Last updated on 2016-01-08

At least Rep. Lance Russell (R-30/Hot Springs) is trying. Unlike Governor Dennis Daugaard, who has yet to offer clear support for his own Blue Ribbon K-12 panel’s recommendation to raise teacher pay, and who may not even discuss the single-most important potential reform of the 2016 Legislature in his budget address tomorrow, Rep. Russell is endorsing the Blue Ribbon plan to raise South Dakota’s teacher pay from last in the nation to 39th and offering a plan to appropriate the $75 million necessary to raise South Dakota’s average teacher pay from $40K to $48K.

True to conservative form, Rep. Russell refuses to raise taxes to pay teachers what they are worth. Instead, he says we can reallocate $75 million from the state lottery. Rep. Russell tells KCCR that since great Daugaard austerity of 2011, the Governor and the Legislature have added more than $300 million to other programs without restoring the hits education absorbed:

Education has lagged behind in the Governor’s budget, and for that reason I felt that a diversion of money from some of the other priorities would be more appropriate than taxing based on the citizens based on the citizens based on where we do have the money in the budget to make this thing work for the 75 [million] [Rep. Lance Russell, second audio clip, in Kevin Larsen, “SD Lawmaker Proposing Bill That Would Redirect Lottery Revenues For Teacher Pay Increases,” KCCR Radio, 2015.12.07].

We’ve heard this argument before, that South Dakotans enacted video lottery on the promise that the money would go to K-12 education, but that those darned legislators have thrown that money into other budget lines.

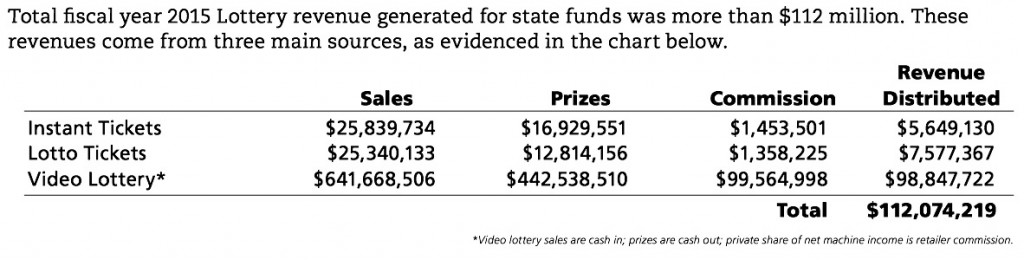

The South Dakota Lottery 2015 Annual Report shows us that in FY2015, the state lottery took in $112 million, with $99 million of that revenue coming from video lottery:

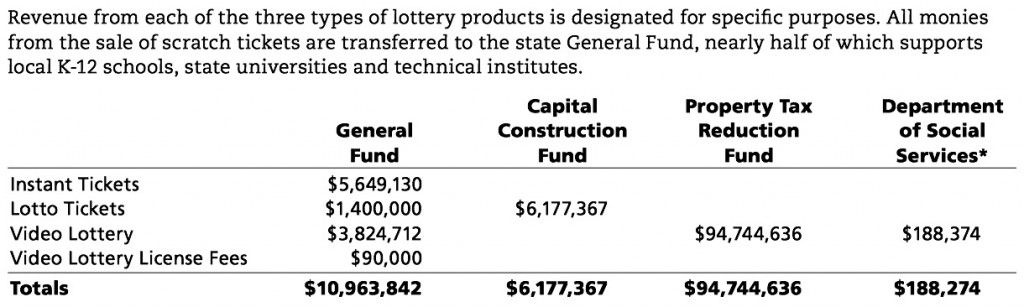

However, only 9.8% of that revenue, $11 million, went to the general fund:

And there’s the problem with Rep. Russell’s thesis that he can fund the Blue Ribbon plan by reallocating lottery revenue without raising taxes. 84.5% of FY2015 lottery revenues went to the Property Tax Reduction Fund. If Rep. Russell moves $75 million of that $95 million over to K-12 funding, he’ll need to reallocate another $75 million from some other budget line to prevent property taxes from going up. Where will that $75 million come from—this year’s $85 million road bill? (Rep. Russell did vote against that road bill.)

Rep. Russell appears ready to have that conversation about competing priorities. But maybe we could keep things simple and talk about personal fiscal priorities. Recall that South Dakotans spend triple the national average per capita on lottery. The numbers above show that, on the state’s stoking of our irrational fantasies, we shelled out $693 million to randomly redistribute $472 million of our wealth, serving little social good and promoting the social ill of gambling addiction.

Instead, Rep. Russell, how about we ban video lottery (go ahead, leave the scratch tickets, let people have a little fun) and tell South Dakotans that instead of taking $642 million out of their pockets each year, we’re going to take a measly $99 million (pick your poison—sales tax, property tax, corporate income tax, gun seller’s excise tax) and redistribute that wealth to our 9,362 teachers? We’d raise every teacher’s pay by $10,558, vault South Dakota from 51st to 26th in the nation for teacher pay, put us smack in the middle of our region for what we offer teachers (better than North Dakota, Montana, and Nebraska, still behind Iowa, Minnesota, and Wyoming), and enjoy the social benefits of better, happier teachers who redistribute their priceless wealth of knowledge and skills to our kids.

Oh, and since lottery is arguably a tax, we’d technically be raising teacher pay by cutting taxes from $642 million to $99 million. Holy cow, Lance! You can’t get more conservative than that!

