Senator Lee Schoenbeck (R-5/Watertown) says South Dakota’s racket of hiding money for dictators and drug dealers is great because all those trust companies packed into a few offices in Sioux Falls create all sorts of jobs.

I suppose there are some jobs to be had helping guys like Bill Cosby protect their filthy lucre from creditors and wronged lovers. But how many of those jobs are actually in South Dakota?

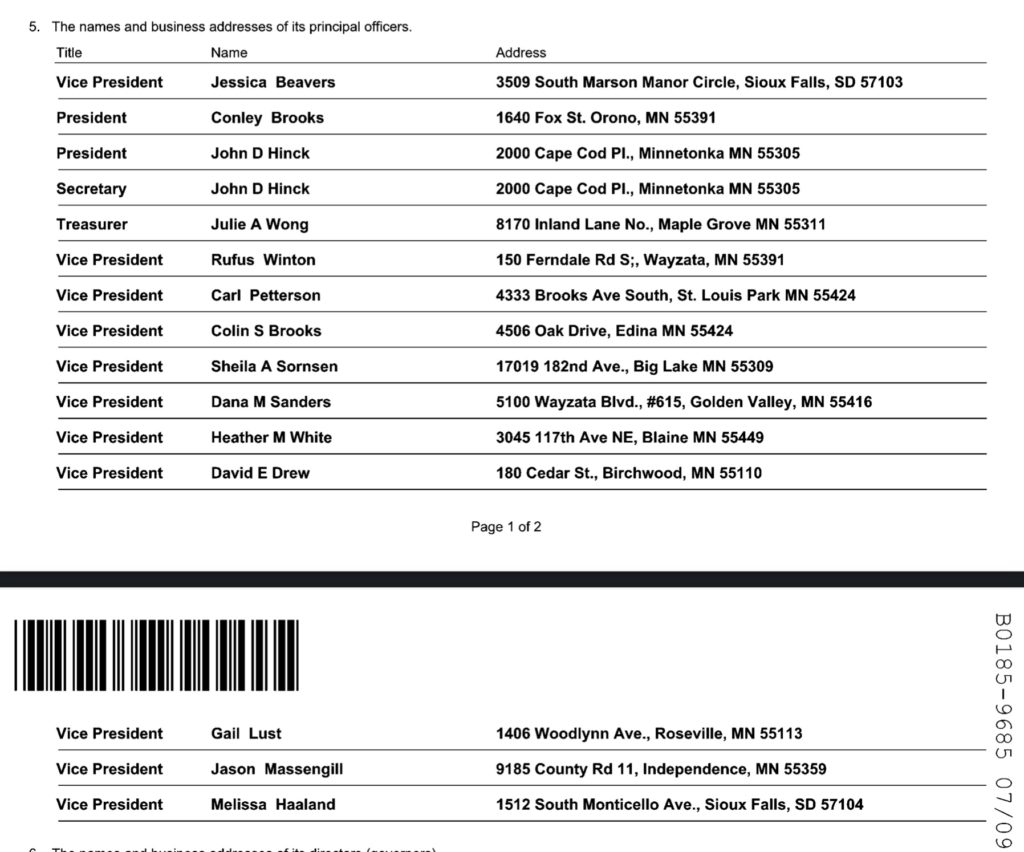

Sawmill Private Management is the parent company of Sawmill Trust Company. In 2017, SPM built a swanky new 12,000-square foot office for its 32 employees… in downtown Minneapolis. Sawmill Trust Company maintains an outpost at 222 South Main Avenue in Sioux Falls. I don’t have a roster of employees at either the Minneapolis HQ or the Sioux Falls outpost, but Sawmill Trust Company’s 2021 Annual Report filed with the South Dakota Secretary of State indicates that only two of its fourteen principal officers list addresses in Sioux Falls; the rest are all in Minnesota:

The same is true for Dorsey & Whitney Trust Company, one of the eleven trust company occupants of 410 East 8th Street in Sioux Falls. It’s 2021 annual report to the SDSOS lists twelve principal officers, only one of whom, Carl Schmidtman, who currently chairs our state’s regulatorily captured Task Force on Trust Administration Review and Reform, claims a South Dakota address. Eight live in Minneapolis, two in Seattle, and one in New York City.

