Last updated on 2023-10-03

I’m having lots of fun ridiculing Governor Kristi Noem for being as ineffective as South Dakota Democrats in repealing our unusual and immoral sales tax on food. Maybe less effective: last year, a food-tax repeal made it out of the House despite the Governor’s opposition; this year, with Noem herself testifying for repealing the food tax, the proposal failed in committee, before even getting a floor vote.

But let’s not let that fun obscure the fact that, on the policy itself, Noem is right. Eliminating the food tax would provide more relief from inflation to more people who need that relief than any of the competing proposals the House and Senate are considering.

The $425 property tax credit the Senate is considering for homeowners in House Bill 1141 would only benefit homeowners. The credit wouldn’t extend to rental properties, so renters (32% of households in South Dakota) would get nothing from HB 1141.

The 0.3-percentage-point decrease in the state sales tax rate that the House is offering in House Bill 1137 would put some money back in the pockets of every South Dakotan who buys stuff. But HB 1137 would give more tax savings to the tourist who goes out for an extravagant restaurant supper and fancy whiskeys than to the local road worker who can’t afford to go out and is having a bologna-cheese sandwich, a banana, and a glass of water. HB 1137 would give more tax savings to folks whose finances are strong enough that they can keep buying luxury items than to low-income folks who are cutting back on buying the basics that are eating up their entire paychecks.

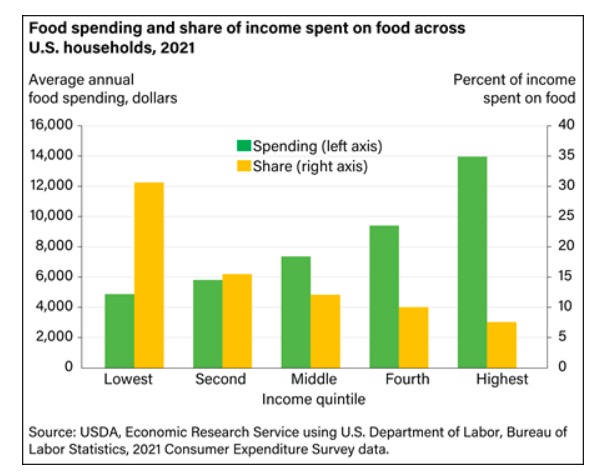

Repealing the food tax concentrates relief on folks who need it most, low-income folks who spend a larger percentage of their income on food.

The lowest-earning fifth of families spend 30.6% of their income on food. The highest-earning fifth spend 7.6% of their income on food. Higher food prices have a far more painful impact on families that are already spending nearly a third of their very tight budgets on food than on families that are spending less than a tenth of their income on food. Reducing the price of food by eliminating the food tax gives meaningful relief to families struggling to afford food and fritters away less of that relief on the things rich families are buying with the other 92% of their income.

Noem originally framed the food-tax repeal as “the biggest way… that we can help South Dakotans tackle the challenge of Joe Biden’s inflation.” She’s not right about inflation belonging to the President or stemming primarily from his policies, but she is right that repealing the food tax provides the best relief from rising prices to the people who need that relief the most.

If only we had a Governor who was good at making that argument….

Just received my REAL ESTATE ASSESSMENT NOTICE 2023. The Republican tax and spend county commissioners jacked up my assessment 19.39%. Nothing changed here: no building permits, no paved driveway, no replaced curled 28 year old linoleum, no 3d bedroom or 3d bathroom in this modest 2×2 cabin, no county road service (HOA dues pay for the roads which adjoin the town), no county/city water/sewer or trash service.

Perhaps that’s how they think they need to pay for their new jail and “law enforcement center” – temples to authoritarianism in the most incarcerated nation in the world.

The republican county commissioners and legislators are out of control.

https://www.dakotanewsnow.com/2023/02/09/homeowners-inquire-about-property-tax-spike/

Yet, the SD moron voters continue electing the same tax and spend republican morons who act as if Bush/Cheney/Trump spending doesn’t matter.

24.67% here, I suppose inflation is the cause. That, and the fact that politicians love to spend other people’s money.

The food that poor people buy is usually not the same food either. It leads to weight gain, too much salt, just generally awful health problems that Republicans then use to justify their treatment of poor people. It’s a vicious cycle.

Sorry to be pedantic here but a property tax assessment is not a property tax bill. The asessment is a reflection of the property’s market value. Large increases in assessment are an indication of rising property values. When the budgets are decided the mill levies will be determined and actual taxes to be paid will be calculated. In all likelihood property taxes will go up, it is unlikely they will go up 24.67% or 19.39%

Property taxes will likely increase, though as Nick points out, not at the same rate as the assessed values, and eat into the Senate’s proposed credit just as inflation will eat up some or all of the relief offered by the food-tax repeal. Both measures offer lower taxes than would otherwise accrue, but the food tax repeal better targets the relief.

As Mark reminds us, economizing on the household food budget means buying crappier food. Eliminating the food tax doesn’t cure the problem, but it gives shoppers a little more budgetary room to buy higher-quality food.

John, that increase is due to a SD law (and which party controls the passage of laws in SD again??) requiring counties to assess property values at 100% of the current market value. Market values go up – so does your ASSESSED VALUE. It’s a change form days past. Taxes are still charged on about 85% of that market value (in my case – I’ve calculated about 79%). Your county commissioners and pother county employees have ZERO control over that change in value. None. Place the responsibility where it belongs, not where Betty Otten wants you to think it is as she prepares to run for a commission seat.

