Ronald D. Arnold’s probate documents indicate that his daughter, Kristi Noem, has misrepresented the family’s 1994 estate tax situation.

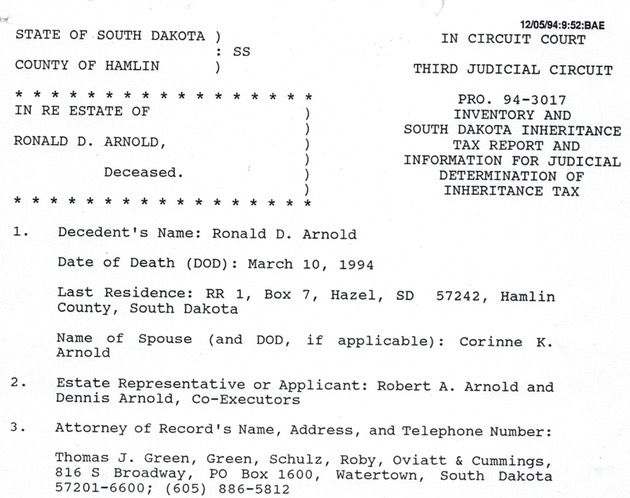

According to the inventory filed in Probate Case No. 94-3017 on December 7, 1994, the net value of Ronald D. Arnold’s taxable estate (gross value minus debts) was $1,108,977.

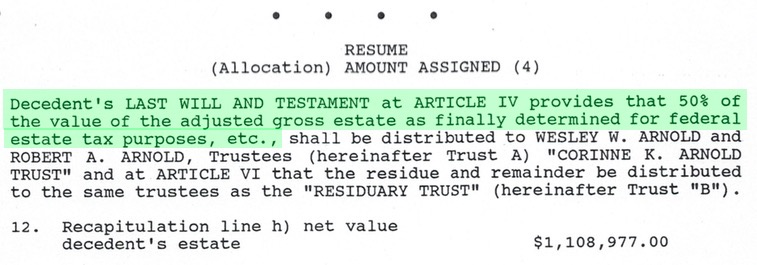

Rep. Noem has told the press that her father had not signed a will:

“My dad had done estate planning, he had had a will completed, but he hadn’t gotten it signed before he was killed,” Noem told HuffPost on Wednesday [Arthur Delaney, “Kristi Noem Says Her Story Shows How the Estate Tax Hurts Families. Not Quite,” Huffington Post, 2017.12.07].

