Yesterday I was reading Moneyland, my friend Oliver Bullough’s 2019 book on the great global cash-stashing shadow state of trusts, shell corporations, and complicit surrender-monkey governments that allow the rich and powerful to hoard their wealth and shield it from taxes and legal scrutiny. “It’s a system,” writes Bullough, “that is quietly but effectively impoverishing millions, undermining democracy, helping dictators as they loot their countries” [p. 4]. In the last passage I read yesterday morning before walking the dog, Bullough cites Brooke Harrington, who expresses the same concern in Capital Without Borders that the unaccountable accounts and accountants of Moneyland endanger the very foundation of modern civil society:

Their work radically undermines the economic basis and legal authority of the modern tax state…. Using trusts, offshore firms, and foundations, professionals can ensure that inequality endures and grows in a way that becomes difficult to reverse short of revolution [Brooke Harrington, in Oliver Bullough, Moneyland, St. Martin’s Press: New York, 2019, pp. 99–100].

Shortly after reading that passage, readers started flooding my inbox with links to and comments on the Pandora Papers, the new report on tax and secrecy havens based on a massive leak of 11.9 million records from fourteen offshore services firms. A project of the International Consortium of Investigative Journalists, The Pandora Papers reveal how powerful figures like King Abdullah II of Jordan, President Uhuru Kenyatta of Kenya, and the alleged ladyfriend of Vladimir Putin and mother of his child hide their wealth in offshore accounts.

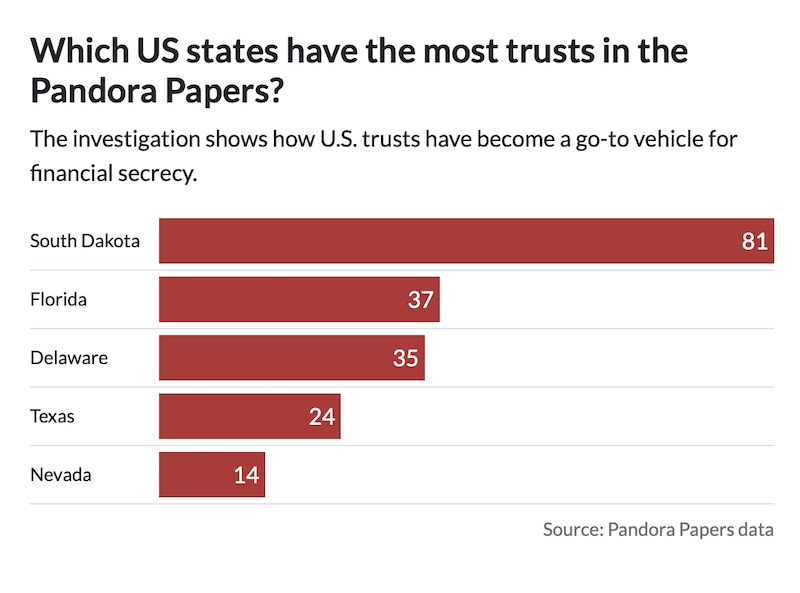

And in the Pandora Papers, South Dakota is America’s biggest player in the global plutocracy’s shell game of trusts:

As a result, ICIJ identified more than 200 trusts settled, or created, in the U.S from 2000 to 2019, with the largest number registered in South Dakota. The trusts were connected with people from 40 countries (not including the U.S.). ICIJ identified assets in single trusts worth between $67,000 and $165 million held between 2000 and 2019. The data shows that U.S. trusts held assets worth a total of more than $1 billion. Those included U.S. real estate and bank accounts in Panama, Switzerland, Luxembourg, Puerto Rico, the Bahamas and elsewhere [Emilia Díaz-Struck, Delphine Reuter, Agustin Armendariz, Jelena Cosic, Jesús Escudero, Miguel Fiandor Gutiérrez, Mago Torres, Karrie Kehoe, Margot Williams, Denise Hassanzade Ajiri and Sean McGoey, “Pandora Papers: An Offshore Data Tsunami,” International Consortium of Investigative Journalists,” 2021.10.03].

Tony Venhuizen, G. Mark Mickelson, and South Dakota’s other trusty lawyers will tell us the same thing that the ICIJ notes: these trusts and other wealth-hiding mechanisms are legal means by which entirely decent people can obtain financial privacy. And if South Dakota didn’t offer these secret cookie jars—or if we at least tried to hold these mechanisms and their mechanics accountable and imposed some minimal tax on them to shore up law enforcement, public services, and democracy against their inimical effects—some other jurisdiction would step in to do this dirty work.

