The 35 Chinese investors suing the State of South Dakota and South Dakota’s EB-5 czar

Joop Bollen for losing their EB-5 visa investments in Northern Beef Packers claim that the state and Bollen misrepresented the financial viability of the ill-fated Aberdeen beef plant. To substantiate this claim, the investors include in their opening complaint two exhibits, versions of the written offerings Bollen’s EB-5 management company SDRC Inc. used to recruit EB-5 investors for Northern Beef Packers:

- Exhibit 1: SDRC NBP Offering, November 15, 2009

- Exhibit 2: SDRC NBP Offering, January 10, 2010

Both offerings are about the same length, 21 pages. Exhibit 2 attaches a 44-page business plan for Northern Beef Packers.

In October 2014, I reported on some truth-stretching in the January 10, 2010, offering. Let’s similarly analyze the representations the November 15, 2009, offering made about Northern Beef Packers, which include :

The following points stand out from this summary of Northern Beef Packers:

- NBP’s “waste water treatment plant” is cited as an asset adding more value to the plant. This sewage lagoon, constructed three miles southeast of the plant, was seen by some local officials as a potential hazard and a violation of trust.

- The November 2009 offering indicates NBP would open in “Spring of 2010.” A completion date just six months away suggests the plant was almost done. NBP did not open until October 2012.

- This offering says the total plant budget, including first-year operating loss and working capital, is $94 million. By the time NBP got through its first and only year of operation, it had gobbled up $95 million in EB-5 investment out of a total of $167 million in capital gone poof in the bankrupt beef plant.

- This offering claims that “a major Asian bank’s capital arm subsidiary is providing up to USD $30 million in financing for the construction and operation of the plant….” This claim appears to refer to the weird financing deal inked by Northern Beef Packers and Epoch Star on March 18, 2010. Epoch Star was not a bank and was not owned by a bank… or so the South Dakota Division of Banking ruled on July 1, 2010 to allow Epoch Star and NBP to avoid paying bank franchise tax. According to the Division of Banking, Epoch Star was fewer than ten investors, incorporated in the British Virgin Islands as a single-purpose entity, providing NBP with a bridge loan without which the plant could not be completed.

- The offering says NBP would be the “back bone” of the South Dakota Certified™ Beef Program, which Governor Mike Rounds signed into law in 2005. This claim turned out to be quite accurate: without NBP’s output to make it sizzle, South Dakota Certified™ Beef fizzled.

- More importantly, this offering tells investors that the State of South Dakota itself “will be guaranteeing the source and age verification as well as the quality” of NBP’s product. Alongside the statement that the state and local governments were supporting the plant with over $20 million in grants, loans, and tax financing, this offering suggests to investors that they can rely on South Dakota government to keep their investment safe, just like their comfy controlled economy back home in Communist China.

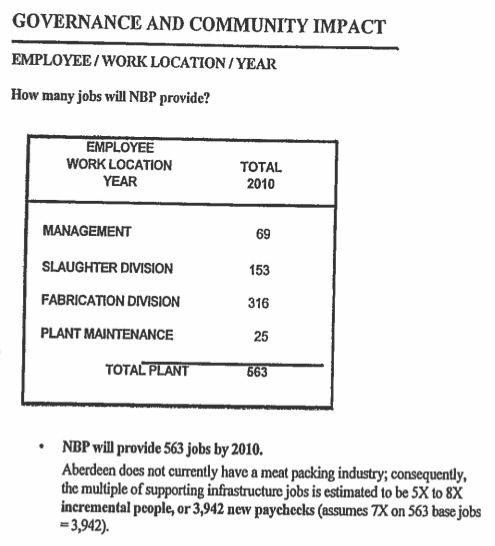

Both the November and January offerings promised that Northern Beef Packers would create 563 beef-processing jobs by 2010.

The January 2010 offering tacked on a claim that those 563 jobs would generate five to eight times as many indirect jobs in Aberdeen.

