The United States House Ways and Means Oversight Subcommittee heard testimony Wednesday on the Pandora Papers and hidden wealth. While conservatives blew plutocratic smoke complaining that the release of and reporting based on the Pandora Papers should make us worry about the privacy of global billionaires, financial experts told the subcommittee that the shadowy financial structures revealed by the Pandora Papers don’t do much good:

The hearing included testimony from two professors and a leader from the nonpartisan Financial Accountability and Corporate Transparency Coalition.

All three argued that tax-haven states bring few benefits to their citizens while leading to tax evasion and cover for bad actors [Arielle Zionts, “Congressional Pandora Papers Hearing Puts South Dakota in the Crosshairs,” SDPB, 2021.12.08].

…and…

While South Dakota’s trust laws have long been the source of scrutiny both in and out of the state, this fall’s reporting of the Pandora Papers, a leak of financial documents to journalists, revealed that some foreign investors with ties to criminal activity or wage theft have trusts in South Dakota.

Wednesday’s lead witness, Beverly Moran, an emeritus law professor from Vanderbilt, noted that South Dakota is one of three states — along with Delaware and Wyoming — to allow for rare, so-called noncharitable purpose trusts. Moran argued these trusts are effectively shielded in secrecy as they possess no “beneficial owners” to report to regulators.

“The Pandora Papers focus our attention on noncharitable purpose trusts as tax avoidance vehicles,” said Moran [Christopher Vondracek, “South Dakota’s Trust Laws in Spotlight on Capitol Hill,” Worthington Globe, 2021.12.09].

Oversight chairman Rep. Bill Pascrell of New Jersey said the secretive trust industry worsens tax inequity in the U.S. and needs more transparency:

“Letting this accumulation of hidden wealth go unchecked will only exacerbate our two-tier tax system,” said U.S. Rep. Bill Pascrell, a New Jersey Democrat who chairs the subcommittee. “I will not be complicit in further-cementing a have and have-not economy.”

The federal government potentially stepping in to regulate trust industries would likely be an unwelcome development for Republican lawmakers in South Dakota, who have worked closely with the trust industry to develop a financial haven. When the Pandora Papers investigation revealed in October that South Dakota had forged the way for the United States to become a leading destination for the world’s wealthy to park their assets, the state’s GOP wore the distinction as a badge of honor.

Pascrell on Wednesday singled South Dakota out as the “the Grand Cayman of the Great Plains” but also acknowledged that Democratic-run states have indulged in the practice. Trusts in South Dakota have more than quadrupled over the past decade to $360 billion in assets, including an increase of $100 billion in the last three years, the Pandora Papers investigation showed [Stephen Groves, “House Committee Wants Trust Secrecy Cut After Pandora Papers,” AP via U.S. News & World Report, 2021.12.08].

