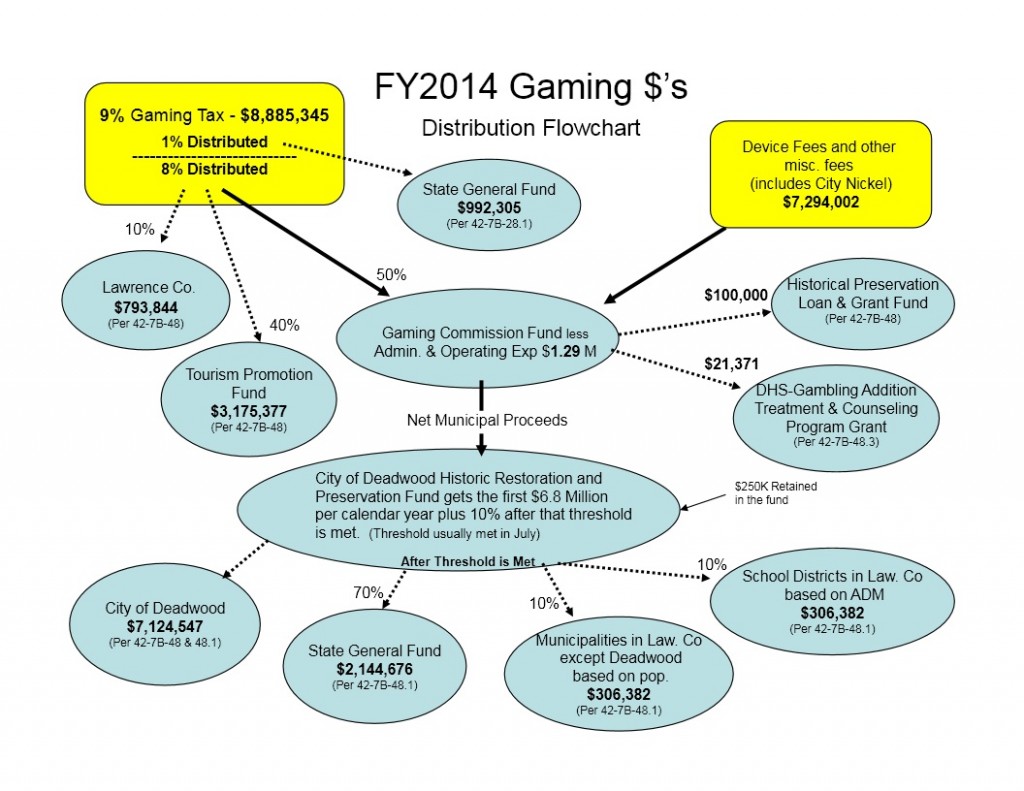

An eager reader paging through state government documents (because that’s what Dakota Free Press readers do!) notices this flowchart showing who got the $8.9 million in gaming tax and $7.3 million in device and other fees on Deadwood gambling in Fiscal Year 2014:

Out of 16.2 million dollars, $21K, 0.13%, spent on “Gambling Addition Treatment & Counseling.”

Pardon me, that should be “Addiction.” Freudian slip by the state.

SDCL 42-7B-48.3 caps that annual grant at $30K… because, you know, we wouldn’t want to spend too much money to help people stop paying a voluntary tax.

https://www.youtube.com/watch?v=w0Sdxrkyui8

Allow gambling which is addictive to be legal, then let the poor suckers drop into a pit and leave them there. This is not what you would think of when reading the Bible in the story of the good Samaritan. There is no other religious point of view that coincides with creating a trap and blaming people with weak psychological skills for falling into the trap. In fact the Bible says that if you cause your weaker brother to stumble it would be better for you if a millstone were tied around your neck and you be thrown into the sea. They could at least help those who had a previous problem that made them addictive because then these victims would at least find improvement in their lives rather than just keep falling into problems.

