Governor Dennis Daugaard gives his budget address tomorrow (Tuesday) at 1 p.m. in the Capitol. Grandpa Cheap is telling us to brace for a lean year:

Since fiscal year 2017 began last July, revenue has been weak. The state’s receipts have fallen short each month: in July revenue fell $1.7 million below projections, in August another $3.8 million below, September was an additional $5.7 million short and October was worse yet with a shortfall of $8.7 million. That leaves us almost $20 million short for the current fiscal year [Governor Dennis Daugaard, press release, 2016.12.02]

If the monthly shortfall kept growing at an average rate of $2.3 million per month, our shortfall in June 2017 would be $27.4 million, and the total annual shortfall would be $173.5 million. If we go easy and assume the shortfall plateaus from October on, another $8.7 million short for each remaining month in FY2017 puts the total shortfall at $89.5 million.

Governor Daugaard blames falling sales tax revenues on sagging ag prices and online sales:

The inability of states to collect sales taxes on some internet purchases is another factor leading to weakened tax revenue. The Bureau of Finance and Management estimates that up to $35 million in these taxes goes uncollected each year [Daugaard, 2016.12.02].

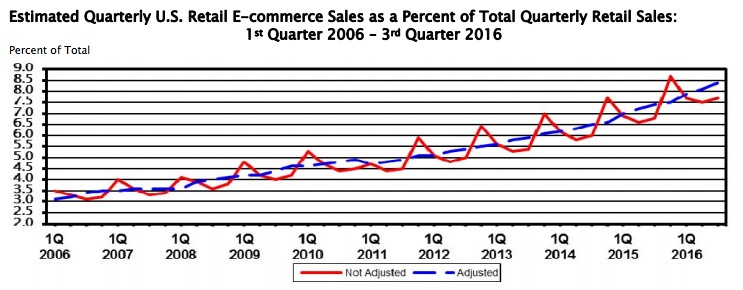

Wait a minute: as the Governor acknowledges by citing the BFM estimates, taxes lost to online sales are not a new phenomenon. Retail e-commerce has steadily grown as a percentage of total quarterly sales from 3.5% in 2006 to 8.5% today:

There’s no surprise in this curve. Wouldn’t BFM and Joint Appropriations have factored that $35 million plus the decade-long growth rate of retail sales into the FY2017 budget projection? For online sales to account for any of the current revenue shortfall, online sales have to have grown faster than that blue curve suggested a year ago—i.e., South Dakotans would have to be abandoning their local stores and ordering from Amazon even faster than anticipated.

I am skeptical. Either Appropriations underestimated a long-standing trend of increased retail sales, or something else big is driving our revenue shortfall. Perhaps the Governor will elaborate more tomorrow.

The longer you have low farm prices the more people will cut back. First they stop buying $200,000 tractors and $400,000 combines which they pay sales taxes on. Then they slow up other purchases. When the farm prices went up I took a trip to Aberdeen to a dem state convention. We stopped in a moderately small town and heard that they had gone from two cafes to four. Farmers had money to spend and they spent some. Now if a few cafes close down it will not be from minimum wages going up, it will be from lower levels of sales. So if it keeps going down it might be from the national economy slowing. With Trump we will probably get higher oil prices so everything will go up but people will not have more money. It might not get better any time soon.

Online sales should be taxed just like any other sales. Time to make that move to save teacher pay.

Online sales might be growing at a faster pace in SD than that chart suggests. In a rural state like this, people living far away from a big retail center probably buy online more than urban dwellers do. No question we’re missing out. Question is, by how much? SD’s reliance on sales taxes is being rapidly left in the dust by technology. Time for tax reform in this state.

What online sales do not have to pay sales tax or city tax? I buy somethings online from several sources and pay a sales tax on each of these sales. I have never purchased a pickup or a New Holland online, so I am not sure on that. Anyone know?

