The Trump Tax doesn’t just cut tax rates for rich people. It also triggers the 2010 Pay-Go law, brought to you by the fiscally responsible Obama Administration and Democratic 111th Congress, which requires that new taxing and spending legislation not increase the deficit.

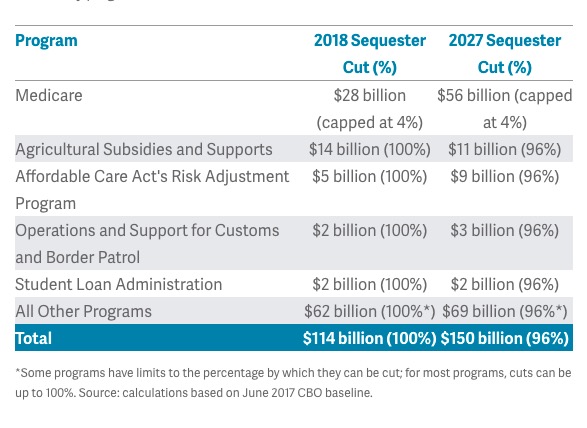

Right off the bat, Pay-Go will start making up for Trump’s $150 billion in new annual deficit spending by taking $307,000 in mineral royalty payments away from South Dakota. South Dakota’s farmers and Medicare recipients will also take a hit:

Congress can suspend Pay-Go, but the Senate will need 60 votes to make that happen. If they don’t, rural America takes a hit:

…in the absence of a suspension of PAYGO, the House and Senate agriculture committees will have $140 billion less—over the ten-year period which is used to determine the cost of a program—with which to fashion the policies they want to make a part of the 2018 Farm Bill. This will affect not only commodity programs, but also young farmer programs, grants available for university agricultural research, environmental programs like EQIP (Environmental Quality Incentives Program), funds to support local ASC offices, and much more.

In addition, many non-agricultural programs that are important to rural areas could be affected. Without suspension of PAYGO, rural US highways and bridges, rural hospitals, the Forestry Service, small business loans, and programs that we don’t even think about could all be negatively impacted by budget cuts [Harwood D. Schaffer and Daryll E. Ray, Agricultural Policy Analysis Center, “Tax Cuts ‘Give.’ Pay-As-You-Go Takes It Away?” Farm Forum, 2017.12.19].

But hey, at least the richest 4% of farms will qualify for a lower corporate tax rate. And some lucky portion of the tiny fraction of farms subject to estate tax (only 0.4% paid last year) will get a break from Kristi Noem’s totally principled opposition to the estate tax.

There will be many adverse consequences of this special interest tax bill. Republicans want to give so much away to the wealthy and big corporations that a lot of those less favored will take hits that hurt.

“Republicans want to give so much away to the wealthy” this tax bill actually only the very wealthy. You should read the law before making such stupid statements.

OK have it your way, OldSarg. I’ll insert the word “very” into my sentence: “Republicans want to give so much away to the very wealthy and big corporations.”

They should absolutely never suspend PAYGO. No borrowing from China. If they need to make those programs whole, take away all the salaries provided to Representatives and Senators. All their staff needs to go. Cut every penny going to the White House. Every cent going to the politically-appointed staff in Departments and agencies should be zeroed out. They can get paid off by the rich, who own them anyway.

Trump says that this tax bill has many helps for South Dakota. Except he does not mention even one of them. As usual, all talk and not action.

It helps everyone that pays taxes in SD Roger.

Rorschach

Please post some of these adverse consequences that you say will happen?

The budget needs to be cut.

I could find 1.5T in cuts over 10 years easily without even touching entitlements and the military.

This morning on the news there was a sound bite from one GOP speaker saying that in February, Americans will see the effects of this new tax code in their checks. Is that even possible? Do even the most strident supporters see this affecting my check in two months? Isn’t my tax bill all really figured come next April?

Fixed it for you, OldSarg: “this tax bill actually only [favors] the very wealthy.”

But at least people will now know where the Republicans stand. First the Republican Wealth Transfer to the 1% Act passes this month and the Republicans say deficits don’t matter. In the coming months Republicans will suddenly say that deficits matter again and we must cut middle class programs like Medicare, Medicaid and Social Security. That will not play well in the 2018 and 2020 elections.

If the Republicans had just passed a more modest tax cut for large corporations and devoted more of the cuts to the middle class, they could have ridden the Obama economy into the next election cycle and probably held things together. They could have taken credit for an economy that has been on the upswing since 2009. Instead, the Republicans have confirmed that they are the party of the rich and powerful. Democrats need only focus like a laser on the plight of the middle class and the bread crumbs that the Republicans have tossed them while the wealthy have the best Congress and the Presidency that money can buy.

The contrast between priorities for the country will be stark. Republicans have enacted tax cuts for large corporations that don’t expire, but tax cuts for the middle class that do expire! By 2027, 83% of all the tax cuts go to the top 1%. Republicans offer a pittance for the middle class in tax cuts, while they cut the heck out of middle class programs and try to sabotage the ACA. Their lie that Obamacare is hurting healthcare was exposed when they couldn’t bring themselves to repeal it and were exposed for not having a plan to replace it.

And in races that are too close, the Democratic party can always play their Trump Card.

o, it is my understanding that the Republican tax bill does not effect your 2017 taxes payable in April, 2018. However, the withholding amounts for your 2018 income will change, likely in February, 2018, to reflect the tax changes. Don’t spend the savings all in one place, you may need it to replace the cuts to Medicare, Medicaid and Social Security that will be coming next.

Darin,

I take it you believe business tax cuts don’t create jobs? The evidence says they do.

Small businesses received a very large tax cut. A 20% reduction of net income income out of thin air.

It’s also a fact that business don’t pay taxes. The customers do.

Darin,

Please explain how a us Corporation paying 35% in tax can compete against a foreign Country paying 15-20% in tax?

Here ya go Jason, Roypublican tax scam for South Dakota https://itep.org/finalgop-trumpbill-sd/

In case you have folks in other parts of the country, Roypublicans will have them screwed as well.

https://itep.org/finalgop-trumpbill/

Jerry

Every person in SD will have a tax decrease. Your article assumes the individual tax cuts will not be made permanent. I really don’t care about 2026.

As for percentages, it doesn’t take a rocket scientist to know that the wealthy pay most of the taxes so they will have a higher percentage decrease than someone who pays very little in tax.

High Income earners in Democrat states might have tax increases because of high State income Taxes. That’s their problem since they voted for high State income taxes.

Pay-Go is the main reason that the Republicans are not worried about the new tax cut adding to the deficit. I can’t believe how little this was discussed in the past few month by Democrats.

The Democrats need to get their act together nationally with a real message, that goes beyond just hating on Trump. They need to stop living off the assumed high that they are going to do very well in 2018. That assumption is merely a sugar high strategy that the national Democrats are implementing at this time – and merely a by-product of luck or trending and not one of innate political strategy.

The inability of the Democrats to stop this tax cut bill is further proof that the Democrats do not have a real cohesive message. Also keep in mind, it was the Republican governors with ObamaCare/Medicaid expansion in hand, who are the real political leaders that saved ObamaCare last spring/summer/and fall and not the Democrats – a health care program only to now be undercut by this tax bill, which eliminates its mandate, but keeps the Medicaid element still intact, and thus, the Republican governors still happy too.

John,

Republicans need to cut the budget regardless of this tax bill.

Jason, you need to look at effective corporate rates after deductions and other considerations. Here is an article that shows what the effective US corporate tax rate is compared to other nations:

https://www.npr.org/2017/08/07/541797699/fact-check-does-the-u-s-have-the-highest-corporate-tax-rate-in-the-world

The US is still toward the top, but the difference is not nearly as stark as the rates would lead you to believe. For instance, our effective corporate tax rate is lower than the UK and Japan and only 3.1% higher than Germany.

To be clear, I was in favor of a cut to the corporate tax rate. I was just not in favor of cutting it 40%. A 20% cut would have kept us in a very competitive position relative to the world and we could have dedicated more of the tax cuts to the middle class. The middle class is the consumer that drives our economy. Corporations are a conduit that may or may not make investments in our economy. I like to bet on a sure thing like middle class consumers that will drive demand rather than a speculative hunch that corporations will create more widgets with extra cash rather than pay out more dividends to shareholders or buy back their stock. The latter two actions almost certainly serve to drive up stock prices, but only the former increases economic output and the demand for workers.

