Last updated on 2016-10-25

Speaking of the man I will replace in the South Dakota Senate, David Novstrup said raising the minimum wage would bring all sorts of bad economic consequences. He had no evidence then to back that claim, and June 2016 South Dakota Economic and Revenue Update from the Bureau of Finance and Management tells us in several charts that Novstrup has no such evidence now.

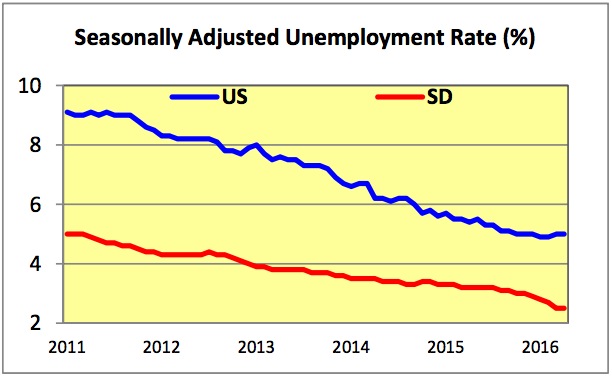

Since the implementation on January 1, 2015, of the voters’ will to raise South Dakota’s minimum wage to $8.50 an hour and adjust annually for cost of living, South Dakota’s unemployment rate has continued to decline.

As of April, South Dakota’s 2.5% unemployment rate was half the national rate and the lowest of any state.

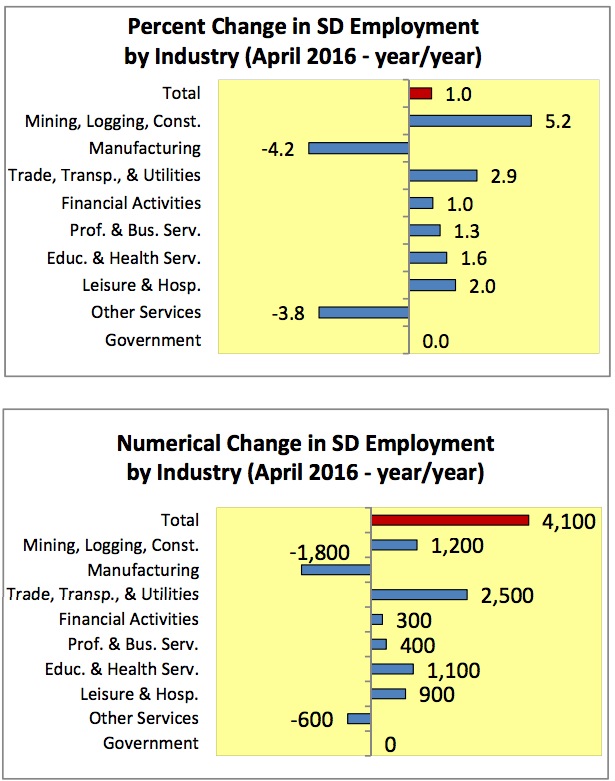

Jobs increased by percentage and number, and they increased in the leisure and hospitality sector, where Novstrup had warned a higher minimum wage would reduce opportunities:

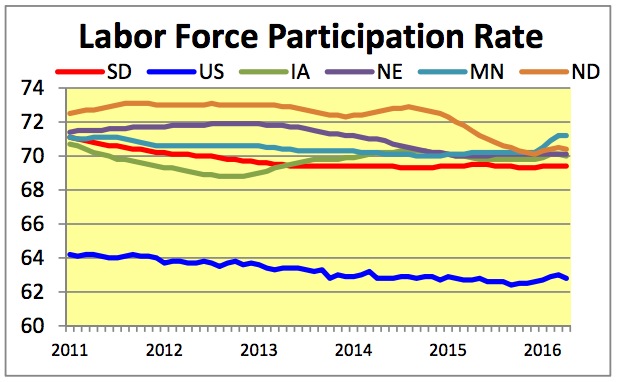

Nor did the minimum wage appear to have any impact on labor force participation:

BFM points out that “South Dakota’s participation rate has declined from a peak of over 73% in the early 2000’s” but settled around 69.5% in 2013. The 2015 minimum wage hike appears not to have budged that curve from its now fourth-year holding pattern.

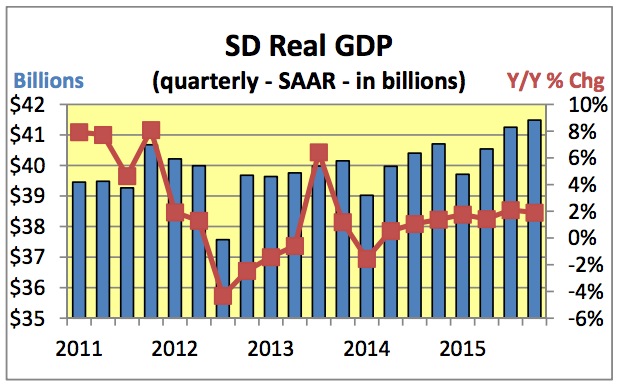

The state’s overall economic output seems to have weathered the increased minimum wage just fine:

Despite low farm prices, South Dakota’s real GDP was higher every quarter last year than in the corresponding quarter in 2014.

