South Dakota Public Utilities Commissioner Chris Nelson, a gooder Republican than whom there is not, today cast doubt on the Trump/Noem tax plan.

It started last night, when lawyer, lobbyist, and Republican Justin Smith tweeted a Los Angeles Times article about “The Republican Tax Bill’s Small-Business Problem”—specifically, as I mentioned passingly in my discussion of the Trump/Noem plan, that the bill does little if anything to share tax relief with most small businesses:

…already about 86% of these so-called pass-through businesses pay no more than 25% under the individual code, the new top rate proposed for small-business income in the tax bill unveiled this week. So they won’t get the legislation’s much-hyped small-business tax cut.

On top of that, the bill makes it very difficult for lawyers, engineers, doctors, consultants and other personal services providers, who make up a good share of small businesses, to qualify for the 25% rate.

“The whole thing doesn’t work for most small businesses,” said Jack Mozloom, spokesman for the National Federation of Independent Business, which has declared it does not support the bill at this point.

“We think there ought to be a substantial benefit for everybody,” he said [Jim PUzzanghera and James Rufus Koren, “The Republican Tax Bill’s Small-Business Problem—Most Won’t Benefit from Special New Rate,” Los Angeles Times, 2017.11.03].

Then this morning, Commissioner Nelson, who so far this year has tweeted less than once every three weeks, felt moved to retweet Smith’s tweet and urge Rep. Noem and her colleagues to come up with a better tax plan:

In a not-so-far-off alternative universe, Chris Nelson would have been in that picture with Donald Trump, grinning over the better tax plan that Nelson says we need. He ran for Congress in 2010, only to be beaten by last-minute entrant Kristi Noem in a GOP primary that he should not have lost. Nelson was able to return to political employment when Governor-Elect Dennis Daugaard appointed Nelson to the PUC seat that freshly elected Dusty Johnson declined in favor of serving as Daugaard’s chief of staff.

My most fervid readers may read in Nelson’s Noem nudge a signal that maybe he’d like to play Noem in the 2018 primary: surprise everyone by entering the race in late February, upset the two long-declared candidates, and claim his rightful place in Congress. But Chris Nelson isn’t the kind of guy to stew over a long-past loss. Besides, he owes Dusty his job, and he’s already sent Dusty’s House campaign $250.

Nelson’s tweet is unusual: it’s his only non-PUC political tweet this year. But it may well be just no more than it is: a public statement by a mainstream Republican that the Trump/Noem tax plan doesn’t do enough to help small businesses.

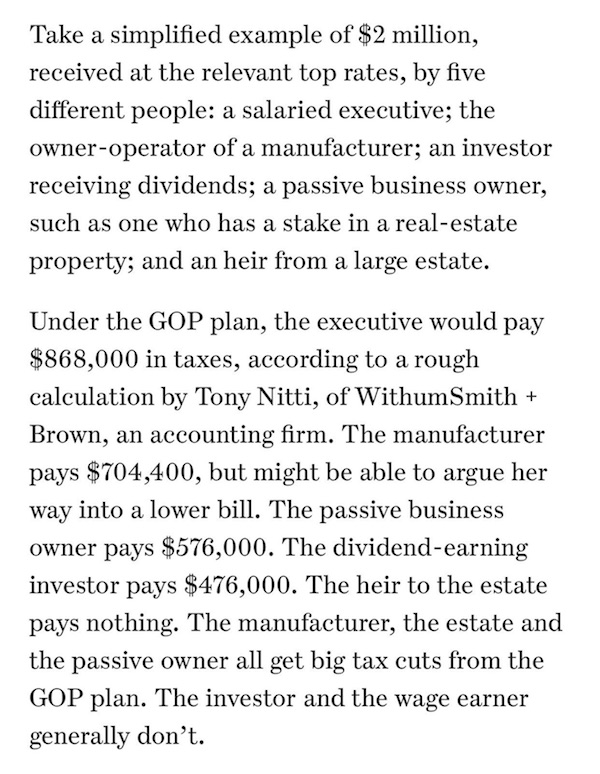

Related: Even among big businesses, the Trump/Noem tax plan seems to fail at promoting real hands-dirty entrepreneurship. Richard Rubin explains in the Wall Street Journal that the GOP plan taxes $2 million many different ways, depending on how it was made:

The passive owner, the dividend-earning investor, and the heir are less directly responsible for the creation of jobs, wealth, and public good than the CEO and the manufacturer, yet those contributing least to the commonwealth pay the least in taxes on their wealth… and genuine small businesses get no break at all. I’m a small-businessman, and I second Commissioner Nelson’s request: Congress, keep working for something better!

https://www.dailykos.com/stories/2017/11/5/1712268/-Trump-s-trickle-down-rich-man-s-tax-cut-is-simply-cruel-to-many-middle-class-families#read-more

This tax plan is written for Trump, does nothing for any of the rest of us, business or not.

Chris Nelson is, as far as I can tell, a good guy, who wants good government (which may be an oxymoron). As a result of this post, I shall send him some money.

That’s why there should truly be a simplified tax plan that people could fill out on a postcard. Take that same $2 million example and have everybody pay the same tax rate regardless of how the money came to them. Exempt the first $X dollars of income to help the poor. Eliminate the cap on social security/medicare income that is taxed and adjust that rate to reflect the lack of a cap and the fact that there won’t always be an employer paying a share of it. Have several graduated tax rates and no exemptions. Make the tax system work like a quartz watch instead of like a Swiss watch. (Here’s a hint: quartz watches are more accurate and far less expensive and complicated).

The NFIB is against the plan. Aren’t they a solidly Republican organization? The mortgage and housing industry is against Trump’s plan, too. Deficit hawks are against the plan.

The dominoes are starting to fall.

The problem with a detailed plan is people start looking at the details instead of relying on Trump’s bloviating.

It’s not like the GOP Party had years to come up with a tax plan while they waited for a GOP Party President. It’s not like they had years to develop an Obamacare replacement either. They were forced by factors completely out of their control to cobble something together at the very last minute with consequences that just could not have been anticipated before the very last minute. It’s all Barack Hussein Obama’s fault with enough of the blame to throw Hillary’s way too.

By the way, Paul Ryan is a genius. He knew years ago before anyone else that his plan when the GOP Party had a president involved cobbling $#!t together at the very last minute, and GOPs now are just realizing how brilliant he was to know this years before anyone else.

Darin, I fear the only details Trump knows how to pay attention to are whether he’ll make money right now and whether he’ll get press. Beyond such immediate-term calculations, he’s useless.

Ror, you raise an important point. If this plan really is about middle-class tax relief, why didn’t Ryan and McConnell bring it forward during the Obama years? Do they really think President Obama would have vetoed genuine middle-class tax cuts?

If the Republicans really think we need to stimulate a sluggish economy, why did almost all of them vote against President Obama’s 2009 stimulus, when the economy was much worse and needed much more stimulus? Why would they not have offered a plan like this at any point from 2010 through 2016, when the economy was still recovering from the Recession and thus not doing as well as it is doing right now (by various metrics, open to debate)?

Medicare for all would do more for economic development than any of the trickle-down tax mythology of the GOP retrogrades. Right now many businesses allow employees to work only part-time so they don’t have to pay them medical and other benefits. If employers had no responsibility for such medical coverage, they could hire employees for a full 40-hour work week and people would not have to have two or three mediocre jobs to survive. How long until Democratic legislators and candidates get on this economic stimulus bandwagon and push a good idea with a better idea?