The Legislature is cooking up more corporate welfare. Senate Bill 157 from Senator David Wheeler (R-22/Huron) would exempt big data centers from paying gross receipts tax on their hardware and software purchases if they move to South Dakota or expand existing operations here. Wheeler argues that this tax break would lure big tech companies to build new server farms in the state, bringing jobs and money and blah blah blah.

SB 157 would apply only to data centers built or expanded after December 31, 2021, and only to purchases of IT equipment and programs beyond the first two million dollars of a company’s in-state purchases in a given year. SB 157 exempts the tax only if the purchased gear is used at or physically located within the qualified data center. It would thus appear that cloud software services might qualify, as long as the users are accessing that cloud software from terminals in data center in South Dakota. But SB 157 would not exempt computers and other equipment used by employees working from home, whether down the street on Phillips Avenue, remotely at the McMansion on Lake Madison, or back in San Francisco where the corporate execs still live.

SB 157 includes a sunset clause: Wheeler apparently just wants to try this incentive out for six years, until June 30, 2028, and see if we get any Big Data takers.

Let us emphasize the term takers. SB 157 is just another South Dakota-come-lately copy of pro-corporate tricks that other states have fallen for, giving huge tax breaks to rich corporations that don’t need to them to get jobs that don’t produce return on public investment. Forbes analyzes 15 data center projects in nine states that have received at least $811 million in tax abatements since 2015 and have produced (or at least promised to produce 837 permanent jobs. That’s $969,000 per job.

If that cost/job ratio applies to SB 157, the Legislature could give South Dakota’s nearly 10,000 teachers a $1,000 raise for the same price it will take to create just ten more data center jobs. We could up and hire 20 new teachers, or 11 Missing and Murdered Indigenous People investigators, for the price of one data center worker.

The Senate initially balked at this price tag, narrowly defeating SB 157 on February 14 on a 17–18 vote. But Wheeler got the Senate to pick his corporate Valentine up off the floor Tuesday and reconsider. This time, the Senate approved SB 157 20–15. Wheeler actually lost Senators Stalzer and Maher, who voted yea on Monday but nay on Tuesday, but he got Senators Zikmund, Smith, Symens, Steinhauer, and Novstrup to flip from nay to yea.

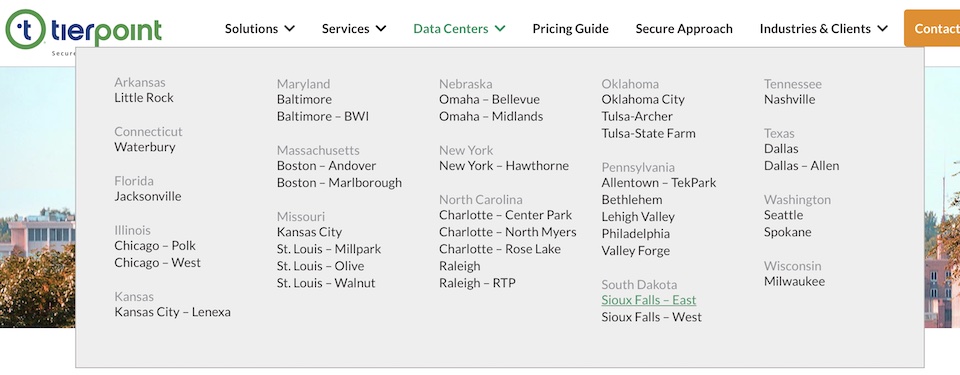

One hard nay came from Senator Jack Kolbeck (R-13/Sioux Falls), who took the floor Tuesday (SDPB video timestamp 29:12) to reiterate his opposition to more corporate handouts. He cited the Forbes analysis cited above as evidence that secret tax deals with Big Data don’t produce huge job gains. He also noted that five data centers in South Dakota—one in Beresford, one in Yankton, three in Sioux Falls—have all paid their taxes in South Dakota so far and don’t need tax breaks to stick around. He then read a statement “off the website of one of these businesses.” His text appears to come from the website of the Tierpoint Sioux Falls–East Data Center:

Sioux Falls is known for jobs, low business costs, and high quality of life. South Dakota has no state, corporate or personal income tax – and Sioux Falls has no city income tax. Many banks and financial businesses choose South Dakota in response to the state’s favorable banking regulations. South Dakota is known for retail, finance, and health care services, in addition to agriculture, meat packing, mineral extraction, and ethanol production. Many businesses choose data centers in the Midwest because the region has a low risk of earthquakes, hurricanes, and wildfires [Tierpoint, “Sioux Falls – East Data Center,” retrieved 2022.02.17].