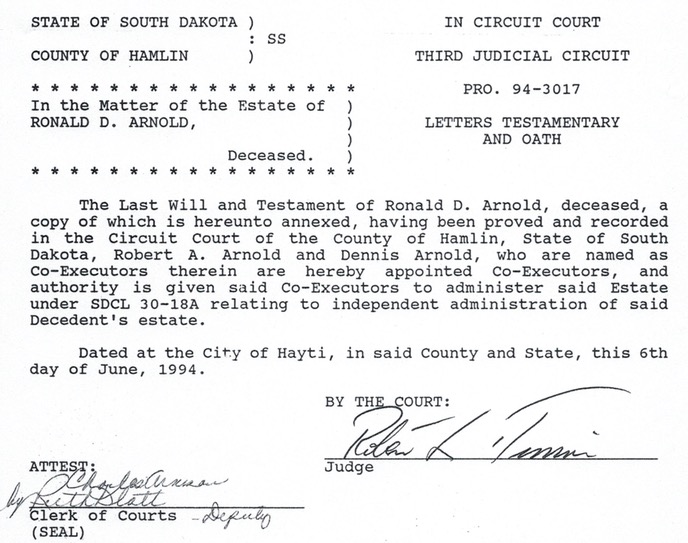

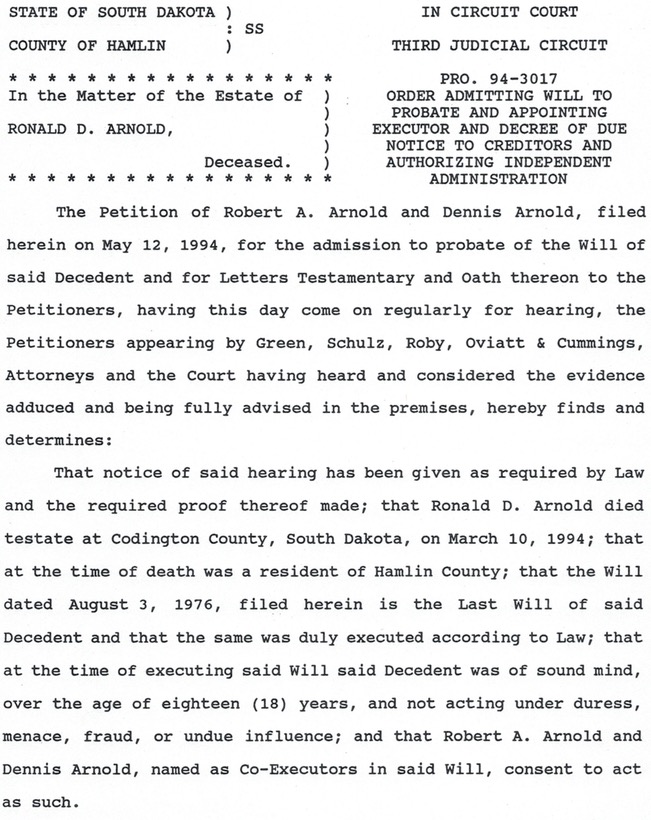

However, on June 6, 1994, Judge Robert L. Timm authorized Arnold’s brothers Robert A. Arnold and Dennis Arnold to co-execute the Last Will and Testament of Ronald D. Arnold dated August 3, 1976:

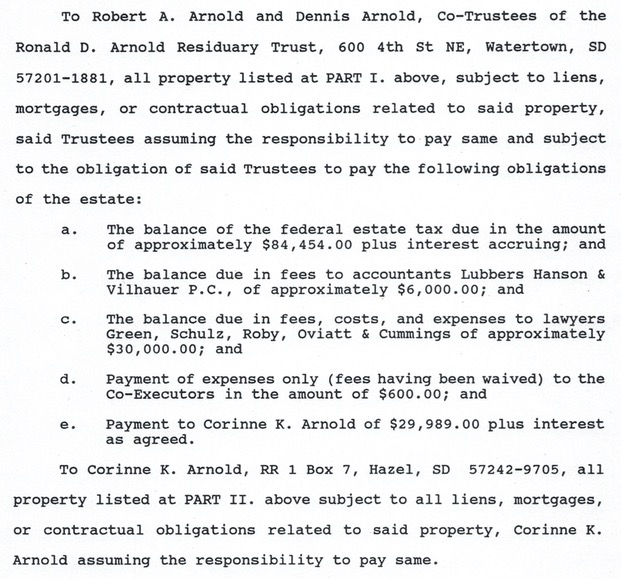

According to the final decree signed by Judge Ronald K. Roehr on December 22, 1995, Ronald Arnold’s will split his estate between his wife Corinne and a trust managed by Robert and Dennis. Corinne’s portion of the estate, as reported in Huffington Post last week, qualified for the marital deduction, meaning the federal government levied no estate tax on that portion of Arnold’s estate. Estate tax was levied on the portion allotted to the trust managed by Robert and Dennis, to the tune of $84,454:

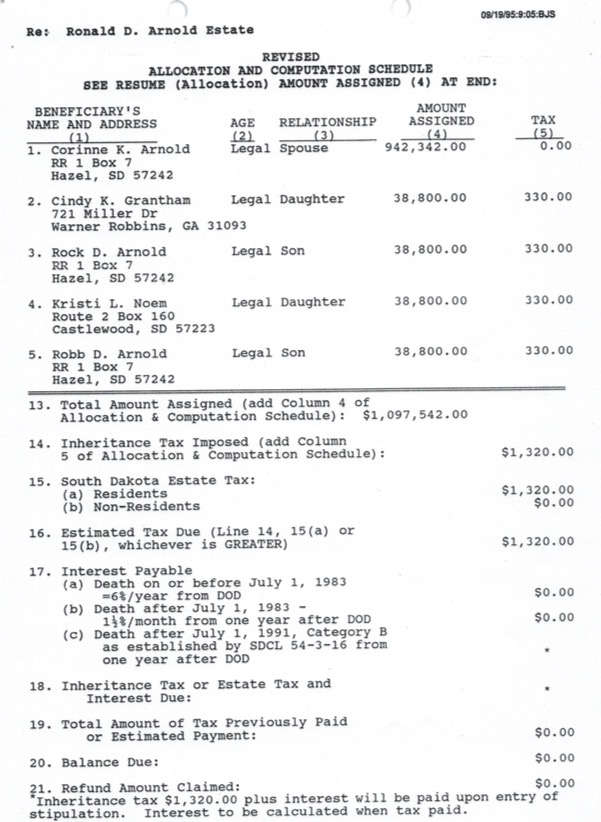

Kristi and her three siblings also received a portion of their father’s estate and thus incurred $330 each in state inheritance tax:

