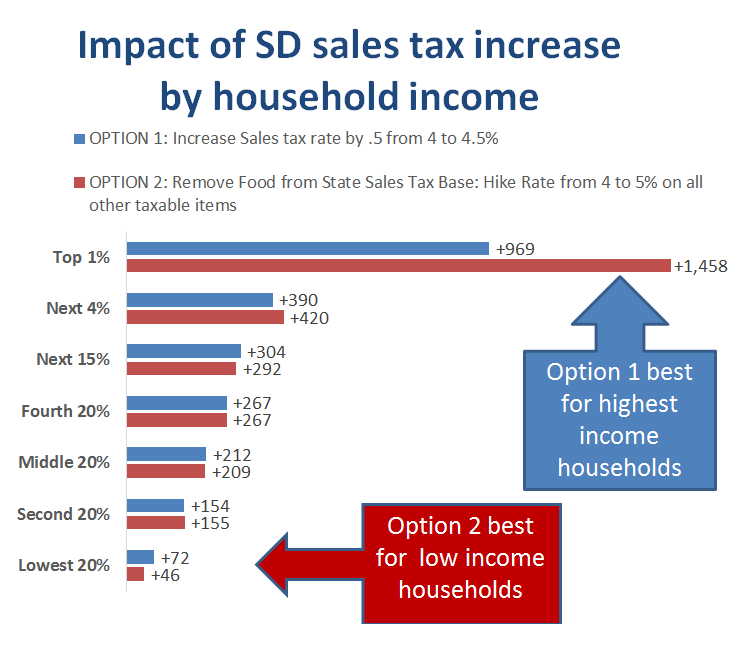

The South Dakota Budget and Policy Institute surges into the teacher-pay-raise debate with a great analysis of the competing sales tax proposals. Both proposals, Republican Governor Dennis Daugaard’s half-penny sales tax and the Democrats’ full-penny with 0% on food, are regressive taxes, but SDBPI’s Joy Smolnisky agrees with me that the Democrats’ proposal is less regressive because the bottom 20% of households by income would pay a lower share of their income under the Democrats’ plan than they would under the Governor’s plan:

Pass the Democrats’ plan, and the poorest 20% of households in South Dakota will pay a third less in increased sales tax than they will under the Governor’s plan. The next 75% of households will pay about the same amount under either plan. Only the richest 5% of households pay substantially more under the Democrats’ plan. The extra hit under the Democratic plan for the wealthy folks in the 95%–99% slot is 8%. The infamous 1% pay 50%, $489, more under the Democratic plan.

Read that again: pass the Democratic plan, and 95% of South Dakota households pay about the same increase as or, where it matters most, among the poor, a smaller increase than the Governor would impose. And we pay teachers a higher wage—median in the region, not the bottom!—without having fire 400 teachers to reach our salary goal.

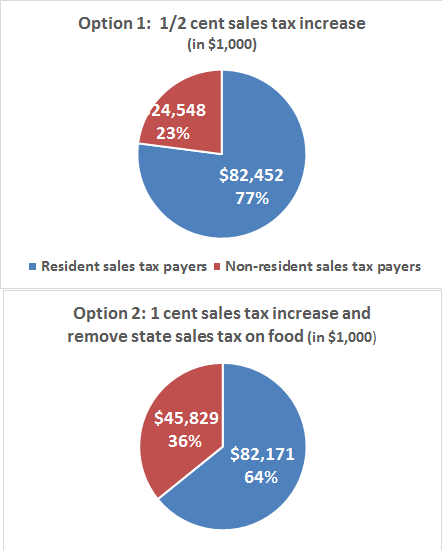

Overall, the Democratic plan raises $128 million compared to the Governor’s $107 million (and remember, the Governor hands $40 million of his revenue back to property owners as property tax relief, further increasing the net regressivity of his plan and decreasing the revenue available for education). Amazingly, the Democratic plan actually collects a few hundred thousand dollars less from South Dakotans than the Governor’s plan. The Democrats recoup that difference and goo-gobs more by capturing visitor cash:

Democrats charge us a little less and soak visitors for 87% more. If our legislators look at the numbers, they won’t shout, “No Taxation Without Representation!” They’ll realize they have an opportunity to pay teachers a whole lot more, tax South Dakotans a few hairs less than the Governor is asking, and take much better advantage of revenue from people who won’t be around to vote against them in November… all by dumping the Governor’s plan and voting for the superior Democratic plan.

