Last updated on 2019-01-19

The primary solution to South Dakota’s worker shortage is to pay higher wages. I’ve said it. Billie Sutton has said it. Minneapolis Fed President Neel Kashkari has said it.

Now Bart Pfankuch of South Dakota News Watch says it with Bureau of Labor Statistics data showing the endemic cheapskatery that makes it hard for South Dakota to recruit and retain workers:

- Roughly 21 percent of employed South Dakota residents, about 87,000 people, make under $30,000 a year; 41 percent of employed South Dakota residents, about 169,400 people, make under $35,000 a year, and 71 percent of employed South Dakota residents, about 292,000 people, make under $40,000 a year.

- Out of the 50 states and the District of Columbia, South Dakota is third lowest in average annual pay at $40,770, with the national average at $55,470. The state is also at or near the bottom nationally for average pay in several occupational sectors, including office and administrative support (51st), architecture/engineering (51st), education (50th), production workers (50th), life/physical/social sciences (50th), construction and extraction (50th), arts/design/sports/media (50th), computer and mathematical (49th), community and social services (48th), legal (47th), transportation and materials movement (45th), community and social services (47th) and business and financial operations (44th).

- While doctors, medical specialists, dentists and CEOs are among the highest paid, the support staffs that work for them are among the lowest paid [Bart Pfankuch, “Jobs Abound, But Low Wages Hamper South Dakota Workforce,” South Dakota News Watch, 2019.01.16].

Check out that skew: South Dakota’s average pay is $40,770, but more than 71% of workers make less than that. That skew means South Dakota’s wealthy boss class—whom we do not tax enough—think everything is fine and can’t figure out why the vast working class doesn’t want to fill all of their low-paying jobs. Income inequality doesn’t register with our cash– and lobbyist-insulated decision-makers, who talk incessantly about anything but raising wages as the way to recruit workers.

Well, we have at least one policymaker who recognizes the impact low wages have on our labor pool—economist and Senator Reynold Nesiba:

One consequence of low wages is that highly skilled and well-educated workers, including teachers and professionals, flee South Dakota for other states in order to make more money.

Nesiba said his two adult sons are both computer software developers who moved away for better jobs in other states.

“I would love to have them back here, but I can’t imagine there will ever be jobs that pay enough to entice them to come back to South Dakota,” Nesiba said. “With higher levels of student loan debt, and combine that with lower wages, and you can see why many of our best and brightest are leaving for other states. It’s a chronic problem for us to be able to attract and retain a workforce in South Dakota, and a lot of that is about wages” [Pfankuch, 2019.01.16].

Too bad Senator Nesiba is in a five-Democrat minority, among Republicans more concerned about aping Der Führer, playing culture war, and slurping up free chili and oysters.

Even the sensible Senator Nesiba recognizes that government can’t do much to raise wages directly. But we could put a lot more money back in the pockets of the 71% making under $40K with some simple progressive tax reform.