Corps can take a credit against foreign taxes paid which can affect that percentage calculation. If you look at Corps just operating in the US that make money, they will be paying 35%.

Then you should be for the lowest taxes possible for everyone. To achieve that, the federal budges needs to be cut.

The republican plan to pay for the Trump/Ryan tax scam will come when Congress reconvenes in January with actual cuts to Medicare, Medicaid, Social Security and a multitude of social programs aimed at the middle class and poor.

Trump was jumping up and down with joy at the repeal of Obamacare that will leave millions of Americans without healthcare coverage.

Eliminating the ACA will help Trump give more cash to the 1%.

With upcoming slashes to the federal budget there will be millions of unemployed Americans with no help for them when they are down and out and yet, Trump calls this tax scam a jobs program.

Jason: “The evidence says they [tax cuts] do [create jobs].

It seems the EVIDENCE does not:

https://www.nytimes.com/2017/10/09/opinion/corporate-tax-cuts-entrepreneur.html

https://www.cnbc.com/2017/08/30/theres-little-evidence-that-cutting-corporate-taxes-creates-jobs.html

I like the Times article quotes Buffet saying that investors do not let any tax disuade them of good investments. I also like the picture painted of where employers are far more likely (as they have in the past) to put those savings.

Jason: “As for percentages, it doesn’t take a rocket scientist to know that the wealthy pay most of the taxes so they will have a higher percentage decrease than someone who pays very little in tax.”

Actually it might take a little rocket science (or at least math). If we are talking percentages, then the percentage is not influenced by the amount of the base we are talking about. 1% of $100.00 and 1% of $1,000 is the SAME percentage – but obviously different amounts. I beleive the objection to the new tax rates is that the wealthy have a larger percent of reduction. As such, they make out as winners in BOTH percentage and total dollars saved.

o, that’s an opinion article. I like to rely on facts.

https://www.forbes.com/sites/timworstall/2015/04/22/tax-cuts-do-increase-employment-do-create-jobs-the-science-is-in/#24edf3757cf6

Wealthy people don’t keep their money under the bed or in cd’s. They invest it to make more money.

Darin, if the corporate rate is all about competition (and I get that argument has merrit for investment decisions), then why do we make it seem like our rate is changable and the foreign rates are not equally as plastic? If low rates really are the key to investment, won’t other countries now drop their rates in response to US rate reductions to preserve (or entice) investment away from the US still?

It seems like we are starting an international race to the bottom.

o,

When the top 1% are paying 90% of the taxes and you reduce the tax rate by 2% they will have a larger percentage and dollar amount reduction than when you reduce the rate for someone in the 15% tax bracket. That’s why I laugh at people who say the wealthy are getting most of the tax cuts.

o, how is lowering taxes a race to the bottom?

You don’t believe wealth comes from the government do you?

Darin, did you read your posted article? Some hilights from that Forbes text:

Your author states: “Now, be careful here, for I am only a journalist interested in economics, not an economist. So we must always have the possibility that I’ve misunderstood things to hand.”

He is reporting on the WSJ reporting on another published paper.

“I would thus read this paper as saying that tax cuts for the lower paid do increase job creation (that’s good, for I like job creation almost as much as I like tax cuts) and the jury is still out on whether high end tax cuts also increase employment. Simply because the design of this study isn’t likely to catch such effects if they do exist.”

Why is mine opinion and yours is not?

“You don’t believe wealth comes from the government do you”? Jason

Case in point, and only one of thousands, former Vice President Dick Cheney has profited by millions with his ownership in Blackwater.

Jason, you don’t seem to get the whole idea of percentages. Why do the rich need a larger percentage (individually) cut than the lower brackets?

Lowering taxes is a national race to the bottom of lower taxes. Yes, I do beleive that national/government wealth comes from taxes. Taxes (and a few fees) are how we pay for government. Government employs people, creates wealth . . . it serves the many the same functions as business. Government spending creates employment and growth.

Another big Trump lie today, he stated that Obamacare has effectively been repealed by his tax scam when in reality only the Individual Mandate has been repealed, all other provisions of Obamacare are still in effect.

Repealing the Individual Mandate will seriously weaken the insurance marketplace.

I will go one further — not wealth, but basic support for our weakest comes from the government. Our needy, retired, those in need of medical attention owe their very existance to the Government safety net.

Even Eddie Munster, head roypublican in the house says he does not know if the tax cuts will pay for themselves. That is a fact not an opinion in his own words https://twitter.com/NBCNews/status/943456508397973511

Just keep clapping Jason, while the walls come tumbling down.

O, we very well could be in an arms race to the bottom that negates the effect of the corporate tax rate cuts.

Darin, that was my point: that this cut in the corporate rate could jsut be the most recent volly in the reduction of national rates. If we are taking money out of the coffer and not becomming more competative, then even the GOP competative rhetoric fails on face.

We are all Kansas now without Dorthy. The roypublican wizard behind the curtain. https://www.reuters.com/article/us-kansas-education/kansas-still-underfunds-schools-state-supreme-court-idUSKCN1C72M0 Mexico will actually do a better job of school funding and social providing than what we will be able to do. https://en.wikipedia.org/wiki/Education_in_Mexico Roypublicans always leading down the drain. REPEAL AND REPLACE trump SCAM

Jerry,

You reduce spending.

Jerry and o, please go look up what happened in Ireland when they reduced their corporate tax rate from 40% to 12.5% and get back to me.

o,

The top 1% got a 2.6% reduction. The bottom got a 3% reduction.

Why shouldn’t everyone get the same percentage reduction?

Darin,

Please explain how it is a race to the bottom when taxes are lowered?

On their path to pay for their tax plan, republicans are refusing to fund the CHIP (Children Health Insurance Program) which essentially shutters the doors for the program in most states for the 9,000,000 children enrolled in the program.

How many jobs will this recklessness cause?

Jason, each country tries to undercut the next country in terms of lowering their corporate tax rate to attract businesses. This is the race to the bottom.

Jason’s idea that “you reduce spending” needs refinement, as a certain amount of spending is necessary to fund whatever we need our government to do for our communities’ survival. Perhaps we need to reduce unnecessary spending rather than spending per se.

Here is an analogy. Assume Bob pays $500 a month for room and board and has no other expenses. He also earns $500 a month take home pay, but needs an additional $50 per month for needed medication. If he raises this money by reducing his spending by $50 he will not be able to pay his room and board and will face eviction.

Applying that analogy to our society helps us recognize that some things are worth funding and we don’t benefit by cutting that funding.

Back to the analogy, perhaps better advice would be for Bob to raise $50 new revenue by getting a second job, robbing a liquor store, or winning the lottery. For our society, however, we have essentially only one way to raise our needed revenue, namely through taxation.

Whether we can fund our needs without further debt seems an important question to answer before reducing revenue. Credible news sources suggest

we cannot – by about $1.5 trillion.

Roger,

Where do you get your news from?

Most Democrats voted no on the funding for CHIP in the House. House passes the bill on a 242 – 174 vote.

Darin,

Bottom of what?

Less Government spending is a good thing. The US Government needs to be downsized. That is in the best interest of every US Citizen.

Bearcreekbat,

They are using 1.9% for GDP growth to say that. I am saying that will well have higher GDP growth.

According NBC News today Roger has it right:

https://www.nbcnews.com/health/health-news/2-million-kids-will-lose-chip-coverage-right-away-report-n831606

Was there a subsequent House vote that Roger, NBC and I missed?

Thanks for the supporting link on CHIP, bear.

Another scenario being played out today is that Trump has not signed his Tax Scam bill. Supposedly he will it before Christmas if the Pay As You Go glitch is worked out.

On the other hand, if he waits until after the first of the year he will avoid the $25 Billion Medicare cuts for one year making for less controversy for 2018 mid-term election.

Jason, if there is a greater growth as you suggest does that mean our taxes will increase or that more people will have to pay the taxes needed for our Country to function as we want it?