$85,774 in federal and state estate taxes is no small sum.But the 98%+ federal portion of that tax is the logical outcome of Ronald Arnold’s choice to split his estate between his wife and his brothers. And Ronald Arnold’s will indicates he was aware of the federal estate tax implications of his choice:

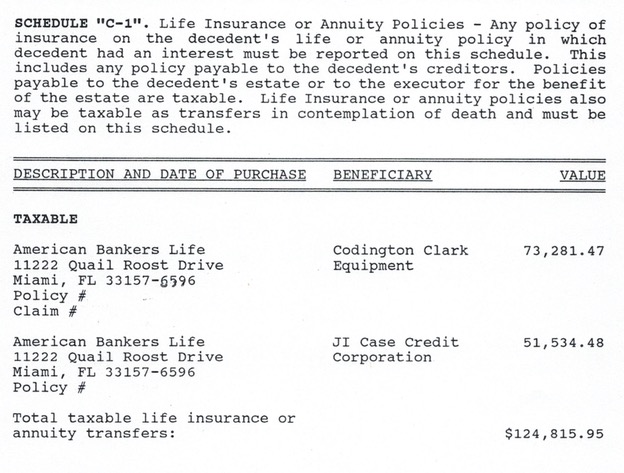

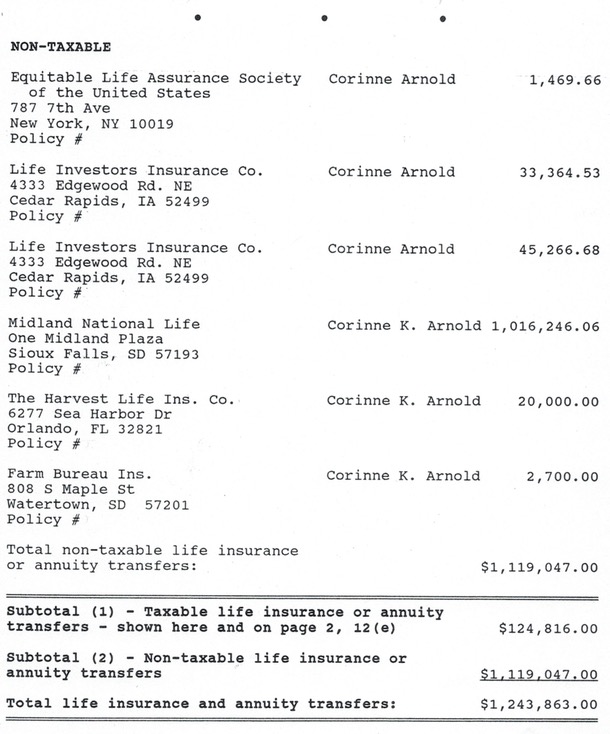

$85,774 is also a small sum compared to the $1.24 million in life insurance and annuity transfers that Corinne Arnold received after her husband’s death:

The Arnolds could have used less than 8% of just the non-taxable portion of the life insurance and annuities to pay all of their federal and state estate taxes and still have had over a million dollars left to cover medical and funeral costs, service some of the farm’s debt, and pay for ongoing operations.

Indeed, Corinne Arnold appears to have loaned over a million dollars to the estate:

These probate documents establish these key facts that call into question Kristi Noem’s narrative of a family farm almost swamped by federal estate tax:

- Noem’s father Ronald Arnold had a long-standing will.

- That will recognized the impacts of federal estate tax.

- That will nonetheless divided the estate in a way that incurred $84,454 in federal estate taxes that could have been avoided by a different division.

- Arnold’s surviving spouse had over a million dollars in cash on hand, thanks to life insurance and annuities, that could have covered the estate tax bill.