Looks like sales taxes have to be collected by firms that have a physical presence in SD, jerry. Researching this a few days ago I had trouble navigating the SD Dept of Rev site to find my answer, but here’s what seems to be an authoritative recap: https://www.nolo.com/legal-encyclopedia/south-dakota-internet-sales-tax.html

Cory, it’s the ag economy downturn in my opinion that is the main problem. Prices for crops and livestock are 40% less than a couple of years ago. In SD, it’s the ag economy stupid. :)

I too tried to find how that works. I just made a purchase and not only was sales tax paid, but they want to know the city for city sales tax as well. As this money is certainly being collected, then the vendors are in violation of the South Dakota Department of Revenue policy. I would be willing to show where my sales tax has been paid by me if they want to go after these national companies in a lawsuit. I don’t want to loose services here because I made a purchase on line that refused to pay the state its dues on taxes. Does Daugaard have any recourse to collect or better put, why are we paying out of state vendors if they are not going to send those taxes collected back to the state?

John T. I see now where I have made the mistake. The company that I purchased from has a tie with South Dakota so that is why they collected my tax. I also checked on some other purchases and there were no sales taxes charged nor collected.

Especially at holiday, these delivery trucks are working late into the evening delivering packages from who knows where. That seems to me that it could run into some serious dollars of uncollected tax for the state.

Quill v North Dakota (1992) in an unanimous SCOTUS decision held that a state cannot force a company without a physical presence (nexus) in that state to collect sales tax. However that doesn’t mean all e-commerce sales are exempt from sales tax. WalMart, Target, KMart, Costco, Sams Club, Staples, Office Depot, Menards, etc all do e-commerce and all have presence in South Dakota and so would have to collect sales tax. Twenty some states have signed agreements with Amazon to collect sales tax.

I read into that Quill that John T. linked to so now I know. Here is something that is now coming from Amazon, this is going to put many people in the poorer house http://www.businessinsider.com/amazon-go-grocery-store-future-photos-video-2016-12/#amazon-go-sells-prepared-foods-and-other-grocery-staples-1

People will not have a clue on what they have spent, kind of like video lottery with a twist.

I am not sure what has changed. Years before the internet we all ordered from mail order companies. They did collect tax either.

Is this just another excuse to raise taxes?

Of course it is Sam2, wait until the bill comes for Marsy’s Law. Dig deep foolish ones for you are about to be slapped right where it hurts, your checkbooks.

Coyote howled it. I just bought from Amazon and CO sales tax was charged. Why doesn’t SoDak get the same, Republicans?

PS … I already buy lots of non perishable food from Amazon. When you need to add something to get to the free shipping amount, a few jars of DUKE’s mayonnaise fits right in. It’s not sold here and makes that real Southern potato salad pop. ?

But, we don’t charge tax on food. That’s just wrong.

@Porter Lansing: Hard to say why CO residents pay sales tax on Amazon. There doesn’t appear to be any Amazon fulfillment centers in CO or call centers which would give Amazon a nexus in CO. Maybe some of your purchases weren’t fulfilled by Amazon and instead came direct from the company itself which has a CO nexus.

Coyote … Very observant. It’s both. The items did come from a middleman and CO now has an Amazon Fullfilment Center. Over a thousand new jobs. Did SoDak’s job crew try to get it? Probably just not talking about it cause it didn’t happen. Try to get one. The workers of SoDak are perfect for that use. Great pay and benefits.

The “Commerce clause” in the US Constitution limits or prevents taxes on transactions across state lines. SD Revenue Dept. pushes a convoluted scheme for making such taxes possible. It involves congressional changes and compacts with multiple states. Such ideas are inherently invading privacy and needlessly complicating business. If you live in a rural area, your zipcode may indicate you live in a city that can collect city sales tax from you. Such problems require monstrous databases that must be nearly continuously updated to work and prevent inequity. This amounts to an employment package for revenue department flunkies all across the US. Do you really think 30 state revenue departments should need to know if you buy Viagra or a chastity belt for your wife. That question got me banned from SD Public Radio call-in programs back in the Janklow days.

If there is to be any tax on online or other distant sales, it should be a federal sales tax with 90% of the revenue refunded to states on the basis of states populations. Such a tax would be the average of all state sales taxes and everybody would know who had to collect and who had to pay. No databases of buyers would be required.

A distant sales tax should apply not just to online sales, but to distant sales in state as well. Newspapers could collect sales taxes and equipment sales taxes on distant sales would have same tax rate and still not require any intrusive, probing databases.

I only see one flaw in that Mr. Wiken, in the UK, if you purchase goods that are from out of country, you have to pay a VAT. The post office makes you come there to pay the VAT before you get your goods. Makes returns somewhat inconvenient, but a national sales tax may be something to consider.