The idea that increased rate of growth will generate enough new tax revenue to replace the lost tax revenue seems oddly circular. What is the goal – increased revenue or less taxation?

If the former why not raise taxes now on folks who will not be harmed by the increase?

If it is the latter, then how can increased GDP justify increasing the tax on enough people in the near future to raise the revenue needed for the Trump tax cut today?

There’s the legendary Mr. C deviousness we all know and love poking out it’s little turtle head!

Jason, I won’t speak for Darin, but for me “the bottom” is reached when we do not have sufficient revenue to meet our needs and instead of raising new revenue, we cut or reduce our sources of funding in a manner that causes harm to the community.

Like Bob did in my analogy. He cut spending and got evicted and lost his job, all for blindly following the reduce spending mantra. Some spending can be reduced and some cannot.

It makes sense to look at what our needs are and evaluate the costs and benefits of satisfying each identified potential need. Tax reduction for corporations and the wealthy does not seem to be a “need” that our community benefits from. Requiring future taxpayers to fund this by paying more taxes due to a growing GDP does not seem to meet any need that has been publicly reported.

Jason, I did do that checking. From what I can see, Ireland is to tax havens what Cypress is to banking. https://www.theguardian.com/business/2016/aug/30/eu-apple-ireland-tax-ruling-q-and-a

The offshoring of American corporate profits is your example of success? I think Panama is right up there as well. Toss in the Turks and Caicos for good measure so we can see more success of grand theft. I think your roypublican leader will sign this dog on New Years day at his resort which is kind of fitting. He will most likely do that in 2018 to avoid the stench of the 25 billion roypublican will cut from Medicare as that would interfere with their election scams.

Raising taxes on the wealthy stimulates the economy.

Cutting taxes on the wealthy only creates fat and lazy rich people.

https://www.cbpp.org/research/recent-studies-find-raising-taxes-on-high-income-households-would-not-harm-the-economy

Read this carefully: “Congress can suspend Pay-Go, but the Senate will need 60 votes to make that happen. If they don’t, rural America takes a hit”. This is what Cory said at the end of his article and he is right!

The Democrats want to raise your taxes and punish YOU! Not a single Democrat voted to give the vast majority of you a tax break. Not a single ONE! And not they are already threatening to not support you if the Republicans try to suspend Pay-Go. . . What a sad state of affairs you are all in. Your “party” doesn’t want you mohave any more money than you presently have and have even gone so far as to threaten to take more from you.

Bear,

The House Voted to extend CHIP and it passed. Democrats voted against the extension. That’s a fact. Go look at the vote on the bill.

Bear,

Please tell us what years the Government took in less money than the year before starting since 1980?

Jerry,

The US Government doesn’t have a revenue problem. It has a spending problem.

OldSarg … That’s why the state doesn’t have nice, new things and we liberal states have to dip into our paychecks every month and send you SoDak Conservatives money, so you can pay your bills. Because you’d rather have an extra fifty bucks a month than contributing to the welfare of us all and buying necessities as a group. Taxes pay for things we need and want. Cutting taxes is like the entire USA economy saying, “I’m only gonna work four days a week. We’ll get by with less.”

Thinking you can live without the group makes we liberals pay your share and just makes you angry at life.

Merry Christmas, Old Scrooge!! 🎅

Porter,

How much does the US send to California and Blue States for Illegal Aliens vs SD and the Red States for Illegal aliens?

What does your Blue State have that SD doesn’t?

Porter,

Cutting taxes is like the entire USA economy saying, “I’m only gonna work four days a week. We’ll get by with less.”

No Porter,

Cutting taxes is like Americans deciding how to spend their own money.

It’s not the Government’s money Porter and the Government needs to live within its means.

Can a Democrat please tell me why the Democrats voted against CHIP?

Jason … Are you sure you want to get in the ring with me? Don’t ask questions if you don’t want truthful answers, pilgrim.

Here, here Porter. Jason asks “what does your blue state have that SD doesn’t?” Really, is that a joke question, Jason! LOL! Higher wages! We don’t have to work two or three jobs just to get by! Less corrupted state govt.

(Also, Colorado has legalized recreational marijuana which would make sense to have in SD so all the slave laborers that have to live there would be able to feel better about not getting so ripped off for the work they do.)

Porter,

I’m in the ring with you now and you are losing.

Jenny,

I don’t care if you want to live in a high tax State. I just don’t want to subsidize you for it.

As for corruption, let’s talk about Illinois Governors to start off with and then we can make our way to the current BLM scandal and FBI/DOJ scandal.

Face it, Jason SD is a big Welfare state. They don’t pay their way and their state govt is one of the most corrupted ever and just getting worse, and you know what I’m talking about.

Jason, I don’t know if you are aware, but the Republicans control the House, the Senate and the presidency. When will they be enacting an extension of funding for CHIP?

Why did your party cut large corporate tax rates 40%, while only cutting individual taxes less than a quarter of that amount?

Why did your party make the large corporate tax cuts permanent, but the individual tax rate cuts are not permanent?

Darin, I am aware they don’t have a filibuster proof Senate.

So are you going to answer why they voted no in the House or not?

Jenny,

I deal in facts and your post has none. Medicare is one of the largest entitlements that is hardly funded by the worker. currently (2.9%). Do you want to do the math or do I have to do it for you?

The Blue States are not subsidizing SD.

Jason, please explain why the carried interest loophole was not closed in the Republican tax bill that was just passed?

Furthermore, please explain why Republicans insist that the income of wealthy people that invest in corporations is generally taxed at a low rate (capital gains) while the income of working men and women is taxed at generally higher rates (ordinary income)?

When Jason asked “what does your blue state have that SD doesn’t?” it made me wonder what rock he is under. I don’t think Jason has been across the border to Minnesota, which has a state government that runs surpluses as opposed to South Dakota government deficits. Minnesota also has a thriving economy as compared to South Dakota’s flat, no-growth economy, better wages, far more entertainment options, and a whole bunch of professional sports teams. Maybe he’s heard of some of them. Minnesota also has a lot of businesses that South Dakota has tried unsuccessfully to recruit. The same things can be said for Colorado. Both of those blue states have successfully attracted more businesses and more people than South Dakota. I hear tell that Minnesotans are fine with paying their own bills through taxes, but they are tired of subsidizing welfare states like South Dakota that just take, take, take from the federal government then whine about the blue states that subsidize them.

Jason- howz the pay, troll. Why did Dems vote against CHIP funding? Pretty simple, if you can read- Almost every Democrat voted no because the bill pays for CHIP by cutting more than $10 billion from Obamacare’s public health and prevention fund, and by raising Medicare fees for higher-income senior citizens.

The bill also cuts the grace period for people who miss a payment on their health insurance premiums from 90 days to 30, a change expected to cause about 700,000 people to lose their insurance.

The bill’s lead author, Rep. Greg Walden (R-OR), blasted Democrats Friday morning, accusing them of “voting against kids and their doctors.”

“We’re fully funding CHIP for five years. We’re fulling funding Community Health Centers for two years. We’re asking the wealthiest seniors in America to pay $135 more for their Medicare,” Walden said, casting withering looks at his Democratic colleagues preparing to vote against the measure. “How ironic. How cynical.”

You tools just gave away Fort Knox to billionaires and now you want the elderly to pay the ransom for children’s insurance and to pay for the taxcuts to the koch bros. What a bunch of sweethearts you phony kristians are.

Jason, I’ll bit on the CHIP disucssion.

On November 3, Modern Health Care reported: “Prior to Friday’s vote, House Democrats slammed Republican proposals to pay for the bill by charging higher Medicare premiums to seniors earning more than $500,000, shortening the grace period for people who don’t pay their Affordable Care Act marketplace premiums from 90 days to 30 days, and also redirecting money from the ACA’s prevention and public health fund to community health centers.”

So it appears that the GOP is again using ANY and EVERY bill as a shell vehicle to dismantle the successful ACA.

Furthermore the Medicaid premium shift would be bad, “She [Rep. Debbie Dingell (R-Mich.)] was worried the legislation would lead to healthy and high-income Medicare beneficiaries fleeing the program. That would worsen the risk pool for Medicare and cause spending to increase. The trust fund for the program is now on track to be depleted by 2029.