But that was really our only option. We could either sell land that had been in our family for generations, or we could take out a loan. So I chose to take out a loan, but it took us 10 years to pay off that loan to pay the Federal Government those death taxes [Rep. Kristi Noem, remarks, United States House of Representatives, 2015.04.15,

So I gotta ask, how come she decided they needed to take out a loan since she was not co-executor of the estate? This smells fishier everytime it comes around. Color mehornswoggled b’god as ever was.

Very interesting, Cory. So they did have life insurance, which helped a lot, and which I had been wondering if they had at the time of his death.

Kirsti could have been a commercial spokeswoman for a life insurance company stressing the importance of having it all these years instead of complaining about estate taxes. Instead of complaining, count your blessings for what they did have.

Why would Dad give a portion to his brothers instead of the wife? I know Republicans stress the importance of traditional values in regards to women, but his own family and children, why not just give it to them?

Why was this not known earlier? Why did none of the campaigns against Noem before dig this up? I guess I’m wondering why this is just now becoming a mainstream story?

Because, Briggs, I was too darn lazy to go get these public documents from the Hamlin County Courthouse… and because the national media didn’t see any need to dig into the sad family story of one mostly ineffectual member of Congress from South Dakota until she started making splashes as a possible influencer in the Trump Tax debate.

Kristi said she decided to take out a loan to avoid selling the land to pay the estate tax. If her uncles were merely the trustees managing the land in trust for the benefit of Kristi and her sister and 2 brothers, then Kristi owed 1/4 of the $84,454 federal estate tax = $21,113.50. It is possible that there may have been existing bank loans on the land and that Kristi didn’t have $21,113.50 cash sitting around to pay the tax.

But the documents are unclear and/or not complete regarding whether Kristi’s $38,800 allocation was cash, equipment, land or what? It may be that she took assets worth 1/4 of 1/2 of the $1.1 million net estate which would be roughly $137,500, but that she owed $21,113.50 in estate taxes.

Veeeeerrrryyy Interesteeeeeng. Who would have guessed No Nothing Noem would feed us a line of crap.

Cue Claude Rains. “I’m shocked!”

I wouldn’t call you anything near lazy. It’s something I would expect a political party or oppenant campaign to have checked into though and not taken as gospel.

Excellent work, Cory.

Like Rorschach says, there is some missing information to really understand the dollars and cents impact on the beneficiaries, but these wonderful public records certainly show that noem is a liar. What’s worse, she’s a liar about a family tragedy, and she’s a liar for the purpose of furthering a personally-beneficial political position, which makes her a sad, immoral, opportunistic liar.

People like kristi noem are what is wrong with this country.

Shocked, indeed! :-D

Thank you, Briggs and Ryan. This post is one of the more important stories I’ve told this year, in that it shows that Kristi Noem has based her entire political career on telling us something other than the full story.

Thank you, Cory, for your hard work getting The Truth out, & dox to prove it! So many of our “elected” officials appear to be either compulsive liars or incapable of discerning truth, including Trump. They know no shame, even using personal family tragedy for personal gain, as Noem has apparently been doing, dishonoring herself and her family, including her father’s memory. Hopefully, information like you’re getting out will help open the eyes of SD voters!

You know wingnut memories tend to get fuzzy a day or so after something was said.

Someone set up a Go Fund Me account so we can buy her some sympathy. Or not.

Congratulations Cory on exposing two tremendously important topics, Mickelson’s corruption, and Kristi Noem’s lie.

Briggs asks, “Why was this not known earlier?” The best answer I can give is that the major media outlets in this state are not interested in investigative reporting, especially when it comes to republicans.

Cory broke the news about GEARUP and EB-5 and did the investigative work to bring these stories to the attention of the public with little or no support from South Dakota media. In South Dakota we are forced to rely on news from a liberal blogger.

Well hopefully this will get Kristi to shut up about her poor me sob story full of half truths.

I second Roger’s congratulations to Cory.

Cory you’ll be seeing a check in the mail from me in the next week! Happy holidays and thank you again for all your investigative work.

Hear, hear Roger Cornelius. Cory could govern the state just in his spare time.

Jenny, I will be very curious to hear how Noem responds to this news, if she responds at all. I suspect this blog post by itself won’t be enough to get her to fill in the holes in her story. We need Angela Kennecke to put on that blue dress and chase Noem down at a town hall for some answers.

