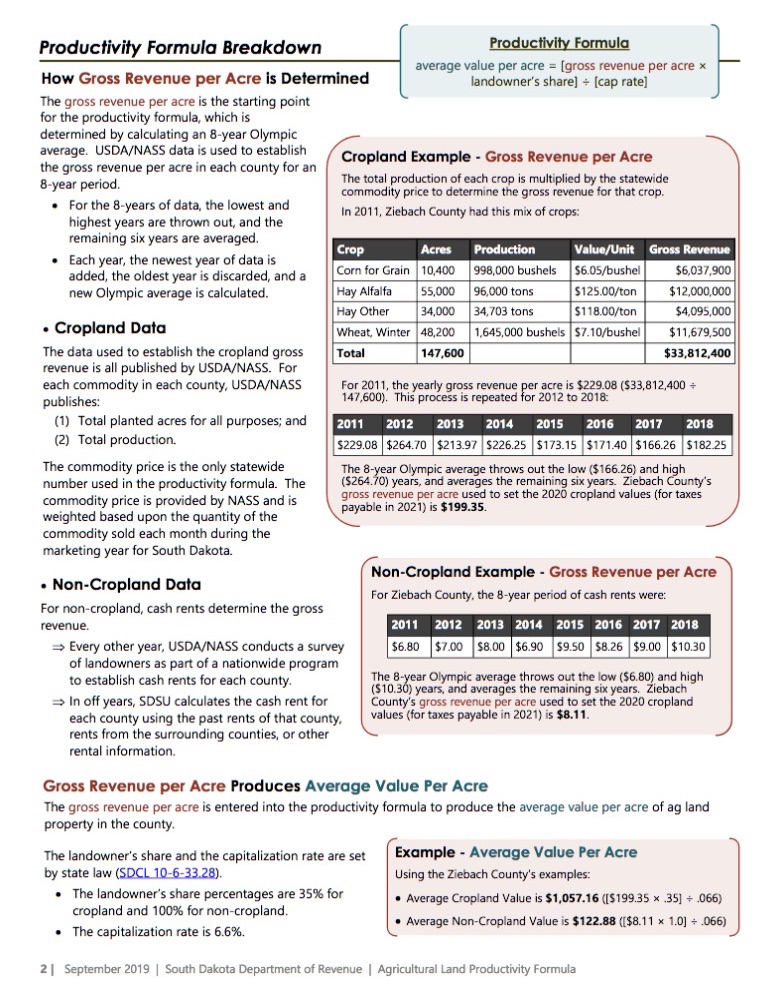

Among the documents received by the Legislature’s Agricultural Land Assessment Task Force last week was this handy four-page guide to the Agricultural Land Productivity Formula, which counties use to determine how much to tax owners of agricultural land. It takes four pages to explain that you farmers will pay taxes based on the prices that everyone else got for crops grown on land kinda-sorta like yours over the past eight years.

So if you just moved here from Minnesota and started growing organic sweet corn and tomatoes and free-range chickens, and you operated at a loss because the first year of business is always tough and your tomatoes were damaged by dicamba drift, you’ll still pay taxes based on the bumper crops of Monsanto/Bayer beans that your dicamba-spraying neighbor was able to sell in the years before Trump destroyed your neighbor’s access to the Chinese market.

Imagine if we applied the productivity formula to sales tax. Instead of just charging you 6.5% (4.5% for the state, 2% for town) at the till each time you actually buy something, we’d send SDSU economists out to survey your neighbors and find out how much they’ve been buying over the last eight years. We’d figure their income, education, health, and other factors affecting purchasing power and choices. Then we’d turn to you and say, “Well, the average person in your condition spends $45,000 a year, so write us a check for $2,925, and we’ll divide that up between your state and municipality.”

Let me beat this drum again: South Dakota could more simply and more fairly tax Tomato Man, Dicamba Man, and everyone else in South Dakota with ag land (or any kind of land, or no land at all) with this two-line tax formula:

- Multiply the amount on Line 15 of your IRS 1040 by 10%.

- Send the amount you calculated in Line 1 to the County Treasurer.

Actual tax on actual economic activity is fairer and simpler than the state’s quasi-communal income tax.

I’m for it! People who moan and groan about government paperwork ought to be for it. Remember when the GOP was claiming they had a tax return that would fit on a postcard? They should be for it.

Win, win, win!

All those SDSU economists and spreadsheets certainly don’t fit on a postcard.

An honest income tax on agricultural land would fulfill alleged Republican principles far better than the current fake productivity tax in which an individual farmers pays for everyone else’s farm productivity.