Senator Kolbeck added the phrase “and has favorable weather” to the end of that quote; Tierpoint does not mention favorable weather, beyond the low risk of hurricanes, on the pages for either its Sioux Falls East or Sioux Falls West Data Center. Concern about hurricanes does not prevent Tierpoint from operating data centers in Florida, North Carolina, Maryland, Massachusetts, Texas, and Arkansas:

But weather or not, Senator Kolbeck’s main point is that South Dakota already offers enough advantages—fiscal, economic, seismological, and meteorological—to bring Big Data jobs to our state. On top of what Senator Kolbeck mentioned, we already have $30 million in the chute (Senate Bill 54) to expand Dakota State’s cyber training to Sioux Falls, $50 million (Senate Bill 55) to expand broadband infrastructure, and great gobs of Biden bucks coming to bulk up our IT infrastructure. The last thing we need is more handouts to corporations to create a handful of jobs that are already coming to South Dakota.

Senate Bill 157 heads next to House Commerce and Energy.

Thanks, Cory.

If the state had media it would be fun to follow the money behind the advocacy of SB 157. SB 157 is a Valentine for someone, and perhaps also for its sponsor.

I thought the GOP didn’t pick winners and losers in business. Just a bit more of the socialism of losses (or costs) for corporations and free market of profits.

On the tangential topic of the busybody legislature being a bug looking for a windshield . . . there are bills afloat telling bankers they cannot mitigate risk via lending standards for ammunition/gun/accessory companies. That’s stupid. Is the legislature going to pay the $73 million dollar settlement between the Sandy Hook parents and now bankrupt Remington Arms? (Relax, Remington’s insurance companies are on the hook.)

The Sandy Hook parents beat the nefarious, Orwellian-named federal law, the Protection of Lawful Commerce in Arms Act of 2005 was designed to shield gunmakers from lawsuits. “It’s amazing when you think about it: The makers of merchandise so destructive were granted immunity from the forms of accountability that are typically imposed on manufacturers of all manner of other goods. The genius of the Sandy Hook families and their lawyers was to cite a state law, the Connecticut Unfair Trade Practices Act, and to focus on the marketing practices used to sell Remington’s Bushmaster rifle.”

“One ad showed an image of the Bushmaster with the words “Consider your man card reissued.” Another included the phrase, “Forces of opposition, bow down. You are single-handedly outnumbered.””

Righteous lawsuits may well “fix” the ammosexuals civil responsibility.

https://www.washingtonpost.com/opinions/2022/02/16/sandy-hook-families-thank-you-taking-on-gunmakers/

Imagine the that maybe next the SD legislature will tell banks that they have to lend to the pillow dude. Banks are dumping him due to reputational damage (and to not scare away reasonable customers. https://www.businessinsider.com/mike-lindell-january-6-subpoena-banks-cutting-ties-minnesota-heartland-2022-1

If Senate Bill 157 adds a big break on energy expense, bitcoin mining near Oahe could grow.

Well…we, the taxpayers of South Dakota, just can’t do enough to help the business community. If we run into a financial crises at the state level, we just put another penny on the sales tax. Let the poor pay, its only just. Everyone needs to pay their fair share, except large and profitable business enterprises. That’s the way God wants it to be.

John, one money trail is pretty easy to follow: the four proponents who backed Senator Wheeler with testimony to Senate Taxation on February 9 were Kevin Kouba, Otter Tail Power Company; Steve Willard, South Dakota Electric Utility Companies; Chris Hill, South Dakota Municipal Electric Association; and Trevor Jones, South Dakota Rural Electric Association. Data centers buy a lot of electricity.

But an eager reader reminds me that data centers may lower their electrical bills by moving to chilly South Dakota. On cool fall days and frigid winter days, the data centers can cool their servers with outside air far more cheaply than running A.C. in Arkansas or Arizona all year long. I’m still not sure where Senator Kolbeck got the “favorable weather” comment, but in this case, the data centers would consider “favorable weather” to be deep-freeze winter, not Chamber of Commerce sunshiny picnic days.