The Legislature’s Executive Board hears a report on Internet sales tax collected from out-of-state sellers tomorrow, just one day before the South Dakota Supreme Court hears arguments in the lawsuit over the 2016 legislation (Senate Bill 106) that authorized that tax.

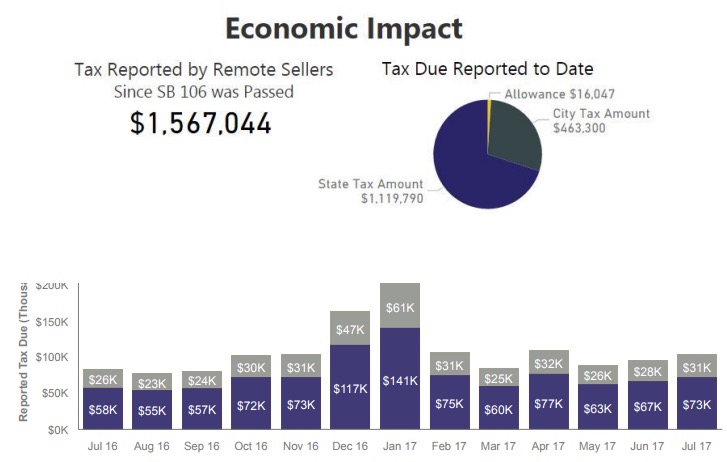

The Department of Revenue’s presentation to the E-Board includes the hotly contested claim that South Dakota loses $50 million each year in uncollected tax on online purchases. The presentation also says that in Fiscal Year 2017, our new Internet sales tax law allowed us to collect not quite 3% of that allegedly lost amount:

According to the Department of Revenue, that $1.57 million in sales tax ($1.12 for the state, $463K for municipalities) has come from 105 remote online sellers who have obtained active South Dakota sales tax licenses since the passage of 2016 SB 106.

ehm, from whom is the state collecting? The state is collecting from us consumers – punishing us from exercising the Commerce Clause, from using better service, using better availability.

I’m with John. Let’s just shut down all main street stores in South Dakota and go with that Amazon Jungle Primate thing they all talk about. It’s free. Plus then we can stick it to the man by not paying any taxes at all. If the good teachers don’t get raises, then that’s too bad.

Taxes bad. Business good. Government bad. Free market good… And that’s the primary reason we don’t have an income tax in South Dakota. Take that logic a little bit further, and this internet sales tax is crushing South Dakota’s economy with unnecessary tax burden on the consumer. Big government beauricrats are laughing in our faces, rubbing that 1.57 million in cash all over their naked bodies at secret parties only the wealthiest South Dakotans are invited to. The Illuminati in this state are strong and it won’t be easy to take our state back from the multinational New World Over that took it from us… oh no… we’re going to have to fight! The can brain warsh Mike Rounds, Kristi Noem, Marty Jackley, and John Thune, but they can’t brain warsh me!!!

Maybe they haven’t gotten to Marty Jackley yet, but they will.

The US is the most over-retailed nation on earth. By multiples more over-retailed than the next. The US has 7.3 square feet of retail space per capita. The UK and France – 1.3; Japan – 1.7. Retail is dead, regardless of the taxing scheme. Progressive businessmen everywhere strive to cut out the middleman. Tesla’s having success in killing car dealerships.

The over-retail is crashing. Adapt, migrate, or die. http://ritholtz.com/2017/03/downsizing-americas-retail-footprint/

The fact that a jurisdiction like South Dakota regressively depends on a 19th Century tax scheme for a bulk of state and local revenues is a different problem. It is a wholly resolvable problem by changing taxing to progressive from regressive.

Exercising the Commerce Clause power of national purchasing is a lawful tax break — every bit as much so as is the cheap tax and registration rate for heavy trucks that cause over 90% of the wear and tear on our roads. Or the out-dated tax breaks in gas taxes or purchases by farmers. No one tells truckers or farmers to ‘pay up like the rest of us’ or ‘pay your fair share’ – slathering them with faux guilt trips.

All me can see is: taxes bad; free market good, government bad, Trump good. Me no understand anything deeper than that. Me believe in complex web of lies more than reality, as me just can’t help myself.

John’s last paragraph is worth noting: the main reason South Dakota is hell-bent on taking this case to the Supreme Court and wringing sales tax out of remote sellers is that our leaders can’t stand the thought of updating our tax code from the regressive nickel-and-dime tax to an honest income tax that makes people realize just how much government is taking out of their pockets and perhaps take more interest in how that money is being spent.