Tim Taylor grunt. Here’s an item on Amazon that can help get to the free shipping amount. (I love ’em all) ??? SPAM ASSORTMENT

https://www.amazon.com/gp/aw/d/B00P2SQSHO/ref=mp_s_a_1_4_a_it?ie=UTF8&qid=1480991013&sr=8-4&keywords=spam

@Douglas Wiken: “The “Commerce clause” in the US Constitution limits or prevents taxes on transactions across state lines.”

Kind of but…. not quite. The commerce clause is actually one of Congress’s powers and it simply states that Congress can “regulate commerce with foreign nations, and among the several states, and with the Indian tribes.”

Federal legislation under the Marketplace Fairness Act is one such piece of legislation. It is fraught with problems such as you mentioned in that local sales tax jurisdictions may cover only partial zip codes. There is software out there that is purported to take those variations into account but then that’s just an additional expense for small retailers engaged in e-commerce to absorb. Essentially it’s just government shirking it’s tax collection responsibilites and defraying it’s expenses by shifting the costs of tax collection to the private sector.

John T. is quite correct about the prevalence of online shopping in rural areas. Frankly, in such areas, it’s often almost a necessity. I live on a rural reservation where the nearest city is ninety miles away, and there isn’t much in the way of retail in the reservation town itself. Now, mind you, there’s more here than on, say, anywhere on Pine Ridge (I’m in Eagle Butte, on the Cheyenne River Reservation), but still not nearly enough for what is often needed. But I often have to resort to online shopping if I don’t want to drive 180 miles round trip and take up most of a day doing so. I would have no problem whatsoever paying sales tax on online purchases, I think it’s only fair to do so.

And, unlike a lot of my fellow state citizens, I recognize the correlation between taxes and receiving needed and necessary services from the state and municipalities. It makes my teeth grind when said citizens complain about taxes, and then in the same breath complain about reduced services or the state not being able to do such-and-such due to reduced revenue.

And this state is still primarily rural. Online shopping is going to become even more prevalent soon in most of these areas, especially since it’s extremely difficult for any business in a rural area to be able to even survive, much less make any kind of a profit. There’s just not enough of a population volume to sustain them.

Complaining about taxes seems to be a state hobby, as well as complaining about the costs of living. But, as a former Ohioan, I have to say that a lot of South Dakotans have no idea how lucky they have it on both counts. Ohio not only has a (insert obligatory gasp of horror here) state income tax, but other taxes as well as the costs of living are much higher there.

Thank you Cory for doing our homework once again.perhaps it’s time for South Dakota to be bold enough to further diversify our economy by embracing new industries. Might I suggest renewable energy?

John T, would online sales in South Dakota have grown faster this year than they have in previous years? The rural isolation and lack of diverse rural retail would have driven South Dakotans to online shopping in bigger numbers before this year. If increased online shopping bears any blame for the revenue shortfall, why didn’t we expect it? Why would online shopping have surged this year to such budget-hobbling proportions? If the farm economy is down, wouldn’t farmers and the folks dependent on farmers for employment and profit be buying less stuff online just as they are buying less stuff in town?

I’m intrigued by Sam’s reminder of the good old mail-order catalog days. Can anyone find stats that tell us what percentage of retail the catalogs claimed pre-Internet?

Laurisa makes an important point: if our economic development isn’t supporting local businesses, then our Main Streets have even less wiggle room to compete against online retailers. More people move away because South Dakota makes them feel like they don’t belong here, leaving fewer people on Main Street to support local business, leaving local retailers having to pare down inventory and offer less diverse products, leaving more of those folks left in Gettysburg, Eagle Butte, and Faith to order more of their stuff online for selection and price.

Cory, I can’t find data but can only be anecdotal. I have some biz out in the country and my staffers there in recent years have noticeably upped their online purchasing, as my biz is their dropoff point and stuff comes by UPS just about every day. There doesn’t seem to be any way of tracking sales-tax-free online purchases, so I doubt that in-state analysts have any data to work from, other than other than extrapolating from the broad national trends in your graphic. From what I’m seeing I’m guessing that rural sales in SD are growing at a faster rate than nationally, for reasons that both I and Laurisa have mentioned.