But it is still dirty work, and it dirties South Dakota:

The records provide “substantial new evidence” that South Dakota “now rivals notoriously opaque jurisdictions in Europe and the Caribbean in financial secrecy,” per WashPost.

- “Year after year in South Dakota, state lawmakers have approved legislation drafted by trust industry insiders, providing more and more protections and other benefits for trust customers in the U.S. and abroad,” according to the ICIJ.

- “Customer assets in South Dakota trusts have more than quadrupled over the past decade to $360 billion,” the ICIJ added.

Zoom in: “Tens of millions of dollars from outside the United States are now sheltered by trust companies in Sioux Falls, some of it tied to people and companies accused of human rights abuses and other wrongdoing,” WashPost reports.

- The outlet notes records show that in 2019, “family members of the former vice president of the Dominican Republic, who once led one of the largest sugar producers in the country, finalized several trusts in South Dakota.”

- “The trusts held personal wealth and shares of the company, which has stood accused of human rights and labor abuses, including illegally bulldozing houses of impoverished families to expand plantations,” WashPost adds [Rebecca Falconer, “Major Probe Accuses South Dakota of Rivaling Offshore Tax Havens,” Axios, 2021.10.03].

Last week brought a slew of scandals on which any good candidate could run on the premise of saving South Dakota from scumminess. But the Pandora Papers could warrant setting aside frequent flying, curriculum standards, sexual harassment, nepotism, and maybe even South Dakota’s 2,145th death from coronavirus (yeah, that was all in one week) and focusing on what could be South Dakota’s participation in its greatest and most globally dangerous scandal: its facilitation of Moneyland.

2022 candidates for South Dakota Governor and Legislature, your greatest obligation could be to study the Pandora Papers as they come out, identify the South Dakota connections therein, and explain to South Dakota voters how our complicity in the global game of perpetuating plutocrats’ profits is supporting Vladimir Putin and other bad guys who want to tear down Western democracy and the rule of law. And your single most important campaign slogan may be, “Bust the Trusts.“

Minutes before he was driven from the White House Herr Trump pardoned Maria Butina’s lover, Paul Erickson at Mrs. Noem’s request. Butina was deported for being a Russian agent. The Council for National Policy has infiltrated Pierre and the extremist South Dakota Legislature because banks in my home state are hoarding nearly $4 TRILLION for its members including Robert Mercer, a CNP member and Long Island hedge-fund manager who bankrolled Donald Trump’s presidential campaigns.

These are not “entirely decent people.” Decent folks don’t skip out on their obligations, cheat others. commit financial and other crimes, murder people for hire, and traffic in human degradation. If there are decent people using these secretive trust scams, let them come forward, honestly and openly. None of this should be secret, and it should all be taxed.

President Biden must match his own rhetoric on shutting down global illicit finance, and start with the biggest offender—his own country.

“Governments’ promises to end tax havens are still a long way from being realized,” said Ruiz. “We cannot allow tax havens to continue to stretch global inequality to breaking point while the world experiences the largest increase in extreme poverty in decades.”

https://www.commondreams.org/news/2021/10/04/us-denounced-biggest-peddler-financial-secrecy-after-pandora-papers-leak

South Dakota has lead the way for greed. Bill Janklow made the word usury obsolete. That was just for Americans but now all the scallywags( I do live in Florida) from around the world can hide their ill gotten gains in South Dakota. This of course will be put in the new social studies courses that talk about what makes our nation great. Sioux Falls hides so many secrets doesn’t it.

To refresh my recollection I reviewed Cory’s linked informative earlier 2019 DFP post and re-read the informative Guardian article linked by the post:

https://www.theguardian.com/world/2019/nov/14/the-great-american-tax-haven-why-the-super-rich-love-south-dakota-trust-laws

As I understand it from that article, and I could be wrong, the incentive for rich folks to create SD trusts primarily has to do with (1) the lack of a SD state income tax, and (2) the lack of a SD state inheritance tax. These rich folks move their money out of jurisdictions that tax income earned within that jurisdiction, and/or tax impose inheritance tax on property located within that jurisdiction. So, hypothetically, a wealthy Minnesotan might move $100 billion into a SD trust and thereby avoid paying Minnesota state income tax on the annual earnings of that $100 billion and his or her heirs will avoid Minnesota’s state inheritance tax when he or she dies.