I corrected myself and you left that off your article…Notaries CAN administer oaths…but there is not one notary who SAID they administered an oath who actually did on those fraudulent petitions. All the notaries did was witness the signature of the carrier (unless you are Todd Schlekeway, you can get by without the person being there, and if you are Brian Gosch you can sign your own petitions)…none of them administered an oath.

It would be nice if whoever drew up our petitions actually read the law (you will notice that the law actually says that there should be a place for petitioners (plural) to sign the petition (single)…indicating they knew more than one person may indeed circulate the same petition.

Please note that I feel NEITHER Bosworth nor Hickey did anything wrong (except for being a huge hypocrite) when they VERIFIED the signatures on their petitions.

BUT if you place a felony on one person for filing a “false instrument” under SDCL 22 (even here MJ used a fraudulent twist to convict her….this is the SD Chapter regarding HOUSE LIENS!! Who does that?) …according to our SD Constitution, our laws must be equally applied.

oops…wrong story…you are just too prolific of a writer for me to catch up with you

After going here by mistake at first, I actually read your article. Great article. Question? Wasn’t the gambling money supposed to go schools? Maybe that was just outside Deadwood. But it looks like a paltry amount actually goes to schools (and then it probably goes to administration for working vacations so teachers can “imput” into Common Core…wonder if Jacuzzi pictures will ever surface)

The $21,000.00 was given to the problem gamblers in rolled quarters, along with drink tokens. The House always wins. We need to move on with this as the state certainly does not want us to know how badly education is getting screwed on this as well.

Video lottery is another addicting behavior that leaves society with a burden. One of my previous employers was victimized by a gambling addicted employee who robbed the cash change box.

What a crime. The primary and highest order of the revenues should be mopping up the uncivil effects. $21k hardly treats 1 case. Man-oh-man did the legislature “game us” on “gaming”. Only after addressing the uncivil effects of gaming should any remaining funds go to targeted revenues or the general fund. No wonder social services, courts, local charities, etc., are stretched. Gaming, alcohol, etc., must first pay their way, i.e., fund the consequences of the weak actors and their uncivil behavior before using remaining revenues for the general good. It’s such a republican idea, personal, institutional, corporate responsibility . . . . but all we see of the gaming and booze promoters is socializing their costs.

maybe it is time to drag out all garbage that was spilled when they wanted to legalize gambling and the schools were supposed to get all the revenue from the gambling machines etc.!!!!!!!!

The good old suckers in south Dakota got fooled again!!!!!!!!!!!

Schools did get the revenue, Rollin. Unfortunately they lost prior revenue to make that all happen though I’m not sure how they accomplished that slight of hand.

Another issue that should be addressed by an Initiated Measure.

It is easy to lump all gambling taxes into one bucket, but it’s important to clarify the difference between Tax dollars from Deadwood gaming and tax dollars from state run video lottery. State run video lottery taxes were supposed to go towards education and public schools, whether that is actually the case is debatable. Deadwood gaming taxes are primarily spent on historic preservation and we’re never intended to provide funds to education even though a small portion do go to local school districts.

Good clarification, TimA. This chart deals strictly with Deadwood dollars. The proportion dedicated to treating gambling addiction is still irresponsibly small. By the way, how is Deadwood doing on historic preservation?

rize money represents the biggest allocation of lottery revenue in all but five states. In those places (Delaware, Oregon, Rhode Island, South Dakota and West Virginia), a larger share of lottery revenue is set aside for the state.

So where does the lottery pesoa go,if not to education?

I have heard that state education payments to schools are reduced by the amount the school gets from a central utility. If that is the case, any taxes from XL pipeline, etc. will reduce state share per student to the district. Gambling provides the history for such.

Douglas, you are exactly correct. For every dollar raised in tax revenue by local effort the schools give up a dollar of state aid to education money. If a school on the Keystone XL route were to receive, say $500,000 from TransCanada, then they would give up $500,000 of the state aid. These are not things that TransCanada tell in their media blitz.