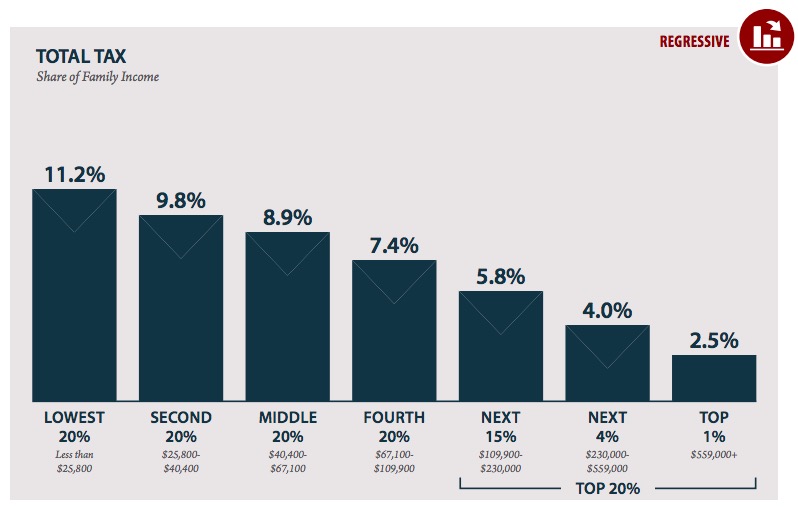

As I pointed out last month, the poorest 40% of South Dakota families pay an average of 9.8% or more of their income in state and local taxes. The richest 20% of South Dakota families pay an average of 5.8% or less. Let’s progressively reversed those percentages—slash the sales tax, target property tax reductions to lower-value houses, impose a state income tax with higher marginal rates. A family making $40K but seeing its South Dakota tax bill go down to 5.8% would keep $1,600 more a year in its pockets—that’s a whole nother two-week paycheck. A family making $400K would pay $23,200 more and would still have 9.6 times more cash in pocket than the $40K family.

Low taxes may be working for our wealthy elites, but the vast working class majority in South Dakota aren’t enjoying those benefits due to their tight-fisted bosses. If the Legislature and the Governor are serious about workforce development, they’ll reform our tax system to relieve the burden on the working-class majority who need relief, and they’ll tell their rich pals, Get with it—pay your workers competitive wages.

Tangentially related, from Axios: “College students from rural areas are moving to big cities for higher wages to help pay off their student loans, according to new research from the Federal Reserve.”

The best unintended consequence of the Bakken oil boom was forcing employers to drastically raise salaries and wages.

An important question to consider, Cory, is how would the progressive tax change you describe affect the annual receipt of total revenue in the State? It seems like one rationale for our unfair tax system may be that we have so many lower or middle income families (40% – 80% according to your stats) it is simply necessary to tax the lower and middle income at a greater effective rate than our relatively few wealthy to raise sufficient revenue to meet the state’s budgetary needs.

Demonstrating that a progressive tax will not interfere with the state’s financial needs would go a long way toward strengthening the argument for more fair taxation. A showing that a progressive tax could improve our tax receipts would even further strengthen the argument.

Best idea comes from AOC. Raise top marginal fed rate to 70%. Put $ toward infrastructure improvements, higher ed aid, Medicare for All, etc.

SD implements progressive income tax similar to what Cory describes. SD economy gets an energetic and positive kick in the pants.

When people at the lower income levels have more income that $ goes right back into the economy, adding stimulation. It’s a win for DC, for SD and for people.

Win/win/win.

If SD is last in USA in production worker’s salary, you’d think factories would be flocking to the state. Obviously low pay isn’t the incentive it’s claimed to be by Pierre Republicans. Factories move places with a solid safety net for their workers lean times. If business slows and layoffs are a necessity, you don’t want your workers moving away from the factory to another state. You’re better off building your factory in that other state, to begin with.

Well, at least we beat Mississippi.

Bearcreekbat, that’s a very important question to consider. I answer that question in my December 3, 2018, analysis. By my calculations, a progressive income tax based on the average rates charged in other states—ranging from 0.10% on our lowest quintile to 2.10% on our middle quintile to 4.90% on our highest one-percentile—would bring in $918 million, enough to replace 92% of our sales tax revenue.

More than tangentially related, Kal Lis. The Fed notes that student-debt-payers are able to make and keep more money and clear their debts faster in the cities even with the higher cost of living. (How many times will we have to put a spike in the “costs less to live in South Dakota” argument?)

That article also mentions the “tremendous opportunities” in the cities. A graduate saddled with debt needs to keep those payments flowing. Even if she can find a good job in Madison, Huron, or Redfield, that may be the only job in her field in that town. If that job dries up, she doesn’t have a quick professional lifeline; she’s going to be ringing up groceries at Sunshine or stocking the pizza heater at Casey’s.

