South Dakota Codified Law Chapter 11-11 authorizes the South Dakota Housing Development Authority to make up for the failure of the free market to provide sufficient affordable housing and daycare facilities.

Apparently SDHDA wants to make it really clear that no other office meddles in public housing. House Bill 1015 would add this sentence to the SDHDA’s authorizing statute:

The authority shall be the sole, statewide designated state public housing agency authorized to administer housing programs on a statewide basis throughout the state.

If this were an English paper, I’d mark this sentence not just redundant but threedundant. “Sole, statewide authority”, “on a statewide basis”, and “throughout the state” all say the same thing.

But since this is a law paper, I’m sure there’s some good technical reason to put belt and suspenders on Grandpa’s coveralls.

The SDHDA does good work supporting Habitat for Humanity, helping renters and first-time homebuyers, running the Governor’s House program (over 2,000 sold!), and rehabbing old homes, all without spending tax dollars (SDHDA’s main webpage says the organization “is a self-supporting, nonprofit entity that uses no State tax dollars to fund its operating budget.SDHDA utilizes housing bonds, tax credits, and other federal and state resources to fund housing programs….” Their work is certainly better than leaving people out in the cold.

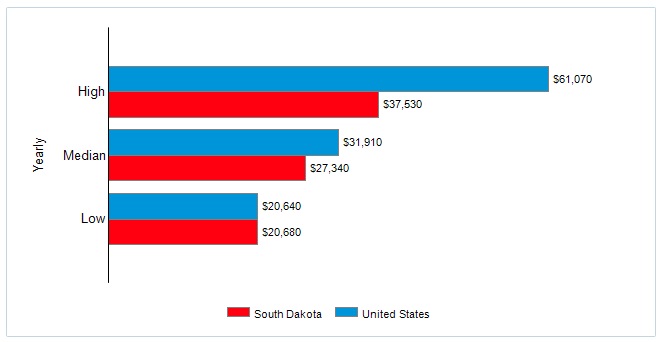

But as I cruise around my neighborhood looking at older houses that could sue some love, it occurs to me that no supply-side effort will do as much to make quality, affordable housing as a solid demand-side effort—i.e., raising South Dakota’s wages so that more people can afford to build new houses and fix up the houses they are in. Consider how much the guys building houses make. The U.S. Department of Labor provides the following salary data for construction workers:

Our construction workers start out on par with the national average for entry-level construction laborer pay but fall behind as they work up the pay ladder. Our guys in the middle are 14% behind the national median. Our hardhats hit a ceiling that the top construction laborers bust right through elsewhere: South Dakota’s high-end construction salary is only 61% of what the best construction workers can earn nationwide.

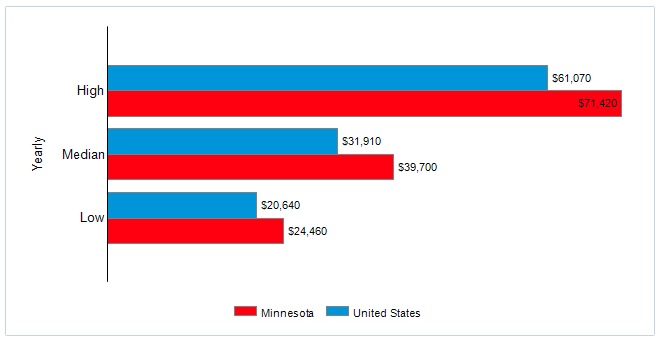

Getting specific, construction workers in Minnesota make out much better:

Minnesota’s builders make 18% more at the low end, 45% more in the middle, and 90% more at the top than their counterparts in South Dakota.

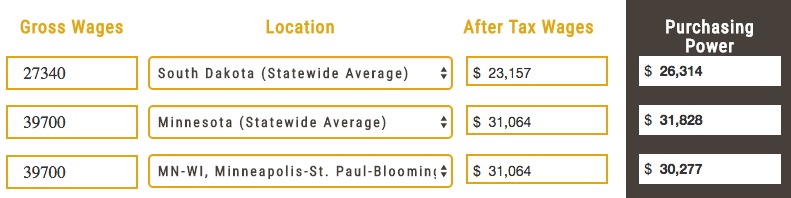

Oh, but everything costs more in Minnesota, right? Let’s go to the Governor’s own “Real Wage Calculator” to see what median construction worker wages look like after taxes and in purchasing power in South Dakota and Minnesota:

After taxes, the median-wage Minnesota construction worker still has 34% more money left in his pocket than the median-wage South Dakota construction worker. Factor in cost of living, and the Minnesota builder can buy 20% more stuff than the South Dakota builder. Even the poor grunt hammering away in the extravagant and expensive Twin Cities would still get 15% more purchasing power from Minnesota’s median construction wage than his South Dakota counterpart. That’s thousands of dollars more that a Minnesota worker can spend on new shingles, windows, and paint, put toward a down payment, or throw into the salary calculation to escape a costly mortgage insurance requirement and keep more money in his pocket for maintaining his new house.

The South Dakota Housing Development Authority does good work. But they wouldn’t have to work as hard if South Dakota didn’t short everyone else who’s working hard.

Purchasing power is vital to “cost of living”. Belgium workers pay 56% of their paychecks to taxes which funds nearly all the great social programs Belgium has. USA workers pay around 25% which funds our mediocre social programs (all of their pensions, all of their health care, and generous unemployment insurance). BUT, Belgium workers have more money left at the end of the month than USA workers. More “purchasing power”. Why? Because buying things we all use as a group is cheaper. If you’ve ever shopped at a Sam’s Club or a Co-Op you’ve experienced it. This is democratic socialism and it gives Europeans a better life. USA workers need a better life, now.

http://www.pbs.org/newshour/updates/calculator-compare-taxes-might-pay-u-s-developed-nations/

ooops … cut and paste error. he he (all of their pensions, all of their health care, and generous unemployment insurance) are benefits received by Belgian workers. USA taxes don’t support our healthcare and our u/e insurance sucks as does our Social Security pension.