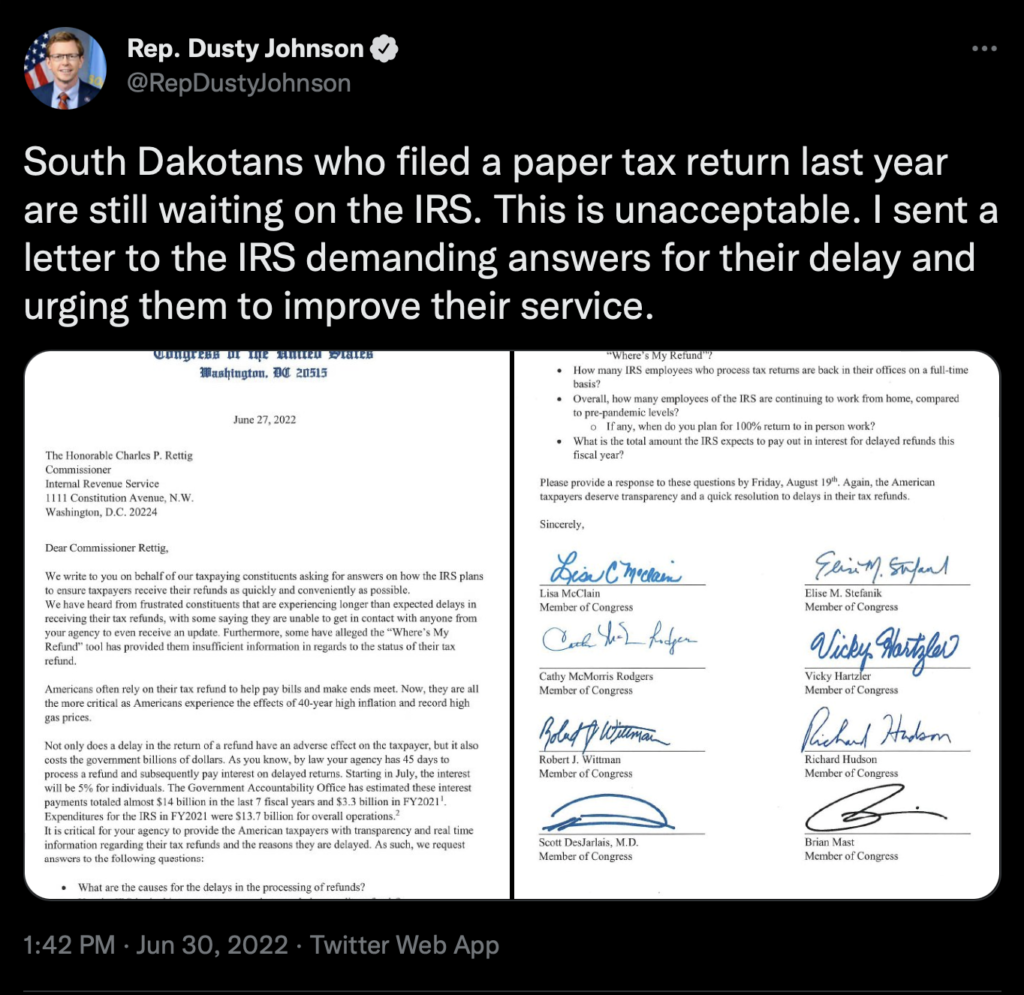

South Dakota’s lone Congressman, Dusty Johnson, is complaining that the Internal Revenue Service isn’t getting its work done:

Dusty, you don’t need to write a letter; just look in the mirror at your own votes and your Republican Party’s efforts to deny the IRS the resources it needs to process refunds, collect taxes, catch tax cheats, and help taxpayers:

Johnson’s staff issued a statement from Washington, D.C., late on Thursday, Nov. 18, to say he’d oppose President Biden’s social spending bill, a $1.75 trillion piece of legislation that could also add $367 billion to the federal deficit over a decade , according to a congressional budget review.