Thank you again, friends, for the compliments. Porter, I would never govern South Dakota part-time—South Dakota deserves better!—but I do maintain that I could govern South Dakota from anywhere with my laptop, my phone, and good signal.

Very interesting. Yes, you will need to get Ms. Kennecke to read this blogging and give her the information so she can do a story on it. Have you sent it to Mr. Jackley yet? He would probably make sure it got to the news media and on the TV

Okay then, this all needs to be pushed out further into the South Dakota mainstream. NOem is a proven liar with the proven facts as presented by Dakota Free Press (ring that dang bell). Jackley is a corrupted lying liar with the you name it files, start with Gear Up and EB-5 for sure and then add on the rest of his crooked dealings. Krebs has shown her perpensity for the big con and lie as well.

When do you think the South Dakota Democratic Party will ask for some funds from the National folks to put this on the air? Doug Jones proved beyond a doubt that you can win in a Roypublican stronghold like Alabama. We have the horses here with Billie and Tim to rid our house of the stench of the lying liars and their corrupted ways. Cory has the goods on them so now all we need is to get that word out.

Great journalism. Sometimes all you need to do is ask the right question or do the legwork to get the right document. Did you try to get Noem to clarify her stance, or to retract her statements? If she had any character at all, she would correct the record and apologize for the stories. She ought to do that from the well of the House, since her statements and lobbying on this issue may have swayed people to take a wrong position on the estate tax.

There are lots of information stashed in government offices. All you have to do is look. Sometimes it’s pain to go through all that stuff, but you can find out a lot.

Donald, I have not contacted Rep. Noem, but the way folks lit up her Twitter with this story, I imagine staff are aware and are considering whether the story warrants response.

As always Cory. Great work, GREAT work! Thank you for always informing us.

Most everyone had the suspicion that this story was always fishy, but to have the actual facts/documentation laid out is tremendous.

Very tragic that NOem and her family lost her father in a terrible accident. Worse? Using his death, spewing falsehoods for so many years, to advance b.s. talking points.

I support our local media – but they got schooled a bit by the national media here. Our government (state and federal) has for far to long, “played” our local media. I hope they have learned a lesson or two with this NOem lie being exposed.

(Cory, have you ever considered doing opposition research for Dem candidates?)

Thank you Cory. This sad, continuing episode exposing NOem’s string of fairy tales brings shame on her, her party, her candidacy, and the lame media. SD media couldn’t find a court house and clerk of courts or register of deeds or planning office – other than to take perp-walk photos – save their lives.

It’s so bad that I’d support stripping the SD universities from having media professors or granting degrees.

Thank you for exposing NOem’s blatant apparent falsifications, G M Mickelson’s apparent blatant conflicts of interest, and Kreb’s apparent blatant 1920s Jim Crow-like bigotry. They all pass their own Roy Moore test. They all are unfit for public service.

After a full 48 hours, the two major newspapers in South Dakota, the Rapid City Journal and the Argus Leader, have not picked up the Huffington Post report.

Once again, Cory leads the pack in reporting real news.

Truly surprised Noem hasn’t run to Fake Noize and whined about bully Liberal Cory calling her names.

Nice going Cory. I always thought her story did not add up.

Has the mainstream media picked this up?

Rapid City Journal in the Two Cents section acknowledges USA reports of NOem’s “lies”. Nothing about Dakota Free Press with the actual goods on the matter. Congratulations Cory on a job that needed to be done, exposure of more lies and corruption and on the House of Representative’s Floor speech. That is a disgraceful act. NOem should be ashamed for demeaning the office she holds.

An apt Seinfeld reference, reflective of Cory’s spec-freaking-tacular investigative reporting:

https://www.youtube.com/watch?v=CF7OnW4XDck

I sent the link for this article to that Sioux Falls paper, the Rapid City Journal, and the Watertown Public Opinion. Undoubtedly there are more news outlets unaware of Cory’s fantastic article that would cover the story, so I suggest others follow my lead.

Cory, if you don’t approve of this type of information sharing, please reply to that effect.