To me it is all the same theme from the GOP – I got mine and creating the ability to share risk/cost in health care ANYWHERE is going to be opposed. THAT is what was rejected by Democrats. The GOP just used children this time as hostages to Rand inspired selfishness.

Jason, are you kidding SD is far more Federally dependent than MN. SD ranks 13 most govt dependent, MN is 49th. So get over your SD pride. You are a big fat welfare state that wouldn’t be able to make it on your one.

https://wallethub.com/edu/states-most-least-dependent-on-the-federal-government/2700/

on your own (not one)

Jason, you are being disingenuous. Republicans just passed the largest most beautiful tax bill ever according to Trump, but you can’t pass a measly little CHIPS funding bill? You are trying to tell me that filibuster rules apply to a small little funding bill like CHIPS but they don’t apply to a huge tax bill like the tax act that was just passed?

Medicare Trust Funds

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare.

Hospital Insurance (HI) Trust Fund

How is it funded?

Payroll taxes paid by most employees, employers, and people who are self-employed

Other sources, like income taxes paid on Social Security benefits, interest earned on the trust fund investments, and Medicare Part A premiums from people who aren’t eligible for premium-free Part A

Jason, are you going to answer my questions about why Republicans favor large corporate tax cuts more than they favor cuts to middle class tax rates?

Why do they favor large wealthy investors who get low capital gains rates over working men and women who pay ordinary income rates?

Funniest statement of the day nominee: “the Blue States are not subsidizing SD.”

OK, young man. You’ve asked me three questions and made one assertion.

1. It doesn’t matter how much federal money CA spends on immigration because they send more to Washington than they receive. Part of that excess is sent to South Dakota because you won’t raise enough money on your own to pay your own bills.

https://people.howstuffworks.com/which-states-give-the-most-the-federal-government-which-get-the-most.htm

2. My blue state is attractive to new business expansion and immigration because it has a viable safety net for when business slows and workers need assistance. South Dakota has no such safety net and thus no viable business expansion. The only people moving in mass to your state are seniors, who require more from the group than they contribute.

That’s one of many things my blue state has.

3. Democrats oppose the Republican plan to fund CHIP because the GOP is using a must-pass bill to gut ObamaCare!!

First Republicans tried to charge higher premiums to Medicare beneficiaries earning more than $500,000 a year after a lifetime of these beneficiaries paying in to the Medicare fund. Now, your revised bill would cut more money from ObamaCare’s public health fund.

The Republican bill would also shorten the grace period for ObamaCare enrollees who fail to make premium payments. According to an analysis by the Center on Budget and Policy Priorities, between 259,000 and 688,000 people could lose their insurance as a result of the shortened grace period.

4. You live in an incredibly safe place to work and be wealthy. Taxes pay for that security. Acting as if you could survive without the group isn’t well thought out. Once your taxes are collected they most certainly are the group’s money. You have your vote on what needs to be bought and what doesn’t. The group decides what’s within our means.

Lowering taxes on the wealthy doesn’t create jobs. Buying as a group and getting the best price saves much more money than tax cuts and creates many more jobs.

Q – Why doesn’t the military make every soldier, sailor and airman cook their own meals?

A – Because it’s cheaper to feed the troops as a group.

And … it’s cheaper to run a country by buying necessities as a group.

~ My turn to ask you three questions.

Almost as funny as saying cutting taxes for the wealthy increases tax revenues so we can grow our way out of debt and deficits.

Our South Dakota state government is the 7th most dependent upon federal funding.

https://wallethub.com/edu/states-most-least-dependent-on-the-federal-government/2700/

Jason ran away, he knew he was losing. Another South Dakotan that thinks they’re totally independent with no govt services needed whatsoever.

Jason, come back, I’ve got so many questions . . . .

Darin,

It’s called reconciliation.

Do you know what that is?

Jenny,

Your link doesn’t include social security, medicare, medicaid.

How does a Federal contract help me unless I am involved in the Contract?

That link is laughable.

So Democrats are pissed the Rich got a tax cut just like the poor but don’t want them to pay more for their health insurance.

You can’t make it up.

Porter,

It does matter. That’s my tax money that shouldn’t be spent on illegal aliens. It’s called theft.

There’s no such thing as an “illegal” human. Try again.

Yes there is Porter. Let’s try an experiment. You go live in Mexico without a visa and see what happens to you when they find out.

You keep losing to me Porter.

Darin

They did change the carried interest rule in this tax bill.

News Flash, Jason

It isn’t your tax money, when you pay your taxes to the government it becomes their money for the president and congress to spend.

You have little or no direct influence how that money is spent.

You don’t get to sign any checks or sign off on any legislation on how that money is spent.

“My tax dollars” is a fallacy.

Roger,

The citizens of the US are the Government so yes it is still my money. An illegal alien is not a citizen, so therefore has no right to it.

Jason

When was the last time you told the government how to spend their money and they followed your explicit orders?

Jason, when I said that he cheated the workers that meant that he cheated our citizen workers, not cheated the illegals.

Sorry, I thought you were answering my other post.

Calling a human being illegal is a depersonification tactic used by those with an indefensible argument. All humans are legal, wherever they live and as long as they breathe. A human can do an illegal thing but a human can never be personally illegal.

Just as when you couldn’t understand tax percentages, yesterday you can’t understand federal tax procurement, today. Any federal taxes paid by you in South Dakota are applied against South Dakota’s tax liability … and you’re not covering as much as you’re spending. What CA does with it’s gov’t money is irrelevant to the fact that South Dakota is a “federal welfare state” and we liberal states (including California) send you money. It’s we who can tell you what to do because we’re paying the bill.

So Democrats are pissed the Rich got a tax cut just like the poor but don’t want them to pay more for their health insurance.

You can’t make it up

You just did, tool. Us poors didn’t get a taxcut. The next bunch of taxpayers didn’t get a taxcut like the filthy rich. Only the filthy stinkin’ rich got a taxcut like the filthy stinkin’ rich.

I am on the bottom and got a SS cut because I have to pay more for Medicare and prescription drugs.

Drumpf and wingnuts are lying when they say their taxcuts for the koch bros mostly benefits the middle class because it does not and it ain’t even close enough to auger about. Drumpf and family make out like wealthy bandits because that is the way it was designed by wingnuts to happen. And only by wingnuts.

Someone finally woke stoopid wingnuts up in the WH and they realized they can’t pass koch bros taxcuts for the wealthy until after the first of the year or they trigger automatic cuts in entitlements.

How damn dumb does a party have to be to imagine the public won’t notice wingnuts running up huge deficits with taxcuts for the wealthy and then turn around and claim entitlements-which pay for themselves are the cause of the taxcut deficits and must be attacked causing further suffering for the least among us?

Wingnuts, thy name be imbecile.

Carried interest rule was preserved because it benefits the wealthy.

Porter is correct – no human is “illegal.” People who use that word are contributing to an attempt to dehumanize people, just as was done by the Nazis in the 30’s and 40’s. Dehumanization is an effort to alleviate the natural guilt one human feels when causing other humans to suffer.

Jason is probably a decent person who would not intentionally cause harm to anyone. Thus, he needs the dehumanization crutch so he can face himself in the mirror each morning, knowing that he supports Trump’s policy of tearing families apart and banishing them. Good people have to be convinced to harm others and dehumanization by name calling can be an effective tool unless called out for what it is.

Lets hope it is not too late for Jason to recognize how much the harm that the right-wing noise chamber has inflicted upon his soul (assuming that Jason is not a Russian bot or a paid troll, who intends to inflict this harm on the souls of otherwise decent people).

Excellent, Roger, MFI, Jerry, Jenny, Roger et al.

In short, we’re gonna weaponize this tax turd and feed it back to Trump like the $2.00 Big Macs he shoves in his pie hole (washed down by fourteen Diet Cokes) … every damn day. But, we’ll be cool about it and not look past the present, to predict the future. 👊💣👊

Merry Christmas and Happy 2018, BCB :0)

This just in- https://www.huffingtonpost.com/entry/gop-sabotage-healthcare_us_5a3a8adbe4b06d1621b1187f?utm_hp_ref=must-reads&google_editors_picks=true

Top wingnuts bragging how they sabotaged the program Drumpf swears was destroying itself. Guess that makes Drumpf a liar again, donut?

