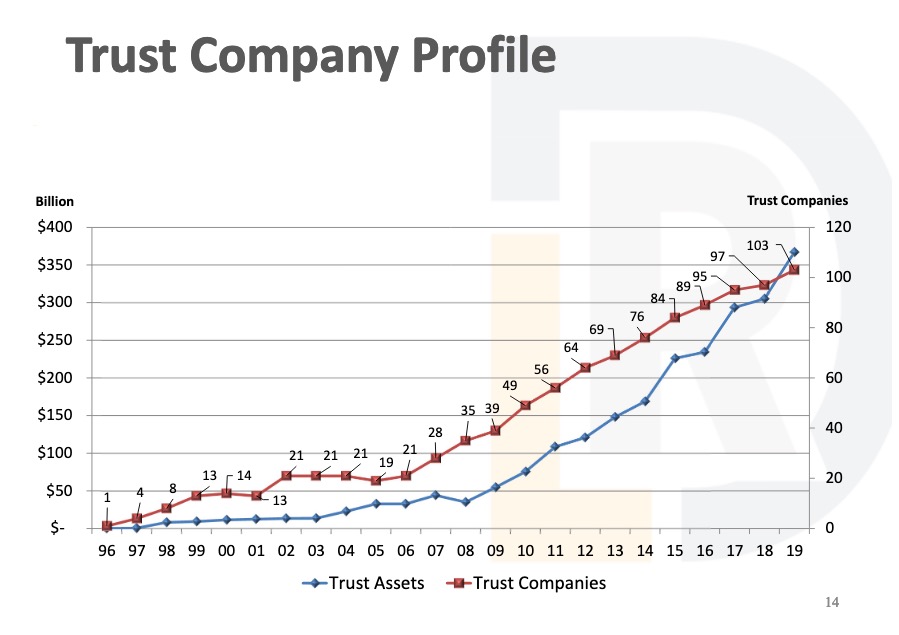

The South Dakota Banking Commission received a report from the state Division of Banking last week summarizing the assets of banks and trusts in South Dakota. According to the Division of Banking, in 2019, 103 trust companies held around $370 billion in assets in the super-secret lockboxes that global elites use to dodge taxes, launder money, and drag us back into feudalism.

Those 103 trust companies employ 390 people in the arcane art of hiding money. South Dakota currently charges those trusts an annual supervision fee seven cents per $10K in assets for the privilege of parking all that money here. Trust companies also have to pay the actual costs of on-site exams and any additional costs arising from enforcement actions. On our total trust holdings, the supervision fee alone would reap $2.59 million a year.

But we can’t figure the total take as a straight percentage, since administrative rule sets lower and upper limits on the supervision fee. Private trust companies must pay a minimum supervision fee of $3,750; their fee is capped at $20,000. At seven cents per $10K, any assets a company can warehouse above $2.857 billion incur no further obligation to the state. With 41 companies holding about $100B in private trusts, the average holdings per company are around $2.4B.

Similarly, companies offering public trusts face a minimum supervision fee of $4,500 and a max of $30,000 (funny: the more exclusive and secret the account, the less we charge—seems rather undemocratic). Public trust companies thus don’t reach their max until they hold more than $4.3 billion. With 62 companies holding about $270 billion in public trusts, the average holdings per company are roughly $4.4 billion.

South Dakota also imposes its financial institution income tax on those trusts, with minimum amounts set by how long the trust company has been in business:

If a financial institution as described in § 10-43-88 has been authorized to engage in the trust business in South Dakota for fewer than twelve months, the annual minimum tax is five hundred dollars; for more than twelve months, but fewer than twenty–four months the annual minimum tax is two thousand dollars; for more than twenty–four months, but fewer than thirty–six months the annual minimum tax is five thousand dollars; for thirty–six months, but fewer than forty–eight months the annual minimum tax is ten thousand dollars; and for forty–eight months or more, the annual minimum tax is twenty–five thousand dollars [SDCL 10-43-90, last amended 1997].

The Division of Banking’s report does not tell us how much income those trusts made for their wealthy overlords last year, but more than 70 have been in business for at least four years, so they would have paid at least $1.75M at the minimum amount set above.

The use of trusts for money laundering is a bit confusing to me. As I understand it, money laundering means creating a fake legitimate source for the receipt of of money from criminal activities so that the proceeds can be openly used and taxed as legitimate income from a lawful endeavor or source.

While I understand that a trust is considered a legitimate source of income for it’s beneficiaries, I am confused about how a settler can avoid detection by simply putting illegally obtained money into the trust.

Can Cory or any DFP commenters offering an understandable explanation of how this can be accomplished with a SD trust? Is a SD trust not required to keep a record of and account for settlor deposits? So if a settlor robs a bank can he or she simply put the money into a SD trust and law enforcement will have no way to learn this fact?

Incidentally, I have looked online and have found many references to the use of trusts to launder money, but most of these seem to require a combination of offshore trusts from other countries with unique secrecy laws, which makes it difficult or impossible for US law enforcement to determine when and where the offshore trust obtains funds from a settlor. But I found no clear answer how this laundering can take place in a single US state like SD.

