South Dakota and Minnesota have increased their minimum wages over the last couple of years, but neither has taken the great leap of Seattle, which raised its minimum wage from $9.47 to $11 on April 1, 2015. Seattle companies employing 500 or more workers in the U.S. must reach $15 by January 1, 2017; smaller companies must reach that minimum wage by 2021.

So how are we all looking for unemployment, which opponents tell us goes up when we raise the minimum wage?

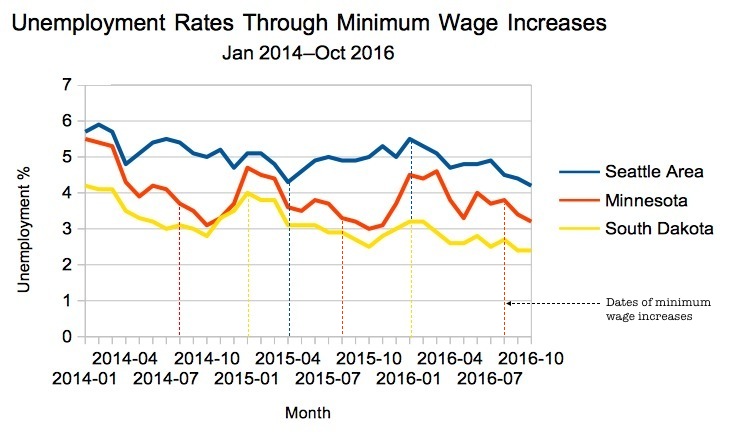

As I have reported previously, South Dakota and Minnesota show no sign of significant job losses over the course of their minimum wage increases. Seattle is also in pretty good shape:

As one of my colleagues wrote last week, the “unemployment rate in the city of Seattle – the tip of the spear when it comes to minimum wage experiments – has now hit a new cycle low of 3.4%.” Meanwhile, a University of Washington study on the minimum wage law found little or no evidence of job losses or business closings.

Although you can never declare a game over until the final whistle, this experiment is starting to look like a rout [Barry Ritholtz, “Minimum-Wage Foes Tripped up by Facts,” Bloomberg, 2016.12.07].

South Dakota Republicans are working hard to undo the will of the voters. Let’s hope the data discourage them from tinkering (again) with our minimum wage increases.

Who could’ve predicted that putting more money in the pocket of people who have to spend every dime they make just to live would not be a job killer? Oh yeah, Democrats, that’s who.

Give tax breaks to the wealthy and they can take the money and put it in the bank or put in an account in the Cayman Islands or possibly invest the money. Give a few extra bucks to a person at the bottom of the income totem pole and they spend the money in our economy and demand for widgets rises. This demand spurs investment to meet the demand and we have a rising economy as a result. The rising economy spurs demand for labor which drives up wages. Rising wages by consumers means more spending on widgets and round and round we go!

I really cannot understand the continuous slamming of and attacking the less-than-wealthy by so-called “conservatives” from a facts and figures economic point of view. On the other hand, it is entirely understandable from a point of view of purely emotion driven interest in preserving self-held positions of power or status. There, any attempt to change the status of others is equally perceived as a threat to one’s own status.

That 100% emotion-based decision-making process is really the only ting there is about “conservatives” (Republicans?) that can truly be considered as being conservative in nature. It is certainly NOT fiscally responsible.

I also find it quite troubling that a standard response of these so-called conservatives to the presentation of thinking on the minimum wages and other facets of economics is often “go back to econ 101” or some other ad hominem phrase that belittles the presenter as somehow analytically naïve. Again, the facts, figures and real-life examples simply don’t matter. It is more important for them (the so-called conservatives) to maintain their sense of status than to know any other thing about the world.

THIS is what was referred to by Trump surrogates as the “there are no such thing as facts” – only perceptions – political world we live in today. This is the mind of the Trump voter. Love didn’t trump hate (or fear). Emotion trumped reason.

Richard Schriever, Cory needs to do an article on the Trump surrogates’ statements that there are no such things as facts anymore. Trump’s latest statements about the number of jobs saved at the Carrier plant are an example and his twitter war with the Union.

After talking to friends in both these areas, I find one thing in common (not a scientific sampling, but a gross generalization) is a sense of community, a feeling that we are all in this together, from those other regions. People are willing to pay a little extra to support the neighbor doing a little better. I think you will see those wages cause the economic downturn predicted when 1) the community only focuses on getting the lowest price possible, and 2) businesses protect a profit margin that pits them against “the help.” The more apt we (individual consumers and businesses) are to look only inwardly, the more likely higher wages are viewed as ruinous.

There is a larger theme here than just minimum wage: it is the fundamental issue that we could all really help each other if we wanted to. But to do that, there has to be some level of empathy, some commitment to not slipping into easy factions and creating enemies of the “other.”

In an effort to mitigate Colorado’s severe labor shortage Amendment 70 passed in November. We welcome all workers.

Amendment 70 increased the minimum wage to $9.30 in 2017, $10.20 in 2018, $11.10 in 2019, and $12.00 in 2020. After 2020, annual adjustments will be made to account for increases in the cost of living. For employees who regularly receive tips to supplement a base hourly wage, no more than $3.02 in tip income may be used to offset the minimum wage.