And with that, as of 14:18 CST today, the House is in session and will debate the Governor’s plan, HB 1182, sometime this afternoon. Watch live on SDPB’s video feed [Update: video is archived below; debate on HB 1182 starts around 42:50]:

I’ve been saying this for the last month that the Governor’s plan does not benefit the lowest income brackets.

It’s been lost by the same individual screaming for schools to decrease reserves. I’ve done the math on the tax base (once the state got the website back up) and this perceived notion of years of reserves to spend doesn’t exist. The math doesn’t work out and the same thought of this hidden money is how we have gotten to where we are.

As for district consolidating you are already seeing that. Go west river and visit communities like Sturgis where kids spend time living in the community because driving back and forth to school isn’t an option in the winter months. In the northeast corner of the state with the unpredictability of winner you have districts having students on the bus for 90+ minutes in good weather. Also statistics will support that larger class sizes reduce testing scores. The more kids you put into a room is not good. I had 35+ students in class at Aberdeen Central during my student teaching (years ago) and it was a common experience according to the students.

Why does a plan to increase revenue by raising taxes also need to BENEFIT the lowest income bracket?

@Jeff because any increase in the bottom bracket is good for the economy in the long run.

…and because, Jeff, the current system unfairly burdens the lowest income bracket, and we have an opportunity in the midst of this increase to lessen that burden. But keep in mind: the “benefit” we’re talking about is that we are raising their taxes $46 instead of $72. We’re still taking more money from everybody, not handing the poor or anyone else a lower tax bill.

let the record show that i let jeff endrizzi sit alone in his own pew.

Flat tax.

Or in Mr. Endrizzi’s case a fat tax would be far more fair.

No increase in taxes!

Put teachers on SNAP!

All right, but apart from the sanitation, medicine, education, wine, public order, irrigation, roads, the fresh water system and public health, what have taxes ever done for us? I’m not a fan of tax increases either, but if we want things to improve in the state then I’m willing to do my part. Of course those corporations that reside here in this state are they doing their part?

Madman did you teach at the old Aberdeen Central up there?

Why should the visitors to our state be responsible for funding education?

I was there when they were talking about building new central.

How long did you teach there? Did you really feel they needed to spend all that money on a new high school? Talked to a graduate from up there and he was opposed to building the new HS and that the old one was in very good shape and well built being practically bomb proof. He graduated from there in the 80s.

In Rapid, no new taxes are needed. What is needed is better distribution of taxes paid and a better accounting of what they buy. When I pay my taxes, it isn’t divided between staff wages and buildings, it is one bill. Yet they say: ” these are two different funds and we are helpless to do anything about it”. Hogwash.

South Middle School, built in the 60’s to last 100 years, has no cracks in the brick walls, a new roof, new air conditioning and heat, with all asbestos removed. It has all new double pane glass and floots; all improvements less than 10 years old. The plan is to tear down this perfectly good building and put up a new one for $20 million. One Board member said: “We have to keep construction workers employed”.

Dakota just had $13 million plus in similar renovations two years ago and they are making plans to shut it down. It seems their grand plan is to reduce the number of schools, increase class sizes, and increase the number of buses. I walked home for lunch when I went to Wilson. My dog would come and get me after school. There is a lot to be said for easy parental and student access to the school.