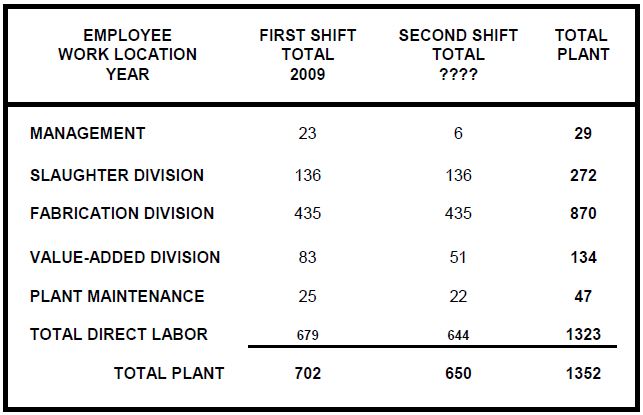

A January 2008 business plan for NBP predicted the plant would open in 2009 and hire 702 workers on first shift and maybe 650 more for second shift:

During its operation from October 2012 until bankruptcy in July 2013, Northern Beef Packers employed at most 400-some workers. As it restarted the beef production line for test runs in October, NBP’s new owners, New Angus, had hired 122 people.

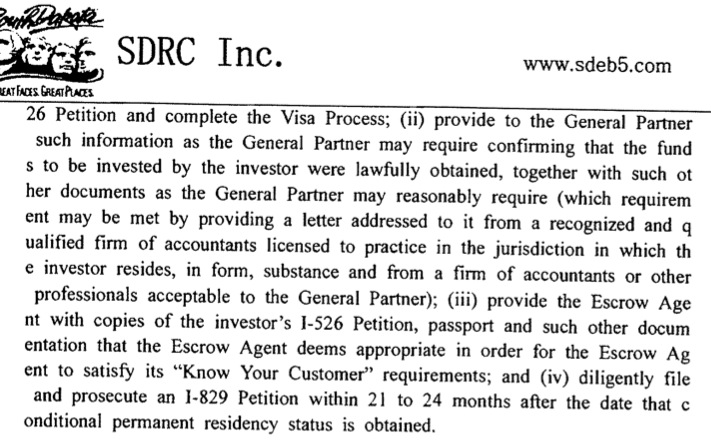

The court will have to sort out hindsight from reasonable statements at the time to determine whether Joop Bollen and his EB-5 team told the Chinese investors whoppers about Northern Beef Packers’ financial position and prospects. Maybe if the Chinese investors had paid attention to small details, they never would have gotten into this mess. For one thing, the November 2009 and January 2010 offerings look like they were typed up by third graders. Check out this blessed abandonment of hyphens and sensible line breaks:

I know I make my share of typos and format flops in my writing, but holy cow, if I’m asking someone for $530,000, I will proofread a couple-three times! If a guy can’t take the time to realize that his computer has fouled the line breaks on an entire page of a prospectus being mailed out to high rollers, can investors trust that guy to run a beef plant right?

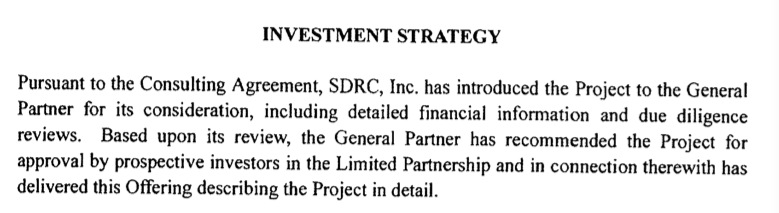

Attentive investors might also have caught this hilariously self-referential paragraph masquerading as an investment strategy:

Remember that SDRC Inc. is Joop Bollen. The “General Partner” is SDIF LLC 6, which is an affiliate of the “Promoter,” SDRC Inc. The “Project” is Northern Beef Packers, which was being run in 2009 by Joop Bollen. Properly translate this “investment strategy,” and you get, Joop introduced Joop’s project to Joop, and Joop recommended that investors invest in Joop.

And that, my friends, is why Joop and the state are in court.

Northern Beef Packers, a ONE ACT PLAY (farcical): (opening setting – Aberdeen, SD) “mooing sounds”

which came 1st? the NBP project, or the EB5 investors? Joop had EB5 investors wanting to come to America and by gum, he was going to create a SD Beef and apple pie project to burn thru and generate fees for joop/sveen’s pocketbooks, I surmise.

ACT I. The bridge loan (well, SDBC would eventually rule it merely a financial “accommodation” not being in the business of money lending in SD)

Joop: we have even more EB5 investors and we want those fees so lets keep this failing dream in the pipe a little longer. I met a guy on the plane who talked my ear off. he lives in Cayman Islands, on the other side of Cuba. He manages an investment fund (of less than 10 investors-some SEC rule I suppose) incorporated there, of course, called Pine Street, because he lives on Pine Street? that is it’s “sole office” says SDBC.

Wait, it gets better. The fund is owned by Epoch Star, a British Virgin Islands single purpose entity with its “sole office” there (way,way east of Puerto Rico), again determined by SDBC. He manages Epoch too.

