The South Dakota Retirement System lost money in Fiscal Year 2022, just like pretty much everyone else playing the stock market. But South Dakota’s esteemed pension system managed not to lose as much value as other investors.

Reporting yesterday to the Legislative Executive Board, the South Dakota Investment Council said SDRS investments returned –0.69% for the budget year ending June 30, 2022. That’s a disappointment compared to last year’s 22% returns. However, we stayed ahead of other losers. SDIC estimates that state pensions in general returned –2.97%; the capital market benchmark was –13.02%.

This dip does not negate the state retirement fund’s strong long-term average annual returns. Counting FY2022, SDRS has produced annual return rates of 6.86% over the last five years, 8.95% over the last ten, and 8.35% over the last twenty.

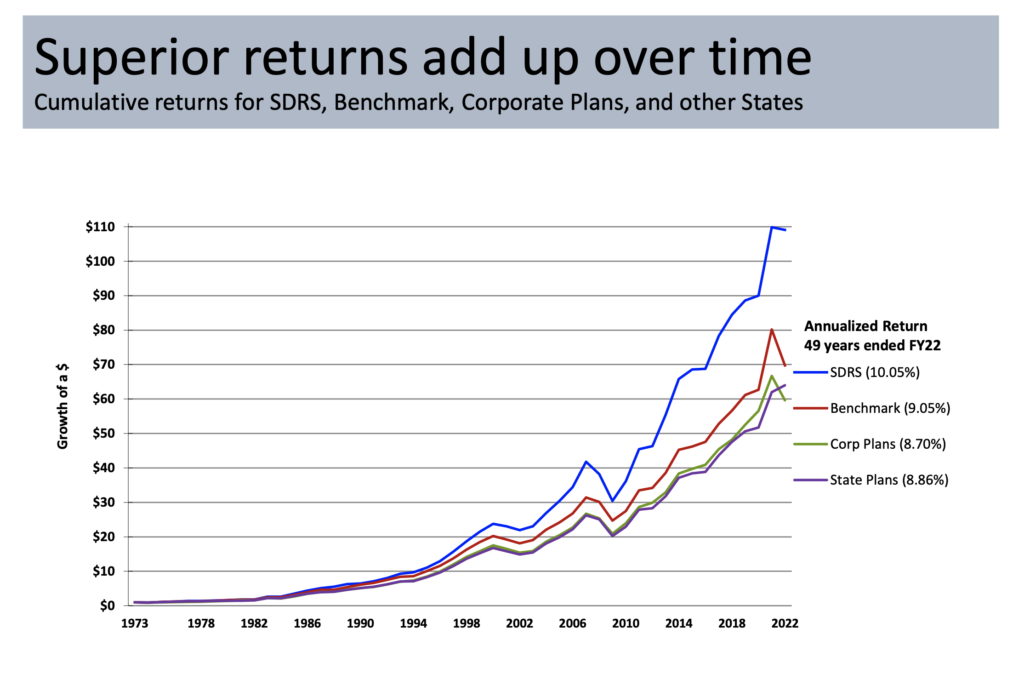

Since its inception under the wise leadership of South Dakota’s last Democratic Governor, Richard Kneip, SDRS has turned every founding dollar into over $100. Under other comparable market returns, those Kneip start bucks would have grown to less than $70:

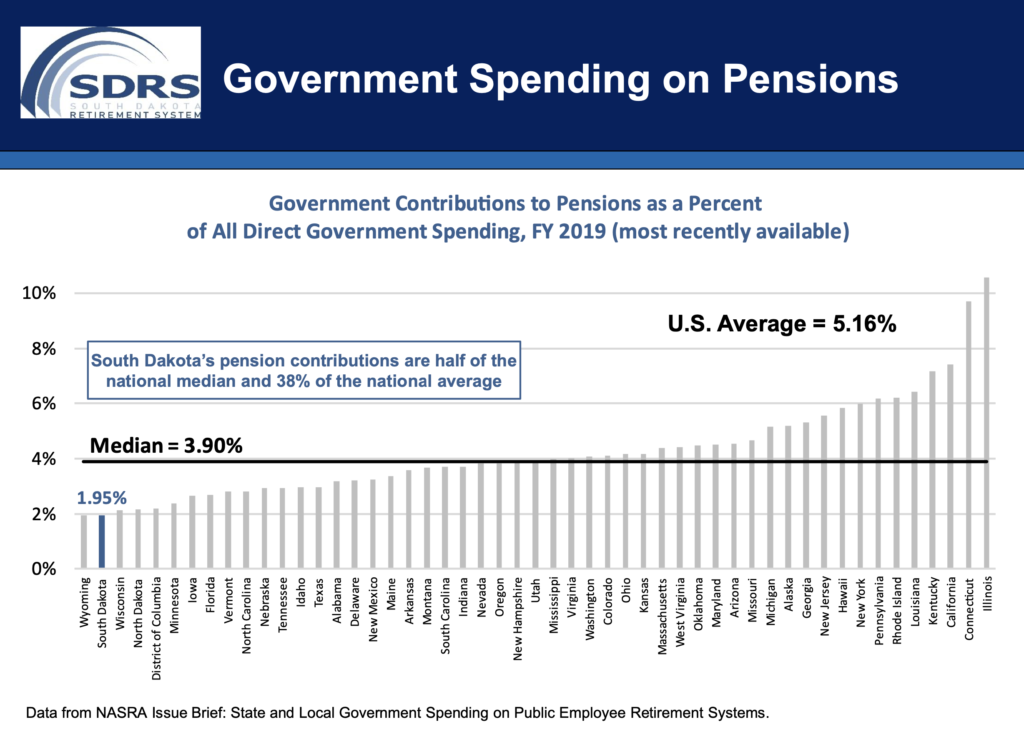

South Dakota is getting these returns for super cheap. According to the SDRS update presented to the Executive Board yesterday, South Dakota’s steady 6% contribution rate to employee pensions is well below the average employer contribution rate, which climbed from 12.9% in 2015 to 14.9% in 2021. In FY 2019 (the most recent year with complete data available), the state’s pension contributions constituted only 1.95% of all direct state government spending. Only Wyoming contributed less to pensions as a percentage of state spending:

SDRS says inflation is taking a toll on member benefits. In July, SDRS gave retirees a 3.5% cost-of-living adjustment, below the 5.92% inflation rate SDRS reports. SDRS says 35% of beneficiaries have seen inflation outpace their cumulative COLAs. SDRS predicts the maximum COLA it will be able to offer next July will be 2%, again falling short of projected inflation of 6%, bringing the number of beneficiaries seeing inflation outpace cumulative COLAs will rise to 65%.

Our stock market has “players”, and our stock market has “investors”. Never buy a stock you wouldn’t keep for ten years. – Warren Buffett

America is at peace. It’s a rare thing. There are “peacetime dividends” to be collected.

Let’s enjoy peacetime.

Republican war mongers are waiting to pounce on the fantastic fears many Americans digest like carbohydrates.

I like the ten-year advice. Place your bets and stick with them.

Mr. H has a dog in this fight to argue with the RS of SD. That’s not a bad thing, but he should go to the legislatures and testify. grudznick doesn’t understand the point of regurgitating the Republican fellow running that show slides other than to point out that Dick Kniep was a Democrat, and one that would fit nicely with moderates today (outside of his religion and anti-prophylactic beliefs. He still has progeny who are Republicans.

grudz, as usual you are pointless.

The South Dakota Investment Board and the State Employees Retirement System are examples of continuing contributions to the welfare of the state sent forward by Governor Kneip’s reorganization of state government. I suppose William Farber, PH.D had a good deal to do with it as well. Kniep was a fiscally conservative Democrat whose advocacy came one vote shy of instituting an income tax in South Dakota. His reorganization of state government was a historic achievement.