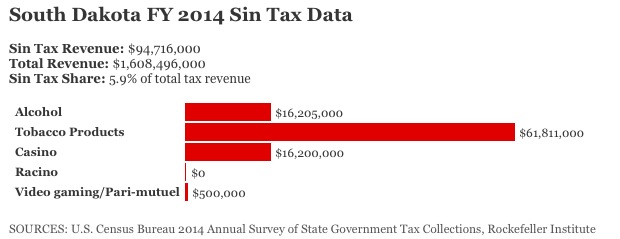

South Dakota is not in the Top Ten for states relying on sin taxes. In FY 2014, we were #11:

- Rhode Island: 15.9% of state revenue

- Nevada: 14.8%

- West Virginia: 11.5%

- New Hampshire: 9.9%

- Delaware: 9.4%

- Louisiana: 9.0%

- Pennsylvania: 8.0%

- Indiana: 6.8%

- Iowa: 6.6%

- Montana: 6.5%

- South Dakota: 5.9%

Nationally, sin taxes—revenue from alcohol, tobacco, and gambling—produced 3.7% of all state revenue in FY 2014 ($32.3 billion out of $865.8 billion). Governing notes that tobacco and gambling don’t have great prospects for growth:

Cigarette taxes aren’t a promising long-term source of revenue, though, as consumption has been declining for years and tax hikes often don’t raise as much revenue as expected.

Although more casinos continue to open in different parts of the country, gambling doesn’t represent a fast-growing revenue source either. Real tax revenues from commercial casinos were flat last fiscal year before falling slightly over the prior year, according to the Rockefeller Institute of Government. Lucy Dadayan, a Rockefeller policy analyst, said she expects gambling collections to grow at a much slower pace than expenditures and other sources of revenue. When states do take in more gambling-related revenues, she said, much of it results from revenue shifts across state borders or different forms of gambling [Mike Maciag, “The States Most Dependent on Sin Taxes,” Governing, 2015.08.21].

Our friends in Minnesota rely on sin taxes for just 2.9% of their state budget. But interestingly, when I glance at population, I find that Minnesota generates $122 in sin taxes per capita, while South Dakota generates $111 in sin taxes per capita… which means either that Minnesotans are more sinful than South Dakotans or that we aren’t as serious as our neighbors about making people pay for the social impacts of their sins.

Our county budgets should become more reliant on sin taxes to cover the criminal justice expenses counties are saddled with. Counties should get a share of alcohol taxes.

How much does it cost counties to pay for non reimbursed medical expenses?

Jerry, the counties place medical liens against people who received medical care but were without the resources to pay the hospitals and medical providers, and ineligible for Medicaid (Had SD accepted the ACA Medicaid expansion virtually all these folks would have been eligible for full coverage by Medicaid). Figures provided by the auditor’s office in Pennington County indicate uncollected medical liens at well over $1 million dollars for medical costs from 2010 to 2013, and total approximately $7 million from 1995 through 2013.

The funds used to pay these bills came exclusively from Pennington County property tax revenue, and will continue to come from such property taxes as long as SD continues to reject the ACA Medicaid expansion. The chance of the County actually being reimbursed by our low income families by paying off the liens is pretty much “none” or “zilch.”

Each County keeps these records and this information should be quickly available at each counties’ auditor’s office. Perhaps Commissioner Barth could access such information concerning Minnehaha County, which I speculate likely has medical liens equal to or greater than those in Pennington County.

well stated bcb.

republicans in SD spend $30,000 a year from gambling revenues cory summarized a month or so ago, for the purpose of dealng with gambling addiction. who was the single lucky addict that got some medical care last year? 28 day rehabilitation often rises to about that amount for an individual.

just as ludicrous was Trump’s bellicose defense at the debate last week against his 4 bankruptcies, this while republicans have complained long and loudly that irresponsible middle class borrowers brought down the economy pre-2008 so that banks and wall street had to be bailed out. economists say failing to hand the middle class borrowers a life ring stalled the entire economy’s recovery significantly. And we are all aware that wall street has surged in most if not all metrics.

bailouts for wall street, bankruptcy protection for trump … and ruined credit for students, credit card holders and middle class underwater homeowners. did i get that about right?

and, fwiw, right here at home, janklow had a lot to do with kick-starting citibank with and with the cultivation and protection of the national credit card industry. NSU, despite it’s EB5 debacle, is ironically a national center for homeland security of the financial infrastructure. The credit or financial industry is considered the state’s largest industry, above ag or tourism.

I hate the way this state relies on the “sins” of our population to build and fix our roads, and pay for education. These are thing that are part of the “commons”, meaning we all commonly use them and rely on them. Should we all not chip in and pay our part or should we leave those things up to the “sinners” to pay? If we as a State are going to continue to prey on the sinners to cover the commons we should at least declare a Smokers, Gamblers, and Drinkers Tax Appreciation Day to thank the sinners for paying for what we are unwilling to pay for but are very willing to use.

We need to tax people who take out Pay Day loans. Not put the loan people out of business or limit their vig, we need to tax the hell out of the idiots who take out those loans.

This will make Mr. Hickey and the bleeding hearts happy, because it will make these loans unaffordable, and it will fatten the purse of the government so we can use that money to give good teachers raises.

The morons will always be morons, the profits go to the best teachers in the state, and we squeeze the loan sharks a bit. All for the betterment of the good teachers with no cost to the regular citizens who work hard for a living and don’t do dumb things.

“Minnesotans are more sinful than South Dakotans or that we aren’t as serious as our neighbors about making people pay for the social impacts of their sins.”

I’d say it’s a little of both. There is plenty of Sin in Minn.

Grudz, remind me: do you oppose the 36% interest rate cap? If so, how about a sin tax on usury: for every percentage point above 36%, lenders have to pay a tax of (rate-36%)/rate on all interest collected? Charge 50% APR, pay 28% tax on all interest to the state. Charge 100% APR, pay 64% tax. Charge 500% payday lender APR, pay 92.8% tax.

Or instead of complicating things with math, how about we just say some sins, like taking advantage of Rachel, will not be allowed or used as a basis for funding public goods?