SDBC commissioner: actually the manager for both is Anvil Asia, a professional investment fund manager incorporated in Cayman Islands, too (as an arm of Industrial Bank of China, according to reporter Denise Ross). So Anvil manages both Epoch (the BVI entity) which NBP will eventually purchase, and Pine Street (the Caymans corporation). to be clear!

Joop: Eventually some lawyer says a loan in SD this big might be governed by banking laws. No problem. I work(ed) for the Governor (Mike Rounds, R.). My direct boss is(was) in his cabinet, the Tourism/Economic Develepment Secretary or some such title. no way do any of these island “thingees” do business in the USA, except that Epoch will make a $30 mill bridge loan to NBP and in the process will be purchased by NBP from SD.

And no way-no way are any of Pine Street’s “less than 10” investors in the “sole business of money lending”. in the USA. except to NBP. in SD! same goes for Epoch or Anvil (China Industrial Bank)! no way, says mike rounds’ (R.) banking commission (SDBC).

commissioner: [on the record] can’t do better than that, huh? unanimous vote by the banking commission (grins at joop’s lawyer)! (calls governor back at the office: “let’s meet for drinks?!”)

INTERMISSION

ACT II.

2008 called for 2 shifts of workers.

2010 called for one shift of workers. Did they downsize the plant in between times?

If they presented it as a sound investment and needed 29% interest from Epoch who they said was Asian and was actually Caribean, then there were inconsistencies which a good investor would have caught and a good seller would have found a better way. So there were mistakes on both sides but if the presentation of the investment covered up the problems, they could get sued quite badly.

Also, the way the court sold the property had no concern for the investors or even the mechanics lien holders which may have been illegal on the part of the courts. The mechanics liens should have preference over the investors and that is not how it sold but that type of sale was approved by the court.

THERE IS a second act!

Denise Ross character played by Julia Roberts:

“Gov. Rounds has NO recollection of this meeting ever taking place,” wrote campaign spokesman Mitch Krebs in an email to The Daily Republic.

David Kang’s Maverick Spade (NOT a BVI or Cayman Islands creative entity!!) had the contract to revitalize NBP’s financials to attract further investors.

His to story casts doubt on statements Rounds made during an interview with The Daily Republic in March 2014, when he said the state had NO involvement in securing the $30 million needed to keep Northern Beef afloat.

Rounds said the state’s SOLE involvement was the South Dakota Banking Commission’s approval of the deal on June 29, 2010, when the commission WAIVED the requirement for a banking license and taxes.

“That’s the extent of the state’s involvement with it,” Rounds said in March. “That’s the END of it. There’s NO connection.”

(my dramatic emphasis)

there may be further acts too when denise gets the axe, along with democrat, Kathy Tyler (if she can be properly cast. ideas?)

So, to recap, Julia Roberts:

Dave met then-Gov. Mike Rounds during a meeting in the South Dakota Capitol in Pierre…run by Richard Benda, Rounds’ cabinet secretary in charge of economic development who died almost a year ago — Oct. 20, 2013 — in what officials have ruled a suicide.

In addition to himself, Kang said Benda, Bollen, Park, others from the Hanul law firm and David Palmer, then the CEO of Northern Beef Packers, attended the meeting in the Capitol.

“I’m not sure whose office it was, but Benda was running the meeting,” Kang said.–Benda’s office was located in a building nearby–not in the Capitol itself.

Kang described Rounds’ involvement in the meeting as a “meet-and-greet” with handshakes and introductions, with Rounds departing before substantive discussions began. He said Benda introduced those present to Rounds.

“Benda coordinated the meeting,” Kang said. “The main focus of the project was the Certified Beef program, so ranchers in South Dakota didn’t have to keep on shipping cattle to Texas or Oklahoma or so forth.”

Kang referred to South Dakota Certified Beef, a key initiative of the Rounds administration launched shortly after he took office in 2003.

Senator Rounds: “I did not have sex with that woman…(pointing at the camera)”.

(to be continued)

According to EB-5 data recently posted on the Rapid City Journal, based on 1002 immigrant petitions submitted by SDRC multiplied by $30,000 fees that would be $30,060,000.00

Based on 702 approved applications at $500,000.00 for a total of $352,500,000.00

Someone is doing some serious bait and switch!!

So I agree with Joop Bollen, let’s not politicize this, but just get the TRUTH out. And let’s start with Joop Bollen!

Yes it’s a wonderful program, but for whom?!?