If Kristi Noem really wants to make inflation a campaign issue, maybe she needs to tackle the root causes. President Joe Biden isn’t raising prices; corporations are raising prices. And while we should expect sensible businesses to raise prices to cover higher wages and remedies to supply chain challenges, corporations appear to be raising prices just to pad their profits.

BP’s price hikes have gone well beyond covering increased costs of doing business:

BP’s profits hit their highest in eight years in 2021, lifted by soaring gas and oil prices, as the company boosted share repurchases and accelerated plans to cut emissions with increased spending on low carbon energy.

…In the fourth quarter of 2021, BP’s underlying replacement cost profit, its definition of net earnings, reached $4.1 billion, beating analysts’ forecast of $3.93 billion.

That was BP’s largest quarterly profit since early 2013.

BP shares were up 0.3% at 1446 GMT, compared with a 0.1% decline in the broader European energy index (.SXEP).

For the year, BP’s $12.85 billion profit compared with a loss of $5.7 billion in 2020, when it wrote off $6.5 billion from the value of its oil and gas assets following a slump in energy demand [Ron Bousso, “Energy Prices Lift BP Profits to 8-Year High,” Reuters, 2022.02.08].

Cereal-maker Kellogg faced rising commodity prices and a big strike that it had to settle with better pay, but their profits are still up:

Cereal maker Kellogg Co (K.N) forecast full-year profit growth above market expectations on Thursday, riding on higher product prices that helped overcome labor strike disruptions and soaring input costs in the fourth quarter.

…Kellogg, however, expects adjusted full-year profit per share to grow by 1% to 2% on a currency-neutral basis thanks to increased prices for its breakfast cereals and snacks such as Pop-Tarts and Pringles. Analysts on average expected a 0.1% rise, according to Refintiv IBES data [Mehr Bedi, “Kellogg Annual Profit View Crunches Estimates on Price Hikes,” Reuters, 2022.02.10].

