Last updated on 2021-06-08

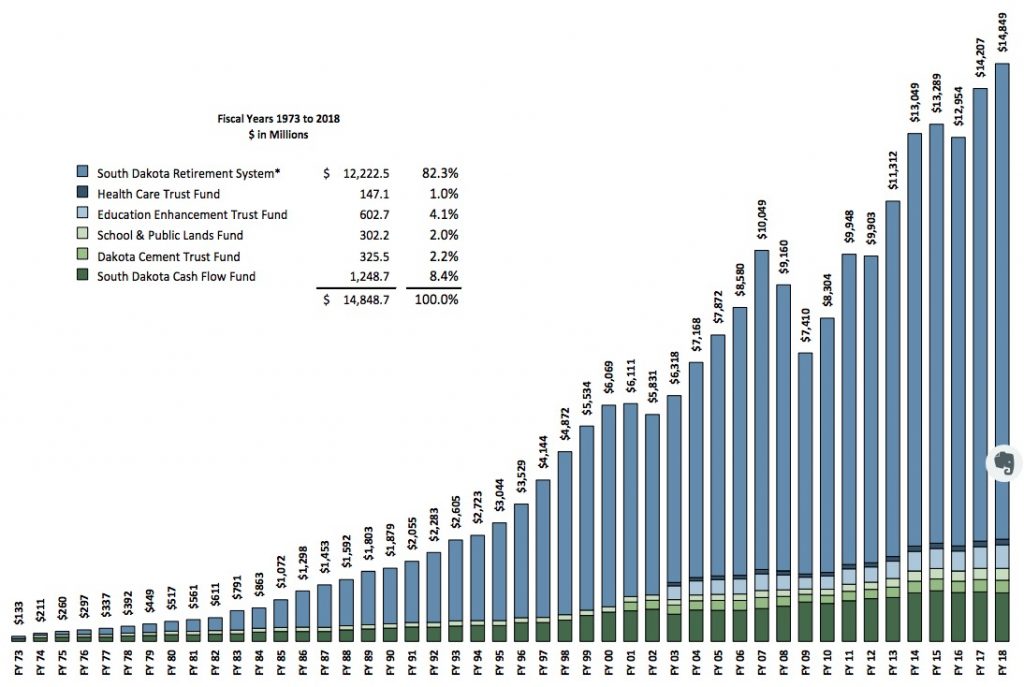

The South Dakota Investment Council continues to soundly steward the state’s pension fund and other holdings. According to slides to be presented to the Legislative Executive Board today, the Investment Council grew the state’s investment portfolio by 4.5% in Fiscal Year 2018 to $14.849 billion:

The South Dakota Retirement System makes up over 82% of those assets. That pension fund grew 7.94%, an improvement over the 6.44% annualized rate of return for the last four years and darned close to the 7.97% rate of return over the past decade, which includes the precipitous dip of Fiscal Year 2009.

That FY2018 rate of return was a bit higher than the capital market benchmark of 7.33% but a bit lower than the estimated “state fund universe” rate of return of 8.55%. But the state retirement system is still outpacing both benchmarks long-term: since FY2009, SDIC has more than doubled the retirement system assets from $4.687 billion to $12.222 billion. That’s $1.466 billion more than we’d have made at the capital markets benchmark would have produced and $1.365 billion more than the state fund universe would have produced.

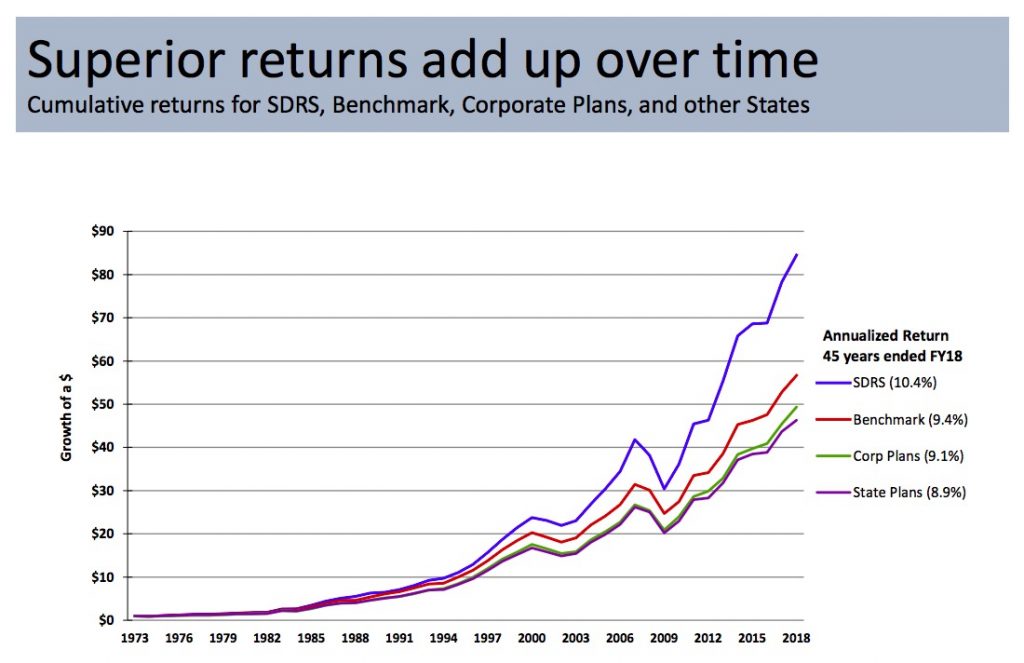

Since its creation in 1973, the Investment Council has grown our money at an annualized rate of 10.4%, beating state and corporate plans:

And we’re getting that superior return for a fraction of the fees and other costs we’d pay a typical funds manager. SDIC’s internal costs are 0.10%, while internal and external fund managers take 0.34%, compared to a benchmark cost for similar funds of 0.67% and median alternative asset managers taking 1.50%.

To top it off, in FY2018, the Investment Council expended only 90% of its staff compensation budget and 63% of its total budget. Their $12.2 million in expenditures last fiscal year are equal to 0.1% of the entire retirement fund and 1.9% of the total value added to the state’s investment holdings last year.

SDIC thus turns to the Legislature today and asks for a 3.09% increase in compensation and a 2.43% increase in total budget. Take a look at those charts and tell me: who in your financial circles will give you better than 10% growth each year for a measly 3% raise?

Good thing they didn’t invest in soybean futures.

This is, and has been, one of the shining stars of South Dakota. This is huge for our state’s well-being, and for our state employees/teachers/etc. retirements!

Still after more than 40 years the Mitchell School District aides, secretaries, janitors and cooks see their school board members in SDRS and they are shut out! What a tragedy. It is time for some leadership in Mitchell. Mitchell and about four other districts cheat their hard working classified employees out of a great benefit.

I enjoy a little jab of sarcasm Mr. T. 😊

Rod, I’d be open to opening SDRS to more participants. Would there be any harm to allowing more workers to buy into SDRS? Could school boards afford to offer support staff matching contributions? Could SDRS support more retirees?