Lest we forget Governor Janklow’s property tax relief: My household continues to benefit from it every year about $800.

My point being that we already receive property tax relief. It’s time for food tax relief now.

If, IF we were truly serious about property tax relief, food tax relief, sales tax relief, and responsible funding of the social safety net and responsible government investment, we would be talking a progressive income tax and elimination of the regressive other taxes.

Richard, Nick and the link from John are all correct. Janklow’s tax freeze set this all in motion with gross taxes charged by each taxing authority (schools, county, city township, fire district etc),only allowed to be increased by the Consumer Price Index CPI in any one year. If any of those entities wanted more than the CPI increase they had to Opt Out. Opt out tax amounts can not increase with CPI. Originally opt out amounts were permanent increases for the entities but now they have a sunset provision.

Increases in assessments from inflation or new construction to the total valuation within a school, county ,district etc have zero impact to the taxes that can be charged. Total entity taxes charged divided by total entity assessments equals a composite levy which is then applied to each individual taxpayer. This is where the county equalization gets involved as they are to keep track of how much new growth is happening, how many new improvements have been made, what the local market values have done. Often in most counties this is a rolling project where they may focus on small town structures one year, small acreages another, lake property still another, farmland, rural farm homes another. Unfortunately it depends on which group you are in for that year, because almost always they will see an increase relative to all the other property and it looks huge because either they had been sliding along for a few years and had to catchup and then don’t realize it may be several years before they get any more increases other than the small CPI.

One argument made for some big industrial, commercial, dairy CAFO etc is how much more taxes it will bring to the entity. IT DOESN’T. It will not provide more tax dollars for anything, (roads, schools, law enforcement). The only thing it does is make your own taxes a little less as they begin to share in paying for them, UNLESS your county wants to give them a free ride for several years and they don’t have to pay at all.

Consider this: Everyone must eat, not everyone has a property tax bill… renters, elderly in care, etc. Food tax relief seems most across the board for everyone… other taxation modifications affect other levels of individuals.

Thank you Mr Nemec, Mr Schriever and RS. Yes the Director of Equalization is mandated by statue statute to asses properties at least 85% of full and true value. Legislatures write and or amend laws, they could change the formula if they wanted to. HB 1141 places additional work on the County Auditors during a time when in some years they are very busy preparing for an election. This is another example on how out of touch our Legislatures are. It would also be interesting to know how many of the Legislatures will double dip into this property tax rebate as some have dual residences and you can bet one is owner occupied in a spouses name :-/

Food taxes aside, the single largest source of potential revenue – the 69 billion dollars (minimum) socked away in South Dakota (Protected) Trusts – remain sacred dollars. A state tax of only 0.625% on these sacred investments would yield at minimum – hundreds of millions of dollars to SD taxpayers. But to even suggest such a heresy will incite our lawmakers to start an inquisition. It is much easier to tax the food of our citizens than to assess a penny from out of state carpetbaggers.

Do we know how much of those billions stashed in the various trusts are from China or other “prohibited nations”?

Curt – “Someone” does.

We should not be taxing people on their hard-earned savings, which were already taxed.

If it was earned in South Dakota and saved they never paid taxes to SD. If it was earned in another state, SD loves taxing tourists. Just saying.

Noem chose to jump on the food-tax-reduction bandwagon offered by Dems for years just before the election to increase her share of the votes, then abandoned the cause until just before the end of the session when it is probably too late to let that be a priority in the legislature. Promisse anything but deliver as little as possible while getting national news for the more preposterous suggested reforms. Crazy!

Taxes are the legislators never saying they’re sorry.

The D and R parties bigots show a lot more concern about their budget revenue numbers than they care about the average guy or gal in Aberdeen or on the res.

The Legislature should be filled with people whose main concern is, how can we shrink the budget 1% a year, and how can the government actually act and perform a good example every day.

We know the D and R guys are playing at governing and talking trash of each other.

We should know, we are the True Governors, we know the idiot parties don’t deliver. We Governors know lower taxes is best, and you can’t make the people prosperous by incarcerating 2x what North Dakota does.

True Governors, rule your day! Let’s get R and D Governors and legislators retired permanently. We can show the world We govern best!

grudznick, I contest your assertion that those trust “savings” have been taxed already. Those fellows who have the wherewithal to be hiding away their funds in little ol’ SD certainly have the wherewithal to have hidden their fortunes along the way from the tax man previous to this moment as well. We are only the most recent stop in a long tax avoidance train. Dynastic wealth is very bad; the French rolled out the guillotines to make that very point once.

You know the old sayings, Mr. O:

One does not build himself up by begrudging another their good fortune.

Jealousy is a green eyed demon with long eyelashes.

Envy is the biscuit of the devil.

You willfully misunderstand, my dear Grudznick. I look out not for myself, but for my neighbors who are in need — a need I find myself incapable of meeting with even my middle-class means. Our society needs the fairness of the days that were great – the Great Society when interstate highways were built, national defense was assured, unions rose, and the top tax rate was 90% — that’s when America was GREAT. Then those foolish Republicans chipped away at the basic tenant of fairness in taxes to undermine the whole system. I do not envy; I morn for the greatness lost.

I am paid to willfully misunderstand, Mr. O.

And a credit to your profession you are, my dear grudznick!

Grudzilla finally admits he is a paid troll? Will wonders never cease?