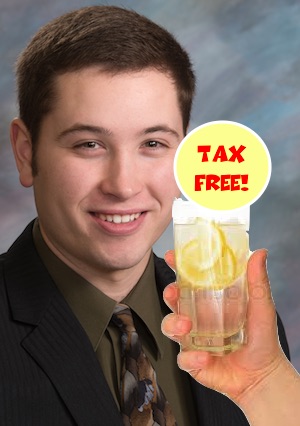

As the youngest member of the Legislature, twenty-something rookie Rep. Drew Dennert (R-3/Aberdeen) is most attuned to the hopes and fears of young’uns on the street corner selling lemonade. It seems only logical that young Dennert spearhead a bill repealing what his reëlection campaign will surely and smartly title the “Darned Old Lemonade Tax.”

House Bill 1175 proposed to exempt from sales tax “the gross receipts from any casual or occasional sale of goods or services made by any person who is under eighteen years of age.” By “casual or occasional”, HB 1175 meant the kid is making “less than one thousand dollars in any calendar year.”

We could inquire into what would have happened when Dennert’s young non-voting constituents sold their two-thousandth cup of fifty-cent lemonade (more likely once Dennert’s President causes an acceleration of global warming and summer lemonade sales—Make America Sweat Again!). HB 1175 didn’t clarify that the first $999.99 is an exemption for every junior seller, casual or regular. As written, HB 1175 defined “casual or occasional” in terms of “the seller’s gross revenue.” If your kids sold $999.50 worth of lemonade in one summer, or if they sold $2.73 worth of lemonade every day of the year, HB 1175 made them casual/occasional tax-exempt sellers. If they sold one more cup and made their thousandth dollar, HB 1175 left them regular taxable sellers who have to pull 4.5% of their earnings back out of their piggy banks to pay the tax due on their first $1,000.

I would have loved to have seen the Daugaard Administration to send Liza Clark or Tony Venhuizen in to House Taxation Tuesday to oppose the bill as an irresponsible tax break amidst a budget shortfall. But the Daugaard Administration isn’t that stupid: they didn’t send anyone over to oppose Dennert’s repeal of the lemonade tax, probably because they know there isn’t a child in this state who’s collecting that sales tax now and the state will enver send its revenuers out to shake down any lemonade stands, even stands run by Democrats’ kids.

HB 1175 passed House Taxation 9–5, but then, incredibly, failed in the House yesterday, with 40 Representatives, including big mean G. Mark Mickelson himself, voting to leave our youngest entrepreneurs, technically, tax cheats.

A Republican-controlled Legislature voting to tax children’s lemonade stands? Now there’s an issue real conservatives like Drew Dennert and Neal Tapio can campaign on! Drew can hit the streets saying, “I voted to repeal that Darned Old Lemonade Tax, but those crypto-liberals in Pierre keep trying to tax your precious children! Down with DOLT and liberal dolts!”

And heck, Tapio can chime in by blaming the vote against HB 1175 on 190 Muslim doctors in Sioux Falls who think girls selling lemon beverages on street corners violate Sharia law!

For the link of me, I can’t understand why anyone would vote this down. Is there some lemonade tax scam or some other reason we should tax young people in this way? I’d like to know the reasoning, even if I don’t agree.

Nice subliminal try, Master. Trying to sneak a pointed acronym past readers or was it calculated to strike at the heart of the none too bright majority? Bwahahahahahahahahaha!

The reason is because a fetus was forced to be carried to term. Then it became another possible drain on future taxcuts for the koch bros. Wingnuts only love a fetus until it is born. After that it is on its own. Haven’t they made that patently obvious over the years? They do not want to waste koch bros potential wealth to feed, insure, educate, medicate children. There are other reasons as well.

Mike, I’m always swinging for the fences. :-)