Bob Mercer reports on the first data made available on South Dakota’s new public funding program for Christian schools.

Recall that in 2016, to salve the angst Republicans felt over having to give in to market forces and increase public school teacher pay, the Legislature approved Senator Phyllis Heineman’s stealth voucher program, which reimburses insurance companies via tax credits for giving scholarships to private school students.

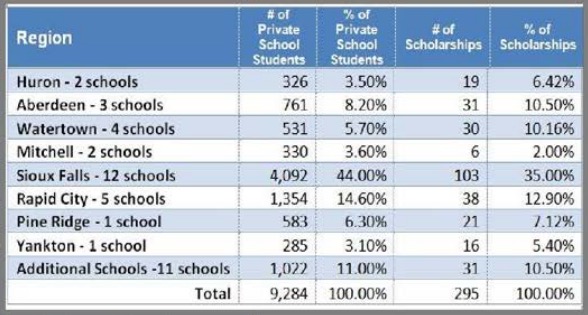

Last month, former Senator Heineman submitted this report on her stealth vouchers to the Government Operations and Audit Committee. In the first year of the program, we taxpayers spent $260,000 to subsidize tuition for 295 children at 41 Christian schools (every private school is South Dakota preaches Christianity). That’s only 13% of the two-million-dollar annual cap placed on the program.

Four insurers laundered this public money into religious subsidies:

- Sammons Financial Group—$150,000;

- Avera Health Plans—$100,000;

- ReliaMax—$50,000;

- 1 company desiring anonymity.

That’s interesting: a private company gets public dollars, but the company gets to keep that fact secret. Rep. Herman Otten (R-6/Tea) and a bipartisan coalition tried to undo that secrecy with House Bill 1125 this year, but former Senator Heineman, the religious right, and, most strangely, Matt McCauley on behalf of the Foundation for Government Accountability persuaded House Education to kill that bill. Thus, we still have no way of knowing whether Heineman’s husband D. Greg and his William Insurance Company received any additional state funds for subsidizing Christian education.

We can at least thank Sammons, Avera, and ReliaMax for their openness. Any other recipients of public largesse should adopt the same openness.

Heineman’s stealth voucher program gives insurers an 80% credit for their donations; thus, our tax dollars covered $260,000 of the $325,000 insurers donated. The program awarded a total of $213,402 in scholarships, which I can only assume means the scholarship program bankrolled $111,598, including $46,598 in tax dollars, for use in future scholarships.

Using public dollars to prop up religion violates the Establishment Clause, good religious sense (taking government money subjects your church to government control), and our civic obligation to commit public dollars to public education. But under the heading “Budget Neutrality,” Heineman’s report claims that the vouchers helped pay for themselves by pulling 61 kids out of public school and saving the state money. Their math:

- State law allocates $5,464.011 per K-12 student.

- The state picks up 56.1% of that amount.

- The state cost per student is $3.065.31

- By pulling out of their public schools, those 61 kids saved the state $186,983.91.

- That’s 71.9% of the total state tab for church school subsidies.

The Heineman report extends its math to include 118 scholarship recipients who were new to South Dakota schools. Had all 118 gone to public schools, they’d have required another $361,706.58 in state K-12 aid. Thus, the stealth vouchers team claims $548,690.49 in gross savings in state aid, more than twice what we spent on the stealth vouchers. However, Heineman and friends provide no data on how many of those 118 new enrollees would have gone to private school with or without the scholarships; thus, claiming any savings from those students is fairy-tale math.

Besides, every dollar the state “saved” is actually a dollar your local school district didn’t get. And knowing how school staffing and supply acquisition work, pulling maybe three more kids from Vermillion, Salem, and Dell Rapids didn’t reduce costs for Vermillion, Salem, and Dell Rapids. Pulling those state funds to support church schools only disadvantaged hundreds of other kids in the public school system… which of course is the outcome Heineman, ALEC, and other school privatization backers facilitate when they divert public funds from public schools.

180 of the 295 students whose religious education taxpayers subsidized come from families poor enough to qualify for free or reduced lunches. In other words, more than a third of the students receiving tax dollars for private school probably don’t need our help to obtain the luxury of a private education.

The Heineman report provides no information on student performance. But we have research that shows kids who use vouchers to switch from public to private schools score worse on tests.

Public subsidies for religious education are bad for kids, public schools, private schools, and the First Amendment. Legislators should claw this church/corporate handout back and put every dollar back in public education where it belongs.

WOW!!! Thanks, Cory. You break stories we just don’t see over on the Vatican Blog. No wonder, huh? Because when you criticize Catholics and born-agains you’re criticizing Jesus. Similar to when you criticize Trump you’re criticizing USA. It’s a ball of corruption reminiscent of “The Music Man”.

Dirty business up in DakotaLand … with a capital C, that rhymes with P and that stands for “phew”, what stinks?

Wow! Is right! I’m having a difficult time wrapping my mind around this whole story.

Talk about corruption, self interest and greed! I can see I’m going to have to get on my broom stick once again and write, call, text my state reps. Oy Vey!

I wonder how this all equates with the 80% of insurance premiums collected to pay claims goes. How does the insurance companies relate that information to the South Dakota Division of Insurance for passage of rate increases and how then would that work with the federal requirements of the same 80% premium collected for claims paid? What kind of administrative voodoo is being used to stealth that from the division of insurance and why are they allowing it?

This would seem to violate the state law that put the 80% loss ratio in place before the ACA/Obmacare came into existence. The stealth voucher law is flawed and must be repealed.

