Last updated on 2017-02-13

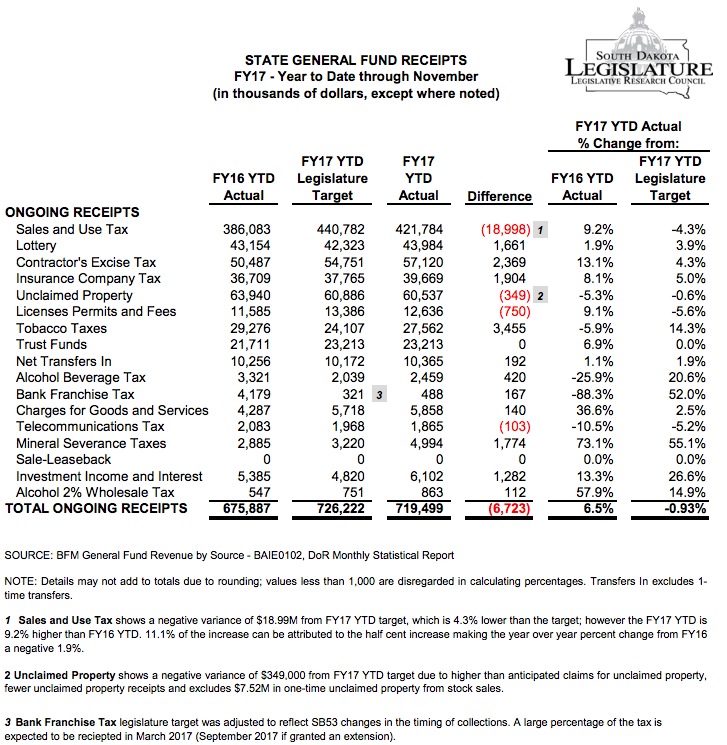

The Legislative Research Council updated its revenue report last week to show how we’re doing on general fund receipts through November. Due mostly to lagging sales tax receipts, we’re down $6.7 million, 0.93%, from where the Legislature projected we would be at this point in Fiscal Year 2017:

Note that sales tax revenue is actually 9.2% higher so far than it was in FY2016; however, that includes the bump from 4% to 4.5% that we enacted on June 1 (and started collecting in July, the first month of this fiscal year). Had we been taxing sales at 4.5% last year, FY2016 year-to-date revenues would have been 12.5% higher, $434,343,000. The Legislature’s FY2017 YTD target of $440,782,000 thus assumed a meager 1.48% uptick in actual consumer activity. The actual FY2017 YTD figure, $421,784,000, is thus down 2.9% from last year and down 4.3% from what the Legislature hoped we’d see.