Roger, I’m not sure where you get the nation that those big-ticket Farm equipment items get tagged with a sales tax: Here:

http://sdlegislature.gov/Statutes/Codified_Laws/DisplayStatute.aspx?Type=Statute&Statute=10-46-17.7

10-46-17.7. Exemption for gross receipts from sale, resale, or lease of farm machinery, attachment units, and irrigation equipment. There are exempted from the provisions of this chapter and from the tax imposed by it, gross receipts from the sale, resale, or lease of farm machinery, attachment units, and irrigation equipment used exclusively for agricultural purposes. The term, farm machinery, includes all-terrain vehicles of three or more wheels used exclusively by the purchaser for agricultural purposes on agricultural land. The purchaser shall sign and deliver to the seller a statement that the all-terrain vehicle will be used exclusively for agricultural purposes.

Source: SL 2006, ch 58, § 20.

And FWIW – here’s the long list of things exempt from sales tax in SD.

http://dor.sd.gov/Publications/2013_Session_Presentations/PDFs/SummaryofStateSalesTaxExemptions0113.pdf

The estimated amount of tax revenue in SD on exempt items = $582,243,812 per year. That’s = to about 1/3 of ALL tax revenues (not just sales) the state collects.

Cory,

2016 has been a watershed year for online sales. Black Friday online shopping increased somewhere in the neighborhood of 23% over last year.

Amazon and other online retailers now have automatic subscriptions, and wifi connected buttons which you just press when running low on laundry detergent, dish soap, toilet paper, etc. and it automatically ships more to your home.

I think South Dakota’s online sales adoption has probably increased dramatically.

But I’m not sure how large an impact it has when compared to $750,000 combines with heads. When corn & beans were good, everyone I knew upgraded. Now prices are down. There’s no reason to purchase new equipment – the stuff they have isn’t that old, and they’ve been used to making them last for 20+ years.

Richard, it’s true that farm equipment doesn’t have a “sales tax” and therefore isn’t subject to additional local taxation, but the state does have a 4.5% Excise tax on all farm equipment.

Just like you don’t pay sales tax on your car, but you do pay excise tax.

$750,000 fully loaded John Deere combine w/ heads = $33,750. Of course, that’s mitigated with trade in value, So let’s say you trade in your old combine worth $250,000.

$500,000 x 4.5% = $22,500

If we assume the median household of South Dakota pays about $600 in sales tax to the state (using the IRS sales tax calculator), each combine is worth about three dozen households.

Ag is a small percent of our population, but it’s a big part of our economy.

As for online sales…. it is something

For amazon, I live in Arizona and this is how it works. If it goes through amazon, and is delivered by the amazon fulfilling station in Phoenix I pay taxes. IF its from a company through amazon who is not in state I don’t. If it is through amazon but through lets say Kentucky I usually don’t pay taxes either.

Yes many people buy things online, its easier, its simpler and you don’t have to write a list and figure it out. But again as stated, agriculture cut backs have way more of an impact than internet sales.

Looks like CY 2015 taxable sales in SD were right at $21 billion (http://dor.sd.gov/Taxes/Business_Taxes/Statistics/2015/Calendar%20Year/CY15StateMjrGrpDiv.pdf.) If SD online purchases matched national percentages, they’d be about $210 million. How much of that is subject to sales taxes is hard to figure, but if they were all sales-tax-free (doubtful, but might as well go worst-case), the state is giving up about $9 million in sales tax revenues to online retailers. That’s nearly half the shortfall that Daugaard expects. At this point I’d say the concern is the trendline that Cory posted, which I think will continue to curve up. This is the first year, iirc, that state officials noted on-line retailing as a factor in tax receipts. It’s bound to be moreso down the road.

To Douglas Wiken’s comment, the Commerce Clause DOES NOT prevent taxes for items sold across state lines. Under Quill v. North Dakota, the US Supreme Court stated that it would require a physical presence in the state before it allowed the state to tax the sale under the Dormant Commerce Clause. That is why if you buy something online from a party that has a physical presence in South Dakota (Walmart or Barnes and Noble), you have to pay sales tax. The Quill case is an odd case, because the Supreme Court basically said that it is the wrong result under recent case law, but that it will allow for Congress to “fix it” because Congress can pass a bill authorizing states to tax under the dormant commerce clause. Congress has not “fixed” it. Justice Kennedy about 2 years ago said he wants to revisit Quill. That would be good news to the South Dakota budget, and South Dakota teachers, providers, and state employees in turn.

