Republican District 13 Senate candidate Jack Kolbeck has the courage to post his views on all ten ballot measures on his campaign website. I give kudos to any legislator willing to tell the voters where he stands on the ballot measures. Here’s Kolbeck’s ballot-measure breakdown:

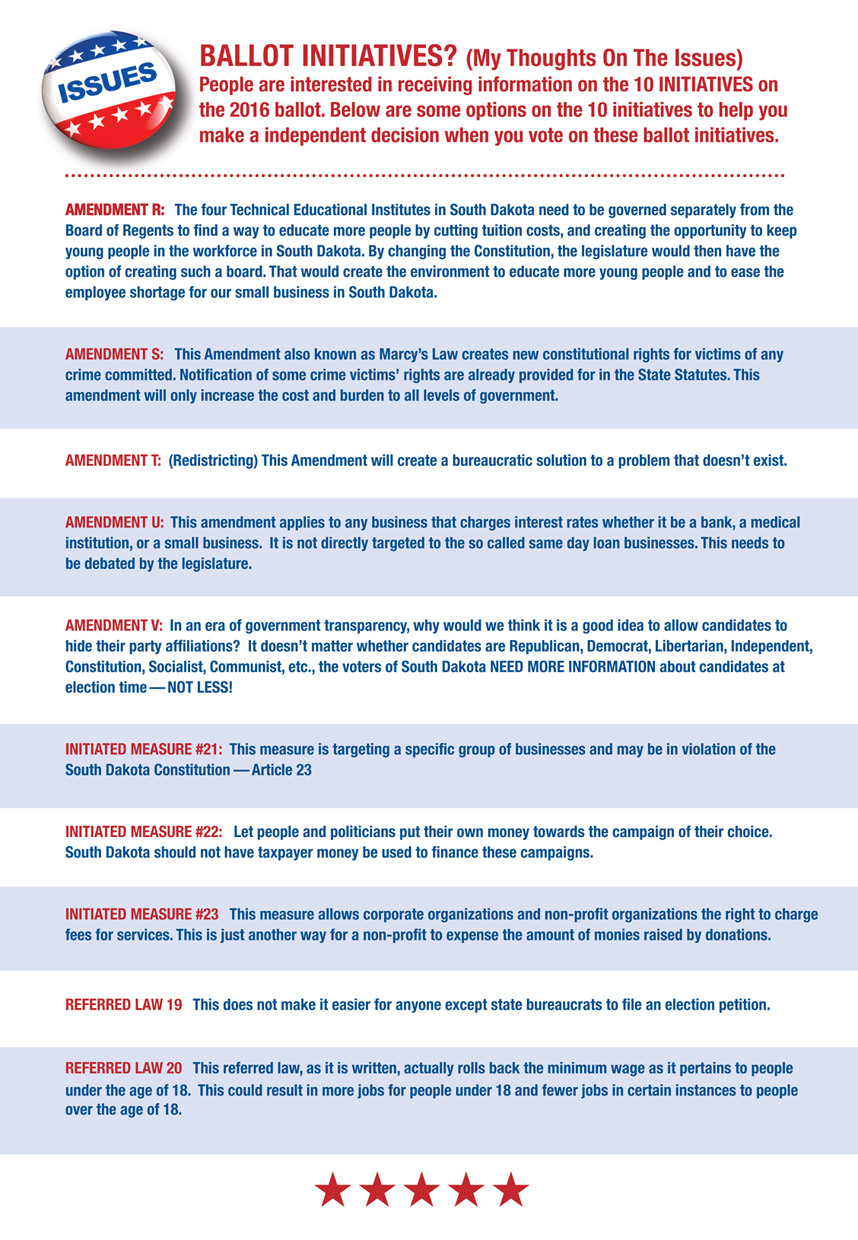

Kolbeck’s only clear Yes appears to be for Amendment R, the vo-tech governance proposal, which he, like his District 13 neighbor Rep. G. Mark Mickelson, hyperbolizes far beyond the actual text on the ballot. Kolbeck clearly rejects S, T, V, 19, and 22. He wants the Legislature to debate U, which I assume means he wants us to vote against it to allow that Legislative debate. On 20 and 23, Kolbeck sounds ambivalent.

I found Kolbeck’s statement on Initiated Measure 21, the 36% rate cap on payday loans, particularly interesting. “This measure is targeting a specific group of businesses and may be in violation of the South Dakota Constitution,” says Kolbeck. He cites Article 23, but I checked with him and learned that’s a typo: Kolbeck is concerned that IM 21 may violate Article 3, Section 23, which prohibits private and special laws. Article 3 Section 23 bans eleven specific types of special laws, but none of them appear to apply to IM 21. We can’t pass a law saying, “Dollar Loan Center can only charge 36% interest, but North American Title Loan can charge 574%.” However, I see no ban on regulating all businesses in a specific industry—in this case, short-term lending.

