One of the complaints against Senate Bill 136, the bipartisan grassy buffer strips bill that Governor Dennis Daugaard vetoed last spring, was that the bill sponsors didn’t calculate an exact cost for the property tax incentives SB 136 would offer for returning cultivated land to grass.

The Daugaard Administration presented a draft of its preferred grassy buffer strips bill to the Ag Land Assessment Task Force in Pierre yesterday. Governor Daugaard hasn’t calculated the cost of his plan, either:

Houdyshell said he’s working on cost estimates for the counties of Lincoln, Minnehaha, Pennington and Perkins for 50 feet and 120 feet. “We haven’t completed our analysis,” he said.

For Lincoln County, there would be 400 acres of crop-rated soils and 473 acres of grazing-rated soil. Strips 50 feet wide would reduce taxes by more than $4,000 and strips at the full 120 feet would run an estimated $11,838 in reduced taxes.

Houdyshell said he would bring more detailed analysis on the potential cost to the October meeting of the task force [Bob Mercer, “Costs Still Unknown for Buffer Strips Tax Break,” Mitchell Daily Republic, 2016.09.12].

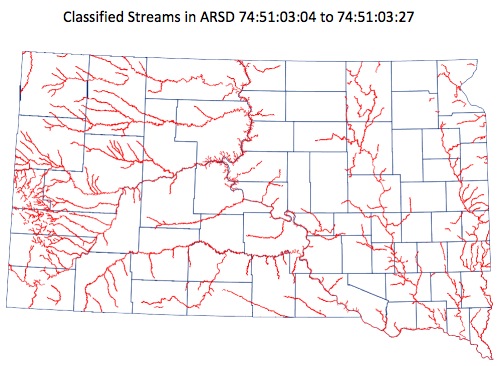

The Governor’s plan may not have a dollar figure, but it does have two geographical figures: 575 lakes and 24 rivers and streams and their tributaries. Governor Daugaard’s proposal specifies two lists of water bodies—lakes designated for immersion recreation or limited contact recreational benefit and rivers and streams designated for fish life propagation beneficial uses—for riparian buffer strips. Those streams constitute roughly 11,000 miles of waterway:

Looking at that map, it’s interesting that Marshall, Day, Clark, Hand, Hyde, Edmunds, and McPherson are almost entirely devoid of streams that would qualify for the grassy buffer strips tax incentive. However, even those low-flow counties are dotted with lakes that will qualify.

The Governor’s proposal would allow landowners to decide how wide they want to plant grass, between 50 feet and 120 feet out from the top of the stream/river bank or the lakeside vegetation line.

The Governor’s brief highlights four key differences from SB 136:

1) Establishes a separate classification for eligible riparian buffer strips, similar to other existing separate classifications; SB136 established no such classification – it provided a unique exemption from SDCL 10-6-33.32 [Daugaard Administration, “Riparian Buffer Strips—Bill Summary,” submitted to Ag Land Assessment Task Force, 2016.09.12].

This distinction is wordplay. Governor Daugaard contended in his SB 136 veto message that we can’t constitutionally tax land within the agricultural classification at different rates; he thus dresses his different tax rate up as a new property classification.

2) Provides a tax reduction for crop-rated and non-crop rated soils at 60% of its assessed value; SB 136 only applied to crop-rated soils and reduced them to non-crop rated soil levels [Daugaard, 2016.09.12].

A major point of SB 136 was to get farmers not to plant to the water’s edge, thus insulating lakes and streams from sediment, fertilizer, pesticides, and other pollutants. The Governor appears to be expanding the incentive to land that, with a lower soil rating, may not require as much incentive to be left to grass.

3) Identifies specific lakes and streams – already in administrative rule – to which this classification applies; SB 136 did not define which water bodies were affected [Daugaard, 2016.09.12].

This change is a straight-up improvement. We can draw the map, measure the shorelines, and figure out the maximum cost if every adjoining landowner participates.

4) Outlines the criteria properties must meet in order to qualify (vegetation type and height, grazing restrictions, etc.) that will improve water quality and better align with federal and state conservation program guidelines; SB 136 included less specific criteria [Daugaard, 2016.09.12].

This change, too, feels more substantive. Senate Bill 136 was silent on the issue of haying and grazing. The Governor’s proposal clarifies that grassy buffer strips may not be harvested or mowed until July 10 and can’t be cut shorter than six inches. It also restricts grazing from May through September, to keep cow poop out of the water during the high recreational season.

All of these issues could have been worked out in Senate Bill 136, and we could have started incentivizing good conservation and water quality practices this year. I won’t grouse much about passing this helpful environmental measure a year late… but remember: grassy buffer strips are such a good idea that even Governor Daugaard is willing to back them without knowing the total cost.

Would these filter strips qualify as CRP entities so the Fed will help pay to install them?

MFI,

I don’t think so unless the landowner owned a very long strip. The minimum acreage for the CRP is 10 acres. An acre is 43,560 sq. ft. Thus, one would need to have a continuous strip (at 120 ft wide) of almost 2 miles. Maybe a few which control an entire lake or west river along the Cheyenne/White/Moreau/Grand or Bad Rivers (Ted Turner might own 2 miles along the Bad).

Thanks, Troy.

I don’t have a shoreline length on the lakes, but if we have 11,000 miles of streams, and if we fully grassed both sides of those streams out to 120 feet, that would be 500 square miles of grassland, or 320,000 acres. Houdyshell’s 873 total acres in Lincoln County seems a bit small… but maybe that’s simply because a lot of land there is urbanized and ineligible for this incentive.

But if I can extrapolate anything from Houdyshell’s Lincoln County estimate, he’s figuring $14 tax break per acre. That’s more than the $12 an acre Senator Peterson said he might get on the difference between cropland and non-cropland assessment under SB 136; it’s less than half what Houdyshell said SB 136 would cost on Moody County cropland moved to noncropland.

And if that $14/acre figure is valid statewide, full implementation along both sides of every designated stream would cost over $4.3 million. That’s $5 per South Dakotan.

There are also CRP contracts called “continuous CRP”. For example tree plots that can be far less than ten acres in size. Maybe the federal government will come up with such a program for streams.

From the map it looks like only the major streams will be eligible. Makes no sense. To make a big difference all streams need to be eligible. Dumping cow manure into Medicine Creek in Jones County SD is almost as much a threat to Missouri River water quality as dumping cow manure into the river near Big Bend where the Medicine Creek flows into the Missouri River.

Same thing holds true for soil erosion. Where did all this soil load come from that is clogging the lake by Gavins Point? Much of it came from far upstream. A reservoir will fill up with soil just from natural erosion at the rate of 1% per year. Unless stronger measures are taken to prevent soil from farmland finding its way into these reservoirs they will become mudflats way sooner than we would like.

MFI,

My math is all wrong. To qualify under the 10 acre rule (there might be more than size to also qualify), a 50 ft. strip only has to be .167 miles long.

I think one impediment to a farmer double-dipping will be the CRP grazing/harvesting restrictions are more onerous than what this bill requires. Additionally, because much of the land near water is relatively flat, it might not qualify under the “erodible” requirement. I don’t know any of this for sure. Just my conjecture.

I can get behind this plan as well. It won’t cure all the ills of our lakes and rivers however it is a start.

The best part is farmers have a choice to install the buffers or not.

Good luck with the CRP angle:

http://www.capjournal.com/news/sd-sees-dismal-crp-general-signup/article_f83af8ce-18be-11e6-a267-eb950a01b5ae.html

Troy: Your math is still wrong ;>)