Senator John Thune tells WNAX that South Dakotans will see significant benefits from the Senate tax plan:

In South Dakota, according to the Tax Foundation, it’s going to be an average of over $2,500 dollars tax cut to the average family in our state [Senator John Thune, transcribed audio, in “SD Senator John Thune Discounts Polls Critical of Tax Cuts,” WNAX, 2017.12.01].

That Tax Foundation number appears to come from this prediction that the Senate tax plan would raise after-tax income for a middle-income family by $2,528 and add 2,768 full-time-equivalent jobs in South Dakota. If that’s what Thune is reading, Thune is misrepresenting that analysis. The Tax Foundation does not say that the Senate plan will cut taxes for a middle-income family by $2,500. The Tax Foundation says trickle-down economics will result in more jobs and higher incomes that will bring the net after-tax benefit to $2,500:

Using the Tax Foundation’s Taxes and Growth (TAG) macroeconomic model, our analysis found that “the plan would significantly lower marginal tax rates and the cost of capital, which would lead to a 3.7 percent increase in GDP over the long term [and] 2.9 percent higher wages.”

The TAG model estimates that the plan would result in the creation of roughly 925,000 new full-time equivalent (FTE) jobs, while increasing the after-tax incomes by 4.4 percent in the long run, meaning families would see an after-tax income boost of 4.4 percent by the end of the decade. The increase in family incomes is due in part from individual income tax reductions and the broader rise in productivity and wages due to economic growth [Nicole Kaeding and Morgan Scarboro, “The Senate Tax Cuts and Jobs Act: The Impacts of Jobs and Incomes by State,” Tax Foundation, 2017.11.10].

Evidently Thune can’t read analyses of the tax plan he voted for any better than he can read the plan itself.

According to the Institute on Taxation and Economic Policy, Thune’s plan gives 89% of South Dakotans a tax cut in 2019, but the average tax cut for everyone making less than $104,000 (that’s 80% of us) is only $796. We’ll be counting on the 1% of South Dakotans making over $539,000 to share the average $66,080 tax cut each of them will enjoy.

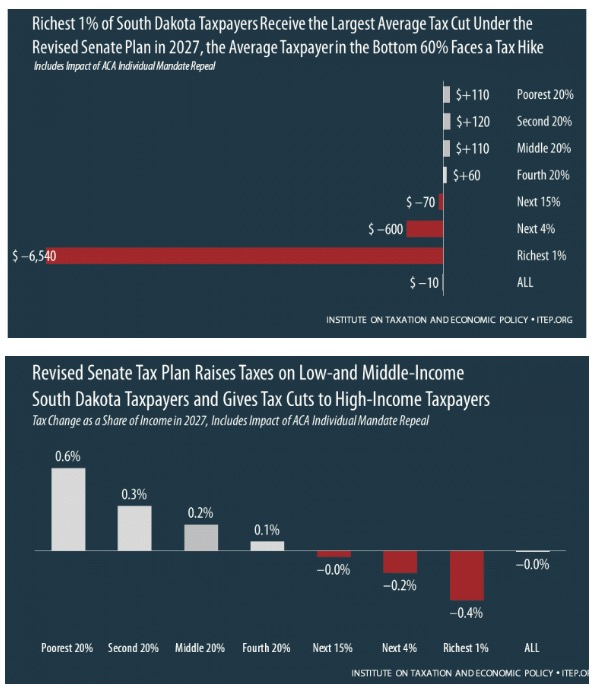

By 2027, the benefits of Thune’s tax plan skew even more heavily toward the rich. Nineteen states will pay more in federal taxes than they would under current law. South Dakota still will enjoy a net decrease in federal taxes, but only because ongoing tax breaks for the richest 20% of South Dakotans (an average of $6,540 for the top 1%) will exceed the tax hikes imposed on the bottom 80% ($110 more per person).

So in its full implementation, Thune’s rosy prediction of more than $2,500 in a middle-income family’s pockets depends on over $1,700 in increased income from magic GDP growth in 2019 and over $2,600 in increased income in 2027, all of which is magic income, not direct tax relief specified in the plan Thune voted for. And data show that magic income doesn’t exist: those permanent tax cuts at the top won’t trickle down to enough wages to offset the eventual higher taxes at the bottom:

There is no evidence in recent American economic history, no evidence from international comparisons and no evidence from individual U.S. states that corporate tax cuts will boost the wages of American workers. This is a case we’ve been making for a while [Hunter Blair, Economic Policy Institute, “CEOs Agree: Corporate Tax Cuts Won’t Trickle Down,” The Hill, 2017.12.03].

Thune misstates both his source and the facts. His tax plan does not cut average taxes for middle-income South Dakotans by over $2,500. His plan banks on voodoo economics that have been disproven time and time again not to undo the damage done by tax cuts for the rich.

