Ever since voting for Trump, farmers have gone further into debt:

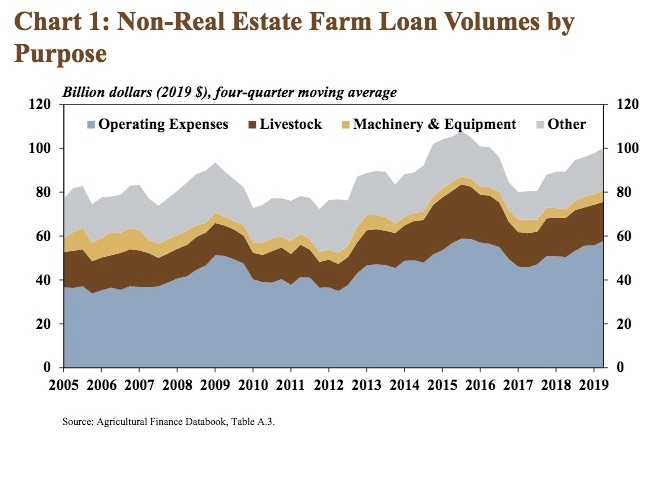

Non-real estate farm lending continued to increase at a moderate pace in the second quarter, according to the National Survey of Terms of Lending to Farmers. The volume of loans increased 11 percent compared with last year, the fastest pace of growth in the second quarter since 2011. Operating loans continued to comprise the majority of non-real estate farm lending and increased more than 16 percent (Chart 1). The second quarter also marked the ninth straight quarter of a year-over-year increase in total non-real estate loan volumes and during these nine quarters, the annual pace of growth has averaged 14 percent [Nathan Kauffman and Ty Kreitman, “Large Loans Drive Further Increases in Farm Lending,” Federal Reserve Bank of Kansas: Ag Finance Databook, 2019.07.18].

Notice that the Kansas City Fed isn’t just counting dollar amounts; they’re adjusting for inflation.

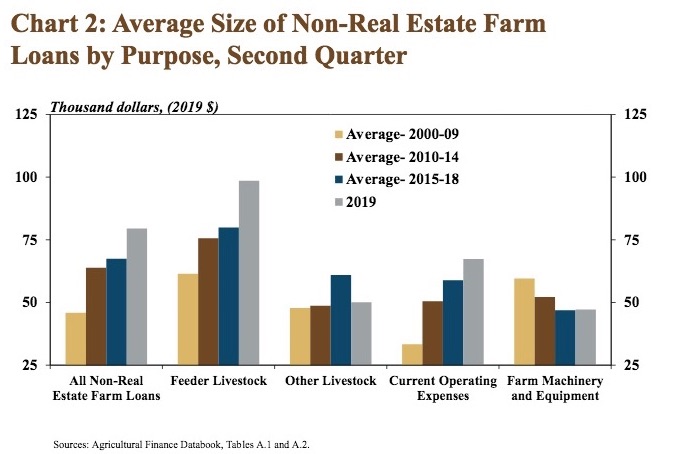

Farmers are borrowing significantly more for feeder livestock and operating expenses:

Farmers sinking into the red get no relief from the Trump Administration yesterday, which, in vowing to expand the trade war and more taxes on consumers, sent ag markets down:

A fresh salvo from Donald Trump in the U.S.-China trade war has roiled agriculture markets, deepening weekly losses and damping chances of any fresh Chinese purchases of American farm products.

While crop futures recovered some poise on Friday, soybeans are still on track for their worst weekly loss since early May and hogs are heading for their biggest weekly plunge in a year.

…China had earlier waived retaliatory tariffs on some U.S. farm imports in apparent preparation for new purchases, but there has been no confirmation of fresh deals, and Trump’s latest move may well mean they are now less likely. Adding to the trade pain was news Thursday that China had made its biggest ever cancellation of American pork [“Crop Markets Deepen Weely Losses as Trump Escalates Trade War,” Bloomberg via Yahoo, 2019.08.02].

If the Trump Administration thinks this new tariff threat will pressure China into buying more American ag products, it is likely mistaken:

The Eurasia Group analysts said it is possible that Thursday’s tariff threat is meant to spur China into buying more American agricultural products but, they added, Beijing is unlikely to respond the way Trump hopes. It would be “extremely embarrassing for China to step up imports from the U.S. under the threat of blackmail,” they wrote.

Tapas Strickland, director of economics and markets at National Australia Bank, also said that it was impossible for China to concede without losing face.

“It goes against China’s core demands of sincerity and the removal of existing tariffs,” he wrote in a Friday morning note, adding it is possible that Beijing “will retaliate with an intensification of non-tariff barriers, as well as further Chinese stimulus to ward off headwinds” [Saheli Roy Choudhury, “Trump’s New Tariff’s Show He’s Reading China All Wrong, Risk Consultancy Warns,” CNBC, 2019.08.02].