“This massive spending package undermines work, further strains Medicare, and according to the CBO, isn’t paid for,” Republican Johnson said in a statement. “I will be voting no.”

…Furthermore, Johnson pointed out the bill would also spend $80 billion for IRS enforcement and expand subsidies for the Affordable Care Act and Medicare, which he says are already at risk of “insolvency” [“South Dakota’s Dusty Johnson Votes ‘No’ to Build Back Better Legislation,” Mitchell Republic, 2021.11.19].

…and…

Under pressure from well-heeled conservative advocacy organizations and donors, Republican senators have removed funding for IRS enforcement from an emerging bipartisan infrastructure plan, threatening to tank a proposed crackdown on rich tax cheats.

…The scrapped provision would have increased the IRS budget—a frequent target of GOP cuts in recent years—by $40 billion over the next decade to help the agency combat tax dodging, which is depriving the federal government of trillions of dollars in revenue. An analysis released earlier this year by academics and IRS researchers estimated that 36% of unpaid federal income taxes are owed by the top 1%.

Due to persistent funding shortages and inadequate staffing, the IRS now audits poor Americans at roughly the same rate as the wealthy, who often use complex strategies to avoid paying taxes. Big businesses are also taking advantage of the depleted IRS; the agency now audits just half of all large company tax returns, allowing corporations to claim unwarranted tax breaks [Jake Johnson, “Republicans Renege on Deal with Democrats, Strip Funding for IRS in Gift to Rich Tax Cheats,” Salon, 2021.07.19].

…and since before Dusty’s time in Washington…

The IRS has been targeted for sharp funding cuts since 2010. Its current budget of $11.2 billion is 18 percent below the 2010 level, after adjusting for inflation.[5] As most IRS funding goes to staffing, the cuts have forced the IRS to dramatically reduce its workforce; the agency lost roughly 13,000 employees — around 14 percent of its workforce — between 2010 and 2016.[6]

These damaging cuts have weakened the agency’s ability to perform its core functions of collecting taxes and enforcing the nation’s tax laws. As seven former IRS commissioners from both Republican and Democratic administrations have written: “Over the last fifty years, none of us has ever witnessed anything like what has happened to the IRS appropriations over the last five years and the impact these appropriations reductions are having on our tax system.”[7]

Cuts in staff and other resources have affected taxpayer services, cybersecurity, and enforcement.[8] Taxpayer services have remained at subpar levels across this period, despite an improvement in 2016 after Congress modestly boosted taxpayer services funding. Even with this improvement, only 53 percent of calls from taxpayers were answered in fiscal year 2016 (down from 74 percent in 2010) and callers waited almost 18 minutes on average for an answer (up from 11 minutes in 2010).[9] Funding cuts have also caused the IRS to delay much-needed upgrades to its information technology systems, compromising the security of taxpayer data and weakening its ability to identify and assist victims of identity theft. As IRS Commissioner John Koskinen stated, “We’re falling behind in upgrading hardware infrastructure and software. This compromises the stability and reliability of our information systems, and leaves us open to more system failures and potential security breaches”[10] [Brandon Debot, Emily Horton, and Chuck Marr, “Trump Budget Continues Multi-Year Assault on IRS Funding Despite Mnuchin’s Call for More Resources,” Center on Budget and Policy Priorities, 2017.03.16].

…and…

The IRS is in big trouble. It has a historic backlog of unprocessed tax returns and the thinnest workforce the agency has had in decades.

House Republicans have been hitting the IRS with a steady wave of funding cuts since at least 2011, in response to signals that then-President Barack Obama intended to increase the agency’s funding. Since then, the cuts haven’t stopped, and Democrats aren’t happy.

On Thursday, Ron Wyden, Democratic senator from Oregon who currently chairs the Senate Finance Committee, chided Republicans for the depleted state of the IRS, suggesting that the party is to blame for millions of unprocessed tax returns this year. It is unclear if Wyden was responding to any new measure from Republican lawmakers with regards to IRS funding.