Long story short, there are always lots of reasons behind increases and decreases in budgets. I would note that sales tax is generally more stable than income taxes. However, set aside that debate, and South Dakota looses a lot of money, and has for a long time, for the inability to tax on sales where the company has purposely availed itself of the South Dakota market.

Relying on sales tax is highly unreliable. A three legged stool is quite stable. A state income tax would be a proper addition. Unless you spend all the money you make each year, annual personal spending fluctuates where annual taxable personal income doesn’t … if you have a good investment counselor.

@John Tristian:

“If SD online purchases matched national percentages, they’d be about $210 million. How much of that is subject to sales taxes is hard to figure, but if they were all sales-tax-free (doubtful, but might as well go worst-case)”

Why go with a “worst case scenario” since it’s obvious as I had pointed out earlier, that much of the e-commerce sales in South Dakota are taxable. 60% of the top 25 e-commerce retailers have a presence in South Dakota.

#2 WalMart

#3 Apple

#4 Staples

#5 Macy’s

#6 Home Depot

#7 Best Buy

#9 Costco

#11 Target

#12 Gap

#14 Kohls

#15 Sears

#17 Walgreens

#18 L Brands

#22 Lowes

#23 Victoria’s Secret

Well they don’t tax Amazon yet – and try as they might to force people to pay sales tax on their own, it just isn’t going to happen. Personally I believe the SCOTUS ruled on the issue long ago, so any attempt to collect sales tax on a company that doesn’t have a state presence isn’t legal anyway.

This is the new normal, and as long as they continue to try and fund our state with sales taxes, they will need to adapt to it.

Uff, da …. HOW TO SPEAK MIDWESTERN by Edward McClelland

Readers will learn the lingo of Yinzers (Pittsburghers), Cheeseheads (Wisconsinites), Baja Minnesotans (as those from the Land of 10,000 Lakes derisively call people in Iowa) and Michiganders (a coinage often attributed to Abraham Lincoln, who used it as an insult during the 1848 presidential campaign). But in addition to Midwestern, they will also pick up a good bit of Linguist.

http://www.nytimes.com/2016/12/04/books/how-to-speak-midwestern-edward-mcclellands-regional-guide.html?action=click&=&=&=&=&=&=&=&contentCollection=books&contentPlacement=1&em_pos=large&emc=edit_nn_20161206&module=package&nl=morning-briefing&nlid=72790262&pgtype=sectionfront®ion=rank&rref=collection%2Fsectioncollection%2Fbooks&version=highlights&_r=0

South Dakota government does not “lose” money it does not deserve to begin with. That is like saying a bank robber loses money because a bank has guards at its vaults. I also think Congress put in another regulation that effectively prevents taxes on internet sales. The Quill case is a strange one. It always seemed to me it was not driven by good legal arguments, but judges’ realization that their pay came from sales taxes too.

There may be problems with my idea of federal sales tax refunded to states, but it is much simpler and does not require thousands of state revenue department bureaucrats across the country. It would also be known by everybody and the rates would not change across commodities and communities. The feds could exempt groceries and drugs for example and the system would still be simple and effective.

Mr. Wiken, how about a virtual warehouse presence? South Dakota could put the School of Mines as the incubator for this project. As an example, all companies that have sales in the state of over $25,000.00 per year, would collect the sales tax for the state. The state would then break that down into city taxes where applicable to take care of that end as well. The state could then take the 35 economic development salaries and use those to fund the center of distribution of sales tax collected. The state gets its tax, the cities get theirs and the local’s feel like they are not getting the short end of the stick.

I have not seen any slow down attributed to the presidential election. Every four years during presidential elections there is a general atmosphere of uncertainty. There tends to be less investing and purchasing when there is more uncertainty. Isn’t part of this economic dip because the general state of chaos from the election?

When people feel stability again, their spending will reflect that.

o – Your posts are always pertinent and proper. Thanks for posting here.

Point taken Coyote, but somebody in Pierre thinks e-commerce sales are a significant factor. They need to be taken into account and I have no doubt they’ll become more of a factor as time goes by. FWIW, virtually everything that gets dropped at my property is from Amazon, including a desk console I got, which saved me a few bucks because my local provider was higher, on top of which I had to pay sales tax. Iirc, I saved about 30 or 40 bucks.