The settler in our case is the white bearded “Abe Lincoln” plowing up reservation land on our seal and flag. Indians are yet excluded but the sun’s rays could easily be converted to tipis if the Tribes so wished.

Watch Meryl Steep’s LAUNDRY 1st and then we can ask David Lust to do a guest editorial, and perhaps the Honorable Susan Wismer might chair an oversight committee, with subpeonas! :)

leslie, I’ll check out that Meryl Streep movie – thanks for the suggestion. There is a pretty good Netflix series on money laundering for a drug cartel called “Ozark” that is also an enjoyable watch, but I recall no mention of using intrastate trust laws to accomplish the deed (or foreign trusts for that matter). A guest editorial by David Lust, or any SD trust attorney, might be just what the doctor ordered.

https://www.theguardian.com/world/2019/nov/14/the-great-american-tax-haven-why-the-super-rich-love-south-dakota-trust-laws

***

Her view was dismissed as “completely jaded and biased” by a trust lawyer sitting for the Republicans [Lust ridiculed Wismer in the press]. It was a brief exchange, but it went to the heart of how tax havens work. There is no political traction in South Dakota for efforts to change its approach….

***

Two election issues at heart. Climate denial. Economic inequality (covers everything else). Most important election in our history.

leslie, that is an excellent link and well worth the read to help understand how trusts have enabled the rich to avoid SD state income taxes, inheritance taxes, and shelter money in perpetuity. As for money laundering, however, it does not provide much information except to declare that SD trust law:

If SD statutes can be used to prevent federal and state law enforcement from obtaining needed information about a settler’s deposits into a trust fund then this would seem to be an open invitation and opportunity to launder illegally obtained money, whether from fraud, bank robberies or major illegal drug activity. But does SD law actually do this? Is there a statute or statutes that stop law enforcement from learning about the identity of a settler and about the timing and quantity of the settlor’s money deposits into a trust?

The article you linked has an informative internal link to another interesting article describing money laundering under British trust laws, and sets out a 5 step process used to launder money in Great Britain. As best I can tell, however, the key steps are simply to violate British law!

And then Step 4 is pretty straight forward:

https://www.theguardian.com/world/2019/jul/05/how-britain-can-help-you-get-away-with-stealing-millions-a-five-step-guide

If violating SD law is the means of laundering money, then the problem is enforcement, not SD trust laws. This brings me full circle – do SD laws actually prevent law enforcement from discovering information about the settlor and trust deposits? Or is this like Great Britain, simply a matter of lax enforcement of the existing laws so money laundering is accomplished by simply violating SD trust law?

Ask yourself, who’s economy is the one we have? https://www.cnn.com/videos/business/2020/08/31/ws-unemployment-js-orig.cnn/video/playlists/business-economy/

You still don’t know what a public trust company is.

Enlighten pls.

It used to be that “banks were the only [trust] game in town,” said Pierce McDowell, co-founder and co-CEO of South Dakota Trust Co. of Sioux Falls. McDowell started Citibank’s trust office back in the early 1990s, which drew clients from around the globe. During that time, “we were lucky to get 100 clients a year, and that was considered a good year.” Today, South Dakota Trust is handling about 75 new clients every quarter, McDowell said.

…the trust industry is not particularly beholden to the ups and downs of the economy. “There is wealth transmission all the time regardless of whether the economy is booming or in recession,” said David Lust …. SD Legislator

…in the 1990s, when a [Janklow?] governor’s trust task force began laying a regulatory foundation that was rigorous [?] yet welcoming to trust companies, according to state and industry sources.

Lust, the current chair of the trust task force, said that the task force was crucial in “creating a friendly environment for trusts.”

Afdahl agreed, noting that the task force continues to tweak regulations, and that its importance “cannot be overstated in all of this [trust growth]”. Bret Afdahl, director of the South Dakota Division of Banking….Every year, we go through and analyze what other states are doing and what we can do better” to remain an attractive location for those considering trusts and trust companies.

“We’re always looking for subtle differences,” Afdahl added. Without this group meeting every year to make incremental changes to South Dakota trust law, “we would be where most other states are currently at—behind the curve of a fast-moving landscape.”

South Dakota is one of the few states without a corporate or personal income tax and no tax on investment earnings. Life insurance is also common in trusts, and the state imposes the lowest life insurance premium tax in the country….

Privacy is a big deal….Our confidentiality laws are very strong, and this is a very important factor for most ultra-high-net-worth families,” said Afdahl. South Dakota is the only state in the country with a “total seal forever” law, which means that all records in any lawsuit are permanently sealed. https://www.bridgefordtrust.com/why-trust-locations-matters-the-south-dakota-advantage/

***Do voters and legislators need to know?***

Startup capital costs are also low in South Dakota. Afdahl said “South Dakota requires just $200,000 for private trust companies, “and we are at or near the lowest minimum.”

Trusts are wonderful and wonderful for South Dakota too. Voters and the legislatures have no business knowing about other people’s private business just because they want to be nosy busybodies.