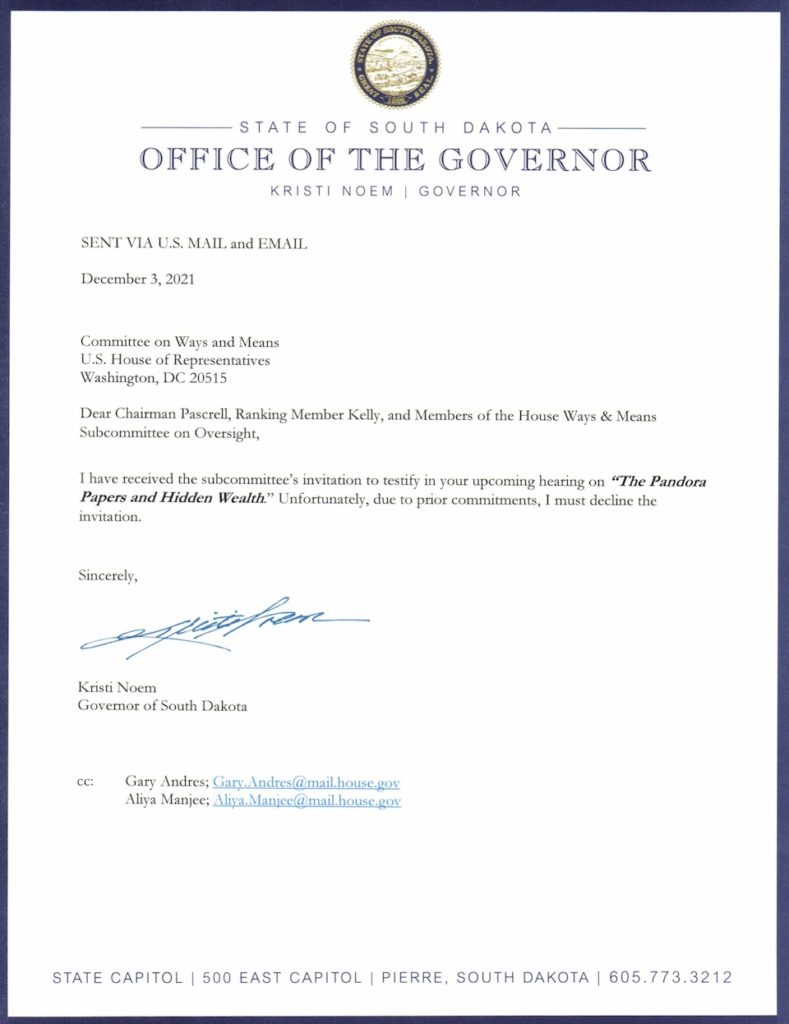

Recognizing South Dakota’s prominent role in the global trust industry, House Oversight invited Governor Kristi Noem to testify on Wednesday. Noem regularly touts her out-of-state travel as an opportunity to promote South Dakota’s interests around the country, so one would think that an invitation to testify to her former colleagues in Congress in defense of an important South Dakota industry would induce the Governor to jet right out to Washington and stand up for our state.

Noem did indeed travel to the East Cost Wednesday, but she declined the Congressional invitation:

Noem included no comment on the topic she chose to avoid; she just cited a prior commitment. What could be more important than defending our state’s economy and good name in Congress?

You guessed it: campaigning.

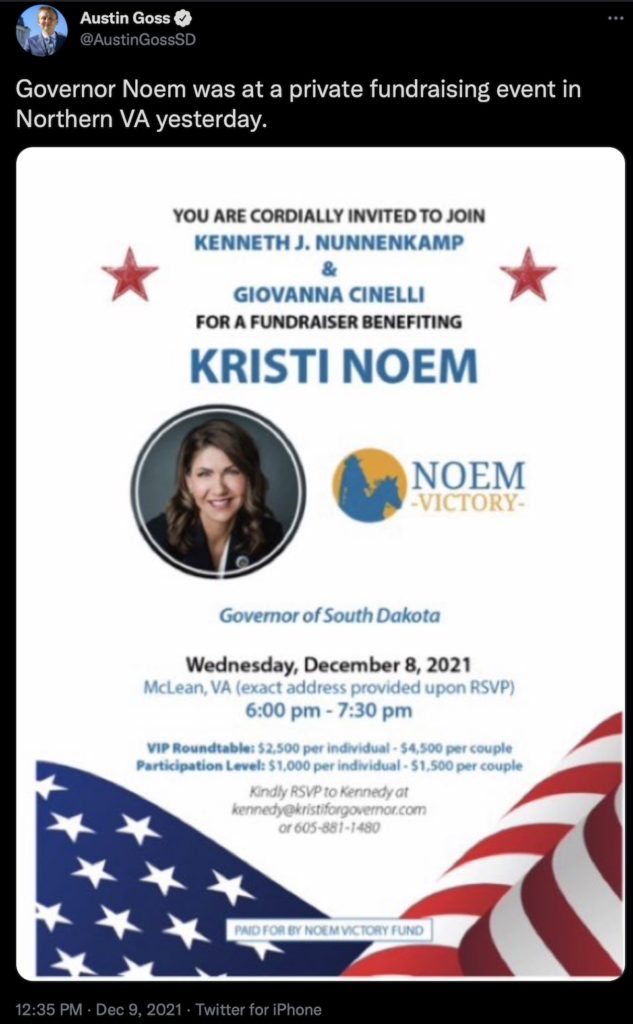

KSFY’s Austin Goss reports that Noem flew to the Beltway Wednesday to boost her own name and campaign cash at a $1,000-ticket fundraiser in McLean, Virginia:

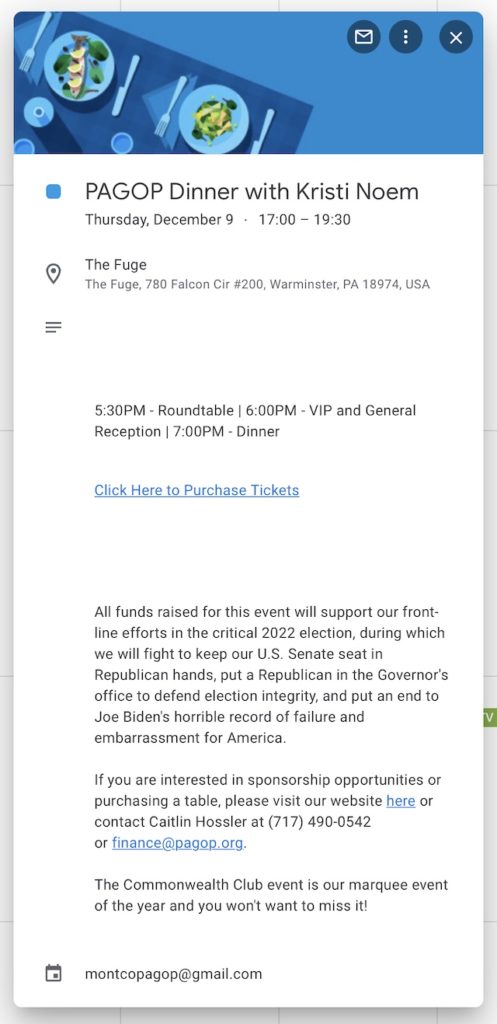

Noem didn’t have to get to McLean until 6 p.m.; House Oversight met at 10 a.m. She could have stayed on the Hill all day talking up South Dakota and still made it across the river to McLean, just 11 miles away, with time to spare. But Kristi had to save her strength for the campaign trail: she was slated to follow her Wednesday night campaigning in Virginia by headlining the Pennsylvania GOP Commonwealth Club dinner—”our marquee event of the year and you won’t want to miss it!”—at The Fuge (as in the Johnsonville Centrifuge!) in Warminster:

One could get into the Pennsylvania event for a mere $250, but $15K would get a well-placed table for ten at dinner, ten VIP reception tickets, two photo opps, and two seats at the private roundtable. Noem didn’t have time to speak to Congress to defend South Dakota, but she had time to pose for photos with, among others, a Pennsylvania businessman running for Congress:

Congress is looking at ways to regulate the trust industry. South Dakota figures centrally in that discussion and will be affected significantly by any such regulation. South Dakota’s Governor was invited to help Congress understand how the trust industry works in South Dakota and how South Dakota would be affected by any new regulation. But South Dakota’s Governor dodged that opportunity in favor of private big-dollar campaign events.

The business of Kristi is Kristi.

Really? “… South Dakota’s trust laws have long been the source of scrutiny both in and out of the state….”

Just how do you scrutinize an industry built on Republican secrecy laws, year after year? (Is it the “Governor’s Task Force” for trust law’s annual review? Did SD Republicans teach Trump or visa versa?

WE South Dakotans are the bad apples. You Republicans are rotten to the core :)

Really? “… South Dakota’s trust laws have long been the source of scrutiny both in and out of the state….”

Just how do you scrutinize an industry built on Republican secrecy laws, year after year? (Is it the “Governor’s Task Force” for trust law’s annual review? Did SD Republicans teach Trump or visa versa?

WE South Dakotans are the bad apples. You Republicans are rotten to the core :)

Noem’s been swinging for Trump for years, she could have easily defended the indefensible in congress and made it a positive for her campaign. It must really really be indefensible.

Erica Hanichak, the government affairs director with the Financial Accountability and Corporate Transparency Coalition, told the committee, “It is imperative that Congress fill its oversight and appropriations role to aid the administration in denying financial safe haven, not only to tax evaders, but also to drug traffickers, human rights abusers, kleptocrats, terror financiers and sanctions dodgers.”

…criminals are using offshore jurisdictions (island in the prairie, anyone?) where there were “few rules and little supervision.”

Pandora Papers investigation revealed the secret holdings of more than 330 politicians and 130 billionaires, as well as celebrities and royals. The files also shed light on the financial dealings of fraudsters, drug dealers, fugitive cult leaders and corrupt sports officials.

—South Dakota’s next new thing. It’s business model. Republican’s SCOTUS has its SHADOW DOCKET, South Dakota Republican’s have their SHADOW MONEY. Secrecy works!

But, the “FBI was able to intercept 27 million messages with its platform Anom – a honeypot for criminals. It is mainly on the basis of information from these three major operations that we find that we have a real problem….An example: when criminal groups launder money by buying real estate in certain European cities, this leads to undermining – the mixing of the legal upper world with the criminal underworld. And this undermining weakens society, the economy and the rule of law.”