Despite low farm prices, South Dakota’s real GDP was higher every quarter last year than in the corresponding quarter in 2014.

In other words, we raised our minimum wage over 17% and South Dakota’s economy rolled on without a hiccup. David Novstrup’s effort to cut the minimum wage for young workers was absolutely unnecessary; we can kill his Referred Law 20 for good this November without any qualms about economic impacts.

It’s worth noting the elephant in the room as a confounding factor: the years covered were not far removed from the largest recession since the Great Depression and coincided with a gradual economic recovery. I still think your points are damaging to the stance originally taken by Novstrup, but they aren’t necessarily a killshot.

Boost my kill ratio: the recession barely hit South Dakota. But please elaborate: if there were any merit to the cries of economic peril issued by Novstrup, wouldn’t we have seen some sort of bend in those curves away from their recovery trajectories? Labor force participation, for instance: it stabilized in SD in 2013. There’s no dip when the minimum wage rises at the beginning of 2015. Where’s the impact Novstrup and friends anticipated?

“the recession barely hit South Dakota”

I don’t think that is true. Yes, South Dakota did comparatively well to the rest of the US economy, but 2009 saw roughly 13% of manufacturing jobs cut and a net loss of workers that hovered around half of the national average (a bit less than half actually). Source: http://dlr.sd.gov/lmic/economic_report_2009.aspx#recession Much like fashion, music, food, and the varied positions of the kama sutra, things hit South Dakota a bit later than the rest of the nation. True, we did not suffer the negative impacts of the recession like others did, but we still felt it. I’d like to attribute this to the inelastic supply of our exports: people gotta eat. Nonetheless, we got hurt.

As to labor force participation: I think someone could reasonably argue that the decimation of 401(k)s and investment portfolios during the recession has forced boomers to remain in the labor force for much longer than they would have otherwise. I’ll quote a relevant passage from a Stanford piece and provide the link:

Is there any evidence to support the argument that a loss

of retirement wealth among older adults has induced them

to delay retirement? This argument can be addressed by

examining changes among older adults in their labor force

participation rate (defined as the percent of the civilian noninstitutional

population in the labor force). It’s clear from figure

2 that older men’s participation rates have indeed changed

during and after the Great Recession. The most interesting

shifts occurred at ages 62 to 64. Between 2007 and 2009,

participation rates surged for men in this age group, increasing

3.4 percentage points as the unemployment rate soared.

Relative to the 2007 participation rate of 34 percent, this is

a 10 percent increase in only two years. The only other two year

period in which participation rates for men age 62 to

64 grew as rapidly over the past three decades was 2000

to 2002. Interestingly, the stock market crashed during both

periods, with the S&P 500 stock index falling 49 percent from

September 2000 to October 2002 and 57 percent from October

2007 to March 2009. The timing suggests that, just as

some have hypothesized, retirement wealth lost in the crash

kept some older workers in the labor force and discouraged

them from retiring early.

Because economic recovery has been slow, but steady, I don’t think it’s a stretch to argue that the massive losses accrued in the Derivatives Debacle™ have been slow replacing and thus labor force participation by the massive number of baby boomers has kept things high, minimum wage impact be damned. Nonetheless, I do think Novstrup oversold the s— out of his position, acting as though raising the minimum wage would lead to the apocalypse. Bernie Sanders is out of his mind with this across the board $15 minimum wage bulls—, too.

My guess is that we lag behind our neighbors in Labor Force Participation Rate because we’re the #1 state for retirees.

Kind regards,

David

People who have more money are able to EMPLOY more other people. They are “job creators”.

Richard, oh, my goodness. This is one of the insanities we have been fed for the last 40 years that keeps us in the mess we’re in as far as production, employment, and wage growth in this country.

It is the demand for stuff and the ability to buy the stuff that drive job creation.

Like this: People who have more CUSTOMERS are able to employ more people, but in order to be a customer, you must have TWO things: need or desire for stuff and money to buy the stuff. When demand outstrips a business’ ability to serve its customers, then businesses hire more people to either sell stuff or make more stuff to sell. When more people have better jobs that provide them with more income, they can, in turn, buy more stuff. This is, again, demand. Increased demand then creates the need for more people to buy and sell more stuff. Businesses hire more people and so on and so forth. At some point, if we’re lucky, lots of people are employed and the job market gets competitive.

When the job market gets competitive, wages go up because businesses have to pay more to get people to come to work for them making and selling the stuff (In case you’re wondering, they hire more people and pay them more because they have to have people making and selling the stuff to make a profit, which is the point of business.).