But the US government will still tax both the earnings and the non-federally exempt inheritances, right? So the so-called “dodge” avoids only those taxes that would otherwise by imposed by another state or country, but not the U.S. government?

As for secrecy or financial privacy, trusts can’t prevent the U.S. government from requiring disclosure of assets and income held by trusts, right? As for private entities, they have no lesser right to obtain information about another person’s assets held in trust than they might have to obtain information about assets not held in trust, right? Either way, individual assets are private absent some government investigation or reporting requirement. And trusts can’t prevent criminal prosecutors looking for illegally obtained funds from investigating trust holdings when those funds generate reportable income for federal taxes, nor prevent prosecutors from obtaining the identity of the individuals that own or benefit from the income earned on these funds, right?

Otherwise, the more historical functions of a trust, such as preventing a spendthrift beneficiary from wasting the funds by limiting creditors access to trust funds, caring for a young person (ior even a pet), supporting a public cause or project, avoiding probate, etc., don’t really seem particularly controversial.

If these points are correct, then the idea that SD trusts enable “impoverishing millions, undermining democracy,” or are “helping dictators as they loot their countries” or are laundering money seems way off base.

Instead, wouldn’t SD’s lack of an income tax and inheritance tax actually be the culprit that might help to enable such bad behavior or circumstances?

♫ The floods is threat’ning

My very life today

Gimme, gimme shelter

Or I’m gonna fade away ♫

I have always believed the adage that behind every great fortune is a great crime.

What does SD get in this process? Janklow’s repeal of usurer laws was to increase employment in SD by bringing in more credit card companies (and allowing even obscene interest rates) — is that it? Does this allow SD people to draw paychecks from the banks holding these investments? Because it is all secret, I presume we get no tax benefits from this warehousing — or is that not correct; does this all affect the bank franchise tax we collect?

Going back to Venhuizen’s and Mickelson’s remarks, do we lose anything if these accounts go somewhere else?

Ultimately, this is a problem that is going to require a federal solution. South Dakota is thus far winning the race to the bottom, but there are a number of other states also running the race. It is not something most voters in South Dakota care about at all. We actually derive some small benefit from handling piles of money from out of state.

bearcreekbat

Considering that those invested in SD trusts under discussion do not reside in SD, how is the fact SD has no state income not inheritance tax enabling the matter?

Or is the U.S. Supreme Court the enabler?

https://taxattorneyoc.com/blog/2019/06/23/us-supreme-court-holds-states-cannot-tax-out-of-state-trust-income-if-undistributed-to-in-state-beneficiaries/

Now this is solid journalism, IMO. On second thought, most of what I read here is solid writing with links that give further references. Keep up the good work.

DaveFN, very good link. Yes, the partisan supreme court will not relinquish their cash cow…ever. The South Dakota legislature, that would be able to do something right here, will not because they are on the teat of those that hold the holdings. South Dakota is a criminal enterprise that will Benda your arse if you stray. NOem proved the point when she banished a director who dared to call her incompetent daughter out.

DaveFn. That SCOTUS decision seems highly relevant and an important factor for the protections SD law provides to out of state beneficiaries to a trust, so long as such interest or dividend gains are not actually distributed and the beneficiary has no right to force a distribution.

If funds can’t be distributed without triggering out of state taxation, however, that would seem to further minimize the arguments made in the above linked Guardian article. After all, if a beneficiary gives up the right to force the trust to make pay outs, then isn’t that sort of counterproductive?

bearcreekbat, there is also a process of talking out loans against the trust which do not count as income and can even have positive tax implications to get money out of trusts and into pockets.

Well…it is an enormous amount of money hidden in South Dakota banks. We don’t tax any interest income and maintain strict banking confidentiality. It is really another government operating inside our borders.

O, as far as loans against a trust go I wonder if there are unique SD trust statites that provide significant advantages over other states?

Arlo, today I heard further discussion of the secret nature of SD trusts in a story on SD Public Radio, apparently referencing something from the Pandora Papers. In a very cursory look at SD’s trust statutes (SDCL Title 55) I only noticed one section in SDCL ch 55-1 dealing with confidentiality (the other chapters in the title didn’t seem particularly unique, but I easily could be missing something).

