In his final budget address, Governor Dennis Daugaard showed he intends to go out with a whimper, not a bang. Faced with troublingly stagnant sales tax revenues, instead of proposing tax reform that would allow the state to access the wealth that a fully employed workforce must be generating, the Governor shrugged, offering no new ideas, no bold policy initiatives, and no raises for state employees or K-12 teachers.

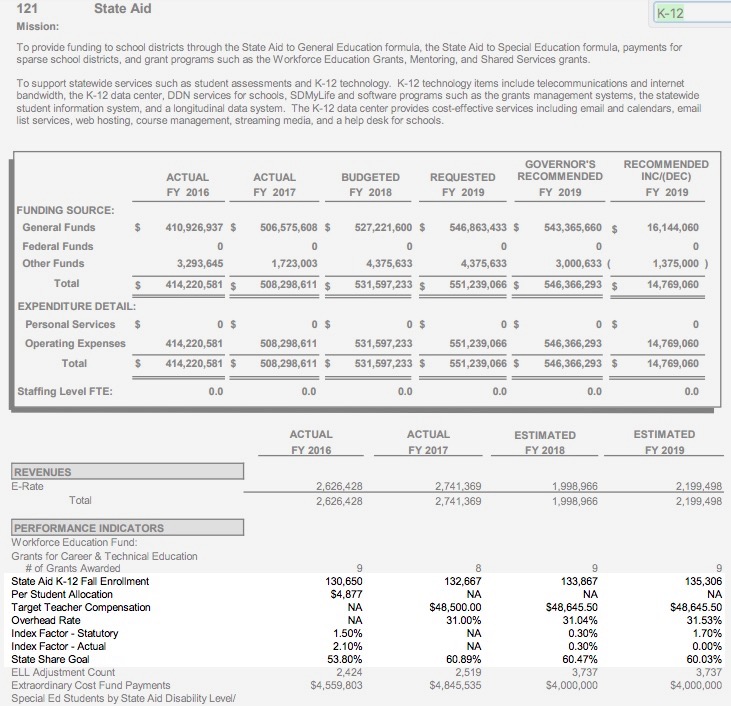

Of most immediate interest to South Dakota voters will be the Governor’s proposal of zero inflationary increase for state aid to K-12 education. Governor Daugaard does propose spending another twelve million dollars on general education and another four million on special education, but those increases are tied to a projected 1,439 more students enrolling in our public schools. While statute (SDCL 13-13-10.1) dictates that the target teacher salary should rise 1.7%, Governor Daugaard proposes zero increase in the target teacher salary:

By breaking the law and keeping the “index factor” at zero, Governor Daugaard is telling school districts they will get the same amount of money per student next year that they are getting this year. A school that sees no change in enrollment will have the same amount of money, meaning no raise for teachers.

The Governor also lowers the state’s share of K-12 funding, from the FY2017 Blue Ribbon peak of 60.89% and this year’s 60.47% to 60.03%.

In 2016, the Governor offered South Dakotans this deal: make everyone spend another 0.5% on groceries, clothes, and other taxable items, and we’ll get South Dakota’s teacher pay out of the national gutter and achieve ongoing, almost regionally competitive levels. In the first year, after using a third of that new sales tax to lower mostly commercial property taxes, Daugaard’s plan raised teacher pay only 54% of the targeted amount, maybe lifting South Dakota’s average teacher pay from 51st to 50th. Now after less than two years, the Governor is keeping the additional half-cent increase in our regressive sales tax in place, but he is giving up on the teacher-pay promise.

Regular reader Darin Larson aptly summarizes Daugaard’s failure:

We just raised the sales tax for teacher pay less than two years ago to get out of 50th place, but soon we will reclaim our traditional spot at the bottom. We raised state education funding by roughly 10% with the sales tax increase, but the effects of this will soon be negated. The first year of the 10% raise was 7% more than the baseline of what a conservative 3% increase would have been for that year. Last year, the legislature gave the schools a .3% increase (not 3%, but .003 expressed as a decimal). That means that the 7% gain from the first year of the sale tax increase was basically reduced again by 3% to a net of 4% at the end of this fiscal year. Now I just heard that Daugaard is again proposing a negligible increase for education in next year’s budget. Thus, the remaining 4% benefit from the sales tax increase will be reduced to 1% better than if we had simply increased education funding at a 3% rate since the time of the sales tax increase. In other words, the progress made in education funding at the time of the sales tax increase will have been almost totally wiped out by the subsequent state austerity budgets. We will once again be the “Mississippi of the North” in short order.

Daugaard had an opportunity to provide some leadership and vision for the future in SD without political repercussions because of his term limited status. Instead of looking to the future with new funding mechanisms and explaining the importance to our future of investments in education and infrastructure, Daugaard is content to rely on the same old broken model of regressive taxation that was abandoned by most states without oil wells. He has allowed the Titanic in the form of our state budget and revenue structure to set sail knowing that the icebergs are looming and the hull has already started leaking precipitously. Every year he tells us how he is moving the deck chairs of our state budget around, but he does not chart a different path that avoids the perils of our doomed voyage. Will the next captain of our state see the folly of our current doomed path to the bottom? [Darin Larson, comment, Dakota Free Press, 2017.12.05]

Before the budget address, the Legislature’s Joint Committee on Appropriations approved waivers—fourteen of them conditional—for 29 school districts that broke the law in not raising their teacher pay enough under the new K-12 funding formula. Those 29 schools had to apply for those waivers and beg for mercy from Appropriations and the School Finance Accountability. Apparently Governor Daugaard faces no similar accountability for obeying the law he signed and providing for the teacher pay raises he promised.