Both of these companies butter their bread by telling the world’s richest people what a great place South Dakota is to do and hide your business, yet the vast majority of their honchos don’t move here to enjoy the fruits of our businephilia themselves.

I thus am having a hard time believing that South Dakota’s trust companies are generating paychecks for all that many South Dakotans. However many figureheads or desk jockeys the trust companies need to establish a paper presence to take advantage of South Dakota’s financial trickery, it appears the trust business supports a lot more high-salary employees in the Twin Cities and other, finer burgs.

Maybe all the Central American Immigrants are just coming to South Dakota to get the money their business and political leadrers siphoned off from their society.

Ironic isnt it that we have no problem accepting corrupt fortunes from Central America but send our National Guard to keep those most harmed by these practices from their leaders.

Maybe we send the money back with them so they actually can invest in their own countries and wont need to flee for America

Thank goodness for the Pandora Papers blowing the lid off this travesty of the public trust.

South Dakota is infamous for its race to bottom and its willful blindness to corruption and malfeasance.

Rest assured that as investigators roll throw the 11.9 million files, those investigators will find more and greater malfeasance and not less.

Do not expect the uninquisitive, lapdog legislators to repair this public trust (and private trust) travesty until after the federal government hand-holds them.

https://www.theguardian.com/news/2021/oct/04/pandora-papers-reveal-south-dakotas-role-as-367bn-tax-haven

Well….this is excess money laying hidden in these accounts. After four or five lavish homes have been bought, after several luxury cars are parked in the mammoth garages, after the ex-wives have been paid alimony and child support, after the children’s college funds have been paid in full, after the professional staff of accountants and tax lawyers receive their recompense, after the cooks, butlers, gardeners, pool boys, assistants, and body guards receive their just pay, and after the yachts and vacations have all been taken care of, the surplus funds are deposited in these accounts.They won’t be eroded by bad investment, they will accrue interest year after year, forever, assuring that no children produced by this line of successful business, show business, professional, and political leaders, from here and abroad, will ever have to work. It’s called privilege and they have only one fear….that the “poor” will break into their houses at night and kill them in their sleep.

This is naught but a bunch of crybaby complaining about people who have more than we do. For those of you weak-minded fellows who may not be overgodders but who go to church, may ye remember

Well said Mark, And one would think that giving the money to the people would be the only ethical thing to do. For a State that professes to be such a God-Fearing, Christian Values people that they want to use their Good Book as a guide to write their state laws and school curriculum. But the sad fact is America’s GQP has traded their Christian Prophets for Corporate Profits.

I covet grudnutz’s ability to protect its identity from those among whom it lives and ridicules in utmost juvenility.

Grudz-don’t preach to us-for we know of what you are! Mark B above says it loud and clear.

sleep uneasy, Grudz, you may be a mark?

Grudz–I don’t covet their cash or envy their lifestyles…..I’m sure that being that wealthy is its own special hell…no matter how wealthy we are, if we live long enough we end up in the nursing home, calling a fifty year old working woman, “Momma”.as she wipes up our drool.

I covet your drool wiper, Mr. Blundt

https://www.youtube.com/watch?v=Zx0ME65y72E

The idea that SD trusts are “helping guys like Bill Cosby protect their filthy lucre from creditors and wronged lovers” seems inconsistent with South Dakota law that prohibits transfers of property to avoid paying lawsuits and other debts under the Uniform Fraudulent Transfer Act, SDCL ch. 54-8A.