Three additional statutes cover registration contents of registratiion statement, and a sample form,. SDCL 55-1-56, 57 and 59. I didn’t see a statute setting out the benefits or protections for registration, nor a statute requiring registration. I wonder exactly which statutes these articles are referencing when describing what they see as some particularly unique secrecy of SD trusts?

bcb–I have no insight into the particulars of South Dakota’s statutes regulating trusts….I don’t recall committee meetings or debates in the legislature regarding these statutes…it seems they are handled as if they were routine “housekeeping”…Delaware is famous as a state with strict banking confidentiality and as a haven for corporations and wealthy individuals, yet, we have attracted 130 % more trusts than Delaware Florida is famous as a haven for illicit drug money, yet we have attracted over twice as many trusts…I don’t know..maybe its what we don’t regulate in law rather than what we do, that is the attraction.

Simple question: Just WTF do we (as a state) get for this.

Seems we’re not getting paid very well, eh ??

buckobear-ya gotta remember our being the “The Freedom State”!

For you with unlimited time on your hands…google “rule against perpetuities.” Janklow had SD law changed way back in 198? to repeal the rule against perpetuities. That was the action that broke the social contract. It broke the dam. It opened Pandora’s box. It reversed a principle of common law that English peasants and King Arthur and his heirs fought for, for hundreds of years. Now lots of other states have passed the same thing…but they don’t all have the advantage of no personal income tax and no personal inheritance tax and an under-resourced complicit legislature

Our part-time legislature, with its one-party rule and mantra of “anything that’s good for rich people is good for SD” doesn’t have a prayer or care about understanding what they are doing with the annual refinements of the trust laws. They perfect secrecy provisions, freely admitting on the floors of the legislative bodies that the language is above their comprehension, but that the industry committee that proposes the changes has only pure motives and they need to move this along for the good of all.

This year the annual trust law revision was not referred to the Judiciary committee, but to the Commerce committee. I construe that as a compliment to Ryan Cwach, the Democrat legal beagle on House Judiciary.

Tax-free investment in muni bonds is also a tax shelter, although easily argued such is a reinvestment in infrastructure.

Perhaps the salient question is what means might be implemented to keep the crooks out of tax-free investments, rather than considering anyone who takes advantage of legal loopholes as a crook.

On the other hand, the definition of what constitutes a legal loophole might better be eliminated?

Irads1….I remember the legislative session when Governor Janklow pushed through the legislation. I was in the gallery a few times and saw the committee meetings on SDPTV…Governor Janklow presented the entire legislative package to a full session, as I remember, and later, appeared personally to testify at committee meetings…there were many bills in the package and they were presented as what was needed for Citi-Bank to move its credit card operations and add a local bank to South Dakota. It was presented that if Citi-Bank were satisfied with the package of new statutes they would come and other large national banks would surely follow. The repeal of the usury law was most controversial, but there were many other bills in the package. I don’t remember any discussion about “perpetuities”, but the Governor stressed that the entire package had to be passed to secure Citi-Bank. There was controversy and a few no votes but, as we used to say “Janklow has the train on the track…get on the train or be under the train.” You are absolutely correct. The legislature never understood what they were voting for, with few exceptions.

These trusts are not hurting you people. Move along. grudznick has no issues with these trusts. You fellows should go worry some other neighbor’s donkeys.

Mr. Blundt. The gallery is for tourists. If you want to have impact get down in the lobbies.

Grudz…who said I ever wanted “impact”. From the gallery a legislative session looks like “Rats in Heat”. I don’t want to know what happens in the lobbies but I’m sure its smelly.

A righteous description of grutz and the politicians he schmoozes. Thanks Arlo

At their most innocuous, trusts that allow the wealthy to hide their income – therefore making it un-taxable – are not hurting anyone? Come on Grudznick, even you are not that irresponsible. The people in need of help are hurt by underfunded programs. Tax payers trying to do their fair share and and following the rules are hurt because their fair share increases.

Income inequality is certainly one of the destabilizing factors of this republic. These trusts help to perpetuate that corruption (plus help to fund other much larger corruptions).

https://www.startribune.com/foreign-money-flows-to-south-dakota/600103699/

Sorry, there is a firewall involved. Other outlets covered the Pandora Papers story and its connections to stateside tax havens like Northern Mississippi.

https://www.nbcnews.com/think/opinion/pandora-papers-put-south-dakota-unsavory-company-here-s-why-ncna1280761

I thought a succession of magat guvs had already accomplished that chore.

