Ask farmers if they are better off under President Joe Biden than they were a year ago, and the majority, if they can take off their self-destructive, self-delusional red caps for a moment, will have to say yup!

At least that’s what their bankers told the Federal Reserve Bank of Minneapolis in its Q3 agricultural credit conditions survey:

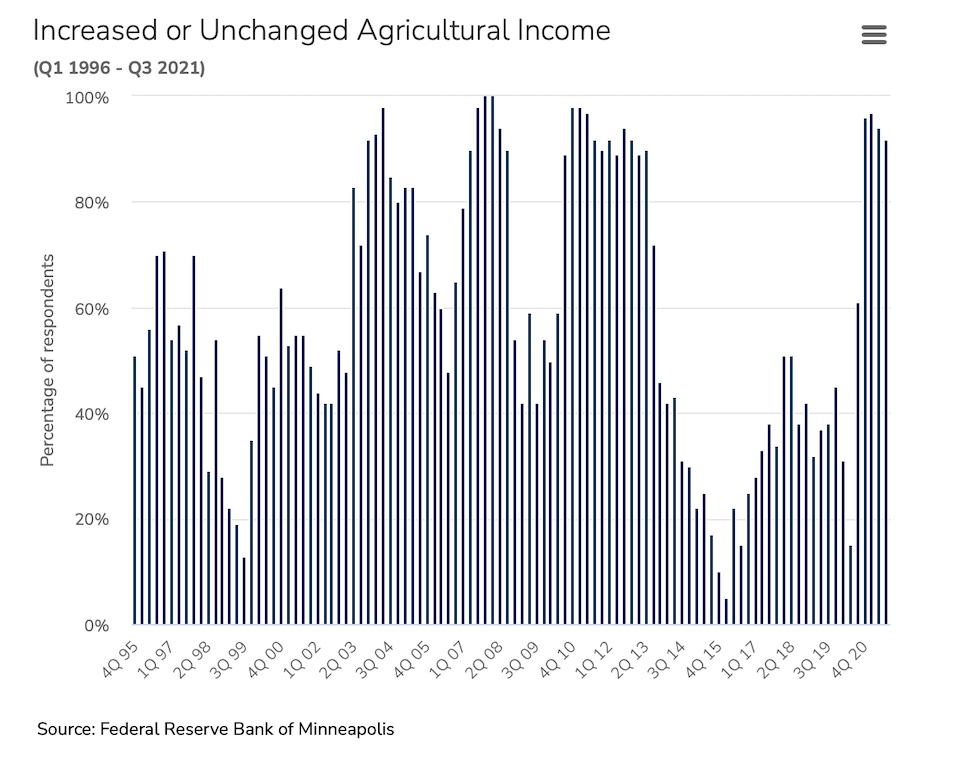

Several commenters noted that as a result of supply-chain disruptions, “high input costs are a concern,” as a South Dakota respondent noted. Still, on balance, crop prices were driving income growth, as 71 percent of district lenders surveyed in the third quarter said incomes increased from a year earlier, while another 21 percent reported no change (see chart). Regarding spending by farm households, a roughly even proportion reported that it increased as reported no change. The breakdown for capital spending was similar, with a slightly higher proportion reporting increased spending on buildings and equipment than reporting steady spending from a year ago [Joe Mahon, “Even with Severe Drought and Supply Chain Woes, Farms Remain in Good Financial Shape,” Federal Reserve Bank of Minneapolis, 2021.11.17].

But what about the drought? Didn’t all those hot dry days fry crops and farm income?

The October survey asked lenders a special question about the effects on farm finances of the worst drought the district has seen in more than 30 years. Most lenders—57 percent—reported that the drought had a “modest negative impact,” with an additional 21 percent reporting a severe negative impact. A modest or significantly positive impact was reported by 13 percent of survey respondents, with 9 percent reporting no impact.

Comments on the survey also reflected this story, though several noted that the overall impact of drought was still unknown at the time of the survey. Livestock producers suffered the worst impacts of drought because of its effects on hay availability, leading a South Dakota banker to predict, “We will see cattle numbers down because of the drought.” Others reported that producers were cutting corn for silage due to lack of hay. Regionally, the effects varied greatly, with the hardest-hit parts of Montana and North Dakota suffering the worst, while respondents in much of Minnesota and Wisconsin noted that crops fared better than expected. But even in one of the driest parts of North Dakota, a lender commented, “We are harvesting an above-to-average crop with better than average prices; for the most part, our farmers are having a good year” [Mahon, 2021.11.17].

Higher incomes mean more farmers buying more tractors this quarter:

“With the improved profits, I expect many of my customers to start upgrading equipment,” reported a banker in Minnesota. Those expectations appeared to be shared widely, as 58 percent of survey respondents expected farm capital spending to increase in the final three months of 2021. Across the district, two-thirds of lenders expected farm incomes to increase in the fourth quarter, compared with 13 percent who expected decreased incomes. The forecast for capital spending was up as well, with 49 percent of respondents expecting increases and 45 percent expecting no change [Mahon, 2021.11.17].