It’s been proved in many states that vouchers are simply vote buying, and have nothing to do with improving education.

The original selling point that conservatives used to sell this con was that a bit of competition by setting up a free market in schools would improve education in public schools and in private schools. This was the same argument that conservatives used for the insurance mandate and private insurance markets that Obama used in Obamacare. It’s a tricky argument: competition in the marketplace can work if the marketplace is set up right. It’s clear by the outcomes that the insurance marketplace needs massive repair and hopefully decreasing public subsidy to get going. The education marketplace that conservatives created in several states has proved a failure, and is now just another taxpayer handout to special interests.

I’m always been in favor of innovative ways to build in some marketplace incentives in health insurance and education, but the simple conservative answer of funneling government money to turn institutions into welfare queens sets up perverse incentives that destroys all institutions. In other words, conservative principles argue against these sorts of stealth vouchers.

Oh, if only they were funding Islamic schools . . . . What a pack of superstition-following, anti-constitutionalists.

Still unconstitutional to my reading of yer constitution.

Right, Mike. They still pass laws in Pierre like no ones watching. Well, people all over the country are watching. Not gonna attract new business this way.

Form a madrassa, get one student there to apply for a scholarship, and the Legislature will shut down stealth vouchers immediately.

Does Aberdeen have the largest Muslim community in the state, Cory? A Madrassa would be perfect. Right between Roncalli and Holgate. They’ll be a soccer powerhouse.

I don’t know if there’s good real estate along Dakota St. there for a new school. Maybe east by the bike trail at 15th Ave… or maybe in a more visible location, like the old Dollar Loan Center lot at 2nd St. and SW 6th Ave…. or maybe the vacant lot on South Main where the apartments burned down a couple years ago?

Your math is wrong, you add 150,000 plus 100,000 plus 50,000 and one anonymous donor and get 260,000. I get 300,000 plus one anonymous donor would be more than 260,000. Maybe my math is different because I went to Christian schools.

Once the word circulates among the big city Mosques, (and it surely is, already) that South Dakota has nearly free religious schools, the diversity level should rise to proper numbers quickly. What a great thing Republicans are doing for ethnic equality.

Under this structure, income taxes indirectly finance private schools. That being the case, why can’t we have an income tax for public school financing ?

Do schools like St. Francis and Red Cloud get that sneaky voucher stuff?

Anybody sit down and figure out where all the lottery monies for school went to? I’m guessing they went to a friend of a friend of a friend to whoever was next in line for some grifted cash. That’s my humble opinion. After reading all of Master’s, and several other Dakota journalists work on EB-5 and Westerhuis suicides, it is somewhat difficult to not wonder what the hell was going on. Absolutely no oversight, apparently.

MFI … Your post brought back a memory of Pat Powers’ excuse for why SoDak is in the top ten most corrupt states. It’s not because of the “Decade of Corruption”. Oh, no. It’s because the test wasn’t fair!! HUH? Here it is. Golden Oldie from 2015.

http://dakotawarcollege.com/south-dakota-named-8th-most-corrupt-state-and-did-kelo-actually-tell-us-how-many-cases-there-were-of-course-not/

Planned Parenthood comes under fire because it provides services that some object to; they receive government funds (although none of those funds are used for the objected services), so they have to narrow their mission and service when that government money is used. Even so, the constant threat of absolute shut down is omnipresent because some services are not in line with what a government “ought” to support.

I ask rhetorically now, do religious schools have to narrow their mission when using government funds? There is not even an illusion of compartmentalization with these education funds.

I think “vouchers” is too generous of a label: this is the de-funding of public education.

this is the de-funding of public education.–yup. this is happening everywhere to every pot of public money.

e.g. http://thehill.com/blogs/pundits-blog/transportation/346294-dont-confuse-air-traffic-privatization-for-modernization

Jerry, yes, Red Cloud on Pine Ridge is on the list.

Betsy DeVos told AP this week that a federal tax credit for private-school scholarships is “certainly part of our discussion” as the White House puts together its tax reform package. Watch for that. Oppose it.

Interesting read, Porter. And thanks. Lordy, wingnuts are goofy.

I’ve read it three times and I’m still not sure what Pat is talking about. He’s not a numbers guy and that post doesn’t read like something he wrote. It’s more like one of the “turds of misdirection” that Troy Jones like to float in our pool of common sense. LOL

There’s a list of corrupted acts and a list of the unconvicted felons of corruption nearly as long as an arm. To say there’s only one is puzzling … unless he’s talking about his part in the great flag theft.

That Heineman lady was insaner than most when she was in the legislatures and it is not uncommon for her ilk to prepare a golden glider upon retirement. This is the corruption Billie needs to unearth.

Vouchers will turn public schools into schools for special education, New Americans, troubled kids and poor performers. You know, the students private schools don’t want.

It is clever, though. You have to give the tax credits to insurance companies instead of directly to the churches because … wait for it … churches don’t pay any taxes. Like no one is watching.

Roger E, on math—the total scholarships offered are reported to be $325K. The stealth vouchers law refunds insurance companies 80% of their scholarships via rebates on their state insurance income tax (yes, South Dakota has income tax). 80% of $325K is $260K, the amount we taxpayers are footing for the stealth vouchers so far.

I urged (D) Senator Hunhoff to oppose this legislation a couple years ago. I told him it would hurt funding for public education. Hunhoff told me not to worry about it …

Alas, Senator Hunhoff voted for that bill in 2016. Compromise to smooth passage of the sales tax for teacher pay? (I’m not trying to excuse the vote; I’m just suggesting a possible motivation.)