SDCL 54-8A-4 specifically covers “Transfers fraudulent as to present and future creditors,” which includes transferring funds “. . . whether the creditor’s claim arose before or after the transfer was made or the obligation was incurred,” and transfers made if the transferor “. . . believed or reasonably should have believed that he would incur, debts beyond his ability to pay as they became due.

The statute has additional elements, but the general idea is pretty clear, namely if someone wants to avoid paying creditors or anticipates owing money in the future and tries to hide their dough by transferring it to a trust, this law is designed to give the creditor a remedy to get at the trust funds and would seem to provide a means for Bill Cosby’s creditors and wronged lovers to attach such funds.

Next, I am not sure how it is relevant to the purported evils of SD trust law that some SD trust companies have branches in additional states, similar to companies with stores branches in SD that sell groceries, dry goods/hardware, fast food/restaurant, delivery services, etc, etc, which also have branches in other states. Is there some SD trust statute that should be amended or repealed to prevent such expansions to other jurisdictions?

On a slightly different banking note… https://www.keloland.com/news/local-news/four-men-charged-in-international-scheme-involving-south-dakota-banks-victims/

grudznick, my anger comes not from what these wealthy folks have, my anger comes from the crimes they committed to amass this wealth and the way this wealth is sheltered — making the owners detached from their part in funding a civil society through taxes while at the same time enjoying the benefits of that civil society.

Bear, on the branches in other states, it appears to be more of the case that these companies are headquartered elsewhere, and they establish small branches here in South Dakota just to take advantage of our laws. Their economic impact in our state is thus limited. When Republicans claim that the trust companies are generating lots of jobs, we should ask them to get specific and tell us which jobs they’re talking about and scrutinize whether they are counting the jobs that exist throughout the corporate structure or just the actual jobs in the store fronts packed into that handful of buildings in Sioux Falls.

Cory, I appreciate your response, yet it still seems like you have been sucked into an unproductive rabbit hole. Recall that the Republican job claim was made to defend SD trust law in general and the fact that some extremely wealthy, but questionable, foreigners have placed money with SD trust companies. Republican responses making general assertions about purported job creation seems a targeted distraction from the fundamental issue. Even if you concluded that Republicans were correct about the number of jobs, how does that even address the issue of avoiding taxes, laundering money, or other activities that SD trusts could be enabling?

Before attacking such a defense shouldn’t we really consider what particular SD statutes need to be amended, repealed, or added to correct a specific problem with our trust laws? One gets the imnpression, however, that such statutes are imaginary and that the real problem has more to do with SD’s taxation policies than actual trust statutes. I have repeatedly asked you and/or other DFP commenters to simply identify the particular statutes (i.e. “get specific”) that you see as troublesome, but to date no such specific statutes have been identified. The relevance of arguing about whether enough jobs are created to justify some unidentified SD trust statutes remains a mystery.

bcb – nailed it again. The problem is the underlying criminal behavior that some of these rich folks allegedly committed. I am all for stopping criminals and fraudsters and tax dodgers. I don’t think scapegoating some trust officers and accountants is helpful whatsoever. If somebody thinks schoenbeck is a liar because he didn’t provide specific in-state employment numbers, fine, call him a liar. That doesn’t mean the whole industry is rotten, it just means another republican is a liar, and if somebody pretends to be surprised by that, well, there’s nothing we can do about that.

bearcreekbat, one element of the SD statutes I have a specific problem with is that it seems SD trusts are allowed to go on in perpetuity. That seems to uniquely perpetuate the wealth gap.

Overall, I find ti troubling that our nation taxes wage earning at the highest rates — capitol gains lower than wage earning — and inheritance even lower than capitol gains. Trusts, in their role as elements of tax policy, are misguided in how they reward accumulation of wealth and the stagnation of that accumulated wealth.

O, thanks for that response. Given the fact that SD has no estate tax whatsoever, the rule against perpetuities is irrelevant to state inheritance tax in SD. Now the rule could be highly relevant in relation to the federal estate tax, however, since extreme wealth is subject to that federal estate tax after relatively large exemptions from the estate tax (something like over $5 million for an individual and over $10 million for a couple). And Republicans like John Thune are working hard to repeal the federal estate tax altogether.

