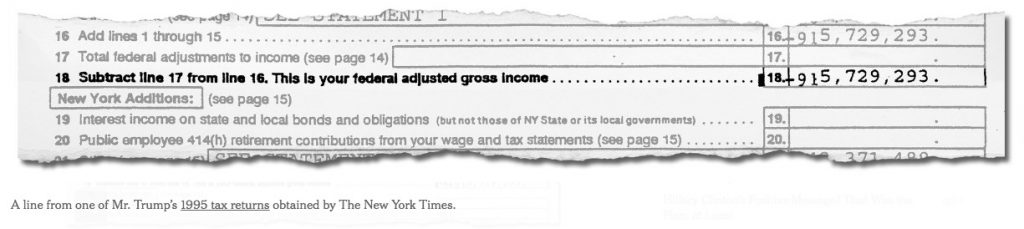

In publishing evidence that Donald Trump claimed losses so big in 1995 that he could have skipped paying income taxes for eighteen years, the New York Times establishes the credibility of its evidence with fascinating bit of font-ernalia, explained by Trump’s former tax preparer Jack Mitnick:

Mr. Mitnick, 80, now semiretired and living in Florida, said that while he no longer had access to Mr. Trump’s original returns, the documents appeared to be authentic copies of portions of Mr. Trump’s 1995 tax returns. Mr. Mitnick said the signature on the tax preparer line of the New Jersey tax form was his, and he readily explained an obvious anomaly in the way especially large numbers appeared on the New York tax document.

A flaw in the tax software program he used at the time prevented him from being able to print a nine-figure loss on Mr. Trump’s New York return, he said. So, for example, the loss of “-915,729,293” on Line 18 of the return printed out as “5,729,293.” As a result, Mr. Mitnick recalled, he had to use his typewriter to manually add the “-91,” thus explaining why the first two digits appeared to be in a different font and were slightly misaligned from the following seven digits.

“This is legit,” he said, stabbing a finger into the document [David Barstow, Susanne Craig, Russ Buettner, and Megan Twohey, “Donald Trump Tax Records Show He Could Have Avoided Taxes for Nearly Two Decades, the Times Found,” New York Times, 2016.10.01].

The Republican nominee has already threatened to sue the New York Times for printing “illegally obtained” documents. But that’s “just words”—instructively for us bloggers and other public watchdogs, Trump has no legal grounds for suing journalists for publishing documents they obtain from sources:

Even my journalism students in my entry-level media law class know that the First Amendment provides an absolute legal shield to journalists who are sued for publishing lawfully obtained documents that are a matter of public concern.

The U.S. Supreme Court’s rulings in Pentagon Papers, Florida Star v. B.J.F., and the tongue-twisting Bartnicki v. Vopper created a First Amendment protection for journalists who publish documents that are confidential by law – so long as the journalist is a passive recipient of the documents. The journalist cannot be prosecuted for criminal violations or sued under civil privacy laws even if the leaker broke civil or criminal laws by obtaining or leaking the documents [Susan E. Seager, “Donald Trump Can’t Shut Down New York Times Tax Leak Showing He Lost Nearly $1 Billion in 1995,” Daily Beast, 2016.10.02].

Journalists can still face charges for breaking into a locked desk and stealing papers (though what good reporter would ever do such a thing?) But if someone hands us documents, and those documents shed light on matters of public interest, we need not fuss about the provenance of those papers; we need to get our scanners and keyboards humming and inform the public.

Trump, Guliani, and Christie in an effort to make Trump’s tax cheating a page 3 story as saying today that Hillary has cheated on Bill.

Trump surrogates Guliani and Christie also think Trump is a ‘genius’ for taking advantage of tax laws that regular tax payers don’t have available to them.

Only a “top” level businessman could blow a near $Billion in 12 months. He really knows The Art of the Deal.

Think what he could do for America.

Come on Donald release those taxes.

How much do you owe Putin?

How deep are you into organized crime? Do they “help” run your casinos?

How little have you donated to charity?

How many women are you paying off?

Prove me wrong or admit it is true. Release those taxes.

There is no way Mrs. Clinton cheated on her husband. That is just absurd. Show forth this fellow who would cheat with her, I say.

grudz must be a picture to behold that he can criticize another’s looks.

@Roger Cornelius: “or taking advantage of tax laws that regular tax payers don’t have available to them.”

