The Legislative Research Council this week issued the best monthly state revenue report I’ve ever read. I superlativize not because the numbers are particularly good—South Dakota’s sales tax revenues, received in May from April sales, were down $6.64 million, 7.6%, from the Legislature’s revised budget target—but because in addition to the usual tables and charts, LRC wrote three more pages explaining the specific impact of the coronavirus pandemic on the South Dakota economy. By LRC’s explanation, while the sensible and widespread precautions we took in April to flatten the pandemic curve hammered some business sectors, our social-distancing medicine hasn’t been all that bad for the overall economy or state revenues.

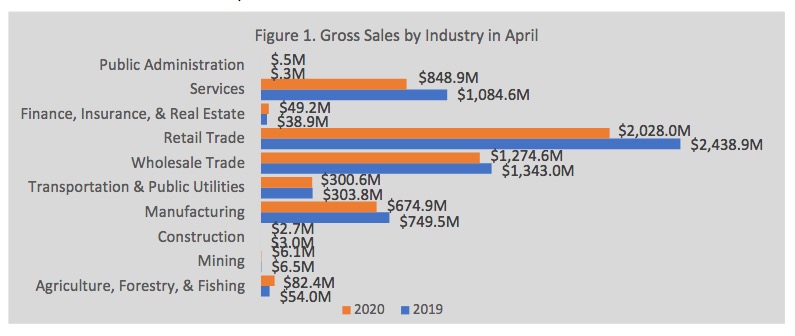

In April 2020, we bought 12.5% less stuff than we did in April 2019. That’s $5.27 billion in gross sales versus $6.02 billion, a drop of $755 million. The three biggest chunks of gross sales all saw noteworthy declines: retail 16.8%, wholesale 5.1%, and services 21.7%. However, two of our smaller industrial sectors saw remarkable growth over the previous April: the financial/insurance/real estate sector made 26.% more sales in April versus last April, while our farmers (and maybe our foresters and fishers) really went to work and produces 52.6% more sales activity (either April’s weather was more more favorable to farm work than it was last year… or a month when you couldn’t go to town and sit around gossiping with the fellas at The Rustic Spoon meant farmers hung around the farm and got more work done).

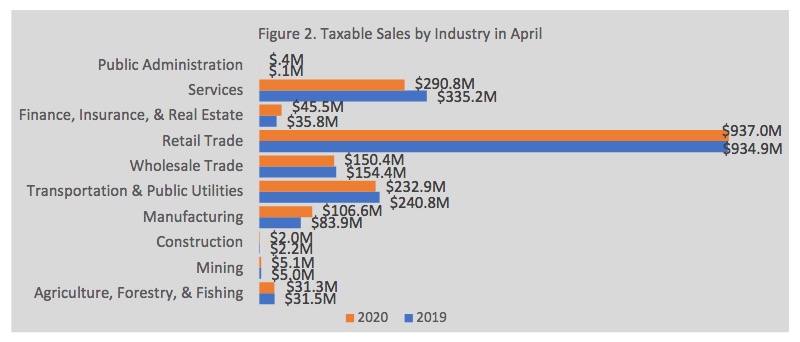

South Dakota taxes only about a third of those sales. (In April 2019, 30.3% of the stuff we bought was taxable; in April 2020, 34.2% of our purchases were taxable.) In that third of our economic activity, our total shopping (and thus the revenue the state could collect) dropped only 1.2% from the previous April. Taxable retail sales actually ticked up 0.2% in April 2020, while taxable wholesale dropped just 2.6%. Taxable services still dropped 13.2%. The taxable portion of finance/insurance/real estate increased 27.1%, but the taxable portion of farm/forest/fish action decreased a meager 0.6%.

Now if you looked just at the taxable retail sales line, you wouldn’t have any idea there was a pandemic. A slack increase of 0.2% suggests maybe an Easter weekend snowstorm keeping people shopping and traveling as much as we’d hoped, but not a month-long disruption of normal commercial and social activity.

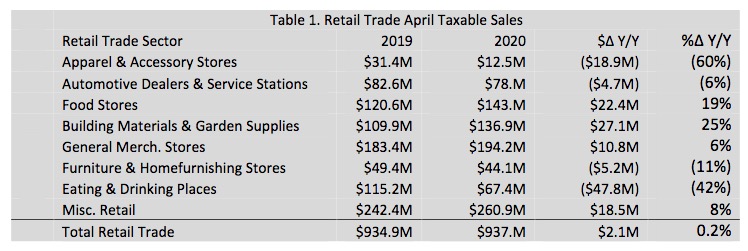

But a look at the shifts within taxable retail shows the real and varied impact of lots of South Dakotans staying away from each other for a month. We spent $47.8 million less at bars and restaurants this April versus last, but we spent $22.4 million more at grocery stores. We spent $18.9 million less on clothing, shoes, and accessories, but we spent $27.1 million more on building materials and garden supplies (the Heidelberger household caught up with that trend in May!).