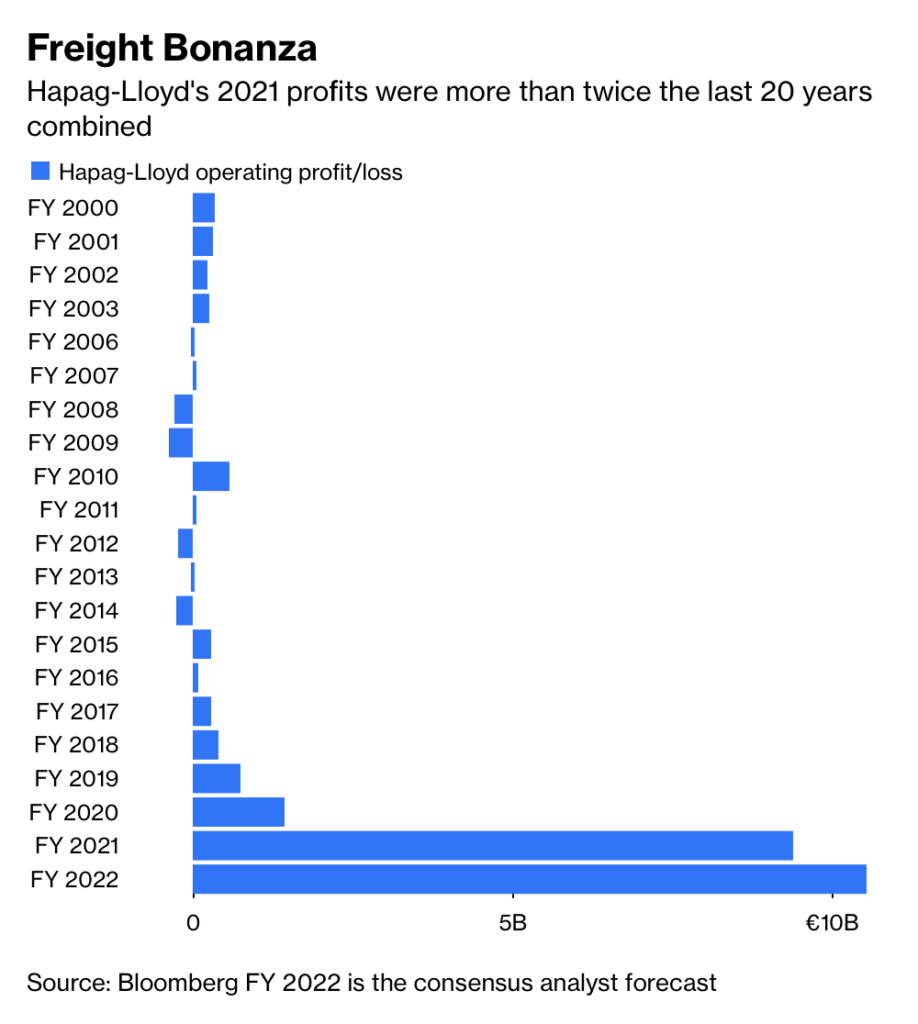

Container shippers, who have figured prominently in the shortage of global hauling capacity, have cranked up their prices to produce record-breaking profits. Bloomberg reports that Hapag-Lloyd’s 2021 profits were more than double their total profits over the last two decades:

Corporations and Republicans will tell you the higher prices you see are due to workers seeking to catch up on decades of wage stagnation, but price data belie that blame:

But while corporations may point fingers at rising pay, economic data show wages are far from the main driver of inflation. The prices growing fastest today — cars, fuel, housing and furniture — point away from wages and toward other explanations, such as goods shortages or companies padding their profit margins. More broadly, it has long been clear that the relationship between what workers earn and what consumers pay has been tenuous at best.

If higher worker pay was truly the main driver of prices, it follows that more labor-intensive service sectors of the economy would be seeing the largest jump in consumer prices. Yet the inflation picture today shows the exact opposite: Price increases for goods are outstripping services by a factor of three.

“Goods prices are the main driver of inflation,” Julia Pollak, labor economist at ZipRecruiter, told CBS MoneyWatch. “Wages so far have not been the main driver of inflation at all. Inflation was higher at first in less labor-intensive industries” [Irina Ivanova, “Rising Fuel Prices and Corporate Profits—Not Wages—Are Chiefly to Blame for Inflation,” CBS News, 2022.02.22].

Labor costs are mitigated by the savings of replacing experienced workers with fresh talent, so profit margins can keep growing:

Some corporate leaders have been blunt about their plans to pass companies’ higher supply-chain prices to consumers. For example, consumer goods giants Colgate-Palmolive, Procter & Gamble and Unilever have been able to raise prices without losing sales. Nearly two-thirds of publicly traded companies report fatter profit margins than before the pandemic, according to the Wall Street Journal.

Meanwhile, surveys from Salary.com and the Conference Board show that corporations are planning on pay increases of 3% to 3.9% in the coming year — barely half the current rate of inflation.

“Many companies we’ve spoken to have seen their overall payrolls barely budge at all,” ZipRecruiter’s Pollak said. Because of pandemic retirements, “They’ve lost their most experienced, highest paid people and replaced them with a younger cohort” [Ivanova, 2022.02.22].

Corporations are able to hike prices to boot profits in part because of a problem Kristi Noem mentioned last year in one of her many disjointed headline-grabs but hasn’t really followed up on: corporate concentration. We have to turn to Senator Elizabeth Warren to make the connection between unchecked corporate monopoly power and profit-driven inflation:

Senator Warren: Well, but, let me ask it the other way, then. Because we’re still kind of doing Econ 101 here. If you’re a corporation that has eaten up most of the competition and cornered the market, is it easier for you to raise prices on your customers and maximize your profits because you don’t have to worry about losing your business? In other words, that’s– you’ve lost the discipline that the market imposes.

Chair Powell: In principle, if you don’t have competition and you’re a monopolist, yes, you can raise your prices.

Senator Warren: Okay. And over the past year, we know that prices have risen because of supply chain problems, unexpected shifts in the demand for goods, and even higher labor costs.

But if corporations were simply passing along these costs in highly competitive markets, would the companies’ profits margins have changed much?

Chair Powell: So many things affect– affect those– that calculation. But– in principle, you could be right, but.