That’s not true. My partner and I used these same tax laws with some business losses we incurred when we purchased a company whose profitability had been misrepresented to us. Long story short, we were able to negotiate a buy back but still incurred losses including but not limited to lawyer and accountant fees and operating expenses. While our losses were nowhere the magnitude of Trump’s, the losses reduced but did not eliminate, our adjusted gross income over 5 or 6 tax years. Taxation of business income has to apply to cumulative income and not solely to net profits or you would destroy any incentive to start or expand a business.

Also the NYT is implying that Trump is receiving a tax credit instead of an income loss that only diminishes the adjusted gross income by reporting that he might not have paid any income tax for 18 years. If he was only allowed to take credit for $50M against the agi but made $100M in that year, he would still be liable for the income taxes on the other $50M. Bad reporting by the NYT but I can’t say I’m surprised as this was meant to be a political hit piece.

Drumpf is a brilliant business man-smart enough to lose nearly a billion dollars in one year so he wouldn’t have to pay taxes for 18 years.

Screwdy Rudy says that makes Drumpf brilliant. Rudy has enough skeletons in his closet he really shouldn’t be talking about someone else cheating on his wife.

And Mitchy McCTurtle is still mad at Obama for not talking the senate out of over-riding Obama’s veto and looking like complete idiots for doing it. The Senate has to re-write the bill to sue Saudi Arabia when congress is back after the election. Harry Reid was the only Senator not to vote for over ride.

Take a comprehensive look at Drumpf’s business accumen and there should be no doubt this guy is/was/and always will be in over his head. Now he doesn’t have daddy to bail him out.

Awww, Trumpy doesn’t like it when people disclose his personal information! He sure was in favor of Russia going after Clinton’s personal emails. Most recently, he encouraged people to view alleged sex tapes of the former Miss Universe. He has also tried to ruin anyone that criticizes or crosses him including a Gold Star family.

It appears that two things that Trump said are true: 1) he loves using Other People’s Money. 2) The system is rigged.

He loves using OPM because it is a game of Heads–Trump wins, Tails–A Trump entity declares bankruptcy and other people lose. If the deal goes good and he buys into a rising market, he uses OPM to leverage his own money to make a killing. This is why he was rooting for the real estate market’s collapse. If the deal goes bad and he buys before a market retreat, he makes his creditors mark down his debt or he threatens to declare bankruptcy. He declares bankruptcy often enough for his creditors to know that he is not bluffing.

The system is rigged in his favor. He is a billionaire and he pays no taxes. If he did pay taxes, they would be at the alarmingly low capital gains rate compared to all us working schmucks who are going to typically pay upwards of 40% in income and payroll taxes. Even his charity is a sham that pays for his lawsuit settlements and for artwork of himself.

It is not bad reporting by NYT, they can only report what they have access to and Donald Trump refuses to disclose all of his tax returns to the American voters.

What is the whole truth about Trump’s tax returns, Coyote, and why is he so privileged not to reveal to the public what he has been doing with his taxes since 1995.

He is the only presidential candidate not to report his taxes to the public since the practice started. Why is that Coyote?

best line of the day so far.

“If you’re rich and don’t pay taxes you’re a genius and if you’re poor and don’t pay taxes you’re a moocher.”

Drumpf’s foundation isn’t properly licensed or permitted according to NY’s AG.

Say what you may about the New York Times, but they kept their word. They have kept their word even at the risk of legal issues. Is that not what our 4th estate is really about. Note to local news folks, do your damn job, go after the story and find the answers. http://money.cnn.com/2016/09/12/media/ny-times-editor-jail-donald-trump-taxes/ The New York Times has aggravated me on occasion, but this is really something amazing.

No wonder Trump believes in debt and is always bragging about being highly leveraged at times. That is because most likely he takes the debt and overtime turns it into a loss (with the help of accountants), then uses this debt to pay for future tax obligations… What a stunt or cottage industry….The wealthy are always complaining about how the capital gains taxes in this country are too high, but that is merely an academic complaint at best, if you are sitting with a credit at the IRS office, however. I wonder how many other wealthy Americans have the same credit with the IRS as we speak?

Oh, the life of the owners class, they are always telling us to be like them, but if we did that, who would pay to run the government?…. Maybe we could run it with credits from the IRS?….;-)

Release your taxes Donald Trump! This is an example of how our tax laws favor the wealthy who can afford the specialty tax lawyers (who are among the highest paid legal specialists) who speak an entirely different cryptic language from the rest of us. What we do not know yet is whether this was illegal. It certainly does not help the Donald in the court of public opinion for sure.