In two out of three cases, money laundering occurs quite simply, through a direct investment in the legal economy. Think of hotels, restaurants, real estate, gold, luxury goods or art. But one in three money laundering operations are complex. That’s where we see these offshore [island in the prairie] locations popping up. For this purpose, criminal organizations hire money laundering experts who offer their services.” In Rapid City, South Dakota too. Not just Sx Falls.

* We advocate that member states make it a priority to freeze criminal assets.* https://www.icij.org/investigations/pandora-papers/europol-pandora-papers-report-warns-of-parallel-underground-system-exploited-by-criminal-networks/

GET IT RIGHT FOR EVERYBODY(C) pbs? Good All Over 2021

Another thing I read about today is that the Biden administration has charged the employers of undocumented workers who engaged in basic human slavery rather than rounding up the victims the way Trump did. Its a start.

I’m sure Noem and her handlers knew she would not do very well by appearing before this committee. Her poor performance before such a committee would then be used by her opponents and critics.

Noem is someone who does good when she has her canned talking points to go over. Noem does OK when she deals with SD media outlets, but those media outlets do not push Noem because they know the finical consequences it will have if they get on the bad side of the republican party.

I just envision Kelly Bundy of Married with Children if they tried to prepare Noem to appear before this committee. I cannot remember the name of the TV episode, but Kelly had to bulk up on her knowledge of sports for a sports trivia show. Kelly’s brain could only handle so much info and for each fact that she takes in, another falls out.

Is the Kennedy of Kennedy@kristie for guv that Kennedy, fruit oif Noem’s loins and recipient of endless nepotistic riches?

Why don’t you fellows leave these people alone? They can park their money wherever they want. It is, after all, their money and not your money.

Stop it, grudznick.

Sure, Grudz, sure. I notice if someone parks their money in Cannabis, you get the vapors. But if some foreign or domestic terrorist decides to launder illegally gotten money in South Dakota, you’re go all libertarian. Are you getting paid to say this sh….stuff?

As Donald’s comment makes clear, money obtained unlawfully, i.e. “illegally gotten money,” whether obtained by theft, forgery, extortion, non-payment on legal obligations such as taxes or other unlawful means is simply not “after all, their money.” And unless I am mistaken the proposed regulation of trusts seeks only to identify such unlawfully obtained or held funds, not money that lawfully belongs to an individual or trust.

Weren’t 2 men found guilty in South Duhkota last week of stealing 13 million in change from banks. Is that crime enough?

mfi, exactly:

https://www.cbs42.com/news/crime/pallets-of-silver-coins-seized-in-international-fraud-case-tied-to-south-dakota/

Authorities say the men used religion as a way to lure their victims in. ha ha ha What religion do you suppose?

grudznick says “stooooopid” things and then when we call him on it he claims he was just luring us in, to see if we’d overreact.

That’s what his distorted definition of, “Got your goat!” means to him.

Busted, grud.

Even worse, Porter, is when grudznick plays the “I don’t remember writing that” card and blames his declining mental powers.

Thanks as always, bcb. I remember reading it but didn’t remember from whence it came and I clean cache and memory every 4-5 days. If I don’t clean memory and cach,cookies, etc I have to log into DFP 3every time I want to post a comment.

I like the way you think, Bonnie. #grins

SD Republican politicians have a rich legacy of swimming in the deep end with Russian criminals (Dusty/Butina/Erickson). SD’s new trust industry ($360B in secret assets) is competing in the deep end.

SD financial “regulators” lack life saving or even treading water competence.

Sun 3 Oct 2021 Guardian:

“Australian accountant Graeme Biggs, [CEO Asiaciti Trust, in] September 2014 in Zurich … [met] the Russian businessman Kirill Androsov, the then chair of Aeroflot and a former deputy chief of staff to Vladimir Putin….[over] a complex structure of trusts in Singapore involving Androsov and two other high-profile Russian businessmen, Herman Gref, the chief executive of the Russian bank Sberbank and a former minister of economics in Putin’s government; and Evgeny Novitsky, a former president of Russia’s largest publicly traded diversified holding company, Sistema.”

The Pandora Papers reveal “alleged failings in Asiaciti’s compliance with anti-money- laundering and counter-terrorism funding (AML/CTF) rules.