That Denny is going to try to convince us that our on-line shopping is ripping off the state, is just laughable. As Laurisa outlined, being a rural type state, on line shopping becomes a necessity at times. And also like Laurisa, I’m certainly not opposed to paying taxes for on line purchases that I make, however, when our republican controlled legislators continue to allow SD as a tax haven and they think my on line order of dog food is shameful? Sorry, I’ve got a big problem with that.

This is like the ole flim flam that they played with revenues for our bridges and highways. Terrible, terrible games and regressive taxes hurt so many in this state, while the wealthy live off of the rest of us.

@Dana P: “And also like Laurisa, I’m certainly not opposed to paying taxes for on line purchases that I make”

If that’s truly the case, then I expect you and Laurisa to be first in line to file your use taxes with the South Dakota Dept of Revenue. I believe you can even do it online.

Jerry, If SD gets its share of a fed sales tax based on our population, the state can then divide it up by population of counties, towns, or school districts.

What role does sales tax play on the sale of agricultural commodities? We understand that grain sold onto the commodities markets are tax exempt but, what about grain, hay and other products that are raised and sold back into the industry in the state. How much corn, as an example, is resold for hog or cattle production or manufactured into products for beef production, poultry production or even bird seed. Since the value of ag products has diminished significantly, how does that loss of income relate to less sales taxes. Just asking because some are attributing the budget shortfall to a depressed ag economy and others are blaming failure to collect sales tax on on-line purchasing. It is likely a combination of the two but.

ASK YOUR REPUBLICAN why they’ve not done this for South Dakota small businesses.

“Amazon tax” law stands in Colorado

The state is still allowed to pressure online retailers.By Mark K. Matthews

The Denver Post

WASHINGTON» The U.S. Supreme Court on Monday let stand a Colorado law that pressures online retailers to collect sales tax — a decision that could motivate other states to pass their

own “Amazon tax” measures.

The high court announced in its latest order list that it won’t hear a challenge to a February ruling by the 10th U.S. Circuit Court of Appeals, which sided with Colorado in a lawsuit from industry.

In doing so, the Supreme Court affirmed a Colorado law that compels out-of-state companies to collect sales tax from residents who make internet purchases — and one that got its nickname from the online giant Amazon.com.

“It certainly feels like validation for all the mom-and-pop businesses in Colorado who stood up in 2010 and wanted to compete on a level playing field,” said state Sen. Mike Johnston, D-Denver, one of the co-sponsors of the Colorado law. “It was nice to see the Supreme Court agree with us on what seemed so clear in 2010.”

By itself, the Colorado’s law doesn’t force online companies to act as the tax man.

Rather, it gives them a tough choice: either collect the sales tax or deal with more red tape, including additional paperwork and the requirement they

Way to simplistic Porter, here we want to blame the poor for the shortfalls. Works every time.

I know, right Jerry? You have to be South Dakota Nice to online retailers and not ask them to follow the rules,that they either collect SoDak’s rightfully due sales tax or they have to make a concerted (not just one e-mail) effort to notify all their customers in the state that they are legally obligated to pay the tax to the state. And then follow up by asking if they’ve paid it, yet. Because guilt works wonders in the prairie states but you don’t want to put a burden on Amazon’s bookkeeping. (Actually, the software is already in place. All they have to do is insert the state’s name.) This is why I pay sales tax at Amazon, even before the Fullfillment Center came to Aurora, CO.

Wait a minute! I’ve got it! Excise tax on UPS drivers!

As a farmer, mother of 4 and small business owner that does have a online website, there are many factors in this for me. We have shipped to 32 countries this year , and without online sales would not be in business anymore. If people can order the same item online from another state and not pay sales tax, I promise they would do their research to save money. I feel like this might hurt our SD online store and small businesses. I struggle to keep the doors open somedays now, so if they do this, I feel it could also hurt other aspects of small businesses. We have more sales in store and SD sales because of the internet, but could not make it work without our other states, and countries support either. My taxes would be a nightmare if we had online sales tax. I honestly don’t think it would be possible for me to do my own taxes any longer, and would have to probably get rid of one of my employees just to pay a tax person to figure it all out – and that would break my heart as they would be out a job and they are like family. One person can only do so much to help their community and still keep a business open. Times are hard for so many right now.