.75% | 7.81% | 4.53% | N/A | N/A |

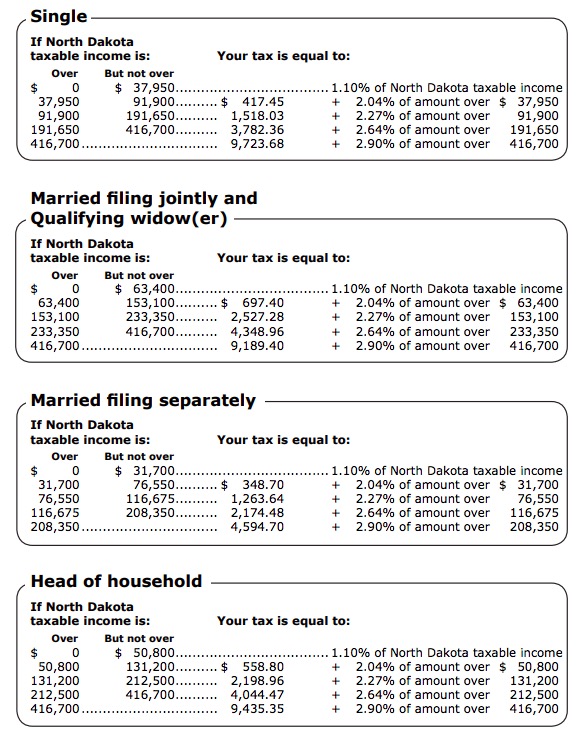

59% of that added burden, $955, comes from North Dakota’s individual and corporate income taxes. If you’re a working stiff, you won’t directly pay any of that corporate tax. As for the $709 in new individual income tax, well, once again, your mileage will vary. North Dakota’s individual income tax rates progress from 1.10% to 2.90%:

A North Dakota family of four taking the standard deduction in 2017 wouldn’t pay $709 in income tax unless its total income reached $92,850 (subtract $12,700 for standard deduction and $16,200 for four personal exemptions, and that leaves $63,950, which page 27 of the ND Tax Table says creates $709 in income tax liability).

The same will be true in Minnesota and other states whose sensible progressive tax rates keep the tax burden from falling too heavily on lower-income residents.

Now recall that I’ve often run numbers showing that, even when we factor in per-capita tax burdens, South Dakota wages don’t keep up with the earning power we can get by hopping the border in just about any direction. But my calculations of tax burden are still too generous to South Dakota, since they assume the average tax burden per person, a figure that is skewed upward by the top earners. The majority of workers will pay less than that per capita burden in states with severance taxes and progressive income taxes… meaning it’s that much harder for South Dakota to make the argument that its low but regressive taxes make up for its low wages.

Yep. South Dakota taxes are low ……… but we don’t get much for ’em.

buckobear is correct, what do we get compared to our neighbors that have the state income tax?

Cory, I think this may be another way to present your same basic argument using ITEP data.

ND household with median income ($55,200) pays 8.5%, or $4,692, in state & local taxes.

SD household with median income ($52,600) pays 8.9%, or $4,681, in state & local taxes.

This is a difference of $11 for hard working families.

There may be other variables I haven’t considered here, but for the median family, this hypothetical move from SD to ND looks like a net gain of $2,589 ($2,600 increased income – $11 increased state & local tax). I also haven’t considered the additional federal witholding, which is no longer partially offset by federal income tax defuctions. I’m guessing that eats up about 20% of the gain, but that’s still an average pay raise of about $2,000 by moving north. Perhaps the Legislative Research Council could present this data as an addendum to their report, for the benefit of hardworking South Dakota families.

Please check my math and assumptions.

https://itep.org/wp-content/uploads/whopays-ITEP-2018.pdf

Looking at the 2nd chart one can really see just how regressive SD’s tax system is. Sales tax and property tax are 76% of the total. 3/4 of SD’s taxes are paid at the same rate, regardless of income. That’s so unAmerican and unfair and economically unhealthy.

Then take a look at the best economy in the Midwest. (Cory, I couldn’t find that link again. Scheit!) Property tax and sales tax are 43% of the tax base. Income taxes are 36.3% total. Both corporate and individual income taxes are progressively rated, with the top individual rate just raised in 2011. It was very popular legislation because Minnesotans like fairness. That’s why there are no taxes on food and clothing.

The takeaway for smart economists who want the best for their state ought to include progressive taxes. Or find a vast oilfield in your state.

Nick, wow! I’m going to have to read ITEP’s methodology, because their individual tax burdens for the median-income households in ND and SD are far different from the per-capita burdens presented by LRC above, much higher for SD and much lower for ND. They appear to capture the impact of the regressivity that Debbo highlights. Check out ITEP’s chart on p. 7 of the link Nick provides: South Dakota has the fourth-most regressive tax system in the country, charging the lowest income quintile 11.2% of their income in taxes, the middle three quintiles 8.7% of their income in taxes, and the top 1% only 2.5% of their income in taxes. (Dang—that’s going to end up in a blog post of its own.)

And yes, Buck and Jerry, not quantified in the LRC’s simple comparison of tax systems is the value of public goods each state’s residents get for their investment. A guy can brag about spending only $10,000 a year to maintain his house while his neighbors all average $15,000 a year, but when the cheapskate is sitting there with a leaky roof and drafty windows, should he really be bragging?