The reasoning is hardly mysterious: it’s all about the money the dynasty trust industry, prostitution, the Sturgis Rally, policing for profit, sex trafficking, hunting and subsidized grazing bring to the South Dakota Republican Party destroying lives, depleting watersheds and smothering habitat under single-party rule. Even Mike Sanborn (grud) is lamenting the South Dakota Republican Party’s disintegration. He calls it a soap opera.

https://www.bhpioneer.com/opinion/you-can-t-make-this-stuff-up/article_2968dd4e-2539-11ec-9954-ff38de3f9803.html

Mike, great link. My favorite line: “Has Pierre brought treasure to its population with its rich-people-friendly policy? Not really. ” One pass-through link in the article also stated that SD charges an 8 base premium tax on trusts (.08%); the national average is 200 base (2%). We REALLY went cheap to pull in the big spenders.

That has been my question all along, WHY? Why would we get so deep into this shady finance pool?

Is it beneficial to allow trusts to hold the wealth of the super wealthy for centuries, even thousands of years? Or is it better to require estates to distribute ownership of that wealth to succeeding generations so that those succeeding generations may control, spend, invest, sell, etc. that wealth? Answering those questions involves social, political and economic policies. Centuries ago, England decided that allowing estates to control property indefinitely was bad policy and enacted the rule against perpetuities. The effect of that rule resulted in the breakup of large landholdings that were acquired during the middle ages. Requiring succeeding generations to receive the land led to more diverse land ownership. An exception to that rule is the British royal family where the extensive landholdings of the royal family are held in trust for their benefit.

I believe the English benefitted economically, politically and socially by enacting the rule against perpetuities. Permitting dynastic trusts is a bad idea. Now that the super wealthy from foreign countries are also moving their wealth to favorable trust jurisdictions like South Dakota, the ill advised policy of dynastic trusts will impact countries throughout the world.

Convincing states like South Dakota to re-enact limits on how long decedent estates may own property in trust is highly unlikely. Corrective action must consequently be taken at the national level. Limiting the privacy rights and creditor protection aspects of trusts will also require action at the national level.

SD majority, it seems, will do anything (no matter how dubious, distasteful, and dastardly) to feel important to people who couldn’t find South of Dakota on a world map.

Whitless, I remember stories from older residents of iowa telling how farmers would marry 1st cousins to keep farm wealth in the family. Generation after generation.

Porter, as long as their accountants can find it on a map, that is all that matters.

Those asking what we get for these laws – the answer is not that hard. We get some tax revenue, as even a very small tax on billions of dollars adds up. We also have about 500 people employed in this industry, and most of them make above-average wages for South Dakota.

It is really a classic collective action problem. If we were not doing it, someone else would be doing it and reaping those economic benefits. The only way everyone wins is if no one is doing it. That will only happen if there is national, and to some extent global, regulation.

I just listened to David Brancaccio’s Marketplace Morning Report on NPR this morning and caught this statement from Tom Simmons, Professor at the Knudson School of Law at The University of South Dakota:

[ “We have a very vigorous and lively oversight regulatory (process? in) South Dakota to try to eliminate any criminal-sourced funds ever making their way into a trust”.

https://www.npr.org/podcasts/381444599/marketplace-morning-report ]

Does anyone know who or what that “oversight regulatory” process is? Or how it somehow failed in light of the ICIJ reports? It doesn’t seem foolproof at all, professor.

O, can you provide an example of “trusts that allow the wealthy to hide their income?”

My understanding is that the law would require a trust to report distributions to beneficiaries. If the distribution is from trust principal, then it would be treated the same way as distributions from principal not held in trust, namely not treated as income for taxation purposes. But if the distribution is on income earned on the principal held in trust then is is treated as income to the beneficiary, with all the normal reporting requirements for funds tranferred from one source to an individual.

https://www.investopedia.com/ask/answers/101915/do-beneficiaries-trust-pay-taxes.asp

Obviously there are many illegal means to hide income and some probably include the use of an illegal trust, but do SD statutes (or anywhere else for that matter) provide a lawful means to hide income with a SD trust, ie “that allow the wealthy to hide their income?”

bearcreekbat, I was not as clear with my language as I had thought. My point is that the list of clients in these trusts had some unsavory, if not illegal, attachments to that income. I would have been better to say launder the source of their income.

