South Dakota’s current budget faces a $33.7-million shortfall. Revenues are on track to come in $20.3 million lower than the Legislature expected when it wrote the FY2018 budget. The state faces $10.4 million in increased expenses, mostly from more kids than expected enrolling in our K-12 schools. Plus, we need just under $3.0 million for emergency appropriations.

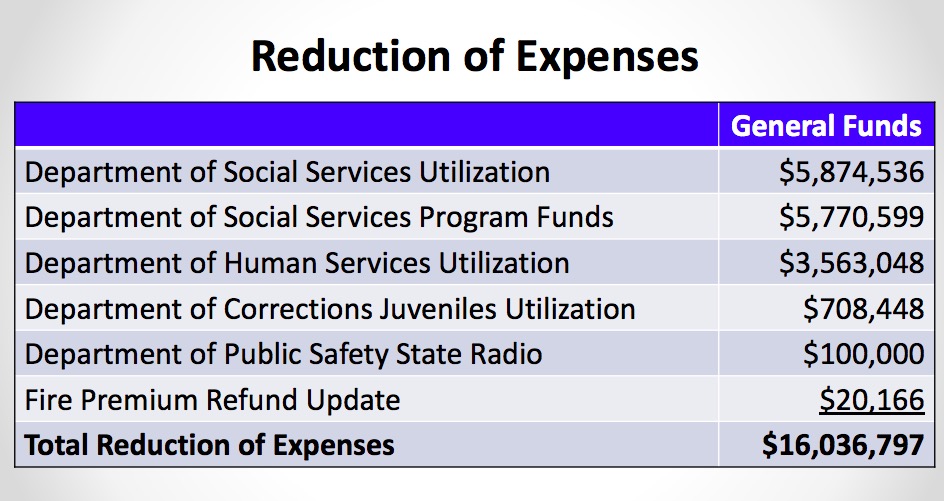

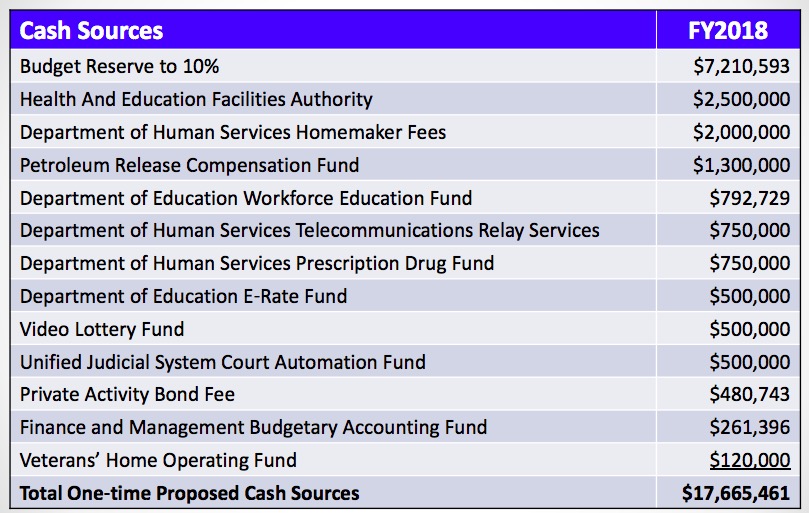

Governor Dennis Daugaard proposes to fill that $33.7-million hole by cutting $16.0 million from approved spending and raiding $17.7 million from a variety of funds, including $7.2 million from the budget reserve.

That $7.2 million from reserves will bring the state’s rainy-day fund back down to an ideal 10% of general fund expenditures. The Governor could fill the entire shortfall with reserve money and still have over $130 million in the bank, but the Governor does love his arbitrary metrics.

