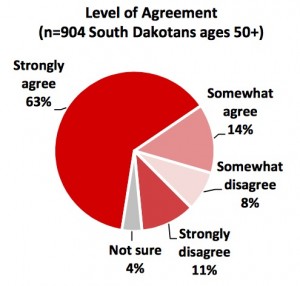

Our elders recognize a bad deal when they see one. AARP surveyed 904 South Dakotans age 50 and over and, according to AARP-SD director Sarah Jennings, found that they overwhelmingly support capping payday loan interest rates at 36%:

“South Dakotans 50+ do believe that we need to cap the interest rate on payday loans. Sixty-three percent felt strongly that we need to do this and an additional 14 percent felt somewhat strongly, so at that point you have almost 80 percent of the 50+ across our state of South Dakota who believe we need to take action on this issue,” Jennings says [Kealey Bultena, “AARP Survey: People Over Age 50 Support Payday Loan Cap,” SDPB Radio, 2015.10.28].

AARP is backing the petition drive to place a real 36% rate cap on payday loans on the 2016 ballot. This popular support for the 36% petition should not surprise anyone: AARP found similar results in a October 2013 survey of Louisiana adults. Americans for Financial Reform found similar results in a nationwide survey earlier this year.

AARP finds opposition to loan sharkery runs across party lines. Support for the 36% rate cap is 82% percent among Democrats, 78% among Independents, and 75% among Republicans.

In other words, legislative candidates, no matter what party you are from, you will improve your numbers (and serve democracy well) by speaking highly of the 36% rate cap in your stump speeches and reminding your neighbors to vote yes on 36% next November.

Of course, to get to that point, we need to make sure this November that the 36% petition gets enough signatures to get on the ballot. The petition submission deadline is November 9. If you haven’t signed yet, head to Josiah’s Coffeehouse in Sioux Falls or contact me here in Aberdeen this week and weekend. Out in Rapid City, check for petitioners at the county administration building, but on the street, diligently ask your circulator questions and demand to read the petition sheet itself to ensure that you are signing for the real 36% rate cap, not the fake 18% cap that the payday lenders are paying for to confuse voters and sabotage the will of the people.

Related Ballot Measure Reading: Ohio voters decide two competing ballot measures next week. Issue 3 legalizes recreational and medical marijuana. Issue 2 prohibits petitioners from using the state constitution to form a monopoly. Ohio legislators put Issue 2 on the ballot to sabotage the popularly petitioned Issue 3, which designates ten exclusive marijuana-growing locations.

But if both measures pass, the Ohio Constitution rides to the rescue: when successful ballot measures conflict, the one that gets the most votes wins. South Dakota has no such provision… but it could before next year’s election. Legislators, given the prospect of the conflicting real 36% and fake 18% rate caps both making the 2016 ballot, how about passing a bill in the 2016 Session that would allow resolve conflicting ballot measures by vote count?

What old folks see and what most people should see is that 36% is still a very high level of interest for a short term loan, but it is doable to pay back. The payday lenders do not want loans paid back and the old guys know it. Now if we could just get the old guys to acknowledge that Fox News is like professional wrestling, we would be on to something.

Jerry, that comparison is an insult to pro wrestling!

I have an idea,let’s get John Stossel to investigate Pro Fake Noise and see if he gets b##### slapped by Ailles.

https://www.youtube.com/watch?v=M0q44ALM7jo

This is too funny and couldn’t happen to a more deserving tool.

I am sorry bcb, that may have been a bit harsh on pro wrestling as that is a little more believable than Fox news.

I was very sorry to read (prarie perspective blog) hickey may have a serious health issue. best of luck to you sir!

Hickey has a lung disease that landed him on the transplant list. He’s had to slow down, but he’s been able to keep up with his current studies in Scotland.

huffpost today: payday disguised research still shows average 8 loans per borrower.