They show Asiaciti’s regulator, the Monetary Authority of Singapore (MAS), cited Asiaciti’s handling of some transactions involving two of the Russians as examples of the business failing to adequately corroborate the source of its clients’ funds, and criticised its senior management, including Briggs, for failing to set an “appropriate tone, risk appetite and compliance culture for the company”.

***

Shall SD taxpayers fund an equivalent state monetary authority capable of policing it’s new trust industry with stringent anti-money laundering and counter-terrorism regulations? The state couldn’t even figure out EB5 or GEARUP frauds!

***

“Asiaciti … legal loopholes to minimise or avoid tax in numerous countries…have been in the sights of the Australian Taxation Office (ATO) for more than a decade – and on its relationship with one of Australia’s best-known offshore tax masterminds, the Sydney accountant Vanda Gould. Dealing with the Russians was not without potential risks for Asiaciti…. Androsov…was a politically exposed person (PEP)….Under AML/CTF rules, PEPs are regarded as a higher-risk category, and institutions [trust factories] dealing with them are required to do extra due diligence because they hold positions that can be abused to launder money or engage in offences such as bribery or fraud.

The intergovernmental group overseeing AML/CTF standards, the Financial Action Task Force, makes clear that the requirement for enhanced due diligence in business relationships with PEPs are preventive (not criminal) in nature….

Unsubstantiated allegations had also been made publicly against Novitsky, whom the MAS also identified as a PEP….”

In 2018 “ the Monetary Authority of Singapore conducted a three-month onsite inspection … [which] hit Asiaciti with a list of damning findings that identified what it described as multiple … systemic lapses in Asiaciti’s AML/CTF risk awareness and governance. It cited the company’s failure to appropriately identify and apply enhanced due diligence measures in relation to PEP customers, identifying the higher risks posed by the three Russians.

The MAS examiners criticised Asiaciti for its inadequate risk assessment and monitoring of some of the trust structures used by the Russians, given they were set up by closely linked PEPs and their associates. The examiners said that over a period of three years there were some unusual transactions and patterns of fund flows that ought to have been flagged for closer scrutiny. It asked Asiaciti to conduct a ‘holistic review’ of the structures it had set up for the Russians….”

***

Does SD have systematic, enforceable and competent, or even any, examiners of this $360B? Can SD afford to? It has been reported there is one whistle blower at the state who is VERY nervous.

***

“[F]or Latin American clients… who held offshore assets that have not been declared to Mexican revenue authorities and who did not expect to need to bring the money back to Mexico….[Asiaciti] proposed shutting down existing structures in the Caribbean and instead setting up a trust in New Zealand that would own a company in Singapore, which would in turn hold the … assets.

Asiaciti also promoted the use of a structure available in Samoa, known as creditor controlled companies (CCC), using legal loopholes to minimise or avoid tax in Belgium, Canada, France, Germany, Japan, New Zealand, Russia and the US.—The Samoa CCC can be an effective entity in which to accumulate foreign source income and to defer liability to domestic taxes—Asiaciti staff said….”

“Gould, the Sydney accountant, who in a 2014 tax liability case brought by the ATO was found by the federal court to be the secret controller of a vast network of tax haven companies….Nye Perram, the judge [in] a tax liability dispute between the Australian tax commissioner and five companies allegedly connected to Gould … asked for his judgment to be passed to the authorities to investigate further, saying: “The facts I have found strongly suggest widespread money laundering, tax fraud of the most serious kind.”

Gould had been charged with tax fraud offences [later dropped, but] Perram’s ruling found that Briggs and other directors of Hua Wang Bank Berhad, a Samoan company set up and administered by Asiaciti, while not responsible for illegality themselves, ‘were puppets who did as Mr Gould told them.’ He ultimately found the five offshore companies controlled by Gould liable to pay Australian tax…[The] relationship between Briggs and Gould went back [to the] 1980s … [and in] a 1993 letter to Gould…Briggs made it clear that the Samoan [pension] funds could be used to minimise or avoid Australian tax, because while tax was payable on contributions, there was no way for the ATO to collect it.

These structures also enabled so-called back-to-back loans, where the beneficiaries … can borrow their own money, bringing it back into Australia and claiming a tax deduction on the interest payments at the same time – a type of transaction that is legal provided it is declared to the ATO.

Gould is in Long Bay correctional centre in Sydney serving a prison term of at least three and a half years for attempting to pervert the course of justice during the federal court trial.”