What needs addressing is the welfare going to construction companies, not only by school districts, by tearing down good buildings to put up new ones that won’t last half as long. It doesn’t matter who pays the lion’s share of this new tax, it will be wasted just as the taxes we now have.

I spent a couple of years there doing my field experiences (Junior and Senior) and subbed there in between experiences.

The building itself was not the issue but rather the amount of growth that the district had seen. The elementary schools needed to be realigned because of class sizes or additional elementary and middle schools needed to be built to accommodate growth. To add more classes they shift the 6th grade into the middle schools and pushed the 9th graders into the high school.

I did my student teaching in old central in room with 30 desks (I had a class of 35 students so there were already space issues at the high school). This new school wasn’t built because of structural issues but mainly because there is no place in old central to add onto.

I see Larry Kurtz still has no interest in real conversation.

larry has more knowledge in his left pinkie…if u can’t see that ask drubbed grudz.

barry, get on the school board. don’t carry in the meetings though.

Sorry about that, Jeff. The rest of us will still happily engage you on the question of progressive taxation.

Okay, Endrizzi let’s have a real conversation.

Businesses should be allowed to ban obese people: airlines and taxi services should charge more for fat people. Scales and Body Mass Index stations should be outside stores where food is sold. Businesses with buffets should have scales at the door and anyone with a BMI over 23 will pay an additional $1.00 for every whole number above that.

Food stores should have scales at tills that add surcharges according to BMIs. Gas stations should have scales that determine price per gallon according to BMI unless you have documentation in your debit/credit card updated by your doctor that you’re on a weight reduction regimen.

Tax BMI.

http://interested-party.blogspot.com/2015/03/brookings-daktronics-beneficiary-of.html

Tax bad food at higher rates.

http://southdakotaprogressive.blogspot.com/2015/07/study-tax-sugary-drinks-junk-food.html

Thanks Cory. I don’t post here often….should be obvious why.

Write something meaningful, Endrizzi and you needn’t fear the Reaper. Say stupid stuff at your own risk.

Yeah. The “reaper” kurtz might say something mean. Just don’t click his blue links to gay porn and those malwares.

http://www.plaintalk.net/local_news/opinion/article_78a8001c-d1be-11e5-a0de-6f3e1f46e584.html

So you think it’s got a chance then, Lar?

@Larry

What are bad foods? Are they ones not recommended in My Plate? Or are they the ones not recommended by the American Heart Association? Or are they the ones not recommended by my local doctor? Are eggs good or bad for me this week? If I order coffee and add sweetener does that make it a sugary drink? Also do you drink juice? (If you do most doctors would tell you, that you are consuming the same amount of sugar as pop)

If you want to tax prepared foods that is fine, but to put a tax on “bad” or “sugary” foods would make the process so confusing to the consumer that I would just drive to Minnesota to buy groceries.

Madman,

They recently added to Central and there is much more room to add more building on the south side and to the west. South Middle has at least 10 acres on its north side for an addition.

To tear down a good building suggests corruption. No one on this blog would put on a new roof, install windows, floors, insulation and a few years later tear down their house to build new with a vacant lot they own right next door.

Barry Freed,

We were talking about the old Aberdeen Central School complex. It is a large complex up there and very well built from what I have heard.

70-something Wilson school has every square inch blanketed with utilization. over-utilization, I would say. the other old schools in RC are likely the same. South Middle, though maybe a few decades younger, uses very nearly every square foot of its surrounding acreage for athletics, community practice fields and parking. Tennis courts, barely functional ice rink and huge city pools are long gone. Stick-built annexes almost the same age are still in use. Surrounding slab homes, extremely cheaply mass constructed, on shale that cracks foundations and walls, are 60 plus years old.

kids walking to school or home for lunch, is more rare for obvious reasons.

oh, and dogs sheit on every exposed bit of open ground and are arrested on sight if loose.

are you comfortable with kids walking home without armed escorts or crossing gaurds? (tongue in cheek)