Rural broadband could help expand opportunities—I know at Presentation College, we still run into situations where students and instructors in rural areas have trouble getting enough bandwidth to access live and recorded video and other high-data apps for class. But being able to swing a telecommuting job from Redfield still isn’t as sure a deal as being able to walk or bike or bus across town and find three or five or ten potential employers who have an office to fill with your warm and present and wel-educated body.

Opportunity matters. Diversity of opportunity matters more. South Dakota towns that want to survive can’t recruit just one big firm; they have to recruit multiple firms offering options to workers.

Cory, thanks for the reminder about your December 3rd analysis. That was an impressive post! Tweaking the proposals slightly to raise the result from 92% to 100% and then making that a primary argument in support of an actual progressive tax seems a potentially effective means of demonstrating the positive benefits of such a taxation approach to most people, including many conservatives.

Here’s a model of progressivism for SD and the USA that comes from, surprisingly, India. The small state (sound familiar?) of Sikkim on the northern border of the country (similar) has gone on far ahead of their federal government in improving the lives of their citizens.

It provides housing for ALL residents, uses no pesticides or fertilizers, literacy is 98%, people living below the poverty line is only 8% compared to 30% nationally.

They feel low population density (SD) is part of the reason for their success. Tourism (SD) is a major revenue source, as is hydropower (SD).

Sikkim is planning on implementing a statewide minimum guaranteed income in 2020.

SD can. The SDGOP won’t.

https://goo.gl/9xxCi8

Amen. The progressive tax proposed in this post would also serve as a significant boost to the SD economy. Tax cuts for lower and middle income families is much more likely to be spent within SD where it will turn over more times than money deposited in a rich persons trust account.

Wow, Debbo! If Sikkim can do it, so can we! Sikkim—it’s not just what we tell the dog; it’s a model for economic development!

Bingo, Nick. Put that money back in the pockets of the lower three quintiles, and they’ll spend darn near every penny of it buying more groceries at Kessler’s, more nails at Runnings, and more steaks at The Flame. We still need to kick our employers in the pants and tell them to share the wealth and raise wages, but for a smaller shot of economic stimulus (not to mention plain old tax fairness), a progressive income tax with concomitant reductions in sales tax would be good for everyone in South Dakota.

Thanks, Bearcreekbat. I’m glad you find that December 3 analysis useful. Those numbers are the best ones I’ve been able to put together. I think it’s interesting that just following national averages for state income taxes would come that close to replacing our entire regressive sales tax. We could certainly tweak those brackets for full replacement. I wish we had some progressive-minded legislators who would take that proposal to LRC, draft a bill, and lead that debate in Pierre.

As your next Governor, I’ll use the above analysis as the starting point for the state income tax I will propose as part of my centerpiece tax reform proposal in the 2023 Session.

There’s another nation doing a much better job of caring for its citizens than SD or the USA.

Bhutan doesn’t measure success by the GDP. They use the Gross Happiness Index.

“The four pillars of GNH were: sustainable development; preservation and promotion of cultural values; conservation of the natural environment; and establishment of good governance.”

Sheila Kennedy has a great post about the many shortcomings of focusing only on the GDP. Shes been to Bhutan to witness how that’s working.

https://goo.gl/75mqHK

Let’s compate Bhutan’s four pillars of GNH with Kristi Noem’s Four Pillars of Protection:

Bhutan: sustainable development, preservation+promotion of cultural values, environmental conservation, good governance.

Noem: protection from tax increases, protection from government growth, protection from federal intrusion, protection from government secrecy.

Bhutan’s four pillars provide a foundation for holistic community development, a vision of how everything in a nation or state or town could work together toward broad and common goals to improve everyone’s lives and protect future generations.

Noem’s four pillars provide talking points for a Grover Norquist campaign, with no globally or locally applicable vision and no clear goal beyond maybe some more appearances on CNN.

No Vision.

No Goals beyond Greed.

That’s the GOP and SDGOP in a nutshell.