“South Dakota is working,” Governor Daugaard told the Legislature yesterday, cheering yet another statutorily mandated balanced budget. (Funny how concerned his is about following that law, but not the law requiring increases in teacher pay.) But economist and Senator Reynold Nesiba (D-15/Sioux Falls) says balancing the budget isn’t the biggest deal we should sweat. “We will fix our fiscal deficits,” Senator Nesiba says. “Our other more persistent deficits in access to education, care for the disabled, access to drug and alcohol treatment, and of fairness in taxation are far harder to fix.”

Senator Nesiba’s list of priorities makes another austerity budget and 10% reserves seem like pretty paltry aspirations. South Dakota needs the green eyeshade to use its wealth wisely, but it also needs vision to create a state government that truly works for everybody.

Sales wouldn’t have flat if we would have expanded medicaid and poured millions more dollars into the economy, creating jobs, getting people health care so they could go back to work, earn more and spend more.

I was wondering when Governor Daugaard was going to conclude that the rainy day funds needed to be tapped. When you can’t meet your commitments to fund education under the law, I think that qualifies as a downpour.

The Governor wants to maintain a 10% reserve. But aren’t we supposed to be able to use that 10% on some rainy day?

Excellent point, Paul T. Cutting off our nose to spite Obama by not expanding medicaid has left us feeling the economic hurt and looking foolish. More importantly, it is hurting destitute people that could have received proper medical care as well as our schools who would have received more sustainable levels of funding.

No, one doesn’t use all of the rainy day fund, Cory. You have to compromise and use up to 5% of it, perhaps. Even that is pushing it when it comes to a conservative grumpy old man like South Dakota.

I would suggest doubling the excise tax on alcohol for a start. That would bring an additional $7m for the State. Under the current formula it would also double the share counties get. My county, Minnehaha, would go from$600k to $1.2m. Currently the cost of booze to Minnehaha is at least $10m a year. Those additional costs are paid by property taxpayers at the county level.

The additional cost of:

*Prosecution $4.5m

*Defense $4m

*Incarceration – $46m jail expansion in Sioux Falls and $13.6m a year to operate

*Health Care

*Indigent burial $200k

*Treatment

*Drug treatment (beer- our first gateway drug)

If we quit protecting the liquor industry. And if they paid for the damage they do on a Statewide basis there would be no Budget issue in Pierre… or here.

(PS- My house does not drink and drive. jb)

(PPS- Who covers the cost of of human lives lost to drunk drivers? jb)

Yep, expanding Medicaid was a no-brainer. Yet, Mr Daugaard decided playing politics was better for the state. Yet here we are now, and he’s claiming foul? Wow.

Regressive taxing (that Darin does a great job of describing) has hurt this state. Big time. But no, Mr Daugaard will not admit that that has been a problem.

Isn’t it time (way overdue) to take a look at the exemptions provided to people? And why are people that don’t even live in this state, show a SD residence and don’t pay taxes here, drive many of the decisions made in this state? The governor et al claim outside influence is “bad”, yet, they lick it up with glee when it benefits the good ole boys club. And then will make a gloom and doom speech about the South Dakota budget.

Wages in South Dakota are right out of the 80’s and the 90’s. Imagine employers actually paying employees in South Dakota a higher wage, wages that are actually more up-to-date. More money in the pockets equals more spending equals more revenue. For Mr Daugaard to not recognize that his leadership has resulted in this continued bottom line, is ridiculous. It is time, and way overdue for different leadership in Pierre.

Jeff Barth is right. Alcohol taxes should be raised to a level that recognizes the financial burden that alcohol puts on governments to fund the criminal justice system. Tobacco taxes have gone up considerably, and Rep. Mickelson proposes to raise them significantly more to fund expenses totally unrelated to tobacco. But government is unwilling to raise alcohol taxes to cover directly related government expenses. It doesn’t make much sense.

Balancing a budget by using reserves is not a balanced budget. That is just a slick way to say they have a balanced budget without actually doing it. To pass such a law to balance the budget and totally ignore it in practice is just a lie to make people think they are balanced when they are not. When people are that devious, it is not just the budget that is not balanced.

