The Agricultural Land Assessment Task Force meets next Tuesday to discuss the absurd, Rube-Goldberg system of taxing South Dakota’s farm and ranch land based on a statistical guess about how much that land could have produced under ideal conditions rather than how much it actually produced and how much tax the farmer or rancher can thus bear.

Figuring centrally in the task forces conversation about this broken taxation system are the figures SDSU age economist Matthew Elliott has assembled into this app mapping the “highest and best use” value of every parcel of ag land in South Dakota.

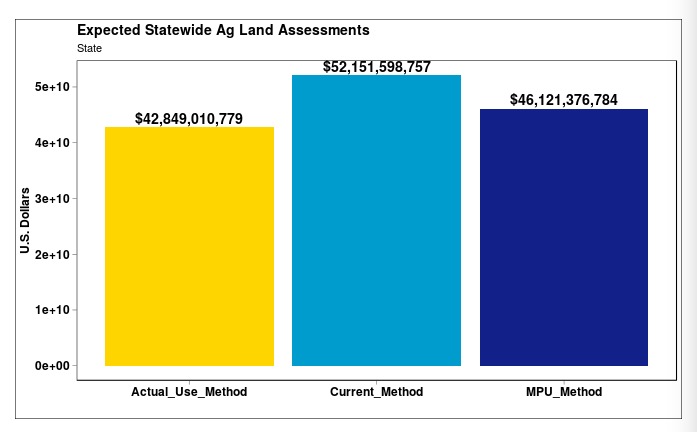

The maps are awesome but take a long time to load. I’d like to look at three charts from Dr. Elliott’s study. Dr. Elliott uses all this data to compare the expected statewide ag land assessments under the current Highest Best Use method with two alternative methods: actual use (my preferred model) and the “most probable use” method. I’m not sure a formula that introduces probable on top of HBU’s woulda/coulda/shoulda, but MPU would drop assessments by 12%, while actual use would drop assessments by 18%.

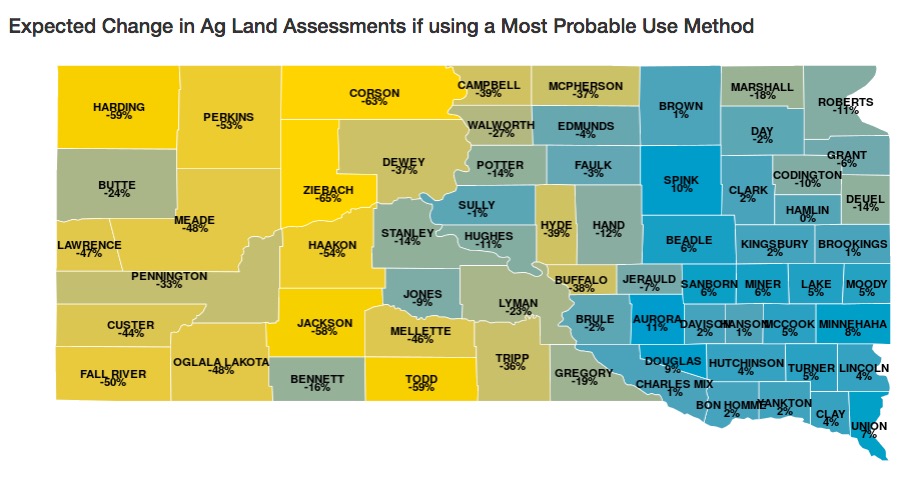

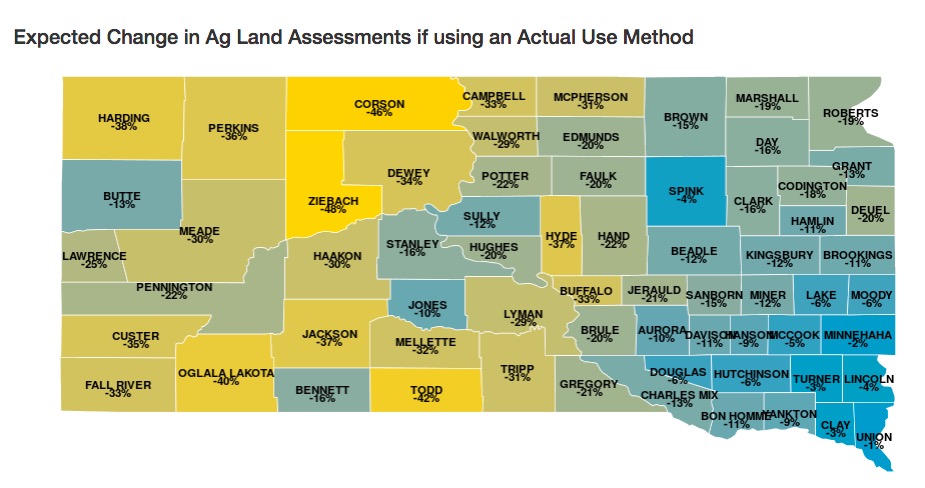

MPU would raise assessments in East River while dropping them in West River. Actual use would drop assessments everywhere:

These maps don’t mean that the adoption of, say, the Actual Use formula would drop ag property taxes by 15% in Brown County. They just mean that we would figure ag taxes on very different assessed values, and the Legislature would likely adjust the levies to ensure some continuity of revenue.

But the second map makes clear: Highest Best Use produces inflated land values everywhere. Actual Use provides a more honest basis for tax assessment; whether the new Legislature will have the will to provide for such honest taxation remains to be seen.

How do neighboring states tax ag land?

Cory, this is only peripherally connected to the topic, but it is an example of what a blue state does for its farmers.

“Minnesota lawmakers in 2017 cleared the way for co-op health plans as an alternative to the state’s individual market, which suffered several years of steep price increases. The individual market serves self-employed people under age 65, a group that includes many farmers.”

https://goo.gl/fNsRd1

news flash – ag land is under-valued by like 50% on tax assessments so these millionaire farmers pay less tax on their land than they rightly would under any model anyway. Feel free to use highest and best use, or actual use, or make up some random table to create a formula and use that. As long as the people putting the dollar amount on the dotted line fudge the numbers for south dakota’s poor, needy farmers, they’ll be alright.

Try this: whatever model or formula is used, take a tax-assessment notice to a land auction and see how fast you can “double” your money.