In other news, this story by Avi Asher-Schapiro & David Sirota, is compelling because it points to research into what appears to be insider trading which is illegal and prosecutable with prison time, i.e. Raj Rajaratnam.

http://www.ibtimes.com/political-capital/big-data-exposes-how-politically-connected-traders-cashed-during-financial-crisis

https://www.youtube.com/watch?v=S_Gf0lB04kE

Obama, can we now prosecute some of the big banksters who crashed our economy (and some of the politicians who gave them the inside information)?

This tax return disclosure has Trump flustered and redish-orange-faced. Whenever he faces increased criticism on an issue, he lashes out like a wounded animal. After criticizing HRC for enabling Bill Clinton’s infidelities a couple of days ago and not leaving him. Now he is criticizing HRC for not being loyal to Bill.

http://www.cnn.com/2016/10/01/politics/donald-trump-hillary-clinton-health/index.html

Whenever he is looking temperamentally unfit to be president and darn near crazy, he calls HRC temperamentally unfit and crazy.

When Trump is exposed for losing $915 million in one year and not paying taxes, he lashes out at HRC like he can compensate for his failures by attacking her. He said “She’s never done anything meaningful. Never. Her only legacy is death, tremendous financial loss and failure,” he added later.

Id.

To recap where we are at on Trump: His temperament is like a spoiled 2 year old. He seems to not care a wit about policy details. He takes stabs at tax policies that are widely panned for their giveaways to the rich. His childcare proposal wouldn’t help poor working folks, but would help wealthier folks. He would get rid of the estate tax which would save his family billions. His claim to fame was his business acumen and building a wall. If it turns out his business success is greatly overstated (and this tax return disclosure plays right into everyone’s theory that he is hiding something really bad), all he has left is building the wall. Ok, maybe the wall and lashing out at people.

Losing $916 million in the middle of an economic upswing is anything but brilliant:

Of course, as recently as 2015, Trump was happy to denigrate people who don’t pay federal income tax as freeloaders.

As was the case in Monday’s debate, the greatest threat to Trump’s campaign is his own words.

I don’t recall a tax or other financial scandal with Jill Stein.

Leo, I have been advised by people that “the low swimming whale does not get harpooned.”

@Darin, I bet you have.

@Darin, are you calling Jill Stein a whale? That is sexist, isn’t it?

@Darin, or were you talking about free speech, and about being careful that it not surface to breathe?

Who is Jill Stein again?

Jill Stein probably never caused her accountant’s software to max out and force him to stick her return into a typewriter to finish writing her nine-figure business loss. Jill Stein, like Hillary Clinton, likely understands the Constitution well enough to understand that you can’t sue journalists for doing their job.

If running around bold face lying to everyone about everything makes you a genius, then, fine, Trump’s a genius.

What about all the women he’s been with and cheated on over the years? – making the cover of all the magazines in the supermarket checkout isles for decades – we’ve all seen it – he’s disgusting. Trump’s 2 big family values are:

• Get the hottest woman you can, then throw her away to find another one when she gets old and boring.

• Family is about the Trump brand and enjoying the kind of ‘quality’ of life that only gold plated toilet seats can provide.

I’d bet my house that his kids were raised by nannies while he was off finding new women at beauty pageants (like his current wife) and digging his intellectually broke ass out of debt.

I’d also bet he ponied up for the very best nannies to raise his kids for him – for whatever it’s worth.

@Darin Larson:

“The system is rigged in his favor. He is a billionaire and he pays no taxes. If he did pay taxes, they would be at the alarmingly low capital gains rate compared to all us working schmucks who are going to typically pay upwards of 40% in income and payroll taxes.”

Umm, no. Just talking income and payroll tax here, the average “working schmuck” (married, filing jointly) is actually paying closer to a 22% effective income tax rate plus an effective 2% FICA on the maximum 33% marginal tax bracket income of $413,350. Together the combined tax rate would be about 24% while the long term capital gains rate for incomes of $464,851 or more would be 20%.

Most people don’t even have the slightest comprehension of our tax code to even be commenting. Darin, you make almost a half million in income a year? Dang son.

Trump claims he is an amazing businessman… but he managed to lose a billion dollars during a period of economic growth, several of his casinos failed (a business model which consists of people giving you money and all you do in return is give a portion of it back), and he has filed bankruptcy within his companies numerous times.