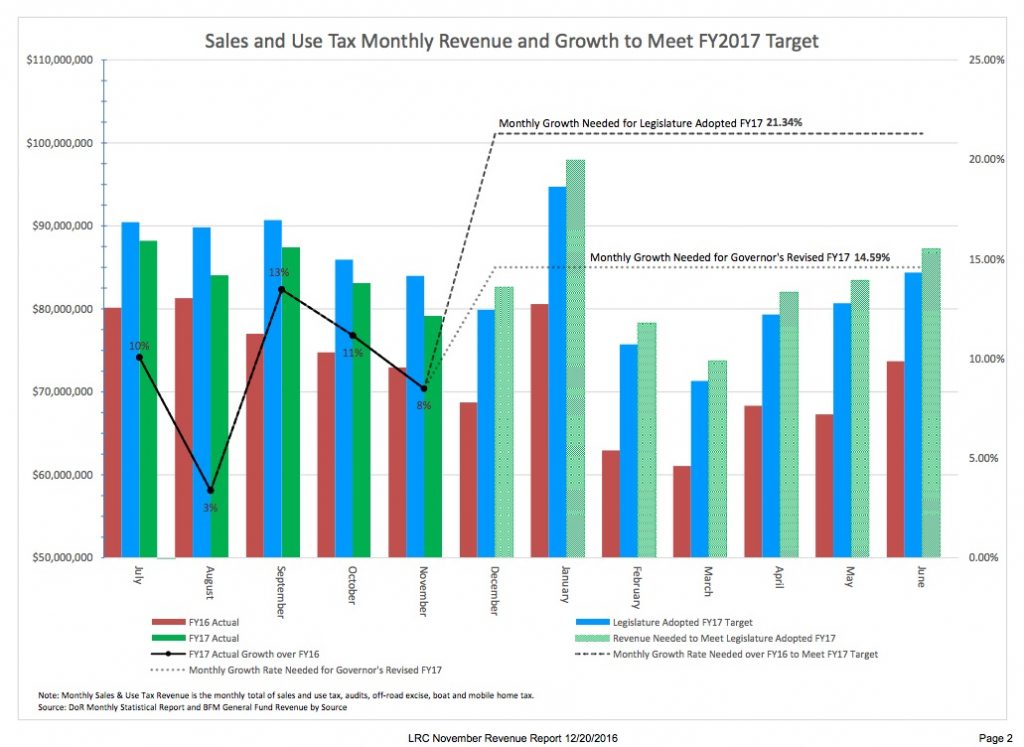

Now we could hope for holiday sales (November’s sales tax comes in December’s collections, December’s sales in January’s collections) to catch us up. December sales have traditionally competed with the high tourist times of July and August for top sales month in South Dakota. However, nationally, November and December are kicking in a lower percentage of annual retail sales as we spread our shopping out year-round and retailers offer cutthroat holiday discounts.

The Governor has already proposed revising FY2017 revenues down $26.1 million and reducing appropriations by $34.7 million. Meeting the Governor’s target for the remainder of FY2017 will still require sales to pick up:

Take the extra-penny sales tax out of the Governor’s target 14.59% monthly revenue growth, and we need to go from underperforming last year’s sales by 2.9% to growing by 2.1%.

More and more people are making more and more purchases online and not paying any sales tax. That trend will continue. Until Congress gives states the ability to tax online sales state government will continue bleeding sales tax revenue.

RAC-wingnuts don’t appear to be good at projecting of any kind.

Hey, Ror, I apologize if you’ve already addressed this suggestion, but consider: instead of waiting for a Koch-Trumpist Congress to pass a tax increase, why doesn’t South Dakota just enact a delivery tax, adding a 4.5% surcharge to every FedEx/UPS delivery? (Say, can we tax Postal Service deliveries?) Absent that, why not simply subpoena the delivery records of every in-state shipper, cross off items sent from out-of-state retailers that collect and remit sales tax, and then send tax collection notices to the South Dakotans on that list who didn’t pay sales tax on their online purchases?

Sounds complicated Cory. Do you think our GOP Party legislature has the appetite to hire lots of tax collectors to shake down their voters on an individual basis like that? I suppose it could be done if the GOP Party felt the need for political suicide. Wouldn’t be very efficient either.

It’s just more efficient for sellers to collect and remit sales tax than for the state to try to determine use tax and collect it from individuals.

@cah: “…why doesn’t South Dakota just enact a delivery tax, adding a 4.5% surcharge to every FedEx/UPS delivery? (Say, can we tax Postal Service deliveries?)”

Because that would still be taxing interstate commerce. South Dakota can and does tax freight on intrastate shipments but not interstate. And no states can’t tax the USPS

And how would you know the value of the shipment’s contents? Or how would you calculate the tax on free shipping?

More taxes instead of eliminating deductions for the connected or eliminating waste… same old, same old Republican and Democrat Planks. Our taxes go to things like county subsidized healthcare that buys $100 plastic water pitchers and $10 each aspirins, but yeah, we need to find the big money of Internet sales tax. The Good Ol’ Boys say: let’s create a new sales tax hunting bureau and waste more dollars trying to find a few cents in sales tax. Now, back to giving monopolistic utility companies their tax refunds and pretend to wonder where the big money go.