But my question is whether SD’s statute repealing the rule against perpetuity has any meaningful affect on the federal estate tax. Generally, federal contitutional law requires national policies, including federal taxation policies, to treat each state in the same way. So it would seem odd if someone could avoid the federal estate tax merely by placing funds in one state rather than another. Likewise, I can’t say with certainty but it seems doubtful that any foreign country where a wealthy individual resides would defer to an insignificant state in another country, like SD, to determine whether a rule perpetuities applied to holdings of that foreign country’s citizens.

In any event, in a discussion of federal estate tax and the rule against perpetuities, one scholarly article concludes that such individual action by states might, in fact, not account for the tax savings that the recent anti-trust articles have suggested:

https://www.journals.uchicago.edu/doi/full/10.1086/671245

According to this study, “The US government imposes a generation-skipping transfer (GST) tax that is designed to address such tax planning strategies by subjecting transfers to grandchildren to an additional layer of transfer taxation.”

On the other hand, even without taxation issues, the rule against perpetuities was more or less designed to bring wealth back into economic activity based on the belief that if wealth had to be transferred to new owners it would be spent rather than hoarded. If the federal government and other foreign countries decided they are bound by SD’s perpetuities repeal, then perhaps this goal would be difficult to meet.

grudznarc doesn’t post videos very often but when he does … wow # grins

Seeing the few names of trust managers who actually live in SD leads to remembering the question I posed to Pat Powers, many years ago when we were still on speaking terms.

I asked, “What the hell did your father do wrong in the FBI to get stationed in South Dakota?”

Same question for those lucky trust people who get sent to Sioux Falls from Minnetonka or Wayzata.

O, I agree that allowing trusts to go on in perpetuity further exacerbates the wealth gap. An increasing number of states are following South Dakota and repealing the common law rules that limited how long property could be held in trust after the death of the person who created it. Our forebearers wisely required estates and trusts to make full distribution of the principal and income after a limited number of years. As a society, we do not benefit from dynastic wealth.

bearcreekbat, given that a perpetuity trust seems to be way to circumvent the federal estate tac, and given that tax doesn’t kick in until $11,700,000.00 is passed on, it becomes more clear how OBSCENE the sizes of these dynasty trusts must be. The GOP argument that these funds have been taxes once already is also less and less the case. Obscene fortunes are not being made by people who are working and being taxed on income. As he often points out, Warren Buffet is paying income taxes a fraction of the rate his secretary pays.

Eliminating poverty and creating a strong middle class are financial policy decisions: policy decisions that SD and the GOP are actively working against for the perpetuation of the 1% and their continued strangle hold on the wealth of this nation.

The final thing that is obvious is that the owners of these trusts are not following their money to SD. Hunting, fishing, even no mask mandates are not bringing these oligarchs to the state to accompany the fortunes they hide.

O, I fully agree that hoarding of wealth is inconsistent with the goal of “eliminating poverty and creating a strong middle class” and that the size of some accumulated fortunes is not only obscene but a ridiculous waste of that wealth. Yet I remain confused about how SD trust law has effectively undermined federal taxation laws

For example, what is your opinion about the effect of the federal generation-skipping transfer tax (GST) laws as they relates to the rule against perpetuities and SD trust law? According to Investopedia,

https://www.investopedia.com/terms/g/generation-skipping-transfer-tax.asp

Have you found loopholes in this federal law that SD state trust law has found a way to exploit by repealing the perpetuities rule?