Yikes, I didn’t expect to see my comment in this story! The spotlight is bright.

I would add one more thing. From my perspective, school boards took on the governor’s challenge to raise teacher pay in good faith. Despite some schools who unintentionally fell short of the overly complicated formula to increase teacher pay, most schools have focused on increasing teacher pay while the rest of their budgets received minimal funding increases. However, the state and the governor have not met, and gathering from the governor’s budget for next year, do not plan to meet their obligations under the plan to increase teacher pay.

What I’m trying to say is that the governor is causing a budget squeeze for schools by essentially allowing no inflationary increase for schools. While schools were raising teacher pay as per the much heralded law, all of their other expenses were going up in the normal course of inflationary pressures. Schools have had to dip into reserves and shift money around to plug these inflationary holes that are not being filled by state funding. This is unsustainable.

The spotlight is the price you pay for being right and literate.

I agree: school boards have tried much harder than the Governor to live up to the 2016 Blue Ribbon promise.

Refusing even an inflationary increase for schools is in effect a funding decrease. This is more of the same old-same old from Pierre.

Once again, the state sold a tax increase by promising new revenue for a specific purpose … and used the revenue generated from the tax increase as replacement spending instead of new spending. It’s a blatant breach of the public trust, nothing less.

That said, I think that Governor Daugaard is a decent human being. Much more so than his feckless and corrupt predecessor. But he has no more governing vision than that predecessor. He doesn’t seem to aspire to being anything but South Dakota’s bean counter in chief. Just another caretaker governor managing decline. This budget plan of his means that he’s given up on everything but making it to the finish line. It’s too bad. He could have been so much more, because in a lot of ways I believe he really cares.

Just think about those state employees who will also will not receive a pay raise again for third time in four years, and the state wonders why anyone not tied to the land flees for anywhere else.

More of the same from our fine elected folks in PIerre. Maybe they could tack on another 1% tax on food, so everyone could equally help out with the budget problem (sarcasm). South Dakota has a list of non taxed items a yard long, but these seem to be untouchable. Heaven forbid an income tax! If one should ever pass, I could easily see our elected folks have it being a tax on only the first $30,000 a year you make, again being set up so everyone pays an equal amount. Face it South Dakota – it is time to look at taxing some of the exempt items, or to institute an income tax. But do it the right way. Don’t tax the first $30,000 to $40,000 a person makes. Our new state motto on our license plates will soon be “South Dakota – We are 51st in everything”.

Madman: good point about state employees. Low pay weeds out talent and makes increases the chances that your workforce consists of more individuals prone to toadyism and corruption, since special favors from the local political machine make up for higher pay that would be harder to get in a competitive public service sector like that in St. Paul or Washington, D.C.

Rorschach, you nailed it when you said: “Once again, the state sold a tax increase by promising new revenue for a specific purpose … and used the revenue generated from the tax increase as replacement spending instead of new spending. It’s a blatant breach of the public trust, nothing less.”

If you add up all the funding sources that are supposed to be going directly to school funding like video lottery, the half penny sales tax, school and public land rents, and other pertinent trust account funds that the state has for education, our schools should be doing very well in terms of funding. Instead, as Rorschach points out, these sources of funding that were promised to education have been commingled in the general fund and spent for other purposes. Certainly, the video lottery money and the half penny for teacher pay was supposed to be in addition to the state’s regular obligation to adequately fund education. But the misappropriation of education funds has resulted in less spending on education from the general fund. Thus, state government is stealing from education funding in order to fund other areas of the government.

But I have to disagree with you on one thing, Rorschach. If Governor Daugaard really valued and cared about our education system in SD, he would not be defaulting on state promises and obligations to adequately fund education. Everything under law it seems is a solemn obligation of government, except the promise to fund education and raise us from the bottom of state teacher pay. We are a nation of laws, except when the Governor and the legislature decide their promises to schools and teachers are burdensome. Then, quick as a wink, their promises go out the door and the public is left to wonder what happened to the new tax revenue that was supposed to go to education.

Bill K, if we elect some decent legislators (i.e., not Republicans who fly to ALEC conferences at South Dakota taxpayers’ expense to learn the bidding of out-of-state corporate fatcats), we could do some sensible tax reform.

Cory, I agree on electing some decent legislators, be they Republican, Democrat, Independent or whatever. Many years ago in a one room country school, I was taught that our elected officials were supposed to do what was best for the people, hopefully after consulting with many of the people they represented. Nowadays it seems that our elected officials do what their party and a few wealthy, politically well connected people want them to do. Sadly, it seems that the good ole boy network in Pierre and Washington, DC feels that they can pigeon hole new comers who don’t march in lock step with them. Maybe those folks need to go back to school and read up on their civics class books. I think it is time some of many of these folks need to be taken to the woodshed for a little heart to heart discussion.

,.;eiwen