Why don’t Blogs in South Dakota charge paying sponsors and donors 4.5% for their advertising? No Law? The State doesn’t care, they will take that money. Lead by example.

Wall Street is buying medicine patents and raising life giving drug prices from 68 cents to hundreds of dollars each, but we better clean up those Internet Tax issues.

Precedent has been set. If Republicans don’t pass this law this term and help collect the taxes due they are negligent, inattentive and irresponsible stewards of South Dakota’s best interests. Or like undocumented workers, would Republicans rather just look the other way because it benefits them, even if it’s wrong?

December 12, 2016

The U.S. Supreme Court let stand a Colorado law that imposes reporting requirements on internet retailers in an effort to get customers to pay the sales taxes they owe.

The Colorado law requires internet retailers to turn over customers’ names, addresses and purchase amounts to state tax authorities. Merchants also must NOTIFY consumers of their obligation to pay taxes and provide a purchase summary to people who spend more than $500 in a year.

https://www.bloomberg.com/politics/articles/2016-12-12/internet-sales-tax-clash-turned-away-by-u-s-supreme-court

e.g. After CO passED this law and confronted Amazon with the ramifications of it, Amazon decided to just collect the Colorado Sales Tax … an nice addition to a depleted sales tax revenue stream.

@Porter Lansing: Actually the SCOTUS ruling in Direct Marketing Ass’n v. Brohl only returns the case to the Tenth Circuit where it was held that Colorado’s reporting law was unconstitutional under the Commerce Clause. It’s now up to the Tenth Circuit to determine whether their decision will stand.

Amazon most likely started collecting Colorado sales tax due to their opening of a fulfillment center in Colorado creating a nexus in the state making it legal for Colorado to require Amazon to collect sales tax on Colorado purchases.

Coyote, could the state impose an excise tax on delivery services? Regardless of what they carry or where it came from, delivery trucks pay a fee per mile on their business activity.

On determining value of goods: if the state has reason to believe that shippers are delivering goods on which state residents have not paid the legal tax, could the state not subpoena the shippers’ records to obtain the value of the items shipped?

Ror, I agree it’s far more complicated tracking down hundreds of thousands of shoppers rather than thousands of sellers, but if the state is serious, why does the state not put the screws to the tax dodgers, who ultimately are us? 43 other states manage to collect income tax from individual taxpayers—why can’t South Dakota reach out and touch individual taxpayers? Heck, send the new state collections agency after them.

Sure, Barry, I know you’d prefer to turn the argument to the moral worth of bloggers rather than the actual policy issue at hand, but you can’t run state government on charity and good will any more than you can run it on hoping Congress or someone else makes all of our problems go away. The question for the Legislature is not, “What can someone else do?” The question for the Legislature is, “What must we the Legislature do to fulfill our obligation to provide fair, equal, and adequate public services to all South Dakotans?” (Just like with stealth vouchers: the state has no business giving insurers tax breaks on the hope that they’ll give kids scholarships to church schools; the state’s job is to provide public education to every child.)

@Coyote Yes, now I see that. Including comity act. Thank you. http://www.sutherland.com/NewsCommentary/Legal-Alerts/170870/Legal-Alert-All-Nine-Agree-US-Supreme-Court-Holds-that-the-Tax-Injunction-Act-Does-Not-Bar-DMAs-Action-in-Federal-Court

We are already paying tens of thousands in property, sales, and income tax. Enough already. Local school district wasted $4 million on a totally unnecessary fourth gymnasium for a school graduating fewer than 40 students per year. School test scores drop every year.

SD needs some kind of performance measures and standards to prevent waste at local and state levels before we get stuck with new taxes so more can be wasted on stupid projects and lazy, incompetent bureaucrats.

And Bah, Humbug as well as Merry Christmas season and Happy New Year.

Porter nails it, there should have been this idea in place months ago. Instead, South Dakota was only thinking about genitalia and how to whisper about it without giggling. Collecting online tax is nothing new and it does generate legitimate money. Trade legitimate money for gambling failure, as an example, should be considered a viable solution to an even across the board collection of tax revenue. Online tax revenue would help to generate working capital for economic development. The list goes on.