I do believe there is also the ability to hide actual income by using loans against trusts where those loans are not treated as income. The trust becomes the collateral for the loan (which is not considered income and has a lower interest rate than the income tax rate). Although any real holding of wealth could accomplish this.

The perpetuity element of these trusts also allows for avoidance of the estate tax. That is a roundabout way of hiding income, inheritance – from taxation

Oh, Trident Trust has an office in Cyprus? That’s great access for those of us who can’t moor our superyachts under the 8th street bridge in Sioux Falls.

As the rich often say, “That’s just poor people talking.”

Bottom line = We can’t tax the rich, to a meaningful degree.

The rich can move their assets to their next method of avoidance faster than Congress can agree on a taxation vehicle.

A few campaign donations to lawmakers and lobbyists will sufficiently slow down the process and allow the transfer of funds, before any harm is done to the principle.

Regarding the question raised by Chris about the regulation of U.S. trusts established by foreigners, the following article summarizes the added scrutiny required of foreigners seeking to establish a U.S. based trusts. The required inquiries and reporting does not weed out all bad actors, but trust companies and banks are careful to comply with the laws and regulations because the penalties can be harsh.

https://www.lexology.com/commentary/private-client-offshore-services/usa/kozusko-harris-duncan/establishing-foreign-trusts-in-the-united-states

O, thanks that helps clarify. And by “launder the source of their income” I assume you are referring to an illegal act rather than a lawful process act authorized by SD trust statutes. I assume it is not lawful for a trustee, settler or beneficiary to create a false origin story for the principal held in trust?

As for avoiding federal estate tax I wonder if the federal law would have to also repeal or reject the rule against perpetuities before one could avoid the estate tax, or is this just a matter of state law that would bind the federal goverment?

Predictably the uninquisitive legislators, professors, attorneys, and banksters are circling their wagons telling us ‘how valuable’ the wildly under-taxed trust industry is for South Dakota.

“It is difficult to get a man to understand something when his salary depends upon his not understanding it.” – Upton Sinclair

First, rhetorical questions: are these trust folks paying an 8% or less US income tax rate? Are they paying the same or similar taxes as is Jeff Bezos? and 50+ corporations that didn’t pay taxes? Did your income increase by 40% during the pandemic – it did for the top 1%ers?

Second, don’t expect your legislators to be able to explain the trust law; or do anything other that encourage the wealthy to further exploit South Dakota. Expect the party of Theodore Roosevelt to continue being an abject disappointment and worse than irrelevant to most of our lives.

Chuck Collins has a good take on this in the Insider. He gave away his fortune. It happens.

An example of our captured Republican legislature and the new trust industry subterfuge/the Mueller Report:

(Failing in search of DFP for trust threads, this will do)

“ The Justice Department’s international money laundering and kleptocracy team took part in the trip.

For more than a year, federal agents have tracked millions of dollars that were wired into the US from companies owned by Kolomoisky and Bogolyubov to snatch up properties — including four skyscrapers in downtown Cleveland — in a spending spree that began around 2008 and lasted for the next five years, according to court records and a source familiar with the investigation.”***

“The larger issue looming in Ukraine is whether Zelensky will allow the National Anti-Corruption Bureau to work with the FBI and carry out its own inquiry and whether the country will extradite Kolomoisky if he is indicted in the US, according to Roman Groysman, a former Florida prosecutor who once lived in Ukraine.”

https://www.buzzfeednews.com/article/mikesallah/ukraine-billionaire-oligarch-money-laundering-investigation

Brooke Harrington is a professor of sociology at Dartmouth College and the author of “Capital Without Borders: Wealth Managers and the One Percent.”

October 6, 2021

What if you could wake up in the morning and choose which laws to abide by and which to ignore? You’d probably keep the laws that protect your property from theft and your good name from libel, but maybe you’d ditch the ones that trigger parking tickets or require you to pay back your debts. For the wealthiest people in the world, picking and choosing laws is no fantasy: It’s why they use the offshore [NOW SOUTH DAKOTA’S FINANCIAL SYSTEM] financial system.” https://www.washingtonpost.com/outlook/2021/10/06/pandora-papers-offshore-trusts-laws/

An update on the Ukraine note above (btw, the Mueller Report reference is puzzling); (and i will see if i can dive deeper into SD’s secret trust industry, which likely services global oligarchs):

Perhaps USD LAW would publish a deep-dive law review article on SD Trust law. Hmmmm?