Only the catch-all clause at the end—”In all other cases where a general law can be applicable no special law shall be enacted”—hints at relevance. But to invoke that clause, we need to identify some general law that already caps or can cap interest rates. Might there be some case law that says we cannot subdivide industries with special laws affecting one group of businesses but not others? Perhaps we cannot cap rates for payday lenders while allowing Citibank and Premier Bankcard to continue charging higher rates on their credit cards (funny how usurers rhymes with Huetherers).

But I don’t see that argument on the face of the text before us. IM 21 is not a special law targeting a specific individual or company. South Dakota already has statutes exempting various subdivisions of the lending industry from various regulations, apparently without constitutional trouble. If there’s a constitutional argument against a 36% rate cap on payday loans, I’m going to need to see some evidence.

Here’s a helpful way to remember the ballot questions.

?? VOTE NO “only” on US1920 (NO on questions U and S and NO on 19 and 20) * that’s U.S.1920 ?? Remember what happened in 1920? The first nat’l election in which women participated. ?? These ballot questions aren’t pro-woman. ?? VOTE NO on US1920 … yes on the rest, if you think that’s right. ?

Yeah, Kolbeck’s argument doesn’t hold water. He is vastly overreaching. His interpretation would negate surface mining laws and much of the rest of the South Dakota Code.

So is Jack for freeloaders to sponge off other workers or for them to pay their fair share.

Cory your analysis is correct, IMO. Donald is also correct in that this is quite the stretch.

The entire section of law we are seeking to change is industry specific, not company specific. We pass laws every year that only effect certain slivers of our economy. This is especially the case regulating the many different kinds of financial products out there on the market. There is no one size fits all and that is a good thing. Our measure was carefully written to NOT effect the other financial products out there– banks, credit cards, John Deere loans, etc because the abuses we are concerned about are not as prevalent with those other financial products. Yes we are trying to end this industry in our state because they are selling an intentionally defective financial product designed to be a debt trap. They can stay in business if they can figure out a way to do it without screwing people. Good business encouraged by our state government should be win-win. The business offers a product and the customer needs it. It’s a win win. The poverty industry is entirely based on a win-lose model. ((BTW, the poverty industry is not just payday and title lending. It is also casino gambling, a business which our state is a partner in. When they win, South Dakotans lose)).

None of the subparts of Article 3, Section 23 apply to IM 21. IM 21 is not company specific. If it were, it might be unconstitutional under the catchall portion of this section, “In all other cases where a general law can be applicable no special law shall be enacted.” But again – IM 21 is not company specific, so this is not a concern.

If there was even a remote concern the AG would have raised a potential Constitutional issue in his explanation on the measure as he has done for other measures. In our case, it is not a concern.

All that said, the lenders have all the money in the world and much to lose so, as in other states, they just may try to undo all this after the election with some sort of legal challenge. They’ve sued four times so far and lost each time. They will lose again.

I’d also expect them, hopefully not in cahoots with the Governor/Division of Banking/Legislators, to try and skirt the will of the voters in this next legislative session by proposing some sort Credit Ladder Act which was just filed in PA, or the Flex Loan Act that they’ve pushed in other states. These are longer-term installment loans at 10-40% monthly (120%-480% APR depending on the state and the bill) for $1,000 to $5,000. They attempted to overrun AZ’s rate cap with a Flex Loan this year. They got beat back down again. We will carry on the fight here too.

Moses11, can you please post an address for me to send an invoice from “grudznick LLC” because you are benefiting from my blogging whether you want it or not. And as such, you must pay me for it. Heck, you more than most.

Lazy unions are dying. Buncha money grubbers, them.

Nick … You’d never have made it one day in a union workplace. Bad attitude and negativity aren’t tolerated by the upper echelon of any job skill. You’re better in a park trailer by yourself. lol

Donald—surface mining! Good example—we have different laws for surface mining versus deep Homestake-style mining, right?

Steve gets me thinking—we have separate laws regulating trusts, right? That would be a small subdivision of the financial sector.

“Special law” means applied to individual or company, not entire class of companies in same business, right, Steve?

Steve duly reminds us that the AG’s explanation for IM 21 says nothing about possible constitutional challenge. But that doesn’t prove there might not be a constitutional issue. AG Jackley said nothing about the constitutionality of RL 19, the Incumbent Protection Plan, even though I have demonstrated quite clearly that the provision banning party members from signing independent petitions is likely to fall before judicial scrutiny. Can we count on the AG to always fly the constitutional violation flag when ballot measures may trigger such problems?

Steve, one way to ensure that no such sneaky measures make it through the 2017 Legislature is to tell your church friends to vote for me! I promise to give the payday lenders no quarter (or half, or 37%) in any effort to circumvent the will of the people.

I believe Jack Kolbeck worked for Beal Distributing for years, so it stands to reason his boss Arch got him to run so Arch could vote twice in the legislature.