Farmers will enjoy 10% more net income this year than in 2018. Unfortunately, almost a third of that income will come in the form of government handouts:

The USDA pegged net farm income, a measure of wealth, at $92.5 billion, up 10% from 2018, due to mammoth federal payments and higher-than-expected commodity prices. Income peaked at a record $123.7 billion in 2013, plunged to a low of $62.2 billion in 2016, and climbed ever since. Stable expenses allowed producers to hold on to revenue rather than pay higher bills.

Senior USDA Economist Carrie Litkowski said indemnities from federally subsidized crop insurance, estimated at $6.5 billion, and direct government payments, estimated at $22.4 billion, would combine to account for 31% of farm income this year. By themselves, direct federal payments would be 24% of farm income, the largest share since 2006 [Chuck Abbott, “Farm Income Is Highest in Six Years, Due to Trump’s Trade-War Bailout,” Successful Farming, 2019.12.02].

100% of my household income is coming my wife’s and my private-sector employment. 0% is coming this year from socialist public-sector checks. What’s your socialism ratio?

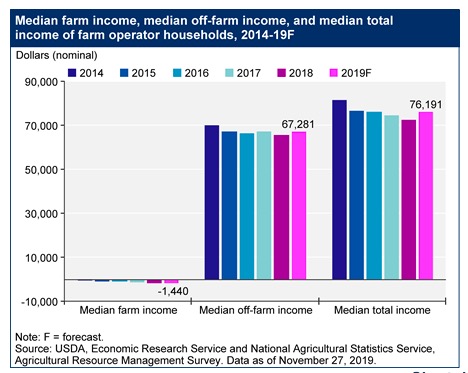

Related Reading: Even with net income up, not many people are making money growing our food. Median farm income for farming households has been negative since 2014, while median off-farm income for farming households in 2019 is projected to be $67,281.

You’d think the free market would find a way to make producing the basic stuff of life pay a living wage.

Socialist handouts to farmers (I am sympathetic with those truly in need, not billionaire korps) is helping drumpf’s economy look much stronger than it really is.

So, “we” cannot decide teacher salaries, but can decide farmer salaries? State income is down because of the tough markets, but farm income is up?

I really am not trying to be obtuse, but none of these economic numbers make sense when lined up and put in context.

I agree, O. All those MFP checks should be stimulating the SD economy. Could it be that the increase in farm income, from the market and from Trump, is accruing largely to rich farmers whose spending doesn’t have the same stimulatory effect as that of the lower and middle class and who in South Dakota don’t pay income tax only sales tax meaning they don’t have as much impact on our budget?

Cory, when mentioning taxes, shouldn’t the state and local property taxes also be included in the discussion? They are a significant part of the overall tax burden for farmers and ranchers.

$ to those that already have plenty never has and never will stimulate the economy because it doesn’t trickle anywhere. On the other hand, our economy is rigged so that the $ earned by the lower half, or more, trickles UP to the greedy bastards who did the rigging.

What will happen to farmers when Chubby no longer needs them?

Korey, it does make sense to mention those taxes, especially because they show the regressive burden of taxes on small farmers. Small farmers are taking a real hit on their income. They are getting less of the Trumpfare checks than Kristi Noem’s brothers and other rich farmers. But their property taxes don’t go down. If we replaced some big chunk of the property tax with an income tax, smaller farmers would benefit, because their tax burden would be more proportional to their income.