Well, remember, Jerry, South Dakota did pass an online sales tax collection bill to trigger a court case even in the midst of all that genitalia obsession.

Yes Cory, that was ill advised in light of the North Dakota case that went nowhere, but typical for Marty and the gang that couldn’t shoot straight. Porter does breathe new life into the mix though, and this time it makes sense for the state of South Dakota to pursue it.

Understandable. Farmers aren’t spending because of commodity prices. Not rocket science.

Cory, there is that 24 to 25 million that is due in January 2017 that I do not see anyone talking about. Is that part of the Pence meeting with Daugaard to forgive the money they ripped off and ran with?

Jerry, remind me what money you’re talking about.

This was published in August on disappeared money. http://www.argusleader.com/story/news/2016/08/13/how-south-dakota-took-money-and-ran/88563764/

With this discussion, the mystery money in SD Certified Beef and the debate on IM22 I was reminded of NSU Professor Art Marmorstein’s column comparing the ethics and money in Pierre with Tammany Hall and this quote from George Washington Plunkitt.

“The books are always all right. The money in the city treasury is all right. Everything is all right. All they can show is that the Tammany heads of departments looked after their friends, within the law, and gave them what opportunities they could to make honest graft.”

Well worth the read.

http://www.aberdeennews.com/news/opinion/marmorstein-sd-ethics-measure-a-light-wrist-slap-against-the/article_ccbaf6d3-ca91-528f-859f-5d0e712f89dc.html

Cory, have you read about what I am talking about?

Jerry! Ah, now I remember!

https://dakotafreepress.com/2016/08/14/rounds-daugaard-hurt-sd-reputation-with-eb-5-energy-stimulus/

Interesting that the money came from the Department of Energy. Ellis’s August article said the law in question lacks enforcement, so it’s not likely DOE will claw back the money. But if they were paying attention, they might not give South Dakota another crack at the economic development aspect of the Borehole project.

There is a new sheriff in town in 2017, he may want to take Daugaard to task over the 24 million that is owed to the treasury. Daugaard made some kind of comment about Trump. Of course, Don is not known for being vindictive, ask Romney how his meeting went, so he and Thune have that going for them..

Leaders of the SDGOP are not tax and spend taxpayer dollars they are steal and run with the funds. They probably spent the millions in the Philippines and banked the rest in Turks and Caicos, as that is a favorite for the outlaw bunch here.

Mystery Money. That is a good term. Where is all the Mystery Money people can ask?

Richard Benda knows where it is Mr. grudznick. The blame has to be on someone and it has worked in the past, so why not keep running with it? The EB5, Gear Up, this 24 million (by the way, that 24 million is due in a few days, that clock is ticking), all of the corruption and outright theft, are all someone else’s fault. Don’t blame them for stealing taxpayer money though as they simply could not help themselves while helping themselves.

Mr. jerry if there is 24 million missing I am sure people like Mr. H and my old friend Sibby who is an accountant can sort it out by reading those reports. Mr. H knows where the reports are and puts blue links to them. It cannot be hidden or it would not be listed in the reports.

Mr. grudznick, it is not missing, it is just strayed or stolen because it is not where it is supposed to be. It is just 24 million dollars of taxpayer money, not like the real money Daugaard begs for to “balance” his unbalance books. It is due in 2017 though, it may be interesting how Don handles this indiscretion from a feller who tossed a rock at him with an insult. I would hope that Don invites him to dinner in the Trump hotel. Then makes him eat frog legs.

Trump has apparently already taken a shot at DoNothing Dauagaard. Once Daugaard and Rounds took their shots at Trump, Daugaard was removed from Trump’s ag advisors.

Daugaard as an ag adviser makes about as much sense as NOem being a governor. Neither one are qualified for those positions. Daugaard is not sure what end the critter takes nourishment from and NOem only knows how deep the outcome is from stepping in it.