And the the uber wealthy individuals identified in the articles and stories linked by Cory that use SD trusts are primarily foreign individuals and politicians. I haven’t found information indicating the number of American uber-wealthy individuals that also use SD trusts. For example, do the Waltons, Bezos, Zuckerbergs, Gates, Musks, or other uber wealthy use SD trust law to hide wealth or avoid paying the federal estate tax or GST? Do you have that information?

https://dakotafreepress.com/2021/10/04/bust-the-trusts-south-dakota-providing-financial-haven-to-destroyers-of-good-government/

And absent the use of trusts like those in SD, would the heirs and beneficiaries of these foreign individuals residing in other countries somehow be subject to US federal estate tax?

Federal estate taxes may be triggered upon the death of the person who created the trust, but after that, a properly designed dynasty trust will not incur gift, estate or generation skipping taxes. The reason is that the principal that was put in the trust stays in the trust generation after generation. In other words, a properly designed dynasty trust does not give the beneficiaries a right to the principal. Often a trust will provide that the beneficiaries are to receive the income generated by the principal. By way of example, let’s say that someone owns 6 sections of farm land (the principal) and transfers it into a dynasty trust, that is to hold the land in perpetuity. After the death of the Grantor (the person who owned and transferred the land into the trust), the trustee is instructed to distribute the income from the trust to the beneficiaries. The income is generated by the farm rent. Initially the beneficiaries are probably the children of the Grantor. After they die the income is to be paid to the Grantor’s grandchildren, and after the grandchildren die, then to the great grandchildren. Because the farm land is held in a dynasty trust for successive generations, no estate or inheritance tax is triggered upon the death of the trust beneficiaries. In contrast, if the farm land was transferred from one generation to the next, there might be estate or inheritance tax to pay.

The generation skipping tax comes into play with a different type of estate plan. Let’s say the owner of the 6 sections of land transfers the land into a trust that provides for only the income to be paid to his children, but after his children die, then the land is to be transferred from the trust to the grandchildren. If the value of the land exceeds the federal estate tax exemption upon the death of the Grantor’s children the generation skipping tax is triggered.

The majority of trusts that are sited in South Dakota are established by wealthy U.S. residents. Many make use of bank trust departments or trust companies. But some of the uber wealthy families establish a separate entity, and the trustee works solely for the beneficiaries of that family trust. The establishment of South Dakota based trusts by non U.S. citizens has occurred primarily within the last ten years and has become a growing part of the South Dakota trust industry. Foreigners are attracted to South Dakota because of the privacy and creditor protections and the low tax rates. The stability of the U.S. economy is another reason.

Whitless, thanks for that explanation and analysis of the GST. Consistent with your explanation, a second read of the Investopedia link seems to confirm that the GST deals with a trust that only delays the actual distribution of the trust principal for one generation, rather than a trust designed to prevent distribution of the principal for perpetuity.

Then, would it be correct that the principal of perpetual trust can never be distributed to any beneficiary? If so, that seems to be quite a significant cost or downside that is saddled on the grantor and his or her intended potential beneficiaries of the trust, namely, the permanent loss of use of a large principal in exchange for a means avoid taxation of the principal. The perpetual income to a beneciaries certainly is an attractive upside to a perpetual trust, but wouldn’t such distributions would still be subject to income tax imposed in the US or other countries in which the beneficiary resides?

It makes sense that “Foreigners are attracted to South Dakota because of the privacy and creditor protections (subject, of course, to the SD law against fraudulent transfers) and the stability of the U.S. economy.” As for “low tax rates,” however, that is more difficult to grasp since SD has no (rather than a low) state income tax, and SD local law would seem secondary to taxation laws in most foreign countries, as well as US law. Perhaps there is a potential difficulty of actually enforcing foreign tax judgment by seizing trust principal owned by foreigners but placed with a SD trust company, i.e., the age old problem of actually reaching assets to collect on a legitimate judgment?

As for the “majority of trusts that are sited in South Dakota,” which are “established by wealthy U.S. residents,” is there any information to indicate what percentage of these might have been created as perpetual trusts where the principal is locked into the trust and henceforth forever denied to the grantor and beneficiaries? For the non-perpetual trusts, wouldn’t the repeal of the rule against perpetuities simply be irrelevant?