This conservative plan brought to you by South Dakota’s true liberal media. You’re welcome.

Outside of addressing the income the lottery provides to bar and other establishments your plan seems workable, though it’s a shame we let our elected officials skew that lottery income away from education in the first place. Righting the ship and putting all of that money back into education or ripping it out seems prudent to me, even if it does increase property taxes.

What I like most about this article is that it is pointing out those who at least stood up and said “we need to fund education, including paying teachers.” I’d like to see a district role call of who is going to support funding education and who isn’t. After those who are trying to continue to ignore the problem come around we can argue about where the money comes from.

Be very careful how that bill might be written. Years ago, Illinois wanted to pass a state Lottery bill. The best way to sell the idea was to tell everyone that the money “would be used for education ONLY”. It passed and, true to their word, the money was used for education. However, it was later found that, for each dollar of lottery money placed into education, a dollar was taken from the education fund and put back into the general fund and used as politicians saw fit. In other words, the lottery money WAS used for education but was NOT an addition, but a REPLACEMENT. Sneaky, but it worked. But I am sure that SD pols would be much more trustworthy, right????

The idea of eliminating video lottery would have been a brilliant ballot measure on this presidential political election. This election will draw out the voters. Too bad it was not on the menu and explained as to how it is more than a thief, it is one that tears the very fabric of our social safety net. Tell the voters that the issue is not about scratch pads and lottery tickets or about Indian gambling or Deadwood, it is about the corner video machines in all the little towns across the state that deprive us all of the education benefits gambling was promised to solve.

So far Russell, May and Verchio are plodding down the road plowed by someone else: we’ll see if they can keep up.

What do you mean, Loren? That is exactly what SD did. They did it a little bit different way, but it all came out the same and they fooled the voters by cutting taxes to do it. Property taxes, that is. Of course who benefits from a property tax cut and freeze? Why the person with the most property, of course, but anyone who owns property and inhabits it. Who loses? Why renters of course, because then whenever it looks like you are going to run a little short, or are going to need more money to expand government the way Mike Rounds did, then you add a 1/2 or a 1 cent sales tax or expand the entertainment tax. That way you are assured of bleeding every last penny from those who live on their paycheck not on their dividends and their increase in the value of their portfolio.

Congratulations to Rep Russell for at least having some idea of what to try. Has anyone else stopped to realize, that the state of SD promised an increase of 3% or inflation whichever was less. But when the state cut teacher pay by 6 1/2% and then did not bother to put that back in the following year, any 3% increase in the future is .2 percentage points or 6 1/2% less than it should have been into perpetuity. And can you believe that SD still reelected those bums in 2014. I guess we have to realize that we get the government that we deserve.

Jerry, even after this year’s circulator chaos, I say the more ballot measures the merrier. Maybe Hickey and Hildebrand will add video lottery to their assault on the “poverty industry” in the 2018 cycle.

Cory:

After hearing Steve Hildebrand speak at SF Downtown Rotary yesterday, there’s no doubt that the payday lenders are just the start for him. His speech rolled payday lenders, video lottery, pawn shops, and others into a “poverty industry” that must be addressed as a whole. At the same time, wages must be raised so that desperate people aren’t seduced into using the “poverty industry”.

Hickey’s studying in Scotland (the country, not the SD town), so it’s unclear whether he’ll participate in future SD ballot measures.

What I was told about the SD lottery was that the original plan was to dedicate revenues for education. However, the education lobby didn’t want that to happen because they believed it would hurt their efforts to gain additional general fund revenues (as in, “We gave you lottery money, so leave the general fund alone!”).

There was a lag between the implementation of scratch tickets and video lottery, and many failed to see the instant popularity and huge revenue from video lottery. This made the education lobby look foolish and feel envious for a while.

The evolution of video lottery over the past 25 years has not been good for the state, regardless of how one feels about video lottery. Revenues have plateaued (meaning a decline in real dollars for early ’90s levels) while the state’s share of gross revenues has doubled. This also means that video lottery owners have seen revenues decrease. Lower operating margins mean fewer venues with more machines than in the ’90s.

There are large social costs to gambling in general and video lottery specifically, but South Dakota has managed to perpetuate the ills while simultaneously reducing the benefit to those operating the games – the state itself and video lottery owners.

Funny how we keep falling back on bad tax policy—either socially costly gambling or regressive sales tax—to fund education. Why can’t we work up a fairer scheme for obtaining revenue for education?

Because “fair” is in the eye of the beholder, and usually involves taxing either what the beholder doesn’t have or what s/he can legally avoid paying taxes on.

Michael, we’ve got ND with no sales tax on food, human labor and possibly other important basics and Montana with no sales tax. Both states appear to have healthier state and local economys including areas not stimulated by their coal and oil.

Video lottery is a tax on the math impaired.

Video lootery is a tax on the desperate.

A voluntary tax on the stupid.

a stupid tax on the involuntary.

the personal responsibility property tax credit

the personal property wealth redistribution tax.

the if-you-throw-your-money-down-a-rat-hole, don’t be a whiner tax.

I wonder if Mr. Chuck Brennan has looked into filling his new pawn shop with video lottery machines. That could bring in enough bucks to give teachers raises!

if-you-throw-your-money-into-the-general-fund-rat-hole-tax.