Feliz Navidad Porter!

https://www.youtube.com/watch?v=RTtc2pM1boE

Come on gang. Only one more post to break a 100. We can do it. Happy 41st anniversary of the dastardly day I got married and a happier 34th anniversary of my divorce and not getting back together with her. Getting married on the shortest day iof the year should have been a warning to a young and dumb me, back then. I am older now.

Yes Jason I know what reconciliation is. Do you? The question that you keep avoiding is why didn’t the Republicans use it to fund healthcare for poor children while they were funding large tax cuts

for corporations and wealthy individuals?

While republicans have been too busy handing themselves Christmas bonuses, the government will run out of funding tomorrow and republicans still haven’t presented continued funding resolutions.

As I write this, CHIP still hasn’t been funded, Sen. Rick Santorum was just on CNN saying that congress would take the matter up in January.

In the continued story of “let’s not talk to each other”, Paul said yesterday that the House would take up entitlement reform this next session and start the process of defunding Medicare, Medicaid, Social Security and other social programs.

This morning McConnell said that the Senate would not be taking up entitlement reform this next session because it has already dealt with in the tax scam bill.

Oh! And Trump still hasn’t signed his Golden Goose tax scam bill.

Roypublicans and bailouts go together like peas and carrots. New York Times Reports: WASHINGTON — Fannie Mae and Freddie Mac, the government-controlled mortgage finance giants rescued during the financial crisis, reached a deal with the Treasury Department on Thursday allowing them to keep some of their profits as they brace for losses that will be activated by the tax bill soon to be signed by President Trump.

Under the terms of the agreement, each company will be allowed to retain $3 billion from their earnings to serve as a capital cushion against future losses, including a decline in the value of their tax-deferred assets.” Hmmmm, where or where have we seen this movie play out before?

So you get a tax cut and then you get a tax haircut from the upcoming bailout. All is even, no? NO, you have to keep paying like it was 2008 while the banks and the rest of their elitist brethren get to keep it. Seems kind of unfair to most, but not to NOem/Thune/Rounds/Krebs and Opie. To them it is all part of the days scams.

Jerry was right! Once again, trump fails to deliver on a promise. He promised he’d give us tax cuts for Christmas, but because of the pay-go cuts I talked about at the top, he has to wait until January to sign, lest he hand his Republican incumbents $25 billion in Medicare cuts to run on in November. Trump has told House GOP leaders that he will wait until January 3 to sign the tax bill, thus putting off the big cuts to Medicare and other programs until 2019, after the election.

Somehow, I don’t think Democrats will let voters forget those cuts are coming, thanks to the Trump Tax.

The house of reprehensibles passed a spending bill to keep gubmint going for a couple weeks and sent it to the sinate, today.

Not to hijack this thread some more, Darin, reconciliation is what my ex and I didn’t do all those years ago. :)

Jason, if the carried interest tax loophole has been eliminated by the Republican tax bill, someone should tell the White House. Do you know what the carried interest tax loophole is, Jason?

https://www.cnbc.com/2017/12/21/indefensible-hedge-fund-tax-loophole-shows-swamp-still-rules-d-c.html

mfi, some reconciliations are not successful, like Trump with the truth, for instance. Sad!

Cory, Trump also promised to do away with the “Hedge Fund tax loophole”, otherwise known as the carried interest tax loophole. This was part of his drain the swamp shtick. Turns out he broke his promise in the tax bill as described in the link at 17:38 above.

Fill the Swamp!

NIce article Darin. It doesn’t even tell you what the new law is. The article is what I call fake news.

Go look it up and get back to me.

Cory,

Remember when Obama cut medicare so Obamacare would score good, and then they had a new bill to restore those cuts?

Jason, What on earth are you talking about?

So Democrats are going to run on raising taxes next year?

I can tell you right now you have lost the ND Senate seat.

Darin,

They changed the carried interest rules. Your article doesn’t say that.

The article is lying by omission.

Do you mean “score well”? As in produce a better score? Or score “good”? Like the Haybilly Stacks playing in the D-League? 😉

Porter,

I mean score “good” as in the “CBO” scoring.

Jason, you should probably call Fox News and the White House and tell them that the carried interest rule has been eliminated. That will be news to them, those darn liars!:

http://www.foxbusiness.com/politics/2017/12/20/money-talks-blackstone-carlyle-kkr-dial-up-donations-to-key-gop-lawmakers-as-tax-bill-protects-carried-interest-loophole.html

No, Jason, I don’t:

http://www.politifact.com/truth-o-meter/statements/2015/aug/07/mike-huckabee/obamacare-robbed-medicare-700-billion-says-huckabe/

President Obama had a plan for cost control. His reduce of future increases in Medicare spending “at the expense of insurers and hospitals, not beneficiaries” had a rational basis. The pay-go cuts Trump is delaying to 2019 by delaying his signature until 2018 is an oopsie, something he didn’t plan for, and something that has no rational basis in the argument for tax reform.

Do you remember when Donald Trump came out during the campaign and during this session of Congress and said, “Tax reform is so important that we need to cut $28 billion from Medicare in the first year and more every year ongoing to make it work?”

No? Exactly. Neither do I.

Darin,

I said the rules changed. Go look up the change and get back to us. I don’t get my tax news from the MSM which includes Fox.

Cory,

Do you remember when Obama said our insurance premiums would be reduced by $2,500 and we could keep our doctor?

You can go look at the bill that was passed that reauthorized the spending on medicare.

Why is Jason having to talk about President Obama when this discussion about the republican tax scam?

Jason, So you are playing word games now? I said the Republicans did not close the carried interest loophole and that is exactly what happened.

You don’t get your news from Fox or even the White House? Who do you get your news from, Breitbart?

From the Fox article referenced above: Trump’s National Economic Council Chairman Gary Cohn blamed Congress’s relationship with big private equity firms and their lobbyists for the carried interest loophole’s survival in the final tax bill, stating that the administration tried to get the loophole removed “25 times.”

Republicans only put a Band-Aid on funding for the government, the fight will be taken up again on January 19,2018.

Darin,

Do you know what the change was?

The bill is out there for you to read.

Go read it and tell us what changed.

Trump’s White House is now saying he will sign the tax scam bill tomorrow before leaving for a golfing trip to Florida.

Roger,

Who got scammed?

Jason, why all the obfuscation? Go read it yourself and tell us how the rule has been eliminated.

Jason … I’ve had my Doctor since before you were born. Everyone’s insurance was well on the way to being $2500 cheaper until Republicans began to sabotage the ACA (first by removing the risk corridors). Everything wrong with Obamacare can be directly blamed on Republicans yet it’s still so popular people marched in the streets and got arrested just to protest it’s proposed repeal.

Roger, I think Trump has figured out that if he waited until after January 1 to sign the bill it looks like he is ashamed of it and is trying to hide the cuts that will be coming to Medicare triggered by the Republican tax bill.

Jason,

When you wake up from this nightmare, hopefully you’ll realize you just got screwed except if you are part of the 1%.

Darin,

If he does sign the tax scam tomorrow that will be the reason.

BAH. Which I just realized comes right before CAH. But my point here is that if Mr. Trump signs this enormous bill, it will probably be the first of items that many libbies will think of the way we conservatives view Obamacare: jammed down our maws

Obama created hatred and resentment against himself by the jamming down the maws he performed. People already hate and disrespect Mr. Trump, so what does he have to loose? He’ll probably quit in another couple years after he gets bored. Mark grudznick’s words, in case I’m not around to remind you.

Jason and grudz attempt to distract us with constant references to President Obama.

Don’t let it happen.

Occasional references, perhaps, Mr. C. At least from me they are not constant, they are occasional. A large difference.

Regardless, whataboutisms are tiring.

What babies. Every one of you are going to benefit from this new tax law. Not a one of you is a multi-millionaire who are the actual only group to suffer under this new law but you all act like someone has eaten all the berries out of your box of crunch berries.

It wouldn’t have mattered if Trump had written everyone of you a personal check. You still would have taken the check but you would all still bitch.