Senator Warren: Well, it’s very much not what we’re seeing right now. Today, nearly two out of three of the biggest publicly traded corporations in the country are reporting fatter profit margins than they reported before the pandemic which doesn’t sound like they’re just passing along costs. So let me ask you: does that increase in profit margins, combined with greater market concentration in industry after industry, suggest to you that some corporations may be passing along increased costs and, at the same time, charging more on top of that to fatten their profit margins?

Chair Powell: That, that could be right. It could also just be, though, that demand is incredibly strong and that, you know, they’re, they’re raising prices because they can.

Senator Warren: Well, that’s the point. They’re raising prices because they can, and they’re not being competed down. You know, market concentration has allowed giant corporations to hide behind claims of increased costs to fatten their profit margins. So the consumer pays more both because the corporation faces higher costs and because, as you put it, because the corporation can increase prices.

The reason I raise this is that higher prices have many causes, and we can’t overlook the role that concentrated corporate power has played in creating the conditions for price gouging [Senator Elizabeth Warren, questioning Federal Reserve Chairman Jerome Powell, nomination hearing before U.S. Senate Banking, Housing, and Urban Affairs Committee, transcribed on and retrieved from Senator Warren’s website, 2022.01.11].

You want root causes of inflation? Republicans promote the corporate tax breaks that help concentrate wealth and power and resist the regulation that would check that power. That unchecked concentration of wealth and power thus allows corporations to resist competition and charge you more for everything, with price hikes well beyond their actual costs of making and shipping everything. This inflation is thus brought to you by Republicans, whom you have a chance to root out this fall.

Inflation is a Republican problem. Trump just called Putin a genius, he called himself one too.

Although Democrats have gone into nearly full appeasement of corporate profiteering, corporations would rather have a Republican in office cutting their taxes and protecting their corporate interests. It doesn’t take much connecting. of the dots to see how a discussion that revolves around the strength of the stock market being the only measure of the health of the economy now finally focuses on a more consumer measure: inflation. That measure (and the pain associated with it) is being used as a political pressure point against Biden and the Democrats. Worst of all, it only “costs” the corporations higher profits to apply this economic now political pressure.

Yet another example of how income inequality HAS destroyed this nation.

How we consumers can best ride out inflation by making lifestyle “changes” (I know “change” is a swear word in SD but not all here are from SD.)

1. Cut back on restaurant meals and take-out.

2. Don’t upgrade to new phones, laptops, and devices

3. Put yourself on a food budget.

4. Buy less clothing.

5. Put off home renovations.

6. Cancel or delay plans to travel

7. Drive less frequently

8. Get a side job.

Businesses are trying to bend us over, just because they can.

Not spending is our only real way to fight back.

Conservatives have been inbred to the point of a DNA change that makes them do whatever they can to throw sand in the gears of economic success for all. Make no mistake, racism plays a big part in all of this.

“Prior to the election of FDR, liberalism was associated with laissez-faire economics and limited government in the US. What Roosevelt offered in contrast was a “New Deal” liberalism that promoted economic liberalism with social democratic safeguards in response to the Great Depression. For Roosevelt, “the new deal for the American people” meant there was a “duty and responsibility of government toward economic life”.

I liked all of it Porter, but since I just finished tiling my third room and two closets, renovated 3 and a half bathrooms, still waiting to do the kitchen although I did tear everything out and raised the ceiling a foot. Since IKEA is covid central that will have to wait. Tore out the old kitchen tile ready for the new. That was a beach. Its been cheap, materials are nothing, the Spanish porcelain canyon tile is great. Have the new stove, refrigerator, dishwasher and microwave all ready. All this by not eating out but a few times in two years. I guess it’s my side job. Did go to Brooklyn for a week to see the kids. Retirement is hard work. Saving money is easy. Youtube your future.

By the way, I’ve got my 200 black t shirts and 50 jeans all stacked, no clothes for me. It’s a great lifestyle list.

Beating Inflation the European Way:

Save Don’t Spend …

Make the greedy bossturds beg you for your money and give you discounts.

They’ll compete with each other only when business is slow.

Corporate greed is the main cause of inflation.

Yet, Uncle Joe hasn’t helped there or elsewhere.