Cory, I too shared your blog post and research by sending a link and explanation to huffington as a news link with a suggestion that they should update Delaney’s 12/7/2017 article that you linked. I hope I didn’t overstep my bounds, but I agree this seems to be one of the more important stories you have done this year.

https://www.commondreams.org/views/2017/12/11/shes-poster-child-gops-estate-tax-repeal-her-sad-family-saga-doesnt-add

Tri-State Neighbor says when her Dad passed she went home to run the farm.

Just came across this in my writting an Email to Noem’s office on proposed tax bill. I did Google Search on “Noem Tax Bill” and somehow slogged over to here. I had actually gotten a pretty detailed response before from her office on another item I wroter her about.

Saw her on CBS this morning on giving a comment on duty to fulfill obligation in completeing comprehensive tax legislation. My feeling is that it needs to be delayed and get Bi-Partisan support and we should have a better chance to look at it and debate a little longer over the possible ramifications.

I told her if what I see in black in white from Hamlin County records is true she should not bother in any response to me. I don’t trust in anything liars say!

It appears that Noem’s father wanted the kids to each get a part of the estate while his wife was still living and was willing to have the estate bear the tax consequences of that decision. The provision for large amounts of life insurance was probably a way to deal with the possibility of federal estate taxes being due because of the structure of the estate plan. The only problem was Noem’s mother was the sole beneficiary on all of the life insurance policies. It appears that Noem’s mother could have easily gifted sufficient sums from the large amounts of life insurance to her children to cover the estate tax burden on her children.

Another question that I have is why didn’t the estate use the Special Use section 2032A of federal estate tax law which would have increased the amount of tax free property passing to Kristi Noem and her siblings. It may be that the large amount of life insurance disqualified the estate from 2032A because you need at least 50% of the estate to be business and farm assets. Here is some further information on the special provisions that could have helped the Arnold family weather the estate tax:

https://www.irs.gov/pub/irs-soi/spestate.pdf

Congress passed another special provision for farms called the Qualified Family Owned Business Interest (QFOBI) that was in effect from approximately 1997 to 2004 until the exemption was raised for all estates and QFOBI went away.

The estate tax laws have changed tremendously since Noem’s experience and made most of her current arguments ridiculously outdated. Furthermore, her unique situation appears to have resulted from a deliberate plan by her father. If I had heard her speak on behalf of the poor and disadvantaged as much as I have heard her talk about her dislike for the estate tax, I might give her a break for stretching the truth. But she has tried to be the poster-child for wealthy families while nary a breath is wasted to talk about the plight of the poor.

NOem has made hay with all of this since she ran against Stephanie Herseth Sandln. I remember the glowing reports of her families “struggles” written by Woster that spoke of the those times as he had known the family. Now that Cory has posted the actual facts, I wonder what the papers in South Dakota will now say further about these details. Their public readers have a right to know the facts, will they present them or will they just hope like hell it all blows over.

When you are a farmer with a big farm, you have a huge estate. It is only right that the Federal Government get part of that, since the value of your farm is likely due to asset increase over the years. Instead of whining like a little baby, talk to a tax attorney, and either sell off some of the land, make intelligent tax decisions, or contribute to charity. No one owes you anything, you tax cheat!!

NOem is a no vote for insurance for children, CHIP will run out for South Dakota in late January or early February. https://www.kff.org/medicaid/fact-sheet/state-plans-for-chip-as-federal-chip-funds-run-out/ So while she lies about her wealthy past, she wants to kill our state’s vulnerable children. What a heartless soul.

I would say to give her a lump of coal for the season but she would probably make a tea with it.

Dana—”opposition research for Democratic candidates”? What do you think I’ve been doing here for the last decade-plus? :-)

HydroGuy, I wholeheartedly support, encourage, and plead for the sharing of my posts. As I indicate to Dana, I write these stories so people learn from them and use them to promote the general welfare. Sharing my posts is the highest form of praise. (Ringing the Blog Tip Jar is a close second! :-D)

Bearcreekbat, ditto. I agree with your assessment of the importance of this story. That importance derives less from my opining and more from the plain facts in black and white on public documents that don’t square with the story a Congresswoman and gubernatorial candidate has been telling to achieve her political ends.

