An eager reader reports that the Lake County Planning and Zoning Commission had to vote and revote yesterday to approve a proposal for another tax increment financing district in Madison. This time Sioux Falls developer Kelly Nielson is angling for a subsidy to plop some purportedly affordable quadriplexes, duplexes, and single-family homes on some currently bare ground in the far northeast corner of town.

Quadriplexes? Hmmm… that should knock some of the “snob” out of what a few of my Madison neighbors used to call Snob Hill. And they’re on a hill, so no flooding there!

The City of Madison had to boot the TIF discussion to the Lake County Commission. Why can’t Madison float the TIF themselves? The briefing the county got on August 6 indicated it’s because of TruShrimp:

Toby Morris, Dougherty & Company LLC, and Casey Crabtree, met with the board to discuss using the county’s bonding authority for a proposed TIF in the City of Madison. The TIF would be in the affordable housing type. A developer is interested in building affordable single-family homes in Madison. The City of Madison has their bonding authority earmarked for TruShrimp and for upgrades. ThisTIF project will be below two million dollars. The board agreed they should move forward with the proposed TIF using the county’s bonding authority [Lake County Commission minutes, 2019.08.06].

The city wants to subsidize affordable housing, but their bonding authority is tied up in a shrimp plant that has taken South Dakota money but hasn’t started building in South Dakota yet, so the county has to give up its potential tax gains to attract a homebuilder to town.

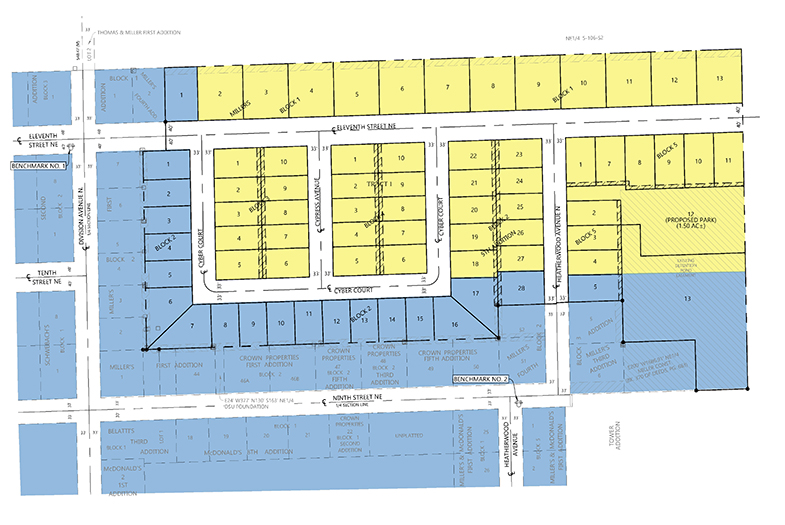

The Cyber Estates TIF may come to the Lake County Commission at their September 19 meeting.

This is going to end badly, ala EB5, Gear Up, etc. Why don’t SD and other governments work with existing businesses instead of chasing these pie in the sky folks looking for corporate handouts? The banks know better than to lend to them, and SD should too. Especially after they left the City of Luverne at the alter.

Exactly Ogre. Exactly.

TIFs are not a good option for housing developments because the residents receive the full menu of government services while the increase in tax revenue is diverted to pay off loans for the developer. So the rest of us pay higher taxes to make up for the TIF.

Karen captures the problem with TIFs nicely. The whole idea of attracting new residents with housing and business investments is that their tax dollars will help support the community. But new residents bring increased demand for services, and TIFs deny us for several years any additional revenue from those new property developments.