I’m tired of Grudz and Old Sarge misrepresenting, really lying, about everything here. Let’s talk about just one of Grudz’ falsehoods. Obamacare was not shoved down anyone’s throat. It’s a nice meme to say that the black president shoved something down your throat, but that phrase applied to Obamacare is completely devoid of truth.

The individual mandate, that big, bad horror the Republicans just repealed in their tax bill, was a Republican idea, originally developed by the conservative Heritage Foundation in the early 1990s and applied by Mitt Romney in Massachusetts in the 2000s. This thirty-year-old Republican idea is what Grudz thinks Obama “shoved down” Republican throats.

Grudz, quite frankly, doesn’t have a clue about anything he writes about here. I remember when Grudz was trying to tie his problems with Medicare supplemental insurance to Obamacare. Sorry, Grudz, that your insurance dropped you, but trying to pin that on Obamacare indicates that you didn’t know what you were talking about back then. You still don’t have a clue.

Now Old Sarge is another cuckoo bird that has been showing up here. I’m not going to be benefiting much from the Trump Tax Bill, compared to what I would have received from Democratic alternatives which would have benefitted the middle class, rather than the one percent. I will take the couple hundred dollars I might benefit and donate it to the Democratic candidates who will make the rich pay for a much bigger tax cut for the middle class when the Republicans are swept from power and Trump is impeached and convicted.

Guess that proves that we are not on the dole then doesn’t it. We know the difference between a con and something that is legitimate. We also know that there is no such thing as a free lunch so we are gonna pay just like we did in 2008 when we bailed out those that were so benevolent to the taxpayers.

Yes, OldSarg, as long as I’m getting a little something out of this deal, I shouldn’t critique Trump’s statements about this tax bill being aimed primarily at the middle class. I shouldn’t be concerned that Trump lies about the bill.

Nor should I bring up the fact that Trump promised during the campaign that he would get rid of the carried interest deduction for hedge fund managers, but he now has broken that promise to drain the swamp. Nor should I mention cuts to Medicare necessitated by this bill.

Why should I care that the debt will increase another trillion dollars to fund large corporate tax cuts and benefits for the wealthy when we are $20 trillion in debt as it is? My kids and grandkids can worry about paying it back. Why should I worry that Social Security, Medicare and Medicaid are all going to be on the chopping block by the Republicans next year because of the increase in national debt?

It’s all about what I can get for me now, right Sarg?

OldSarg, I just posted facts, direct examples, showing that not every one of us will benefit from the tax bill. Do facts no longer matter? Can you not acknowledge your statement was false, drop the Trumpian hyperbole, and just contend, “Most of you will benefit”?

I mean, seriously, what is the point of my making an effort to present evidence to back up my statements if you are going to keep shouting as if I never mentioned any evidence?

Oh, right, the point is that I remain committed to evidence, logic, and honesty, while you remain a brawling, bad-faith liar.

Cory, I also posted facts which you have ignored.

Did you seriously forget what Obama said about the $2,500?

Darin,

Let’s talk about the 10T debt under Obama in 8 years.

You game for that?

Cory,

Do you agree with what Porter said about his insurance being $2,500 cheaper until Republicans did something in 2017?

Darin,

I’m still waiting on you for the carried interest response.

Have you read the new law yet?

There goes Jason with his President Obama ‘whataboutisms’. Apparently Jason doesn’t know that Obama is no longer president.

In fact, to quote OldSarge, President Obama “doesn’t matter”.

Trump said it best, “I’m the only that matters”.

Cory,

Did Obama’s pan reduce the costs of health care?

Roger,

Did Obama say you would have a $2,500 reduction in your health insurance premiums?

Cory,

Do you know how much doctors pay for malpractice insurance each year?

Jason,

I don’t care what President Obama did or didn’t do, he is no longer the president, do you understand that?

Again, your ‘whataboutisms’ are as boring as you..

Jason, I am still waiting for you to make your case that the carried interest tax loophole has been eliminated. . . .

What you’re saying about President Obama, health insurance costs, or malpractice insurance costs does not refute the thesis of this blog post, that the Trump Tax hurts South Dakota by triggering cuts to valuable programs.

However, the ACA would have gone further to control costs if President Obama had not tried to compromise with Republicans who turned out to be determined never to vote for anything Obama proposed anyway. But even absent a clear bending of the cost curve (there’s plenty of debate on that issue), the ACA made sure more people were covered by better plans that insurers would have denied them outright in the status quo ante ACA.

Say, on Medicare Advantage:

Jason, the biggest plus for medical malpractice tort reform is denying injured party’s their day in court. Awards have been trimmed so much most lawyers won’t touch them.

Malpractice insurance has gone down significantly, but the injuries and mistakes still happen and aren’t corrected in court as they should be. Another big win for the rich guys over the peons.

Jason,

The only citation or evidence that you have put forth in this entire discussion is a Forbes article which you cited as evidence and you stated: “Wealthy people don’t keep their money under the bed or in cd’s. They invest it to make more money.”

What is funny is you didn’t even read your own article, but you keep telling me and everyone else to go read up on things. Your own article quotes the Wall Street Journal’s interpretation of a study on whether job creation is spurred by tax cuts and the WSJ said: “Tax cuts are an effective way to bolster a weak economy and create jobs—as long as they are targeted at the bottom 90% of income earners.”

This is why many people are critical of the Republican tax bill. It is targeted at the top tier of income earners given the large corporate tax cuts. Contrary to your assertion that the wealthy don’t keep their money under the bed or in CD’s, they do essentially just that. They keep their money in precious metals, CDs, accounts in the Cayman Islands or Switzerland or other innumerable ways to store value that do not involve investment in jobs or the economy. The rich can afford to keep their money on the sidelines. It is the middle class living paycheck to paycheck that spends their tax relief on consumer goods that drives our economic growth and this is backed up by the study referenced in your Forbes article.

The other consideration that you are not acknowledging is that corporations are already sitting on piles of cash and have access to “Yuuuge” amounts of loans at low interest rates. Corporations are not suffering from a lack of liquidity with which to make investments. Corporations are not investing because consumer demand is lackluster. Tax cuts primarily aimed at the middle class would drive consumer demand and then corporations would make the investments in expanded production and workforce that we all want to see.

Darin,

I am still waiting for you to post what the new law is for carried interest.

OldSludge @ 21:54- Congress’s own think tanks — the Joint Committee on Taxation and the Congressional Budget Office — calculate that in 10 years, people making between $50,000 and $75,000 (around the median income in the United States) would effectively pay a whopping $4 billion more in taxes, while people making $1 million or more would pay $5.8 billion less under the Senate bill. And that doesn’t take into account the massive cuts in services, health care and other benefits that would likely result.

I don’t know (or care) about you, chump, but, I am tired of all the winning for the wealthiest. SOP for stoopid wingnuts.

Cory,

Let me know when there are actual cuts made to valuable programs because of the tax cut. Then we can discuss it.

Cory, why did your party vote against CHIP?

Mike,

Are you saying that Democrats are going to vote to not keep the tax cuts in 10 years?

That is what your post is about.

I take it you don’t know anything about tax law.

Darin,

Are people getting cash bonuses because of the new tax law?

Darin,

Are you saying tax cuts don’t create more jobs?

Jason, Mike, Porter and I all posted very similiar and thorough answers to why the Democrats voted against the Republican CHIP abomination. Asked and answered.

At this point in the discussion, you are just lobbing softballs over the plate to some heavy hitters; your rhetorical tactic seems to be a hope that Porter, or Mike, or Darin or . . . injure themselves hitting your nonsense out of the park.

Call it a TKO in the second.

Seasons Greetings to all.

~Great observation, Cory. My assertion that Obamacare was on it’s way to a $2500 a year ($200 bucks a month) savings is based on fact. Our savings were initially derailed by our President’s willingness to compromise. This resulted in the scrapping of the public option, which would have (and still can) cut insurance premiums by approx. 75%. (As a respected candidate once said, “I ran a great campaign. The only thing I’d change is next time I’ll be meaner.”) One of Obama’s mistakes was not to realize what you noted. Republicans put his head on the block before he was even inaugurated. The fact that we got the ACA at all is a legacy jewel.