Roger, Jerry, RR, and others, I share your hope that South Dakota’s regular media will pick up this story and run with it. Permit me a generous interpretation for their delay: I’ve already got the scoop, so they have no rush to be second. They are perhaps so gobsmacked by the numbers, right there in black and white, that they figure they have time to check and double-check, to make absolutely for sure that that darned blogger isn’t making stuff up. They may also be playing fair and trying to get a comment from Noem’s office before airing anything… and Kristi’s so busy doing Fox News to talk up the Trump Tax and tweeting up expanded gun rights on the anniversary of Sandy Hook that she’s probably hard to reach. Plus, numbers. Math. Tax law. This is complicated stuff to research and explain to the public.

And on top of all that, to justify writing about a 23-year-old probate case, journalists have to explain that the documents and math are newsworthy because they call into question the personal story a sitting Congresswoman has been using to sell a key portion of a controversial tax plan. That’s an inescapable part of the story… and a lot of reporters will be a little gun shy about writing a piece that will certainly be portrayed by the Republican establishment as a hit piece against them by the liberal media.

So give them a couple days (although they’d better not bury it on Friday night!). They’ll catch up.

And if they don’t right away, maybe we’ll hear about it again come spring, when Marty Jackley needs some zingers to secure the nomination. (As I said, I’m all about sharing… even with Republicans. :-D )

Cory (giggle) I know, I know, I know. I should have been more clear in my question.

Have you ever thought about doing it above and beyond your blog? As an actual paid position for the party? You are thorough, factual, detailed, etc.

I know you are a humble guy, but you are doing very important work. VERY important work.

It’s just plain bad to have misrepresented this situation to the public.

Could one consider though that in the estate planning Kristi Noem talks about, a new will was drawn up, possibly with the brothers excluded, and that it therefore would not have incurred the higher taxes. Does make sense that a revision might have been done after 1976.

Death in the family is always a tragic thing but there are many children in this coutry who loose a parent at an early age and do not have the the surviving parent left with the financial resources that Ms. Noem’s mother had.

Where is the compassion in the Republican Party for the future generations which will pay for the neglect they are showing. Oh yeah believe the grinch who is promising us a big Christmas present which he tells us is costing him a fortune. I would gladly pay those higher taxes in support of my grand kids future. Here is a slogan I would like to see catch on. “Make America Good Again”.

From WAPO “”Congressional Republicans finished rewriting their massive plan to overhaul the tax code on Friday, adding in a significant expansion of the Child Tax Credit aimed at boosting benefits for low-income families.

The change was added to meet demands from Sen. Marco Rubio (R-Fla.), who set off frenzied, last-minute negotiations when he threatened on Thursday to vote against the bill unless the credit was expanded.

Rep. Kristi L. Noem (R-S.D.), one of the Republicans tasked with ironing out a final bill, said the credit had been expanded, particularly for low-income and working-class families.””

Keep in mind that this is only for a short time and then will revert back to the screwing it was always gonna be. NOem is a fraud that just keeps proving to South Dakota what a looser we sent to Washington. Unfit for duty there as well as here. Say NO to NOem.

“”A Rubio spokesperson said he was waiting to see the bill text. As are we all, and as we wait, the Center on Budget and Policy Priorities’ Chuck Marr raised a key question—this report of the increase to $1,400 doesn’t address the only difference between the original bill and what Rubio was asking for. Rubio-Lee started the child tax credit at the first dollar of earnings, while the existing Republican plan didn’t count the first $2,500 of income. So unless that is also changing, the compromise Republicans are trumpeting to get Rubio back on board isn’t going to come close to the plan he had been pushing, and won’t do much for the lowest-income families that need it the most.””

So you see boys and girls, NOem smoke and mirrors comes through again. Brace yourselves working class people, you are about to be taken to the woodshed.

Hey Cory, excellent research! You definitely outclass this state’s main stream media and other blog that promotes itself as being the best. I do tip my hat to KELO’s Angela Kennecke; she has become a good investigative reporter. I don’t know if you saw the AL’s editorial printed on Friday about Noem and her “tragic” story that she repeats when she talks about repealing the ‘death tax’. http://www.argusleader.com/story/opinion/editorials/2017/12/15/editorial-time-noem-get-her-tax-story-straight/955944001/

I give them credit for taking her to task but they need to be more aggressive and write a story that informs the public that her story doesn’t add up.

Thanks, Rich! Yes, I have both that editorial and Noem’s swift response up on my browser tabs and will be addressing them shortly. (And unlike the editors and Noem, I’ll give them full citations and links.)