The thing is, it doesn’t really surprise me that Trump would lose money one year and not pay taxes on it – that’s just business. What surprises me is that this self-proclaimed genius businessman apparently hasn’t made enough money since 1995 to offset those losses. For a man who claims to be worth billions and billions you would think he would have made enough in the past two decades where he would incur some level of income tax.

The bottom line is we are told that Trump is a great businessman and that he could lead the country to similar levels of success. However the one piece of evidence we could use to determine his level of success is his tax returns… which he refuses to release. He has a lot of excuses folks – the best excuses – but that doesn’t change the fact that he hasn’t released his tax returns.

If everyone was as “smart” as Donald Trump and used tax loopholes to avoid paying income taxes… how exactly would our government function? This is no different than GE or Apple avoiding tax liabilities by using clever tricks and loopholes. It doesn’t matter that it is legal – the end result is still a person or a company making billions but still not paying any income taxes. That tells us our tax code is broken, and if Trump was honestly proud of not paying taxes then he would release his tax returns. Yet he won’t – because chances are there are a lot of things in those returns he doesn’t want the public to see.

Neil Cavuto had noted tax attorney Cha Chi Arcola as his guest to disgust Drumpf’s tax returns.

Drumps was telling vets with ptsd they are not strong. This is probably what makes Drumpf brilliant at military matters and defense.

MFI, agreed. His genius is his lack thereof. Kind of like George W. Bush disguising his intellectual handicaps by referring to himself a lot as a common sense person – the kind of guy conserva-voters all wanted to have a beer with. Stupid is as stupid does, and conservatives are going to pay so dearly when all is said and done for this whole Trump for President thing.

He is who I thought they were.

Coyote, I’m sure you know I was referring to marginal income tax rates and self employment payroll taxes when I mentioned the 40% figure. For a single filer with income of $37,651 – $91,150 or a married person filing jointly with income of $75,301 – $151,900 or a head of household with income of $50,401 – $130,150, their marginal tax rate is 25%. Add in roughly 15% for self employment taxes and you are at 40%.

Read more at: http://www.moneyunder30.com/income-tax-brackets-marginal-rates

Now, since you mentioned effective tax rates. What is the effective tax rate on Donald Trump when his real estate portfolio increases 25% in one year and say that gain was $500 million? As you know, he pays no tax on this gain until it is realized so his effective tax rate is 0% until he sells the property. Moreover, when he sells the appreciated property his effective tax rate is 20% on the income from the gain on the sale. So let’s say he sells his real estate portfolio for a $500 million gain. Trump then pays an effective tax rate of 20% while a typical middle to upper middle class citizen pays a similar or higher effective tax rate on a fraction of the income that Trump made. So much for progressive tax rates. The system is rigged to favor the wealthy much more than the typical middle income wage earner.

Darin – the same is true for capital gains. A teacher, a coal miner, a nurse, or a carpenter who often work 50-60 hour weeks and give 100% at their jobs each and every day may find themselves taxed for 25% of their income at the end of the year.

Meanwhile someone with disposable income who invests in the stock market and has good fortune could make hundreds of thousands or even millions of dollars only to find it taxed at 15%.

So we are basically saying the money you actually work for and earn should be taxed at a higher rate than unearned income that requires very little interaction. How insane is that exactly?

This is why Warren Buffet was quoted as saying he pays a higher effective tax rate than his secretary… because his income is via dividends and capital gains while his secretary’s income is from wages.

I’ll never understand why one type of income should be taxed at a rate less than another type.

NYT reporter hints she may have more of Drumpf’s tax returns.

Fortune Mag says Drumpf may have severely under-reported his income for 1995. He only listed 6 grand.

Exactly Craig. I’ll add a couple more layers to this discussion. Capital gains can put off until death at which time you can get a step up in basis to fair market value. The result is that the gain on the capital assets will never be taxed. The effective tax rate is 0%.

The wealthy also have at their disposal provisions like the section 1031 like-kind exchange which allows people like Trump to sell real estate and buy other real estate and not recognize the gain on the sale of the first parcel of real estate. Pretty sweet deal.

We are favoring the rich and super-wealthy at every turn. Trump wants to go one better and get rid of the estate tax so that his wealth in business and real estate may never actually be taxed even though he is worth billions. Trumped up trickle down economics, indeed!