~ Well put, Darin. Your post was excellent in it’s observations and facts. Not to detract from it’s power, I’ll reassert that cutting taxes on the rich doesn’t create jobs … unless you work in precious metals sales, yacht sales or offshore banking.

~ TAXING THE RICH CREATES JOBS.

https://www.cbpp.org/research/federal-tax/large-job-growth-unlikely-to-follow-tax-cuts-for-the-rich-and-corporations

Jason writes: “Darin, Are you saying tax cuts don’t create more jobs?”

Jason, did you even read my paragraphs long response to this very question? Bueller? Bueller? Bueller? Anyone?

Jason writes: “I am still waiting for you to post what the new law is for carried interest.”

Jason, let me explain how discussion of issues generally works on this site and in life. I or someone else presents evidence in support of a proposition. You present evidence to refute that proposition if you are in disagreement.

Jason is prolly gonna tout about AT&T next. As if a company that made 16 billion in profits in 2016 alone should be applauded for giving 1k bonuses to every employee. They must be great people to make so much but require a tax break to share any. I’ll be waiting to see wages rise in the first quarter, but I wouldn’t hold my breathe. SD is a taker and always has been. Wages are crap in this state and it will continue to be a brain drain. Businesses just don’t care about our low tax environment if everything else about living here is the bottom of the barrel. On the plus side, Trump is going to probably be a big enough disaster that not even republicans are going to want to be affiliated with him when he gets done or booted.

Darin, two questions: 1) If I disagree, can I just pose the same question over and over and over? 2) If I cannot find evidence to support my position, may I instead post evidence that does not say what I claim?

oh, and 3) If I disagree, can I just pose the same question over and over and over?

o, you have heard of the Socratic Method. Now you are familiar with the Jason Method.

Yeah,but, Jason was sided by the argue-bots who fought skeletons with swords instead of providable proof.

Jason seems to have forgotten the original premise/promise from the mangled apricot in the WH.

Sarah Sanders

✔

@PressSec

The average American family would get a $4,000 raise under the President’s tax cut plan. So how could any member of Congress be against it?

5:37 PM – Oct 22, 2017

12,515 12,515 Replies

9,272 9,272 Retweets

27,115

A thousand dollars for a few workers won’t quite cut it.

https://www.usnews.com/news/top-news/articles/2017-12-22/trump-says-he-will-sign-tax-government-spending-bills-on-friday

Drumpf apparently can’t wait to hack entitlements to pay for his taxcuts for the koch bros.

Thanks to Roger C for the heads up. Roger, you the man!

mike from idiocy, I spent money yesterday in your home state. Had dinner at the Iowa Power House and spoke loudly about the coming tax cuts. The other diners also joined in! It’s a wave mike! The people Love it!

AP Politics

✔

@AP_Politics

House Speaker Paul Ryan is acknowledging “nobody knows” if the sweeping tax cuts Congress is enacting will produce enough economic growth to fend off soaring federal deficits

6:54 AM – Dec 20, 2017

1,400 1,400 Replies

7,692 7,692 Retweets

11,443

OldSap- 9 out of 10 wingnuts are living in state of denial and the 10th one is flat out lying.

Anyone know when Sarah Huckabee’s promise of us “average Americans” will be getting our $4,000?

Hopefully the Treasury can get it done before Christmas.

Jason doesn’t want to discuss the tax cuts to valuable programs until they start.

Start talking, Jason, the time is NOW!

Whoops, Mike is right: after feeling pressure from his TV, Trump signed the tax bill this morning. If what we’ve read so far about the Pay-Go law is correct, he just triggered those cuts to Medicare, farm subsidies, and other programs on which South Dakota depends in 2018.

So the chart above says we lose $114 billion in Medicare and other spending that supports (I would speculate) folks in middle and lower tax brackets. Do all the tax cuts they’re supposed to get next year, plus all the extra income Jason insists against most evidence they will get, add up to more than that?

173 comments AND a Daniel Buresh siting. That beats “Novstrup’s Camel” and “Lora Hubbel calling a respected Rosebud legislator, Pocohantas” in today’s “Everybody’s Got Friday Off” popularity derby. DAKOTA FREE PRESS ~ hip hip hooooooooray!!

Darin,

The tax code was changed in this tax bill concerning carried interest.

That’s a fact.

Porter,

If single payer is so great why won’t California do it?’

Roger,

Which valuable programs have been cut that will not be funded by future bills?

Jason, the tax code being changed is not the same as eliminating the carried interest loophole. Why do you refuse to admit this?

Of course it’s not the same.

Does the new law make some of it subject to ordinary tax rates now?

Jason,

will you ever answer your own rhetorical questions?

Darin,

Why won’t you answer the question?

Jason,

Why won’t you answer my questions?

Jason … that’s an invalid question with a false premise. What Cali will or won’t do is a hypothetical.

~ Predicting is always hard. Especially when it involves the future.

Cory prefers we deal with more valid questions.

If you mean, “Why hasn’t California yet done it?” I can answer that.

~The Public Policy Institute of California reports that 65% of citizens approve of single payer coverage. However, it’s a big change and Prior Planning Prevents Poor Performance.

In USA 49% approve of changing to single payer while your point of view is a very weak 35%. 17% have no opinion.

You see, sir. Giving all of USA an option for a bare bones health insurance policy at a “not for profit” price would be better for all of us, all at once. SoDak, of course, being composed mostly of Volga German heritage is pretty stubborn and set in their ways and usually comes to the party late, stands around without a date and wonders what fun dancing is, anyway. ☺

What’s your question Darin?

Why did your party cut large corporate tax rates 40%, while only cutting individual taxes less than a quarter of that amount?

Why did your party make the large corporate tax cuts permanent, but the individual tax rate cuts are not permanent?

Porter,

There was a bill introduced in California to have single payer. California decided not to pass it.

You seriously didn’t know that?

Christmas 2018: Child: Santa, why does grandma have to die by the curb. Santa: Because everyone got a tax cut and that meant no money for grandma, not even a welcome chunk of coal. Child: What is a tax cut? Santa: My child, you are too young to know about evil coming from my lips so I will give you this to read http://www.kansascity.com/news/business/health-care/article189892269.html Child: So then Santa, roypublicans are really the evil Grinch’s that steal Christmas then, no? Santa: Yes, the orange one who looks like one of his parents may be an Orangutan is the worse, closely followed by the rest of the crooks and liars will not only put your grandma to the curb for certain quick death, but also many of your young friends as well. Yes my child, we are our brother’s keepers or so it was quoted in some novel written some time ago. All of that is now out the window, the American dream is now one filled with the joy of opioids. Do you get it kid? Child: No, I only see grandma dying by the curb with no one to take care of her to give her dignity in her final wonderful life span.

Darin,

Your percentage is wrong for the individuals. You didn’t factor in the 20% deduction to business income.

That is for small businesses.

I thought you understood reconciliation? That’s why the individual rates expire.

Why did Democrats vote to let the individual tax rate expire?

Why did Obama say Corporate tax rates should be lowered?

Jerry,

Thanks for pointing out how incompetent the Government is.

Jason,

I thought you understood under reconciliation the Republicans could have made the individual rate cuts permanent and let the corporate rates expire. But no, they chose to favor large multinational corporations over middle income Americans.

What percentage are you claiming individual tax rates were cut or is that a secret that I am supposed to go read the tax bill and get back to you on?

Darin,

You have to account for the 20% reduction in business net income when you compare them. The percentage would be different for every return. The 20% reduction is 100% of what ever bracket they are in.

The Democrats could have voted to make them all permanent. They didn’t. That is all on the Democrats.

Hold on on Pay-Go: Bloomberg reports that the stopgap funding bill (the ruling majority’s brave continuance of government functions for one more month) gets us around Pay-Go: “Congress on Thursday night cleared the way for Trump’s signing by waiving automatic spending cuts that would have been triggered in January due to the $1.5 trillion revenue loss the bill would cause. The stopgap spending bill keeps the government open until Jan. 19, waiving cuts in all future years due to the tax bill under the 2010 PAYGO law.”

So we’re not even going to try to balance the budget through honest means. It’s all voodoo economics and sneaky tricks from here.

Jason, how do you plan to spend the promised $4,000 windfall from the Trump tax scam as promised by Sarah Sanders?