Farmers with fatter harvest checks may have to wait a few months to get those new tractors as manufacturers recover from a shortage that they themselves set in motion back when Biden was Vice-President:

Actually, the current iron famine has been years in the making with the shortage stage already being set in 2013.

Demand for new machinery collapsed then due to falling commodity prices. In response, manufacturers pared back machinery production.

At the same time, dealers began to suffer an abundance of used late-model machinery that had come in on trade with brisk sales from the previous five years. Companies aggressively worked to rid themselves of this used surplus by arming dealers with buyer incentive programs that slashed asking prices, offered no- or low-interest loans, and extended warranty coverage through attractive certified pre-owned programs.

The carrots worked: Buyers consumed the glut of used iron. This drew buyers’ attention away from new iron, further eroding already sluggish sales. The industry settled in and kept its facilities at a simmer, turning out new machinery as demand warranted. This shortfall in new machinery sales threatened the future supply of used equipment even further [Dave Mowitz, “What Led to the Machinery Shortage of 2021 and What to Expect for 2022,” Successful Farming, 2021.11.19].

Then came coronavirus and the Texas freeze kinking the supply chain. But fear not: the market will solve:

Manufacturers and dealers, starved of sales since 2013, are hungry to meet demand. Already an increasing amount of new iron is showing up at dealerships.

At press time, sales of combines had grown 14% since the first of the year, 100-plus-hp. tractors 27%, and four-wheel-drive (4WD) tractors skyrocketed at nearly 40%.

“True, our lots are usually full this time of year,” observes Neil Messick at Messick’s Equipment in Pennsylvania. “We do have some things in stock like large New Holland tractors. But other equipment such as small tractors, planters, loader attachments, and UTVs are still in short supply.”

“Although equipment availability will be tight you have a good chance at meeting new machinery needs by next spring if you preorder equipment now,” advises Gary Vahrenberg of Vahrenberg Implement in Higginsville, Missouri. “Many manufacturers like AGCO [Vahrenberg Implement sells Massey Ferguson tractors] are putting a priority on purchase orders over dealer stock [floor plan] orders” [Mowitz, 2021.11.19].

As of November 21, 93% of South Dakota’s corn was harvested, behind last year’s 99% but ahead of the five-year average of 93%. We’re heading into winter with 69% of fields holding adequate or surplus topsoil moisture and 56% with adequate or surplus subsoil moisture. However, pasture and range conditions are 29% very poor, 38% poor, 23% fair, 8% good, and 2% excellent.

The grassland fire danger index will reach the high and very high categories again today for much of Kristi Noem’s failed red state; snowpack and water supplies in the upper Missouri River basin are at historic lows yet banksters in farm country continue to enslave equipment buyers. That’s not self-reliance; it’s moral hazard.

Farmers used to be more Democratic, now they all want to be ranchers.

Idaho is drinking our milkshake. https://www.idahofb.org/News-Media/2021/09/idaho-cloud-seeding-program-could

https://www.argusleader.com/story/news/business-journal/2021/11/26/south-dakota-land-values-rising-farmland-sells-12-000-acre/8739827002/

Land is being sold at high prices in South Duhkota and speculator/investor only got one tract, sounds like.

Ranchers are just failed farmers. Small farmers once took care of their property, grew crops to feed their families and doctored their livestock, planted windbreaks, practiced crop rotation and soil regeneration with manure and tilled in immature cover crops, and worked and thought hard about how to sustain their farm, family, and animals.

Ranchers let unattended sheep, cattle, and horses denude their property and neighbor’s (sorry about the fence, no hard feelings, pity about your garden, b*tch) and grazing leases and get subsidized by the gummint for being lazy Reptilians.

Oil dropped 13% on news of new covid variant. I heard #1 diesel is around $5 a gallon.

Commodity prices cratered during the Trump years because of the idiotic Trump trade war with China. Trump and the GOP provided extra farm payments in a successful attempt to pay off farmers and keep them from straying from the Republican fold. Farmers may claim to be rugged individualists but we will take every dime of government money available. Now after a year of Joe Biden prices are way up to levels not seen since the Obama presidency. I’ll take it and give credit where credit is due, Trump was a disaster for agriculture, Biden is a return to normalcy. My financial picture is looking better than ever right now. It is amazing what a good price can do.

Perhaps new ways of farming and finance could make even marginal land more productive. Case in point the Hmong among us. https://www.dailykos.com/stories/2021/11/27/2065925/-How-Hmong-farmers-are-building-collective-power-in-Minnesota

At 12,000.00 an acre, this is no way to farm.

NW iowa farmland values jump 29%. Highest jump in 80Years due to higher grain prices and bigger yields.

https://www.agriculture.com/news/business/iowa-farmland-values-up-29

Good news, I guess for ;landowners.