Zelensky, whom many viewed as a tool of the oligarchs when he won the presidential election in 2019. He had risen to fame via a television show on a station controlled by banking and mining magnate Ihor Kolomoisky, and many assumed he would do Mr. Kolomoisky’s bidding from the President’s Office.

Instead, Mr. Zelensky has frozen him out. Two of the nationalized companies were controlled by Mr. Kolomoisky, and Mr. Zelensky is also reported to have stripped him of his Ukrainian citizenship. (As a result, Mr. Kolomoisky, whose wealth was estimated at US$1.8-billion in 2021, doesn’t appear on this year’s Forbes list of rich Ukrainians.) https://www.theglobeandmail.com/world/article-ukraine-oligarchs-pinchuk-akhmetov/

As delegates gathered this week at the World Economic Forum in Davos, Switzerland, they were greeted by an exhibit [sponsored by ologarchs] inviting them to “be Ukrainian for a moment” by immersing themselves in the realities of the Russian invasion.

The oligarchs made much of their fortunes during the chaotic first years of the country’s independence, when lucrative state assets were passed into their hands via a series of murky arrangements. Many Ukrainians remain cynical of everything they do – including their wartime philanthropy.

Leslie…. https://www.google.com/search?q=dakota+free+press+sories+on+trusts&rlz=1C1VDKB_enUS1024US1024&oq=dakota+free+press+sories+on+trusts&aqs=chrome..69i57j33i10i160.16157j0j4&sourceid=chrome&ie=UTF-8

Have at them with my compliments.

Interesting developments today:

Charles McGonigal, 54, who retired from the FBI in September 2018, was indicted [Monday] in federal court in Manhattan on charges of money laundering, violating U.S. sanctions and other counts stemming from his alleged ties to [oligarch Oleg ] Deripaska, an ally of Russian President Vladimir Putin.

…breaking the law by trying to get Russian billionaire Oleg Deripaska removed from a U.S. sanctions list —

In 2014, Deripaska accused Manafort in a Cayman Islands court of taking nearly $19 million intended for investments without accounting for how they were used.

Deripaska has been a focus of FBI investigative work for many years. In 2021, agents searched two homes linked to him, one in D.C. and the other in New York. At the time, a spokeswoman for the aluminum tycoon said the properties were owned by his relatives.

The name of Deripaska, a politically connected billionaire, came up repeatedly in recent U.S. investigations involving Russia and the 2016 presidential campaign of Donald Trump. Deripaska did business for years with Paul Manafort, whose tenure as Trump’s campaign chairman became an intense focus of FBI investigations.

According to the New York indictment, a law firm retained McGonigal to work as a consultant and investigator on the effort to get Deripaska removed from the sanctions list. He was listed as a consultant and arranged for $25,000 monthly payments to be sent to an account controlled by another person, an interpreter for the U.S. government who was a former Russian diplomat. The interpreter, Sergey Shestakov, was also charged.

The charges against McGonigal alarmed his former colleagues in part because of his depth of knowledge of so many elements of U.S. espionage. McGonigal was an expert on Russian intelligence activities targeting the United States, as well as U.S. efforts to recruit Russian spies, said several former intelligence officials who worked with him and spoke on the condition of anonymity to describe sensitive matters.

https://www.washingtonpost.com/national-security/2023/01/23/mcgonigal-deripaska-indictment-fbi/?

*platypus: more info b/4 clicking your link?

https://dakotafreepress.com/2023/01/21/noem-bans-state-contracts-with-companies-from-russia-china-north-korea-iran-cuba-and-venezuela/

“Noem’s order does not apply, of course, to private businesses, like all the trust companies on Phillips Avenue, who are welcome to continue helping Russian oligarchs and other global evildoers hide their money in dark South Dakota vaults and do more damage to the integrity of the Republic than the Chinese making bacon at Smithfield.”

(Three links to 2021 and 2022 SD Trust Industry blog posts found in Cory’s paragraph above.)

South Dakota’s current Republican governor wants to restrict land ownership by “countries that hate us.” Fact is, of the 195 countries on the planet most them probably hate us but many have parts of the trillions stashed in the state’s banks and trusts anyway.

https://cowboystatedaily.com/2023/01/25/wyoming-lawmakers-flush-attempt-at-corporate-transparency/