Marlboro Barbie done parked his horse

Got off the old nag to engage in discourse

The object was given to fool all the people

But Barbie forgets CAH ain’t a sheeple.

Yeah verily when information got passed

As per intention the people were gassed

One stood alone and challenged the beast

For sure South Dakotans will receive the least

Truth, justice and honest intentions have died

Across this great nation, wingnuts have lied

But Master won’t allow these buzzards a pass

For shoveling dinero up koch bros derrieres.

Vote 4 Democrats and be proud of your country once again.

White House adviser Ivanka Trump said on Monday that Republicans were going to pass tax reform so that every family would have the opportunity to have a Mandarin Chinese language tutor like her children have.

During an interview with the president’s daughter, the hosts of Fox & Friends noted that Ivanka Trump’s daughter had learned a Mandarin song so that she could sing it to the Chinese president.

If MB had just mentioned this, I think most of the people would have been totally cool with this bill. Somebody ^%$% me, please.

Of course Thune doesn’t read the analyses. All he ever reads is the talking point memo, spouts word salad and takes his place behind McConnell for the photo op!

I think you need a degree in Voodoo Economics to support this tax bill honestly. There is the idea referenced by OldSarg and commonly spouted that this bill will grow the economy by an extra .4% per year.

If you run the big picture numbers, a $20 trillion economy in the US that grows .4% faster per year means $80 billion in additional GDP. $80 billion times an effective tax rate of 25% means $20 billion in additional income tax revenue. How long does it take to recoup the $1.4 trillion cost of the Republican tax bill if you raise an additional $20 billion per year in tax revenue because of increased economic growth? 70 years!

Thus, by the year 2087, we will break even on the Republican tax bill. But wait a minute, the $1.4 trillion tax cut is over ten years. So, by 70 years in the future, the cost of this tax cut bill for the rich will be 7 times $1.4 trillion or nearly $10 trillion. Let the good times roll!!!!!!!

https://www.nytimes.com/2017/12/04/us/politics/republicans-joint-committee-on-taxation-estimate.html?action=click&contentCollection=U.S.&module=Trending&version=Full®ion=Marginalia&pgtype=article

Wingnuts were supposed to provide their own analysis of the deficits to come and so far have not bothered. But they did attack this one outfit they have had unusual praise for over the years.More lies and obfuscation from the party that excels at such.

As 3rd in line, Thune lied his arse off. Honesty used to be kind of a big deal for him, but no more. What is even more galling is the fact that he does not need outside money to run a campaign as his war chest is overflowing to beat back even the rightest of right opponents to him. The only way to explain Thune would be to call him exactly what he is, as Un-American as Benedict Arnold. A Russian adjustable wrench of a tool for their cause.

The man in the empty suit is a coward like slick Mike and subsidy queen Noem they won’t face their constituents.They are cowards, if your not going to talk to the people .Are you there for the sweet fat pensions for only working six years for the rest of your life at age 62what a farce these three have been.Plus the photo op Thune.

This week, Sen. Orrin Hatch (R-UT) helped push a tax bill through the Senate that will cost about $1 trillion. At the same time, he lamented the difficulties of finding the money to fund the Children’s Health Insurance Program (CHIP), which pays for health care for 9 million children and costs about $14 billion a year — a program Hatch helped create.

mfi, Hatch has a point here. Are those children job creators or innovators? Thought not. All most of these kids do is take and take from our healthcare system trying to keep themselves alive. If they would get a part-time job while they are in preschool working after nap time until just before bed time they wouldn’t need to be on the government dole and they could afford their own insurance. Hatch really resents it when fellow Senators accuse him and the Republican party of being only for the rich. They are also for children that don’t need any form of government assistance.

Thune a coward who won”t face the people he represents ,hiding behind Mitch doesn’t do it like slick Mike and the subsidy queen Noem.

Hatch can resent it and be damned. He is a liar and he knows he is a liar. He has a nice retirement package awaiting him compliments of him and other scum just like him.

The 99% are paying for it.

McConnell has rushed the tax bill for the same reason he rushed the Senate’s ACA repeal: he doesn’t want his caucus to have to face angry town halls during recess of constituents who’ve read the bill and realize how awful it is.

What Thune has also hid from people besides the eventual tax hikes are the cuts that the GOP wants to make to Medicaid, Medicare and SS. Just as people predicted, Paul Ryan is now talking about the debt and deficits being a problem again. Tax cuts for the rich which blow up the deficit were not a problem a minute ago. Now, as soon as the tax cuts are passed they are going to work on cuts to Medicaid, Medicare and SS.

Now remember, Trump promised during the campaign that there would be no cuts to Medicaid, Medicare and SS. Any bets on whether he keeps his promise?