Farmers aren’t like the federal government: they can’t just raise their debt ceiling and borrow forever without consequences. But Donald Trump will continue to ignore their plight and distract them with racist Twitter insults and welfare checks, scratching farmers’ id to make their legs twitch until the bank forecloses.

China will probably be able to buy up most of the farm land if trump is “re elected” courtesy of Putin’s Russia for little or nothing.

“Not only is the stock market sharply down, but prices for soybeans, which had risen sharply in May after Trump promised China was about to make a record purchase, are on their way back to the basement. That means that farmers aren’t just set to lose more money on this year’s crops, they’re also losing on anything they were holding in reserve for those promised sales. At this point, both agricultural products and futures are down across the board. And this in a year when farmers are facing record foreclosures and record floods.

Meanwhile, former Trump economic adviser Gary Cohn admits that the tariffs are doing more harm to the U.S. than to China. Speaking to The Independent, Cohn stated that he didn’t really think the tariffs are impacting the Chinese economy. But they are having a “dramatic impact” on American manufacturing.”

Boys and girls out there in ag country, you got screwed by republican mantra. Admit it and do something about it. We cannot keep voting republican and thinking they are gonna do anything but keep screwing us, look at their records regarding you. Think about hemp, and you should be able to clearly see what GNoem and her gang have done. Wake up or sell out to China or Russia, the banks are gonna have to do something with all that bad paper.

It’s always darkest before the dawn.

Pearson says “It’s always darkest before the dawn.” This is especially true for Trumpists who refuse to open their eyes to factual reality – closed eyes plus closed minds equals no solo oscuridad sino ceguera (not only darkness but blindness).

You didn’t have to quote me. It’s right above your comment. You think highly of yourself don’t you?

Just speaking from what I have seen, this excessively wet spring and summer has played a roll on farmers and their increasing operating debts. The wet conditions have prevented people from getting their stored crop to the elevators for sale. Also the late season blizzards caused farmers to go through more feed on their livestock. Just what I have been seeing.

While I agree, with trade wars everyone loses. However we are sitting on such an oversupply of corn and soybeans we were already having downward pressure on the prices. The tariffs have added to that downward pressure as well.

It’s sad to see Economic Eunuch trash the rural economy like this. Those small towns SD towns are dependent on the farmers. They buy groceries, cars, clothing, fuel, appliances, equipment, tractors, etc. That $ travels all through town, turning over repeatedly. When they can’t buy, the entire rural economy suffers.

Economic Eunuch, in his vast stupidity, is attacking his own most loyal voters. Somewhere there is a ceiling they will hit, followed by saying, “Enough is enough. We’re done with him.” I hope that awareness comes soon.

You didn’t have to quote me.

Sure he did. This is, after all, pin the tail on the donkey. BCB does not put on airs.

Now that the Fed has been browbeat into dropping rates, the Trump economic strategy becomes clear: use debt, both national and individual to cover the tracks of bad economics.

The economy really is a grenade which looses the pin as soon as interest rates do go up and YUGE amounts of debt begin to incur their true costs.

All this does seem to follow the playbook of businessman Trumps personal businesses before his elevation to the White House. Back then he exercised bankruptcy (or just walk away) solutions that those with the debt now – especially we holders of the national debt – do not have as options.

What more can be said, we are seeing the wheels come off our economy and there are no more rabbits to pull out of the hat. trump/republicans have put America into the slow heat of the water coming to a boil. Most of us frogs don’t realize it yet, but we’re cooked.

“The US economy is slowing, in large part because manufacturing has declined for the past two quarters. Business investment has turned negative, mainly due to uncertainties arising from the trade war. During the second quarter GDP grew at an annual rate of 2.1%, but that included a contribution of 0.85% from federal, state and local governments, much larger than most forecasters expected (the widely-followed Atlanta Federal Reserve GDPNow model anticipated a contribution of just 0.30%). The private economy, that is, grew at an annual rate of just 1.25%.

Consumer spending remains strong, but consumer investment has fallen sharply. Private spending on residential construction is down 8% year-on-year.”

We clearly do not have representation from Rounds, Thune and Dirty, so we have to hope for leadership from Democrats in blue states to turn this wreck around. Red state republicans like our three are making too much money to do anything about the rank and file of South Dakota citizens. They know we’re too damn dumb to figure out the water is starting to boil.

Moar debt? More suicides? Moar mental health grief counselors for moar persons and families in need? Or will it cost too much Dakota wingnuts to cough up?

https://www.rawstory.com/2019/08/trump-tariff-war-victim-minnesota-farmer-auctions-off-what-little-he-has-to-keep-century-old-family-farm/

I have been to Montgomery, Minn when I was young and dumb. Next door neighbor’s daughter and SIL lived there with their 3 sons and I would spend a weekend or a week up there drinking. Nice mosquitoey country.

That’s heartbreaking Mike. 😥