1. He’s taken few if no actions reducing the supply shocks. Could’ve considered computerizing west coast ports using the model from Rotterdam. Could’ve temporarily nationalized a few ports – the Army runs ports like crazy efficient for war. Could’ve established a rail & road Red Ball Express moving goods inland. Uncle Joe is too captive of his unions – the west coast dock workers contract (Mexico to Alaska) expires in a couple months. Watch the supplies hit the fan and many companies ‘miss’ Christmas sales if Uncle Joe doesn’t hardball his unions.

2. Uncle Joe did almost nothing rolling back inflationary trump tariffs. EU steel is less than 30% US steel. Soft lumber, and many other supplies are over priced due to tariffs.

3. It was foreseeable, predictable that boomers would retire in droves when COVID hit the elderly harder. Uncle Joe failed opening immigration to reduce wage inflation (immigrants work for less).

4. In many communities 30% or more of the sales of homes are to corporations, not individuals. Corporations lust for business model of “subscriptions”, aka rents; pricing out young families from home ownership and the American dream. “Last year, investors bought nearly one in seven homes sold in America’s top metropolitan areas, the most in at least two decades,” https://www.washingtonpost.com/business/interactive/2022/housing-market-investors/

On the other hand, Uncle Joe increased drilling to a higher level than trump had. Though, much of the cost of gas is profit gouging, not all time high demand. The profit gouging is demand destruction which increases the transition to EVs.

Inflation will increase before the deflation of innovation kicks in – big time. “The Price of Tommorow: Why Deflation is the Key to an Abundant Future” https://www.amazon.com/Price-Tomorrow-Deflation-Abundant-Future/dp/1999257421/ref=tmm_hrd_swatch_0?_encoding=UTF8&qid=&sr=

Porter’s suggestion to spend less is well taken. Again, it shows US business focuses ONLT on the short term profit. Biden (and Trump) cut stimulus checks to consumers to try to ensure money could still flow in the economy during COVID, to help businesses weather the COVID storm. Leave ti to those very businesses to parlay short-term profit into long term losses by pricing those same consumers out of their markets in the quest for record profits.

I suppose there is no downside, if the businesses push themselves to failure, then there will be some government bail out to save them from their own greed-inspired bad decisions.

In my youth, while others focused on enriching themselves simply by earning more money, I aimed at living well by minimizing spending more than making more money, so I appreciate Porter’s comment. At the same time, now I’m a belligerent adult struggling to find any satisfaction with where the world has headed for decades (not to mention daily developments), so I blow my poverty level income on things I don’t need and maybe can’t afford all the time, against my long-informed understanding of how stupid is my behavior.

That brings to mind something I’ve thought for at least 20 years: accessible health insurance, retirement, and social security will likely disappear by the time I’m old enough for any of them to matter. It also brings to mind another thought: I have no idea if my community can withstand people like me not spending money every day at whatever restaurant, bar, shop, whatever.

So I’ll keep wasting my money to have fun and spread the (minuscule) wealth, and endlessly advocate for a post-money humanity, though I’ll also keep intending a return to my former wiser practices. Eff capitalism, the greedy bastards who started it, and the greedy bastards who ensure it doesn’t go away. If you ask me, despite all its accomplishments in gleaning understanding, humanity remains but a child. Chief among the children be the GOP and its corporate overlords, though I have only empathy for the GOP’s base that it exploits. [/rant]

Shipping company’s have made billions on this pandemic. Look to that industry as the root cause of inflation along with big pharma and the other players of stolen wealth.

Inflation is a hoax.

“A massive cargo ship holding thousands of luxury cars, including 1,000 Porsches, was left floating across the Atlantic Ocean after it caught fire near the Terceira Island in the Azores, the Portuguese island territory.

The ship departed from Emden, Germany, on Feb. 10 and was scheduled to arrive in Davisville, Rhode Island, on Wednesday before a fire broke out. The 22 crew members on board were safely lifted out of the burning ship via a helicopter, as seen in a video.

Authorities did not specify the exact amount of cargo left on the 650-foot, 60,000-ton ship. However, automotive website The Drive reported that the cargo ship is also carrying 4,000 vehicles from the Volkswagen Group, including 189 Bentleys and an unknown number of Audis.” USA Today 2.18.22

I’ll believe in inflation when Bentley’s are as common as Civics.