That was an actual question she asked at a White House press conference.

Me, I encourage others to spend their windfall the same way I plan, by donating to Democratic candidates in the 2018 mid-terms.

Cory,

Republicans learned it from your party.

Did you post articles saying Obama shouldn’t double our debt in 8 years?

If not, i would think you posting now about debt and deficits would be hypocritical.

I do you hope they do cut the budget next year.

Of course I knew, that. BTW … I live in Colorado, not California but I read the NYTimes California edition, every day. Single payer in Cali got delayed because of cost. It’s like Sam’s Club, Jason. The more members Sam’s Club has, the cheaper the toilet paper and liquor. California citizens realize that the public option for all USA is inevitable and it wouldn’t be cost effective to do it themselves and then have to join the rest of us. Their economy is booming and they can wait, what with their successful Obamacare state marketplace. Same with Colorado. We’re booming. I’ve got a house for sale that cost $60,000 and just got appraised at $385,000. How’s your state’s conservative economy doing?

Porter,

I thought you said single payer would slash insurance premiums by 75%. Now you are saying it costs too much?

Which is it?

Nice try, pilgrim. National single payer will slash insurance premiums by 75%. Would you buy a public option policy or can you afford a better one?

Jason,

Have you changed your story now? I thought you claimed that reconciliation didn’t allow the Republicans to make the individual tax cuts permanent and the corporate tax cuts expiring? Now you are saying that the individual tax cuts could have been made permanent but the Democrats are responsible for choosing corporations over individuals?

So let me get your logic straight here. The Democrats who didn’t approve of the bill and didn’t vote for the Republican tax bill are responsible for the Republicans choosing to make large corporate tax cuts permanent and individual tax cuts that expire?

I mean I’ve heard of twisted logic, but this takes the cake.

Roger,

Are you going to donate yours to the US Treasury since you think it’s a scam?

Are the reporters going to return their bonus checks?

Jason is going with the battering husband defense for why corporate tax breaks are permanent and the individual tax cuts are not: The Democrats made us do it!

Darin,

I don’t know the inner workings in this case. It’s crystal clear that Republicans wanted them permanent and Democrats blocked that in the Senate.

It’s a no brainer to make the corporate cuts permanent. Business needs certainty for future investment.

Did you ever take any basic econ classes?

Jason … It’s great that you ask so many questions because …… you know. It’s good to learn new things. You’re getting some really expensive advice here for nothing. It’s time you “rang the tip jar” and showed Cory how much you appreciate him and his blog. Wadda ‘ya say?

Darin,

It’s a fact Democrats blocked it in the Senate. Do you need to get the vote totals for you?

Okay, Jason, maybe it isn’t a scam, but it is a sham, to be sure.

No, I will not donate it to the U.S. Treasury, I already told you I would invest in Democrats running in the 2018 mid-terms.

As to what reporters are going to do with their bonus, you’ll have to ask them.

When do we get those checks?

Now Jason says: “Republicans learned it from your party.” Ahhh, the old Democrats are so bad they should be blamed for things that Republicans do defense.

Porter,

I’ll assume that the 75% reduction in insurance premiums was false by your non answer.

Whoa Jason! Just a second ago you were lecturing me about reconciliation rules in Congress and now you have abandoned your premise that Republicans couldn’t have made the individual tax cuts permanent and put a sunset on the corporate tax cuts. Now you are asking me if I have taken any basic econ courses. Let’s move the goal posts again so Jason can score a touchdown!

Darin,

Are you saying Democrats should be able double the debt in 8 years, but Republicans shouldn’t?

I answered. I assert that national single payer aka public option policies will be 75% less than what is on the market now for comparable coverage. I site every country in the world that has them.

But, enough free education to you until you help out the blog.

Darin,

I answered your question about why the corporate rate was chosen to be permanent.

That answer was a TD answer.

Jason, I’m not sure why you are referring to basic economics when the Republicans’ basic premise that tax cuts pay for themselves is refuted by most of the highly respected economics professors. I thought you guys had abandoned economic theory in favor of Voodoo Economics.

Porter,

Please link me to this evidence and also how much our taxes would have to increase to pay for this?

How is single payer going to reduce health care costs?

Darin,

Why would you think a tax cut needs to pay for itself? That is not logical at all.

If less money comes in, you reduce spending.

Jason,

Have you been living under a bridge? Your Republican brethren have been claiming for months that the tax cuts that they are making will pay for themselves. Breitbart didn’t mention this?

Jason,

Go educate yourself on the many developed nations that have forms of single payer health insurance. The US is the most expensive system in the world by far with worse health outcomes than most of the other countries with single payer systems.

Darin,

What would you have posted if they didn’t say that? The Democrats would have had ads out their saying Grandma’s going to die.

The simple solution to your problem Darin is to reduce spending.

“Deficits don’t matter”, republican Ronald Reagan.

“The tax cuts will pay for the deficits”, Ivanka Trump on Fox Friends.

The only time deficits matter to republicans is when their is a Democrat in the White House.

Darin,

Please specify how the quality of healthcare is better in other Countries?

They do get their medicine cheaper because Americans pay for the research costs.

This Jason feller doesn’t know whether he’s coming or going, he never provides links to support his lame arguments, but demands Porter provide supportive links.

Roger,

What “lame argument” would you like a link to.

Jason- do you realize Medicare/Medicaid have significantly cut healthcare costs and do you know why? With single-payer health care everyone pays the same, everyone is signed up and full participation brings the costs down. ACA was designed to do that, but wingnuts started squealing about people’s right not to have insurance and then wingnuts advised young people not to buy into the insurance to make it cost more.

Every step of the way, wingnuts have worked to make ACA more expensive and ultimately fail. But, it hasn’t failed as you can see by the numbers of people signing up for it. Government run, not for profit insurance will always be cheaper than privatized robbery unless wingnuts jam up the system on purpose. And you call yourselves Americans.

Mike,

8 million people who are getting their insurance paid for by the Government while the taxpayers have to pay for it is not a success.

Do you have any links to where medicare cut their payments?

You do realize that if they did this, the medical provider made back the money from people not on medicare right?

Insurance was affordable for the vast majority of Americans before the ACA. Now it is not.

If you are in the individual market, you would know this.

Roger,

Here is a link to the Obama scandal dealing with the Hezbollah global narcotics syndicate.

https://www.politico.com/interactives/2017/obama-hezbollah-drug-trafficking-investigation/

Is it bias that the NYT, WP, and CNN haven’t reported this?

Just think how misinformed you would be if you only used those as news.

Jason-you seriously have no idea how Medicare works, do you? You need to get up to speed with the rest of America.

Mike,

What did I say that was wrong?

Oh goody, Jason now wants to distract with a scandal linked to President Obama.

Now that Jason has opened that door, let’s go.

I even have my own whataboutism, what about Trump and Putin meddling in our Democratic process.

When will Trump fire Mueller or will he have Rosenstein do it? If Rosenstein refuses to fire Mueller will Trump fire him and find someone that will?

Jason, how many indictments and convictions has Mueller been able to get from the Trump campaign.

How many indictments and convictions did President Obama have, remember that for most of his term he had a republican House and Senate to investigate him?

Roger,

The DNC also got hit with another FEC complaint Monday.

The complaint alleges Hillary and the DNC used state chapters as strawmen to go around campaign donation limits and ultimately laundered the money back to her presidential campaign.

Roger,

Who do you think will be charged with a felony for lying to the FISA court?

https://www.politico.com/interactives/2017/obama-hezbollah-drug-trafficking-investigation/

Ask yerself why Obama would do this. Then ask why, with the exception of Politico, only extreme right wing sites carried this load.

After the Iranian nuke deal, why weren’t these people arrested. Did Obama squeal and spill the beans about all the intel? No that is what Drumpf does.

You haven’t answered my questions about Trump firing Mueller, Jason.

Have you googled the number of indictments and convictions related to President Obama’s administration and campaign?

Roger,

Why would Trump fire Mueller? Trump never committed a crime.

Mueller is finding evidence against Hillary which is good because she wants to run again.

Mueller is also bringing light to the corruption in the DOJ and FBI.

Mike,

Obama wanted the IRAN deal done.

This is from the article. It says arrests were made.