“Republicans are the guy in the hot dog suit, swearing up and down that they are trying to find the guy who did this,” Wyden said during a Senate floor speech, referencing a comedy sketch from the Netflix show “I Think You Should Leave,” that has since become an internet meme.

In the sketch, a car shaped like a hot dog crashes into a store, and a man dressed as a hot dog does his best to distract a gathering crowd and deflect responsibility for the crash, before making a run for it when policemen try to apprehend him [Tristan Bove, “Republicans on IRS Funding Are ‘Like the Guy in the Hot Dog Suit,’ Top Democrat Says, Likening Their Complicity in Gutting the Agency to a Viral Netflix Comedy Sketch,” Fortune, 2022.05.20].

Dusty is mad that the IRS isn’t processing tax returns fast enough. But that’s what happens when you, Dusty, you and your Republican Party, defund the tax police.

Great take down. Thanks. Dusty’s playing both ends off the middle and getting away with it, well, because his voters are that willfully blind, under-informed, and some are plain stupid.

Thanks, John. It’s pretty easy to show Dusty’s hypocrisy here, which exposes the overall GOP tactic of fulfilling their own propaganda/prophecy: Starve government agencies of the funding (and, yesterday, SCOTUS to EPA) the authority to solve problems, then complain to voters that government can’t solve problems. It’s like they want civilization to crumble back to the state of nature.

Gee, Duster, this is what happens when you “deconstruct the administrative state.” Be ready for more surprises as government is uncoupled from every day life. Typical Republican, not thinking beyond today, never thinking of the consequences, the “then what?”

Never forget magats accused Obama of weaponizing the IRS against conservative non-profits when, in reality, it was one office in Philadelphia that was involved. Magats demanded deep cuts then.

Thanks again, DFP, for enlightening news report again that won’t receive much space in our SD ‘major’ press! I just sent the Rusty Dusty my thoughts re: his BS presser attempting to blame Biden for under funding the IRS. I doubt tho, that it will meet his eyes but be responded & powdered up by a staffer’s response only.

Our ability to contact him via email has changed again, in just months of last change. arrrgghhh

Dusty has but one challenging issue that he must face. Does he support the US Constitution or does he support the treason on Donald Trump.

Gee Cory, he sent them a letter…. however, I got my tax return almost immediately. They did fine by me. I’ve also heard that the mail don’t move to fast in Rapid City, South Dakota, so there you go. They are probably underfunded too. I know he was born in Pierre, but I don’t care. Now that doesn’t really rhyme either, out of staters.

According to himself he has good acumen, what else do you need to illumine South Dakotans.

Yeah, IRS is slow if you file by paper. I tend to file about a week before the deadline by paper, so my refund is always delayed about six months. I got last year’s direct deposited in March of this year. I couldn’t figure it out, so I called the bank and told them I hadn’t sent my tax return in yet. I asked the bank if I should call IRS and tell them they sent a deposit that I didn’t deserve. The bank said to check last years’ return to see if the refund matched what I submitted last year. They said they had been getting a lot of similar calls. Yup, it was last year’s refund.

Wondering if Dusting is worried about his constituents Minority Leader Kevin McCarthy of California and his ring leader 45 and their tax liabilities?

South Dakota has long loss the representation of this inept inbred Republican when he buried his head deep into exit part of 45’s bowl track.

Yet another distraction as the inept inbred Republicans were caught trying to overthrow the election bypassing the constraints of the U.S. Constitution, laws, regulations and good moral standing of the common person.

When the inept inbred Republicans are finally successful in tossing out the governance and remake the US into a director state, tribal nations should be able to declare the treaties voided and reclaim the many acres of legally stolen lands. And, ask for past rent. Hurry up republicans and put little Putin 45 back in charge of ruining the US; tribes are waiting.

Republicans and their minions made deep cuts to the IRS and the postal service. What, exactly, didn’t they see coming? 2 + 2 = 4. Does that need to be explained also?