Mark Vargo made a mistake yesterday. The Attorney General read the initiatives proposed by Dakotans for Health to repeal South Dakota’s state sales tax on food and concluded in his ballot question statements that the initiatives would also prohibit municipalities from taxing food.

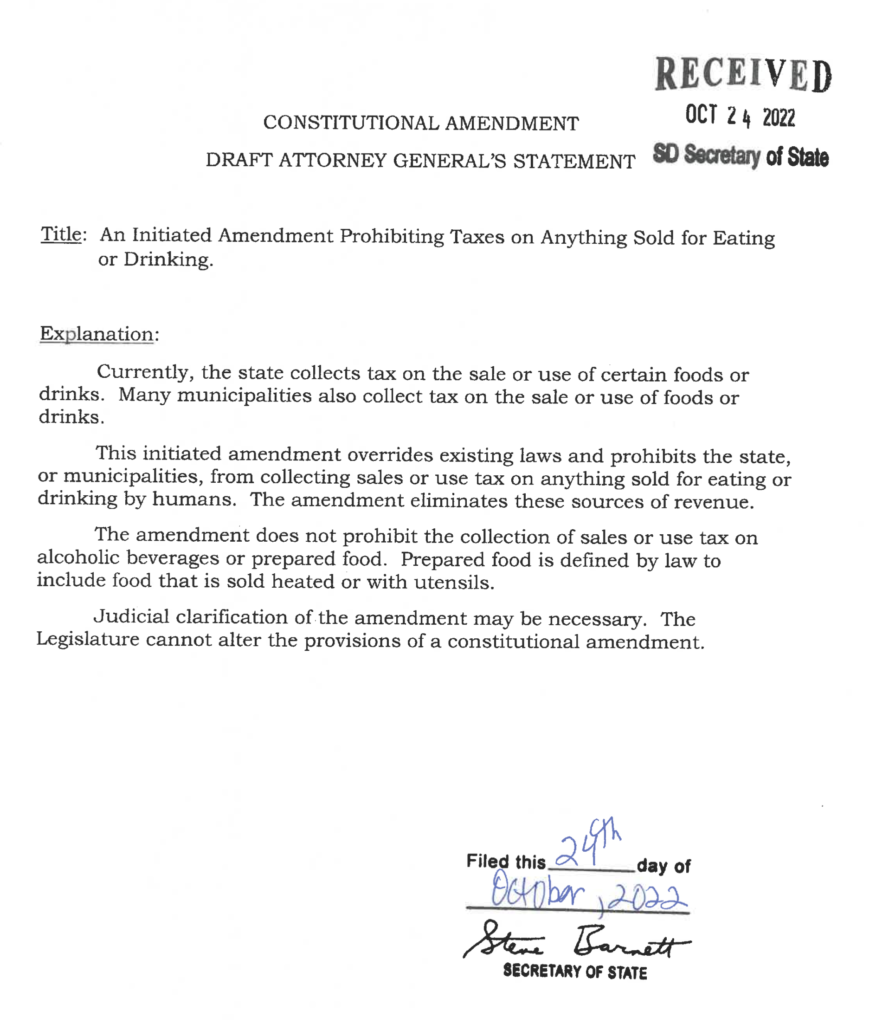

Here are the draft statements A.G. Vargo made public yesterday, first for the constitutional amendment:

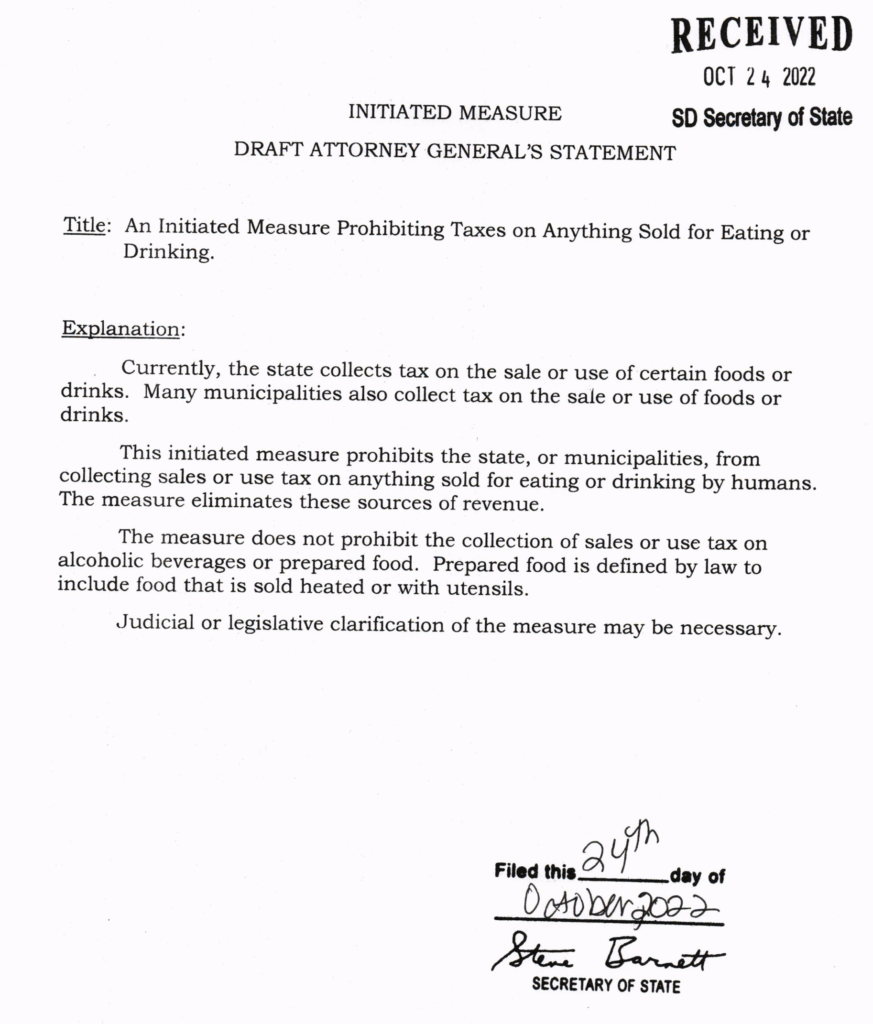

…and second for the initiated measure:

The erroneous line in each statement is Vargo’s second paragraph, which says each initiative “prohibits the state, or municipalities, from collecting sales or use tax on anything sold for eating or drinking by humans.” Vargo misreads both proposals, which include this key line: “the state may not tax the sale of anything sold for eating or drinking by humans, except alcoholic beverages and prepared food.” The state—not “the state and its political subdivisions”—just “the state”.

When legislators want a law to apply to the state and municipalities, they say so:

- SDCL 1-25-1 requires “the state and its political subdivisions” make all meetings open to the public.

- SDCL 1-27-1.1 applies South Dakota’s flimsy open-records laws to “this state, any county, municipality, political subdivision, or tax-supported district in this state, or any agency, branch, department, board, bureau, commission, council, subunit, or committee of any of the foregoing.”

- SDCL 12-27-20 prohibits political campaign expenditures by “The state, an agency of the state, and the governing body of any county, municipality, or other political subdivision of the state”.

The food tax initiatives refer exclusively to “the state”; they thus would not prohibit municipalities from taxing food.

The Legislative Research Council recognized this fact in its fiscal notes issued last week:

Beginning July 1, 2025, the State could see a reduction in sales tax revenues of $119.1 million annually from no longer taxing the sale of anything sold for eating for drinking by humans, except alcoholic beverages and prepared food. Municipalities could continue to tax anything sold for eating or drinking [Reed Holwegner, director, Legislative Research Council, fiscal note for proposed initiated measure to exempt food from state sales tax, submitted to Secretary of State Steve Barnett 2022.10.19].

Yet Vargo imagines the words “and its political subdivisions” into the initiatives and says no government in South Dakota could tax food. He even rights this over-inclusive error into his title for each measure, stating that the amendment and the initiated measure are “Prohibiting Taxes on Anything Sold for Eating or Drinking”. These initiatives do not prohibit all taxes on food and drink; they only prohibit state taxes on food and drink.

Vargo’s error would create confusion and make it harder to win signatures and support for either measure. Initiative petition circulators must hand out printed sheets with the Attorney General’s statement to every person who signs the petition. The statement would appear on the ballot in 2024. Signers and votes alike might be less inclined to support of food tax repeal that cuts revenue for their local city governments as well as from state government. The Dakotans for Health initiatives, like most Democratic proposals to repeal the food tax and like Governor Kristi Noem’s own flip-flop campaign promise, would not touch municipal taxing authority.

Attorney General Vargo has a chance to fix this error, and the public gets to help. The Attorney General is taking public comment on his explanations of the food tax repeal through November 3; he must then consider that comment in drafting the final version of his explanations by November 14. Members of the public, feel free to copy and paste my explanation here and send it to Attorney General Vargo by e-mail (atgballotcomments@state.sd.us), regular mail (Office of

Pierre, SD 57501), or in person in Pierre.

Well done, Cory. Well done, indeed.

Vargo is a stooge, Cory. I’ve been trying to tell you this.

Done and done.

Neal, I’m not convinced Vargo’s error here proves any stoogery. On face, all we have is a plain misreading of the law which shouldn’t convince anyone. It is remarkable that he would make such a counterfactual claim when the lRC has publicly stated the exact opposite.