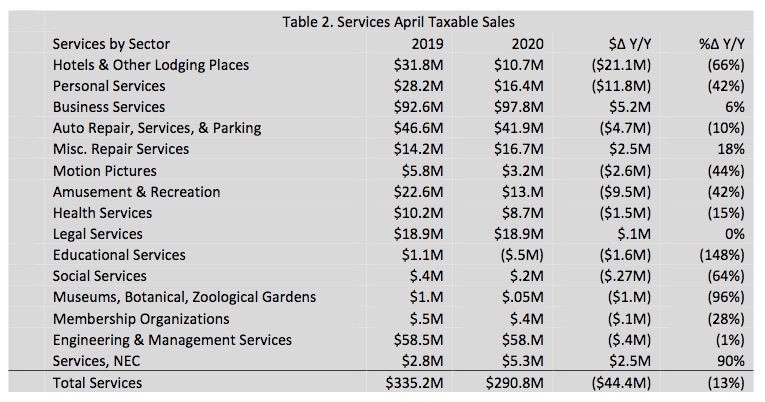

The services industry offered fewer comparable safe harbors. Most of the folks who make a living by trading sweat instead of stuff took a pandemic hit. The two largest subsectors held up o.k.: sales of business services increased 6% while engineering and management services slid just 1%. I’ll speculate that much of that resilience lay in folks calling for help setting up Zoom or seeking consultation with other pandemic adjustments of their operations. But auto repair, service, and parking dropped 10%, hotels and lodging lost 66% of their business, personal services dropped 42%, and amusement and recreation dropped 42%. Among sectors doing less than $20 million in monthly business, legal services held steady in sales, while repair services shot up 18% (perhaps because while we were all sitting around at home, we noticed more stuff that needed fixing).

And in perhaps the greatest pandemic economic oddity, taxable sales of health services dropped 15%, from $10.2 million in April 2019 to $8.7 million in April 2020.

LRC offers this conclusion to this fascinatingly detailed economic report:

Gross sales showed an overall decline in business activity for the month of April with the retail trade and service industries weighing heavily on business activity in the state. However, on a taxable basis, t he month of April provided for a strong retail trade industry with declines offset by increases in other areas of retail trade. The losses in the services industry dragged overall taxable sales down resulting in a slight decline in sales tax revenues for the general fund in April. While the overall decline in sales hurts the South Dakota economy, the taxable sales strength shows promise going forward as the COVID-19 pandemic continues [Legislative Research Council, “Supplemental Information on Sales Tax Revenues in South Dakota,” addendum to May 2020 General Fund Receipts report, 2020.06.04].

There are arguments to be had about whether the “cure”—the so-far successful (but far from over) effort to prevent coronavirus from overwhelming our hospitals and killing millions—is worse than the disease. But LRC’s economic data show that while South Dakota has experienced an economic downturn, much of that downturn stems from consumers shifting their purchases from things they want to things they need.

Related Savings Statistic: According to the Federal Reserve of St. Louis, the personal saving rate, the money we keep in our mattresses or mutual funds, jumped from a Trump-era baseline in the 6%–8% range to a historic high in April of 33.0%. The highest previous peak was in May 1975, when we socked away 17.3%.

I wonder if a lesson learned from this pandemic will be: don’t spend; save. Will this be a Great Depression lesson that is brought into the public conscience?

I also saw that Jim Cramer is calling this pandemic lead to one of the greatest wealth transfers in history — not a wealth decline, but a transfer.

Strib business columnist Lee Schaefer doesn’t want people saving too much. He says we must spend our way out of this recession.

I can attest to the liquor sales !!

o has it nailed. Those who can save are going lean more that way. Those who can’t save are going to be more prudent about needs versus wants. Those are economically prudent responses to the pandemic and the chaos of the Trump regime. Increasing personal savings and prudent purchasing ought to be a priority. Those are also guarantors of a recession.

If you want to avoid a recession, we need a massive wealth transfer from the rich to the poor and middle class. Only the poor and middle class will spend in the economy if the pump is primed. We need a wealth tax and an increase in the top tax rates in the income tax. We need an adjustment in where we spend that money. We need socialized medical care. We need massive spending on infrastructure improvements. We need a $15 minimum wage. We need huge increases in education funding. We need to restructure the agricultural sector in so many ways.

Donald, we know none of those things will happen as long as we leave inpower people like Trump and Noem who think they can just wish away bad news and hard realities.

But I wonder just how much change we all will be able to make just by the force of our own significant changes in spending habits. I also wonder how long it will be before those persistent changes in consumer spending lead Noem and Trump to start exhorting us to go shopping and buy more stuff we don’t need, just to shore up the old economy.

How many restaurants does a town really need? Will Chinese buffets and Pizza Ranch go extinct? (Aberdeen Pizza Ranch is advertising a sit-down buffet; instead of self-serve, you apparently tell waiters what you want, and they bring back your heaping plates. Don’t forget to tip!)

At the same time, how many more grocery stores will open to meet consumers’ rediscovered demand for fresh food they can prepare and eat at home?

Friends, I think we better start making plans to make our own dishes at home with fresh food from the grocery stores and even new ones in food deserts. We are today at over 16% unemployment, more than during the Great Recession and the Great Depression. When the Payroll Protection Plan runs out of money in July, expect another 20 million unemployed people. Republicans better get on the stick and pass an extension or else a stick will be their petard.

“When the U.S. government’s official jobs report for May came out on Friday, it included a note at the bottom saying there had been a major “error” indicating that the unemployment rate likely should be higher than the widely reported 13.3 percent rate.

The special note said that if this “misclassification error” had not occurred, the “overall unemployment rate would have been about 3 percentage points higher than reported,” meaning the unemployment rate would be about 16.3 percent for May. But that would still be an improvement from an unemployment rate of about 19.7 percent for April, applying the same standards.” Washington Post 6.7.2020