The Centers For Disease Control & Prevention estimates problematic alcohol use costs SD nearly 600 million dollars every year.

https://www.cdc.gov/features/costsofdrinking/index.html

In an effort to add additional context to Jeff’s idea of adjusting our States alcohol excise tax we need to understand that the last time we adjusted this tax was 30 years ago, in 1987. The rate is not indexed for inflation. This has reduced the effective rate by more than 50%. In other words our effective excise tax is half of what it was 30 years ago. Adjusting this rate is one of the most effective public health strategies that can be employed in efforts to reduce alcohol related harms in SD. The strategy is supported by the AMA, the CDC and many other reputable health organizations. There is empirical evidence supporting a myriad of other positive outcomes from an action such as this.

Jeff Barth and others are absolutely right!

For every dollar the alcohol industry pays in taxes, other South Dakota taxpayers pay at least $16 to cover the costs associated with alcohol harm – from public safety, adjudication, incarceration, healthcare, treatment, social services, etc. These costs are ‘socialized’ to responsible taxpaying families whether or not they consume alcohol, and take the form of property taxes, sales taxes, increased health care costs, increased motor vehicle insurance costs, and other taxes and fees.

The state budget takes in roughly $14m in alcohol excise and alcohol sales taxes – yet spends in the neighborhood of $250m (the CDC estimates $598m – and includes costs passed on to other responsible businesses) to mitigate the harm caused by alcohol. In any business, this math does not make sense. Good business leaders should not be surprised by the increased cost of doing business in SD because of cheap alcohol.

Lawmakers who want to grow the alcohol business are supporting de facto property, sales, and business tax increases on the rest of the state. If alcohol paid its own tab, each drink in SD would have an additional $1.59 in tax. For more information see:

https://wwwn.cdc.gov/psr/default.aspx

Not suggesting prohibition in any way. Simply saying that responsible adult consumers of alcohol deserve the right to pay the full cost for the privilege of enjoying their favorite adult beverage. Most responsible alcohol consumers agree!

Recently, the Senate just voted to reduce Federal alcohol excise taxes – which will, by default, require states to fund even more alcohol harm mitigation. Under the constitution, states have the right to regulate alcohol in many ways.

NOW is the perfect time to:

– raise alcohol excise taxes (by at least a quarter per drink). Non-excessive drinkers would only pay about $8 per year on average.

– allow counties and municipalities to raise alcohol taxes (via percentage at point of sale, like sales tax). Currently, about two dozen states allow local option alcohol taxation by counties/municipalities – including our friends in North Dakota!

– adjust alcohol excise taxes for inflation (which would roughly double the current alcohol excise tax), and tie it to the rate of inflation.

South Dakota elected officials have not raised alcohol taxes in 30 years. It is not hyperbole to say that hundreds of millions in potential tax revenue have been left on the table – and have gone mainly into the pockets of out-of-state alcohol distributors and producers. The annual bill has been sent to responsible South Dakota taxpayers and families – and we have paid it. How much longer before we understand the high price of cheap alcohol.

Many people will say, in ignorance, ‘if we tax alcohol, people will just DRIVE to other states’. There is ZERO evidence to support this. Just look to tobacco as an example.

Others will say, again in ignorance, ‘alcohol taxes will impact low-income people and they will all become addicted to meth or opioids or something worse’. Many studies say the higher-income households spend much more on alcohol than low-income households – and pay the majority of alcohol tax increases. There is ZERO data that shows alcohol taxes increase illegal drug use – in fact, the opposite is true.

For those who decry: ‘this will cost us JOBS’ – know that alcohol taxes, when dedicated to healthcare, prevention, treatment and public safety create MORE jobs (and better jobs) than in the alcohol industry. This has been demonstrated in research from David Jernigan at Johns Hopkins.

Those are the facts the half-dozen or so alcohol lobbyists in Pierre don’t want you to know.