This is a bit of an over simplification of the economics of wage and job creation (I didn’t even get to inflation, some of which is a good thing, believe it or not.) but, this is where job creation and wage growth occur, not with people who have more money feeling the need to just hire more people cuz they need to get rid of their extra money, somehow.

Of course increasing the minimum wage has no effect on unemployment. Researchers’ settled that long ago. Move on.

http://ritholtz.com/2016/07/the-challenger/

Geez, expand one’s horizons. The prairie and its sky are limitless – so act like it.

Thank you Cory for your outstanding analysis. ‘Farmer in the Hell’ is right in saying more money in hand leads to more economic growth.

“Of course increasing the minimum wage has no effect on unemployment. Researchers’ settled that long ago. Move on.

http://ritholtz.com/2016/07/the-challenger/

Geez, expand one’s horizons. The prairie and its sky are limitless – so act like it.”

There is no consensus on the impact of minimum wage hikes on employment rates, with time series analysis varying across time frames and age groups. The rest of your post past the link is meaningless platitude, so thanks, I guess.

I don’t believe you’ll see the job loss impact as predicted in the current situation where full employment exists and the private sector minimum rate exceeds the statute mandated rate by a considerable amount. Certainly you will see some job loss in smaller, isolated markets such as in Sagebrush, SD but those will be more than offset by the larger markets such in Sioux Falls where fast food jobs go begging with a $10-$11@hr wage being offered. Also consider that while jobs themselves may not be lost, you will see hours being reduced in addition to shorter business hours because of an inability to staff during those hours.

“Certainly you will see”—that’s a fine assertion, Coyote, but meaningless against the evidence I’ve presented. We’ll give your wishful thinking some credence when you show us the job numbers from Sagebrush, SD.

Where is Sagebrush? Is it next to Mayberry?

Kind regards,

David

David, I think Sagebrush is the seat of Bramble County.

@David: “Where is Sagebrush? Is it next to Mayberry?”

Pretty much. I suppose I could have said Small Town, SD or possibly a really snarky pejorative. What Cory’s numbers and graphs don’t show is while the current minimum wage is irrelevant in Sioux Falls, in the smaller town’s it’s not. The mandated minimum wage will have a greater impact in those towns where the economy and growth isn’t as vibrant as Sioux Falls or Rapid City or the I29 Corridor. And while minimum wage jobs may not always disappear because of the increases in base wages, businesses have other strategies when dealing with the rising costs of payroll including fewer hours for workers, shorter business hours and hiring freezes, all of which add up to a weaker local economy. And much of these losses are being masked by the greater increases in business in the healthier and larger parts of SD’s economy.

I’m still waiting for your empirical evidence, Coyote.

The empirical evidence of negative effects of the minimum wage would overwhelm this blog. However, a survey of empirical literature by David Neumark and William Wascher, found that “Minimum wages reduce employment opportunities for less-skilled workers, especially those who are most directly affected by the minimum wage.” Go figure, the Law of Supply and Demand is confirmed.

Statistics can be easily molded and manipulated and misunderstood especially by the economic illiterati. Mark Twain once wrote that “There are three kinds of lies: lies, damned lies, and statistics.” I believe that most advocates of a higher minimum wage understand that raising the minimum wage does adversely affect unskilled worker job prospects but all things considered, that’s simply the price paid for the flawed policy of equality of outcome. But they can’t say that and so they cloak it by claiming the Laws of Supply and Demand are suspended in this situation and that it’s all benefit and no cost.

I, for one, would like to be overwhelmed by empirical evidence, rather than by pedantic snot.

Here, knock yourself out Anne. Be careful not to slip on the pedantic snot.

http://www.downsizinggovernment.org/labor/negative-effects-minimum-wage-laws

Don, nothing overwhelms this blog, especially not your propaganda. Not one word you said has refuted the empirical data presented by our state. South Dakota’s economy has cruised along under the 17% minimum wage increase with no sign of damage.

But if all I have to do is match link for link, well…

http://news.berkeley.edu/2016/03/10/study-sees-positive-impact-of-raising-new-yorks-minimum-wage-to-15-an-hour/

http://www.sfgate.com/bayarea/article/Minimum-wage-boost-creates-positive-effects-5549510.php

https://www.dol.gov/featured/minimum-wage/mythbuster

See also this balanced minimum wage primer:

http://journalistsresource.org/studies/economics/inequality/the-effects-of-raising-the-minimum-wage

Your own guy Neumark calls the job losses “a small drop… that should be weighed against increased earnings for still-employed workers because of higher minimum wages”: http://www.frbsf.org/economic-research/publications/economic-letter/2015/december/effects-of-minimum-wage-on-employment/

…though if you want to stick with Neumark and increase the Earned Income Tax Credit instead of the minimum wage to fight poverty, then I welcome your advocacy of social welfare:

http://www.frbsf.org/economic-research/publications/economic-letter/2015/december/reducing-poverty-via-minimum-wages-tax-credit/